Baby food in market

Baby Food Market Size, Share and Growth

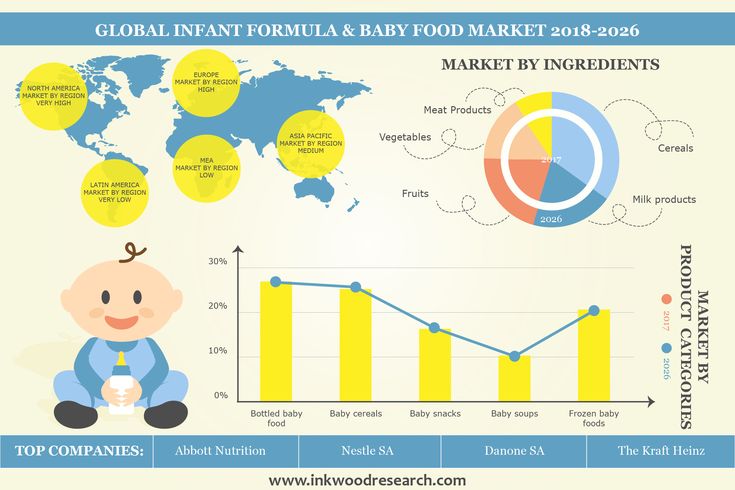

The global baby food market size was valued at $67.3 billion in 2019 and is projected to reach $96.3 billion by 2027, growing at a CAGR of 6.0% from 2021 to 2027. Traditionally, babies are fed with soft home cooked food, a practice that is still popular in underdeveloped and developing countries. However, growing urbanization and changing lifestyles have increased the demand for packaged baby foods in different societies and cultures. These foods are fed to babies between the ages of four to six months and two years. Growing awareness for nutrition, rise in organized retail marketing, urbanization paired with a significant increase in the count of working women population are key factors that boost the baby food market growth. Concerns related to food safety, falling birth rates, and the practice of feeding home cooked food to babies are the key restraints in this market.

The baby food market is segmented based on product type, distribution channel and geography. Based on product type, the market is segregated into dried baby food, milk formula, prepared baby food, and other baby food. Presently, milk formula occupies the largest market share followed by the product segment of prepared baby food. However, over the forecast period, product segment of prepared baby food would gain prominent adoption in the global market. Sales of milk formula baby food is highly concentrated in the APAC region. Alternatively, demand for prepared baby food is largely limited to developed regions. However, market for prepared baby food, in developing regions would pick pace over the forecast period, subsequently leading to the dynamic growth of the market in the APAC region. Thus, this has opened a lot of opportunities for baby food market.

Supermarkets, hypermarkets, small grocery retailers, and health & beauty retailers are the key distribution channels in the market. Supermarkets are the primarily preferred distribution channel among consumers, followed by health and beauty retailers. However, considering the scenario in few Asian developing countries such as India, small grocery retailers and health & beauty retailers hold significant share considering sales in the region. Small grocery retailers account for a comparatively smaller share in the baby food market but would witness rapid growth over the forecast period. Other distribution channels include discounters, non-grocery retailers, and non-store retailing.

However, considering the scenario in few Asian developing countries such as India, small grocery retailers and health & beauty retailers hold significant share considering sales in the region. Small grocery retailers account for a comparatively smaller share in the baby food market but would witness rapid growth over the forecast period. Other distribution channels include discounters, non-grocery retailers, and non-store retailing.

Increasing urban population, changing lifestyles of individuals due to considerable rise in disposable incomes is the main factor that boost the overall growth of the global baby food market. In addition, increase population of women at workplace leaves less time for food preparation and breast-feeding the infants, in turn demands quality baby food for their baby. Packaged baby foods are popular in the urban areas, as they provide adequate amount of nutrition for infants.

Majority of parents prefer home-cooked baby food compared to packaged baby food for their infants. However, this trend has changed owing to the time constraints for food preparation due to increased participation of women at workplace and increasing concerns about the nutritional value of home-cooked food. Moreover, high price of the baby food products have restricted their adoption among middle-income groups. Furthermore, home-cooked food is preferred by consumers duel in the rural and isolated regions, due to lack of awareness about these products. However, promotional campaigns and affordable baby food products would lead to overall increase in the revenue generation of the market.

However, this trend has changed owing to the time constraints for food preparation due to increased participation of women at workplace and increasing concerns about the nutritional value of home-cooked food. Moreover, high price of the baby food products have restricted their adoption among middle-income groups. Furthermore, home-cooked food is preferred by consumers duel in the rural and isolated regions, due to lack of awareness about these products. However, promotional campaigns and affordable baby food products would lead to overall increase in the revenue generation of the market.

Strong global concerns about the pandemic, coronavirus have largely but negatively influenced the global baby food market. Moreover, due to the high demand and low supply trends, the prices and demand for baby food products rises in 2020 to overcome on economic instability. On the contrary, disruptions to the supply chain in shipping could lead to temporary shortages in the supply, putting upward pressure on prices in the short term.

According to the baby food market analysis, the market is segmented on the basis of product type, the market is divided into e dried baby food, milk formula, prepared baby food, and others. On the basis of distribution channel, it is fragmented into supermarkets, hypermarkets, small grocery retailers, health and beauty retailers, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Spain, Italy, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, United Arab Emirates, South Africa, Saudi Arabia and rest of LAMEA).

Baby Food Market

By Product Type

The Milk formula segment held the major share of 60.1% in 2019

Get more information on this report : Request Sample Pages

On the basis of product type, milk formulations segment dominated the global baby food market in 2019, accounting for around half of the overall market revenue. Increasing incidence of lactating issues in infants has influenced increased adoption of milk based baby food products. Breast-feeding problems in women are the major driving factor for the market.

Increasing incidence of lactating issues in infants has influenced increased adoption of milk based baby food products. Breast-feeding problems in women are the major driving factor for the market.

On the basis of distribution channel, the supermarket segment held the significant baby food market share in 2019. Supermarkets is gaining popularity owing to the availability of broad range of consumer goods under a single roof, ample parking space and convenient operation timings. These stores offer variety of brands in a particular product category, offering more options for the consumers. Moreover, some of the supermarkets have company representatives to assist the consumers in their selection of baby food products.

Baby Food Market

By Distribution Channel

Small Grocery Retailers segment witness a CAGR of 6.6% from 2021-2027

Get more information on this report : Request Sample Pages

On the basis of region, Asia-Pacific dominated the global baby food market during the baby food market forecast period. High birth rates and rising purchasing power of population in the Asia-Pacific region have significantly fostered the demand of the baby food and milk formula-based products in this region. Intensive R&D activities by various companies in the baby food segment would help the companies to offer affordable baby food products in this region. Baby food products include milk powder, cereals, snacks and different ready-to-drink fresh fruits and vegetables juices.

High birth rates and rising purchasing power of population in the Asia-Pacific region have significantly fostered the demand of the baby food and milk formula-based products in this region. Intensive R&D activities by various companies in the baby food segment would help the companies to offer affordable baby food products in this region. Baby food products include milk powder, cereals, snacks and different ready-to-drink fresh fruits and vegetables juices.

Players in the market have adopted business expansion and product launch as their key developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in the report include Nestlé, Danone, Perrigo Company Plc, Mead Johnson & Company LLC, Abbott Laboratories, Hero Group, Bellamy Organics, Hain Celestial Group, Campbell Soups and Friesland Campina.

Baby Food Market

By Region

2027

Asia-pacific

North America

Europe

Lamea

The Asia-Pacific region helds the higest market share of 40.

0% in 2019

0% in 2019Get more information on this report : Request Sample Pages

Key benefits for stakeholders

- The report provides quantitative analysis of the current baby food market trends, estimations, and dynamics of the market size from 2019 to 2027 to identify the prevailing baby food market opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size & segmentation assist to determine the market potential.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the baby food industry.

Baby Food Market Report Highlights

| Aspects | Details |

|---|---|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Abbott Laboratories, BELLAMY’S ORGANIC PTY LTD., CAMPBELL SOUP COMPANY., DANONE., HERO GROUP., MEAD JOHNSON & COMPANY, LLC., NESTLE S.A., PERRIGO COMPANY PLC, ROYAL FRIESLANDCAMPINA N.V., THE HAIN CELESTIAL GROUP, INC. |

Baby Food Market Size to Hit Around USD 120 Billion by 2030

The global baby food market size was estimated at USD 73.88 billion in 2021 and is expected to hit around USD 120 billion by 2030, growing at a CAGR of 5.54% during the forecast period 2022 to 2030.

The increased awareness on innovative food products, organized retail marketing activities and increased number of working mothers, decreasing infant mortality rate and increasing parental concerns are all responsible for the growth of this market. During the pandemic, the parents were more conscious about the health of their babies and even though there were lockdowns across the nations the growth in this market has been seen even during the pandemic. In order to provide the infants with organic and healthier supplements and food products, the parents across the world are investing only in these food products. The baby food is soft, easily digestible meal which is created by keeping in mind the human babies aged between 4 to 6 months or up till two years of age.

During the pandemic, the parents were more conscious about the health of their babies and even though there were lockdowns across the nations the growth in this market has been seen even during the pandemic. In order to provide the infants with organic and healthier supplements and food products, the parents across the world are investing only in these food products. The baby food is soft, easily digestible meal which is created by keeping in mind the human babies aged between 4 to 6 months or up till two years of age.

Growth Factors

The demand for the organic baby food is increasing as the number of women working has increased in the recent years. There is a great demand for these convenient foods which is leading to a growth in the market. Due to a lack of time for home administration, the modern households are shifting to the use of these packed baby foods which are easy to prepare and packed with nutrients. This industry is expected to see a growth as it helps in saving time and also helps in maintaining a work life balance for the women while they take care of their domestic work. The nutritional requirements of the children are the priority of any woman. When it comes to working women, they choose the manufactured baby meals, which are resulting in the expansion of this industry. As the food manufacturers are increasing their expenditure on greater quality and inexpensive organic food materials there shall be a growth in the market.

The nutritional requirements of the children are the priority of any woman. When it comes to working women, they choose the manufactured baby meals, which are resulting in the expansion of this industry. As the food manufacturers are increasing their expenditure on greater quality and inexpensive organic food materials there shall be a growth in the market.

Due to the increasing population of infants and the increased penetration of organic baby food the market is expected to grow during the forecast period. The baby food is usually packed in various forms such as powder, liquid or paste, depending upon the requirement of the babies. There is adoption of the baby food across the globe as it helps in developing the brain, the nervous system, the muscles and helps in creating an awareness regarding the benefits of the nutrients it offers.

Report Scope of the Baby Food Market

| Report Coverage | Details |

| Market Size by 2030 | USD 120 Billion |

| Growth Rate from 2022 to 2030 |

CAGR of 5. |

| Largest Market | Asia Pacific |

| Online Distribution Channel Segment Growth Rate | 13.2% from 2022 to 2030 |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Category, Types, Distribution Channel, Ingredients, Formulation, Health Benefit, Geography |

| Companies Mentioned | Nestlé (Gerber Products Company), Danone S.A., Reckitt Benckiser (Mead Johnson & Company, LLC), Abbott, Feihe International Inc., Fries land Campina, Bellamy's Organic, Kraft Heinz, HiPP GmbH & Co. Vertrieb KG, Perrigo, Arla Food |

Category Insights

On the basis of category, the baby food market can be segmented into organic and conventional foods. Although the organic baby food is extremely good quality and have more nutrition value, but they are expensive, so this is a setback in the growth for this market. The conventional foods have shown a good growth in the previous years and it is expected to grow during the forecast period.

The conventional foods have shown a good growth in the previous years and it is expected to grow during the forecast period.

Type Insights

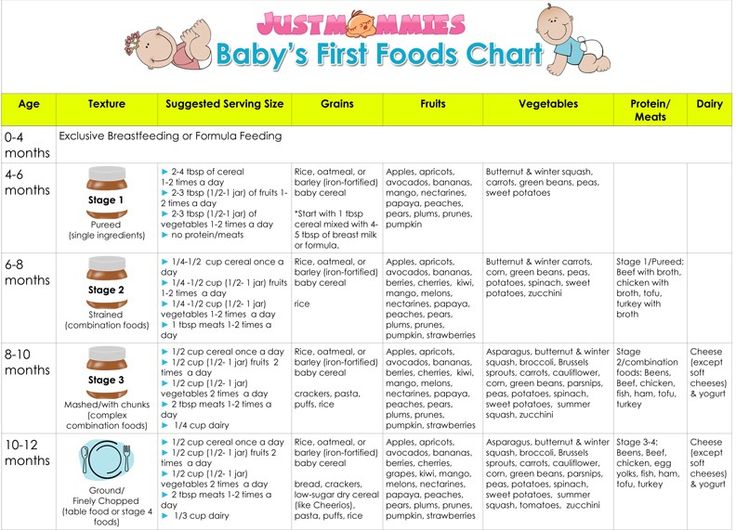

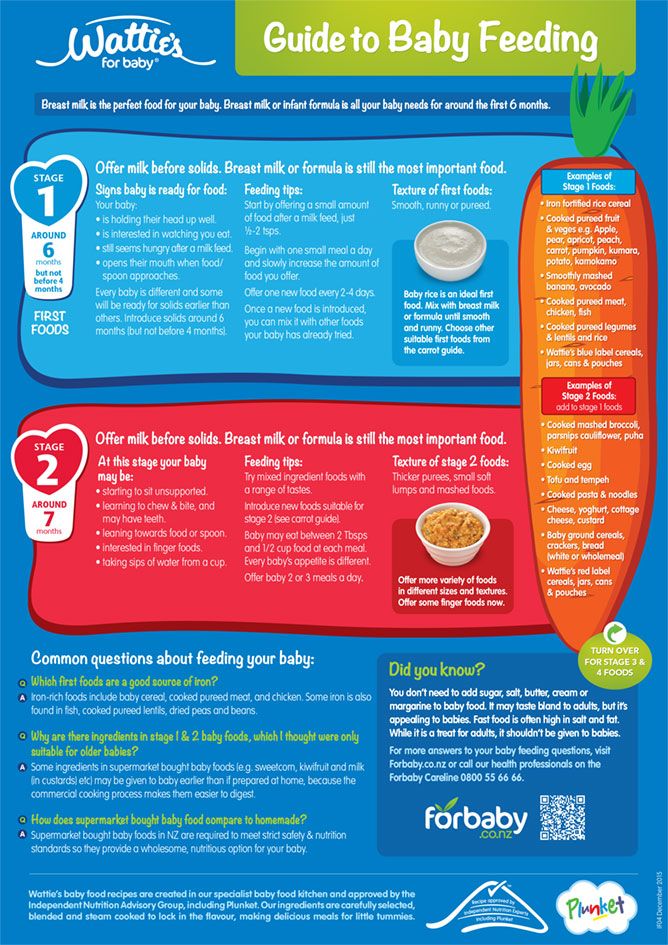

On the basis of the type of the baby food, the market can be segmented into dried baby food, ready to feed baby food, milk formula, and other types. The ready to eat baby food product accounts for the largest share in terms of revenue. It includes porridge, purees, squash. All these food items are ready to eat. As the number of working women is increasing in the economics across the world, the segment is expected to grow.

Apart from this, the dried food segment, which includes the cereals, fruits and vegetables, should also see a growth during the forecast period. The dried baby food segment is expected to grow at a CAGR of 13% as they have a good shelf life and they are easy to prepare.

Distribution Channel Insights

On the basis of the distribution channel, the hypermarket or the supermarket segment is expected to have the largest share, in the overall market it happens to have 35% of the total market size. As there is a great awareness and popularity of these food products amongst the people of the Asia Pacific region the supermarkets are expected to grow during the forecast. This segment provides aggressive marketing and lucrative pricing schemes.

As there is a great awareness and popularity of these food products amongst the people of the Asia Pacific region the supermarkets are expected to grow during the forecast. This segment provides aggressive marketing and lucrative pricing schemes.

Apart from the supermarkets, the online distribution channel is also expected to grow during the forecast. The online distribution channel is expected to have CAGR of 13.2% during the forecast period.

Regional Insights

The Asia Pacific market had the largest revenue in the previous years and it is expected to exhibit promising gains during the forecast period. As there is an increase in the working women population and an awareness of various baby food products that provide the nutrition and ensure the health of the babies the market is expected to grow. Due to diverse distribution options and strong marketing channels, the market shall grow during the forecast.

As a large number of raw material providers for the baby food are present in the European region. Stringent regulations and cutthroat competition among the manufacturers had led to a diversification in the product portfolio and an increase in the nutritional value of the food. The major players are actively engaged in mergers and acquisitions in order to provide a competitive edge. The global players also ensure partnership with the medium,small retailers or enterprise in order to provide the preferred baby food. Lot of revenue is spent on marketing and creating awareness regarding the products that these companies offer. So, the global food market is expected to grow during the forecast.

Stringent regulations and cutthroat competition among the manufacturers had led to a diversification in the product portfolio and an increase in the nutritional value of the food. The major players are actively engaged in mergers and acquisitions in order to provide a competitive edge. The global players also ensure partnership with the medium,small retailers or enterprise in order to provide the preferred baby food. Lot of revenue is spent on marketing and creating awareness regarding the products that these companies offer. So, the global food market is expected to grow during the forecast.

Key Market Players

- Nestlé (Gerber Products Company)

- Danone S.A.

- Reckitt Benckiser (Mead Johnson & Company, LLC)

- Abbott

- Feihe International Inc.

- Fries land Campina

- Bellamy's Organic

- Kraft Heinz

- HiPP GmbH & Co. Vertrieb KG

- Perrigo

- Arla Food

Key Market Developments

- In the year 2021, Danone launched the first ever formula milk in the United Kingdom which will be sold in a pre-measured format in order to provide an ease in preparation and provide greater convenience to the parents.

- A plant-based baby food range which will provide a very high-quality vegan diet to babies was launched in April 2021 by the Kraft Heinz Company. It includes three types of products that are made up of Potato baked with green beans and sweet garden peas, risotto with chickpeas and pumpkin and saucy pasta stars with beans and carrot.

- In November 2020, nestle launched frozen Baby food with a simple ingredient and line of foods made of organic ingredients and home grains packed in the bowls. These products will come in combination with vegetables in five different types.

Segments covered in the report.

(Note*: We offer report based on sub segments as well. Kindly, let us know if you are interested)

By Category

- Organic

- Conventional

By Types

- Milk Formula

- Dried

- Ready-to-Feed

- Other

By Distribution Channel

- Drugstores/ Pharmacies

- Supermarkets/Hypermarkets

- Convenience Store

- Online Channels

- Other Distribution Channels

By Ingredients

- Fats and Oils

- Lactose

- Protein

- Flour

- Flavour Enhancer

- Vitamins & Minerals

- Others

By Formulation

- Powder

- Liquid

By Health Benefit

- Brain & Eye Development

- Muscular Growth

- Bones & Teeth Development

- Blood Enhancement

- Nervous System

- Vascular System

- Body Energy

- Other

By Geography

- North America

- U.

S.

S. - Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Baby food market - AIM

The economic instability of 2009 has already affected childbearing in Ukraine. baby food market. So, in January-April of this year, 7.5 thousand fewer babies were born than in the same period last year. This immediately affected the production and sale of baby food in the first half of 2010.

According to the State Statistics Committee, in January-May 2010, compared with January-May 2009, the output of children's food in the country (excluding liquid dairy products) almost halved - from 4. 5 thousand tons to 2, 5 thousand tons, in particular juices - from 2.1 thousand tons to 0.7 thousand tons. even reduced them. At best, domestic child-breadwinners hope in 2010 to reach the indicators of 2009, which was not entirely successful for them.

5 thousand tons to 2, 5 thousand tons, in particular juices - from 2.1 thousand tons to 0.7 thousand tons. even reduced them. At best, domestic child-breadwinners hope in 2010 to reach the indicators of 2009, which was not entirely successful for them.

Production and market

The baby food market includes such product categories as dry breast milk substitutes, dry cereals, milk liquid baby food with a short shelf life (milk, kefirs, yogurts, curds), canned fruits and vegetables and juices for kids. Data on the volume of this market are quite contradictory. Some researchers, when calculating the market volume, take into account, for example, only juices for children under 1 year old, others - up to 3 years old.90; unites 10 manufacturers of baby food), in 2009, compared to 2008, the production of baby food in Ukraine increased by 5%, to 23.5 thousand tons.

According to Vyacheslav Dmukhovsky, analyst for market research of packaging and glass industry in the CIS countries of the Industrial Marketing Agency (Kyiv; marketing consulting and market research; since 1997; 13 people), baby food production in Ukraine in 2009. increased by 9% - up to 16.8 thousand tons.

increased by 9% - up to 16.8 thousand tons.

The share of imports in the Ukrainian baby food market is high: according to various estimates, it is 40-50% in physical terms (depending on the segment). Last year, due to the growth of the dollar and the reduction in the purchasing power of our citizens, the volume of sales of foreign children's food decreased. For example, the import of baby food packaged for retail trade (the main volume is imported under the UKT VED code 190110000), decreased from 7 thousand tons in 2008 to 5.7 thousand tons in 2009 (see “Import of products ... "). domestic production and sales If earlier retail chains were reluctant to take relevant Ukrainian products for sale, since the state limits the trade margin on them as socially important goods (10-25% depending on the region), then in the period of decreasing purchasing activity, retail is interested in the sale of albeit less profitable, but fast-moving goods.However, this did not save the market from falling in physical terms.

According to Natalia Sinelnik, director of HiPP Ukraine LLC, in 2009, compared to 2008, the volume of the baby food market decreased by 3% in physical terms and increased by 27% in money terms. Last year, both foreign baby food and Ukrainian food went up in price.

The first - due to the growth of the foreign exchange rate, the second - as a result of an increase in the price of milk and energy.

In 2009, some parents not only switched their cubs from imported food to Ukrainian food, but also replaced industrial food with homemade food.

"Since baby food is just starting to enter the regular consumer basket, Ukrainian mothers can easily replace some categories of industrial baby food with homemade products," Ms. Synelnyk explained.

Rate this page

Like it? Share it on social networks:

Need help from a specialist? Contact us right now

Are there any risks of a shortage of baby food

Despite the fact that several large Western companies have announced the suspension of investments or a reduction in the range, the baby food segment has not been directly affected so far. It's one thing to stop spilling soda, and another thing is cereal or, even worse, breast milk substitutes (BMS).

It's one thing to stop spilling soda, and another thing is cereal or, even worse, breast milk substitutes (BMS).

Production of baby food in the country continues to grow, assured "RG" in the Ministry of Agriculture. According to Rosstat, in January-July 2022, the production of milk powder and milk formulas for young children increased by 24.2%, canned meat (meat-containing) - by 6.5%, bakery products for baby food - by 12.6 %. In the production of baby food, both domestic and imported ingredients are used. But primarily fruit and berry purees and concentrates are imported from products that do not grow in Russia due to the climate, the department notes. At the beginning of 2021, domestic producers really faced logistical problems, including the supply of certain imported ingredients. "Nevertheless, the companies were able to establish alternative channels and ensure the uninterrupted release of products to the market," the ministry said.

Infographics "RG" / Leonid Kuleshov / Tatyana Karabut

Now, indeed, we have partially managed to build new supply chains for baby food ingredients. There are no acute problems with imports, said Antonina Tsitsulina, president of the Association of Children's Goods Industry Enterprises. There are none, for example, in the segment of vegetable purees and juices. However, the issue of providing BMS, especially those related to clinical nutrition, still requires special attention. There was no direct ban on the supply of such products. In addition, retailers and consumers made sufficient stocks of BMS ahead of time in the spring. However, now it is necessary to replace these products with imports.

There are no acute problems with imports, said Antonina Tsitsulina, president of the Association of Children's Goods Industry Enterprises. There are none, for example, in the segment of vegetable purees and juices. However, the issue of providing BMS, especially those related to clinical nutrition, still requires special attention. There was no direct ban on the supply of such products. In addition, retailers and consumers made sufficient stocks of BMS ahead of time in the spring. However, now it is necessary to replace these products with imports.

Previously, the Ministry of Agriculture reported that 80% of the demand for BMS on the Russian market is being covered on its own. In 2021, the government approved a project for the production of components for powdered milk formulas. Since there is not enough capacity in the Russian Federation to manufacture special whey used in BGM, the implementation of this project will reduce the dependence of Russian producers on foreign components, the Cabinet explained earlier. Companies, including the availability of concessional loans, subsidies for milk processing and reimbursement of part of the direct costs incurred for the construction of capacities for the production of BMS, the Ministry of Agriculture adds. The possibility of increasing the production of the necessary ingredients is being explored.

Companies, including the availability of concessional loans, subsidies for milk processing and reimbursement of part of the direct costs incurred for the construction of capacities for the production of BMS, the Ministry of Agriculture adds. The possibility of increasing the production of the necessary ingredients is being explored.

Raw materials for the production of BGM continue to be supplied, General Director of Soyuzmolok Artem Belov confirmed. The Union previously submitted an application for zeroing duties on the import of this raw material, which was accepted, and today part of the raw material for BMS is imported under a special regime. "Some items were not included in the preferential list, including some types of premixes for the production of baby food, as well as some ready-made products - dry and high-protein formulas, specialized nutrition. We are seeking preferential treatment for these categories as well," Belov said.

However, the producers of fruit purees and condensed milk faced difficulties amid the sanctions. According to Soyuzmoloko, EU lids and tinplate for their manufacture are under sanctions, and local lid manufacturers do not have raw materials to produce goods of the required quality. "The business is looking for alternative suppliers, but the price of such raw materials and caps is higher than the previous level, and therefore companies are currently asking for the zeroing of duties in order to at least slightly reduce the cost of Chinese raw materials," Belov explained. However, earlier the Ministry of Industry and Trade assured that tinplate is also produced in Russia, part of the demand is covered by supplies from friendly countries.

According to Soyuzmoloko, EU lids and tinplate for their manufacture are under sanctions, and local lid manufacturers do not have raw materials to produce goods of the required quality. "The business is looking for alternative suppliers, but the price of such raw materials and caps is higher than the previous level, and therefore companies are currently asking for the zeroing of duties in order to at least slightly reduce the cost of Chinese raw materials," Belov explained. However, earlier the Ministry of Industry and Trade assured that tinplate is also produced in Russia, part of the demand is covered by supplies from friendly countries.

"Today, almost all food tin and paint and varnish coatings used in the manufacture of meat-based canned food are produced abroad, and the domestic industry is not ready to meet the needs of baby food manufacturers," confirms the head of the department of functional and specialized nutrition of the FNTs of food systems named after. V.M. Gorbatov RAS Andrey Dydykin.

S., Canada, Mexico)

S., Canada, Mexico)  54%

54%