Baby food manufacturers australia

Outlook on the Australian Baby Food Market, 2019-2023 |

| Source: Research and Markets Research and Markets

Dublin, Nov. 07, 2019 (GLOBE NEWSWIRE) -- The "Australia Baby Food Market Outlook to 2023 - By Type (Dried Baby Food, Prepared Baby Food, Milk Formula and Other Baby Food), By Organic Baby Food), By Region and By Channels of Distribution" report has been added to ResearchAndMarkets.com's offering.

The future of Australia baby food looks not so attractive since the current market is largely impacted by huge demand from Chinese and other Asian countries. The market is expected to grow at a significant single-digit CAGR during the five year forecast period 2018-2023E. Milk Formula is expected to remain the largest growing segment by the end of the year 2023E.

Market Review

Australia baby food market has shown remarkable growth in the past few years. It witnessed positive CAGR in the review period 2013-18.

Increase in women workforce, rising population of infants from age 0-36 months, latent demand from China and growing urbanization are some of the major factors contributing to the positive growth. A shift in the preference of consumers was also witnessed in the review period.

Organic baby food witnessed a huge demand due to the rise in parental concerns and awareness about the products. Bubs organic, Bellamy's Organic Bio Bambino, Holle Baby Food, Rafferty Garden, Only organic and many more were some of the major brands selling organic baby food in Australia.

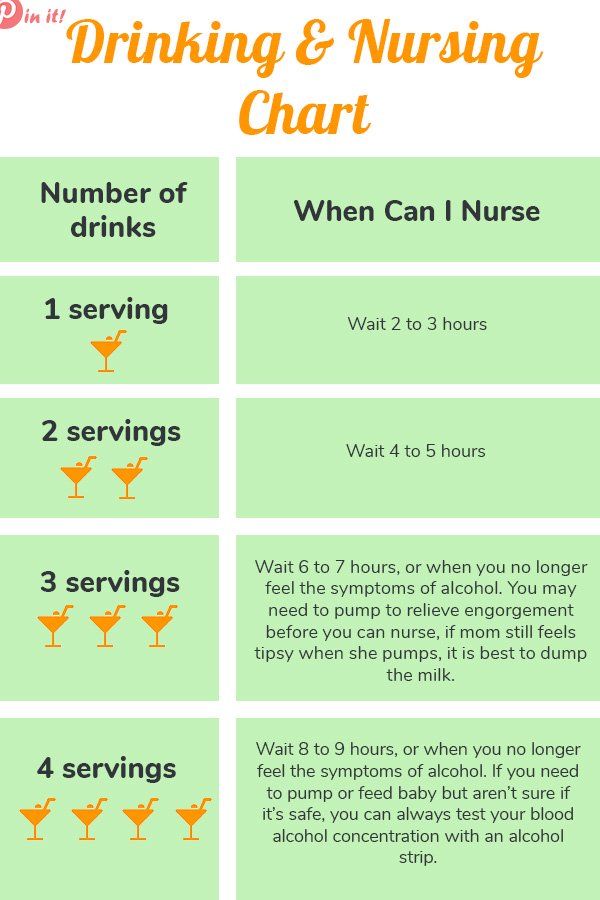

Growing-Up milk formula emerged as the growing category among the milk formula in the five year review period. The major reason behind this growth is that maternity leave is only for 18 weeks and therefore, making mothers more dependent on milk formula for the nutrition of the baby.

Market Segmentation

Milk formula was leading the market segment in the year 2018 since it is the most conventional and trustworthy baby food product in the market and is also considered as a prime substitute for mother's milk.

The majority of the milk formula sales in Australia were contributed through growing-up milk formula products due to a large number of infants falling in the age group of above 12 months. The largest market share was held by infants above 12 months or more in the year 2018.

In terms of nature, inorganic baby food held a maximum share of retail sales as inorganic items costs much lesser than their organic counterpart, therefore, making them the most preferred category.

New South Wales established itself as a market leader by capturing a massive revenue share for retail sales of baby food in the year 2018. It was followed by Victoria and Queensland since they are among the most populated states in Australia.

Supermarkets and Health stores are the most preferred channel for buying baby food by consumers in Australia. Subsequent purchases after consulting health experts are majorly made from these renowned and trustworthy megastores. Online also emerged as one of the preferred channels for distribution due to the increase in the number of internet users and also being convenient and time saving.

Subsequent purchases after consulting health experts are majorly made from these renowned and trustworthy megastores. Online also emerged as one of the preferred channels for distribution due to the increase in the number of internet users and also being convenient and time saving.

Competition Scenario

Competition within Australia baby food market was observed as concentrated with more than half of the market being captured by international players while the rest share is being held by other domestic and regional players.

Major international companies in the market are Danone Group, Nestle, Kraft Heinz, Aspen Pharmacare, and PZ Cussons while domestic and regional players are The A2 Milk Co, Bellamy's Australia, Bubs Australia, and many others.

Key Topics Covered

1. Executive Summary

- Australia Baby Food Market Size, 2013-18

- Australia Baby Food Market Segmentation

- Competition Scenario in Australia Baby Food Market

- Australia Baby Food Market Future Projections

2. Research Methodology

Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Size and Modeling

2.3.1. Consolidated Research Approach

2.3.2. Market Sizing - Australia Baby Food Market

2.3.3. Variables (Independent)

2.3.4. Multi-Factor Based Sensitivity Model

2.3.5. Regression Matrix

2.3.6. Limitations

2.3.7. Final Conclusion

3. Stakeholders in the Australia Baby Food Market

4. Australia Baby Food Market Overview and Genesis

5. Value Chain Analysis in Australia Baby Food Market

6. Australia Baby Food Market Size, 2013-2018

7. Australia Baby Food Market Segmentation, 2013-2018

7.1. By Food Category (Milk Formula, Dried Baby Food, Prepared Baby Food, and Other Baby food), 2013- 2018

7.1.1. Milk Formula By Type (Standard, Follow-On, Growing-Up, and Special Baby Milk Formula), 2013-2018

7.2. By Age group (0-6 Months, 6-12 Months, 12+ Months), 2018

7. 3. By Inorganic and Organic Baby Food, 2018

3. By Inorganic and Organic Baby Food, 2018

7.4. By Region (New South Wales, Victoria, Queensland, South Australia, Western Australia, Tasmania, Australian Capital Territory, Northern Territory), 2018

7.5. By Distribution Channel (Supermarkets, Health and Pharmacy Retailers, Online Retailing, Discounters, Other Foods Non-Grocery Specialists, Convenience Stores And Forecourt Retailers), 2013-2018

8. Trends and Developments in the Australia Baby Food Market

- Preference to organic baby food

- Mergers and Acquisitions

- Increase in Urbanization

- Emerging Diagou Trend

9. Issues and Challenges in the Australia Baby Food Market

- Stringent MAIF Agreement

- Highly Sensitive to Market Rumors

- Stringent Government and Internationa Regulations

10. Decision-Making Criteria For Consumers in Baby Food Market

11. Government Regulations for Doing Business

- Australia New Zealand Food Standards Code- Standard 2.

9.1

9.1 - World Health Organization (WHO) Code

- Guidelines for labeling of baby food

- Guidelines for composition of baby food

- Guidelines for specialty milk formula

12. SWOT Analysis

13. Competitive Landscape in the Australia Baby Food Market

13.1. Market Share of Major Players

13.2. Company Profiles

13.2.1. Nestle

13.2.2. Danone Group

13.2.3. Aspen Pharmacare

13.2.4. Kraft Heinz

13.2.5. Bellamy's Australia

13.2.6. A2 Milk Co

13.2.7. Bubs Australia

13.3. Other Companies (Wattle Health Australia, Blackmores Infant Formula, PZ Cussons, and Others) Operating In Australia Baby Food Market

14. Australia Baby Food Market Future Projections, 2018-2023E

- By Food Categories (Milk Formula, Dried Baby Food, Prepared Baby Food and Other Baby Food), 2018-2023E

- By Type of Milk Formula (Growing-up Milk Formula, Follow-on Milk Formula, Standard Milk Powdered Formula and Special Baby Milk Formula), 2018-2023E

- By Age Group (0-6 Months, 6-12 Months and 12+ Months), 2018- 2023E

- By Nature (Inorganic and Organic Baby Food), 2018- 2023E

- By Channel of Distribution (Hypermarkets, Supermarkets, Independent Small Grocers, Health and PharmacyRetailers, Other Foods Non-Grocery Specialists, Internet Retailing), 2018-2023E

15. Analyst Recommendations in Australia Baby Food Market

Analyst Recommendations in Australia Baby Food Market

For more information about this report visit https://www.researchandmarkets.com/r/q75fnj

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.

Contact Data

CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Contact

Organic Baby Food | Best Baby Food Online Australia

Our organic cereals, baby rice, and baby porridge are perfect for introducing solid foods for the first time. Pure, gentle and nutritious, these products are made from certified organic ingredients and can be added to fruit and vegetable purees.

Pure, gentle and nutritious, these products are made from certified organic ingredients and can be added to fruit and vegetable purees.

Our organic breakfast pouches are a convenient and wholesome way for baby to enjoy delicious breakfast flavours. Made with the goodness of organic oats and organic brown rice they have a smooth texture that can be introduced as early as 4+ months.

Our organic fruit pouches with brown rice are a yummy and convenient way to introduce a combination of fruit tastes. Offering nutritional goodness of organic fruit and brown rice.

Our new and exciting range of no added sugar exotic fruit pouches are made with 100% fruit ingredients and will excite the taste buds of your child (& you!). Delicious addition to our baby cereals or used in home baking for natural sweetness.

Our new no added sugar custard range has the goodness of 1/3 cup of Organic Milk in every pouch. Combined with delicious organic fruit and added flaxseed, cacao and chia seeds for a convenient and wholesome snack.

Our savoury meals are nutrient-dense, chunky in texture and full of flavours that your little one will love.

Our Food - Pasta

Our organic pastas are a great next step in introducing new textures and fun shapes to your baby as well as help to prompt chewing. A versatile product to have in your pantry, simply add grated cheese, pasta sauce or add to soup.

A versatile product to have in your pantry, simply add grated cheese, pasta sauce or add to soup.

Our organic fruit snacks are a convenient finger food option for busy parents with toddlers on the go.

Our Food - Puffs

Our organic corn puffs are crispy and soften naturally in the mouth to help practice biting, chewing and exploration.

Our Food - Rusks

Our organic Milk Rusks are slowly hard baked, making them ideal for your little one to chew during the teething process. Made from organic milk, organic wheat and no added sugar.

Chinese Mengniu Dairy intends to acquire Australian baby food producer Bellamy's for $1 billion

09/26/2019

Company news

China's Mengniu Dairy has expressed its intention to acquire Bellamy's, Australia's largest producer of organic baby formula, for approximately A$1. 5 billion ($1 billion).

5 billion ($1 billion).

Photo: from the Internet

Bellamy's Board of Directors unanimously approved the deal, under which Mengniu will acquire 100% of the company's shares, and urged shareholders to accept the offer.

Meanwhile, the deal still needs to be approved by Australian regulators, including the Foreign Investment Review Board (FIRB) and the Supreme Court of New South Wales.

China is the world's largest importer of baby food, but according to WA Today, Australia, Bellamy's is not licensed to operate in the Chinese market by the State Administration for Market Regulation of China (SAMR).

An Australian company is still awaiting a license from SAMR to sell its organic infant formula in China, despite applying 20 months ago. Meanwhile, Bellamy's says they are "optimistic" about getting a license in the near future.

Mengniu said they would aim to increase the company's sales in Australia and the entire Asia-Pacific region if the deal is approved.

Jeffrey Mingfang Lu, CEO Mengniu, said: “ Bellamy’s is a leading Australian brand with a great reputation among Australian parents. Bellamy's experience and local supply capability is critical to our company.”

Bellamy's CEO Andrew Cohen added, “ Mengniu is a leading dairy company in China and an ideal partner for our business. It offers a solid platform for successful development in China as well as a foundation for growth in the organic dairy and food industry in Australia. This deal will help realize our long-held dreams of promoting our products around the world ".

Source: FOODBEV.COM

China, Australia, organic formulas, baby food, products, sales

Related news:

Belarusian dairy products are in demand in the Chinese markets

On August 22, Consul General of the Republic of Belarus in Guangzhou Andrey POPOV, together with official representatives...

Kommunarka and Spartak chocolate are in demand in China August, a delegation of the Embassy visited the Weihai City District of Shandong Province. August 4...

August 4...

Belgospischeprom expands cooperation with China

A business meeting was held in Belgospischeprom with a Chinese delegation headed by the chief executive...

9 dry milk products for babies contain carcinogens!Chinese mother circle is fried!In truth ...

Source: Australia News.

Parents always hope that their babies will grow up healthy and choose the best for their children. Infant formula. But recently, the Hong Kong Consumer Council announced that many brands of imported milk powder contain carcinogens, which caused parents to panic.

But in fact, the Hong Kong Food Safety Center issued a refutation yesterday of the rumors that all brands are free of carcinogens that exceed the standards, so you can eat with confidence!

The Hong Kong Consumer Council announced in a new monthly edition of The Choice published on the 17th that they tested 15 types of prepackaged infant formula and found that all samples contained chloropropanediol (3-MCPD).

According to reports from the United Nations, the World Health Organization and the European Food Safety Authority, long-term daily excessive intake of 3-MCPD can damage kidney function and affect the male reproductive system.

In addition, the Consumer Council also noted that 3-MCPD exists in the form of 3-MCPDE and the carcinogenic glycidyl (gylcidol) gene exists in the form of glycidyl ethers (GE). In foods such as palm oil and baby food. Dry milk formula, glycidyl alcohol is genotoxic and carcinogenic and is present in foods in the form of glycidyl ethers (GE). In this test, the Consumer Council found GE in 9 samples.

Survey showed that out of 9 samples, 3 were from Wyeth and the product names were "S-26 Gold SMA", "Illuma Infant Formula Milk Powder", "Illuma Soy Protein Infant Infant Milk Milk Powder S-26 Gold Nursoy" . "Soy Protein Powder for Infants".

As for the remaining 6 models, they are Meiji Baby Food, Snow Brand Baby Baby Food, Abbott Similac Isomil Soy Baby Food, and a2 Platinum Premium Baby Food, Nan Pro Infant » by Nestlé.