Baby food target market

2022 Statistics | Global Baby Food Market Size & Share Will

| Source: Vantage Market Research Vantage Market Research

WASHINGTON, March 28, 2022 (GLOBE NEWSWIRE) -- According to a new market research report " Baby Food Market Size, Share & Trends Analysis Report by Product (Infant Formula, Baby Cereals, Baby Snacks, Baby Soups), by Type (Inorganic, Organic), by Distribution Channel (Hypermarkets, Supermarkets, Drug Stores, Specialty Stores), by Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa) - Global Industry Assessment (2016 - 2021) & Forecast (2022 - 2028)", published by Vantage Market Research, the global post COVID-19 market size of the Baby Food Market is expected to grow from USD 29,782. 5 Million in 2021 to USD 42,008.4 Million by 2028 at a CAGR of 5.90% during the forecast period.

Synopsis:

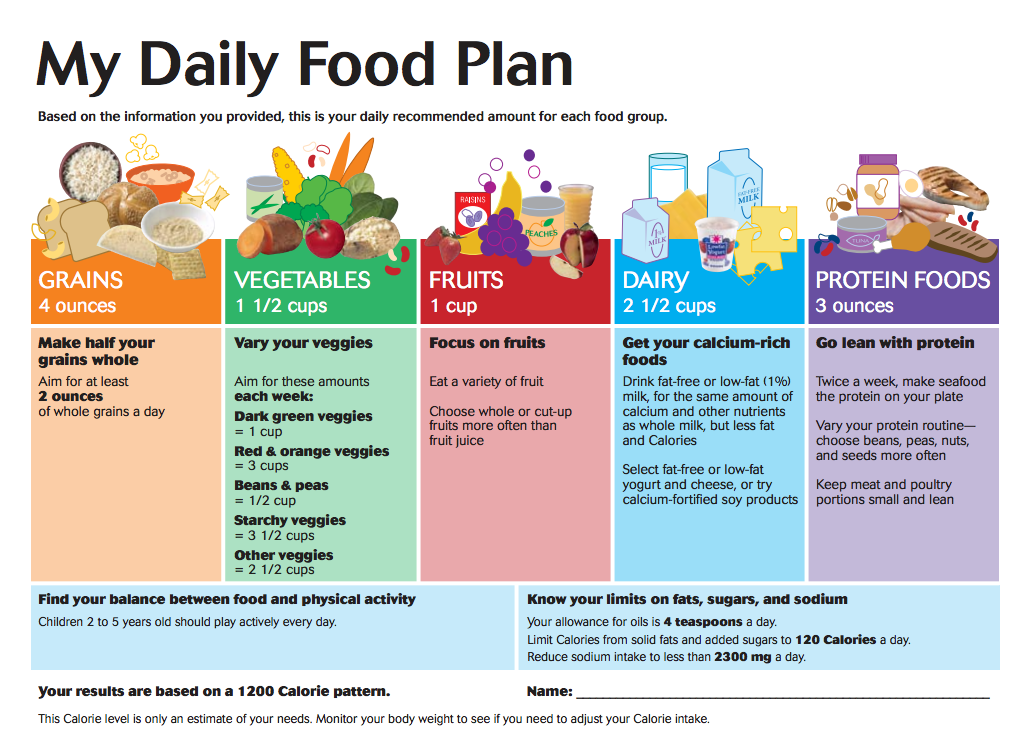

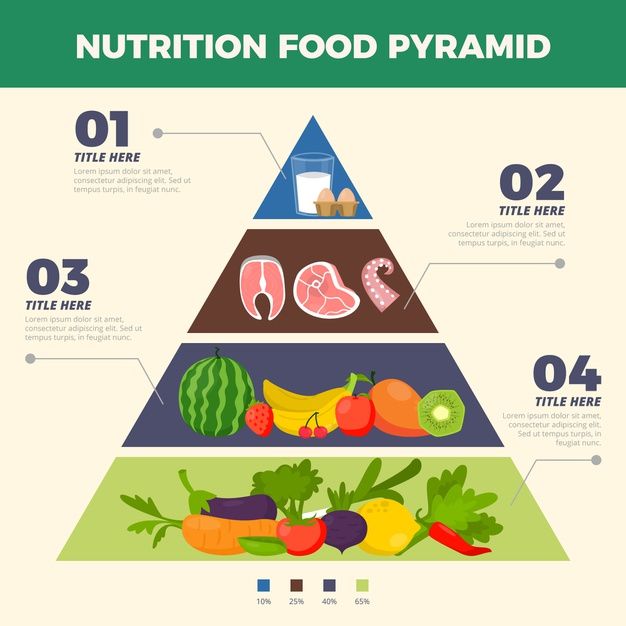

The growing awareness pertaining to the importance of breast milk nutrition has led to the increasing popularity of baby foods containing human milk oligosaccharides (HMOs) to enhance immune system development. Due to the high prevalence of digestive problems in babies, baby foods that can promote digestive health of infants while providing essential nutrients are gaining popularity which is a factor driving growth of the target market. In addition, due to the rising prevalence of various health-related problems such as obesity, osteoporosis, and high cholesterol, parents are increasingly preferring low-sugar baby foods to incorporate healthy eating habits in their offspring, which in turn is further propelling the Baby Food Market.

Please Check Out Our Free Sample Reports and Make a More Informed Decision:

Get Access to a Free Copy of Our Latest Sample Report @ https://www. vantagemarketresearch.com/baby-food-market-1413/request-sample

vantagemarketresearch.com/baby-food-market-1413/request-sample

(Sample reports are a great way to test our in-depth reports or study before you make a purchase)

- The newly updated, 140+ page reports provide an in-depth analysis of the COVID-19 virus and pandemic.

- Using industry data and interview with experts, you can learn about topics such as regional impact analysis, global forecast, competitive landscape analysis, size & share of regional markets.

- We offer these reports in PDF format so you can read them on your computer and print them out.

- Free sample includes, Industry Operating Conditions, Industry Market Size, Profitability Analysis, SWOT Analysis, Industry Major Players, Historical and Forecast, Growth Porter's 5 Forces Analysis, Revenue Forecasts, Industry Trends, Industry Financial Ratios.

- The report also presents the country-wise and region-wise analysis of the Vantage Market Research and includes a detailed analysis of the key factors affecting the growth of the market.

- Sample Report further sheds light on the Major Market Players with their Sales Volume, Business Strategy and Revenue Analysis, to offer the readers an advantage over others.

Key Insights & Findings from the Report:

- According to our primary respondents’ research, the Baby Food market is predicted to grow at a CAGR of roughly 5.90% during the forecast period.

- The Baby Food market was estimated to be worth roughly USD 29,782.5 Million in 2021 and is expected to reach USD 42,008.4 Million by 2028; based on primary research.

- On the basis of region, Asia-Pacific is projected to dominate the worldwide Baby Food market.

List of Prominent Players in the Baby Food Market

- Hero Group

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Kewpie Corporation

- DMK Deutsches Milchkontor GmbH

- PZ Cussons (UK) Limited

- Perrigo Company plc

- and Royal Friesland Campina N.

V.

V.

Purchase This Premium Report Now @ https://www.vantagemarketresearch.com/buy-now/baby-food-market-1413/0

Benefits of Purchasing Baby Food Market Reports:

- Customer Satisfaction: Our team of experts assists you with all your research needs and optimizes your reports.

- Analyst Support: Before or after purchasing the report, ask a professional analyst to address your questions.

- Assured Quality: Focuses on accuracy and quality of reports.

- Incomparable Skills: Analysts provide in-depth insights into reports.

Market Dynamics:

Drivers:

The demand for organic baby food is expanding owing to the increase in the number of working women and the rapid shift towards convenience foods, which is driving the organic Baby Food Market. Today, with a paradigm shift in the organization of modern homes, most adults lack time for household management, especially food preparation and cooking. As a result, the demand for ready-to-eat or packaged foods has increased. These working mothers prefer to have ready-to-eat food items for their children because it saves them time and allows them to maintain a work-life balance along with taking care of the family obligations. Working women are concerned about the nutritional needs of their babies as well as their own work, life and opt for processed baby food products, thereby proliferating growth of the Baby Food Market.

Today, with a paradigm shift in the organization of modern homes, most adults lack time for household management, especially food preparation and cooking. As a result, the demand for ready-to-eat or packaged foods has increased. These working mothers prefer to have ready-to-eat food items for their children because it saves them time and allows them to maintain a work-life balance along with taking care of the family obligations. Working women are concerned about the nutritional needs of their babies as well as their own work, life and opt for processed baby food products, thereby proliferating growth of the Baby Food Market.

The growing appeal to children by adding a variety of flavors to various baby foods has propelled the development of the baby food industry. Rising health awareness and growing vegan population are increasing the demand for vegetable-rich baby food, which is further augmenting the market growth. Furthermore, the introduction of products containing natural ingredients and nutritional values while offering multiple flavors is boosting growth of the target market.

Challenges:

The high cost of organic baby food and companies facing cost-effective hurdles in sourcing organic ingredients are factors that may hamper growth of the global Baby Food Market to a certain extent.

Read Full Research Report @ https://www.vantagemarketresearch.com/industry-report/baby-food-market-1413

Regional Trends:

Asia-Pacific (APAC) dominated the market for baby food in the past, and is expected to grow at the highest CAGR in the foreseeable future. This is attributed to the high birth rate, growing awareness of organic baby food products among people, increasing women workforce, high disposable income, and extensive research and development (R&D) by various companies in the Baby Food Market. China holds a major share in terms of revenue in the global Baby Food Market in the region. Furthermore, developing economies such as India and Indonesia are expected to boost the growth of the market in the region. Moreover, the shifting preference of customers towards online channels, especially in the recent scenario of the pandemic outbreak in order to avoid striding out and, ultimately, stay safe, resulting in high sales of baby food through online channels.

Moreover, the shifting preference of customers towards online channels, especially in the recent scenario of the pandemic outbreak in order to avoid striding out and, ultimately, stay safe, resulting in high sales of baby food through online channels.

Recent Developments:

In April 2021, The Kraft Heinz Company launched a range of plant-based baby food in order to offer a high-quality vegan diet to the infants. This range includes three types of products such as Potato Bake with green beans & sweet garden peas, Risotto with chickpeas & pumpkin, and Saucy Pasta Stars with beans & carrot.

In November 2020, Nestlé S. A. entered the frozen baby food business with the launch of Freshful Start, an organic, simple food line made with bowls of vegetables and whole grains. These products come in five different vegetable combinations.

Speak To Analyst @ https://www. vantagemarketresearch.com/baby-food-market-1413/contact-analyst

vantagemarketresearch.com/baby-food-market-1413/contact-analyst

Key questions answered in the report:

- Which regional market will show the highest and rapid growth?

- Which are the top five players of the Baby Food Market?

- How will the Baby Food Market change in the upcoming six years?

- Which application and product will take a lion’s share of the Baby Food Market?

- What is the Baby Food market drivers and restrictions?

- What will be the CAGR and size of the Baby Food Market throughout the forecast period?

The report on the Baby Food Market highlights:

- Assessment of the market

- Premium Insights

- Competitive Landscape

- COVID Impact Analysis

- Historic Data, Estimates, and Forecast

- Company Profiles

- Global and Regional Dynamics

This market titled “Baby Food” will cover exclusive information in terms of Geographic Segmentation, Forecast, Regional Analysis, Key Market Trends, and various others as mentioned below:

Customization of the Report:

The report can be customized as per client needs or requirements. For any queries, you can contact us on [email protected] or +1 (202) 380-9727. Our sales executives will be happy to understand your needs and provide you with the most suitable reports.

For any queries, you can contact us on [email protected] or +1 (202) 380-9727. Our sales executives will be happy to understand your needs and provide you with the most suitable reports.

Download Free Sample Report Now @ https://www.vantagemarketresearch.com/baby-food-market-1413/request-sample

Browse More Related Report:

- Sports Fitness Nutrition Foods Beverages Market:- https://www.vantagemarketresearch.com/industry-report/sports-fitness-nutrition-foods-beverages-market-1374

- Alternative Protein Market:- https://www.vantagemarketresearch.com/industry-report/alternative-protein-market-1359

- Organic Pea Protein Market:- https://www.vantagemarketresearch.com/industry-report/organic-pea-protein-market-1341

- Protein Hydrolysis Enzymes Market:- https://www.vantagemarketresearch.com/industry-report/protein-hydrolysis-enzymes-market-1270

About Vantage Market Research:

We, at Vantage Market Research, provide quantified B2B high quality research on more than 20,000 emerging markets, in turn, helping our clients map out constellation of opportunities for their businesses. We, as a competitive intelligence market research and consulting firm provide end to end solutions to our client enterprises to meet their crucial business objectives. Our clientele base spans across 70% of Global Fortune 500 companies. The company provides high quality data and market research services. The company serves various enterprises and clients in a wide variety of industries. The company offers detailed reports on multiple industries including Chemical Materials and Energy, Food and Beverages, Healthcare Technology, etc. The company’s experienced team of Analysts, Researchers, and Consultants use proprietary data sources and numerous statistical tools and techniques to gather and analyse information.

We, as a competitive intelligence market research and consulting firm provide end to end solutions to our client enterprises to meet their crucial business objectives. Our clientele base spans across 70% of Global Fortune 500 companies. The company provides high quality data and market research services. The company serves various enterprises and clients in a wide variety of industries. The company offers detailed reports on multiple industries including Chemical Materials and Energy, Food and Beverages, Healthcare Technology, etc. The company’s experienced team of Analysts, Researchers, and Consultants use proprietary data sources and numerous statistical tools and techniques to gather and analyse information.

Follow Us on LinkedIn: https://www.linkedin.com/company/vantage-market-research/

Follow Us on Twitter: https://twitter.com/vantagemarketr

Contact us

Eric Kunz

6218 Georgia Avenue NW Ste 1 - 564

Washington DC 20011-5125

United States Tel: +1 202 380 9727

Email: sales@vantagemarketresearch. com

com

Website: https://www.vantagemarketresearch.com/

Latest Vantage Market Research Press Releases @ https://www.vantagemarketresearch.com/insight/press-releases

Latest Vantage Market Research Blog @ https://www.vantagemarketresearch.com/insight/blogs

Blog:

- https://bwsc.kr/

- https://makitirapide.com/

- https://www.globalresearchwire.com/

- https://marketstrades.com/

- https://v-mr.biz/

Baby Food Market Baby Food Industry Baby Food Market Size Baby Food Market Sales Baby Food Market Share Baby Cereals Snacks

Baby Food Market (2009 - 2014), Global Forecasts, Market Research Report: MarketsandMarkets

Global Baby Food Market (20092014)

The global baby food market is witnessing rapid growth due to the increasing number of working women, and the increasing parental concerns about nutrition. Professionally-made food designed to meet the nutrition requirements of babies also address the problems of paucity of time for preparing baby food at home, as well as non-lactation problems, which may lead to under-nutrition for the baby. Packed and bottled baby food is also considered as a supplement to mothers feeding. The market is growing at a fast pace in developing economies such as China, Vietnam, and India; while the U.S. and Europe markets account for a major share in terms of total revenue generated.

Professionally-made food designed to meet the nutrition requirements of babies also address the problems of paucity of time for preparing baby food at home, as well as non-lactation problems, which may lead to under-nutrition for the baby. Packed and bottled baby food is also considered as a supplement to mothers feeding. The market is growing at a fast pace in developing economies such as China, Vietnam, and India; while the U.S. and Europe markets account for a major share in terms of total revenue generated.

The global market for baby food generated $25 billion in 2008 and is expected to grow at a double digit CAGR in the next few years. A detailed study and analysis of this market will not only define it comprehensively along with market statistics, but will also inform the respective stakeholders about the market drivers and trends. Major players in this market are targeting populous and emerging economies like China and India since the markets in U.S. and Europe have little growth opportunity because of low birth rates and static market conditions. This report analyses the global baby food market and its sub-segments to help stakeholders take strategic decisions based on the upcoming trends and opportunities that this report identifies in the baby food market.

This report analyses the global baby food market and its sub-segments to help stakeholders take strategic decisions based on the upcoming trends and opportunities that this report identifies in the baby food market.

Existing studies and third-party market reports do not provide a comprehensive understanding and classification of the recent developments in the baby food market, such as analysis considering the age group of babies and the nutrient value of baby food. This report breaks the market into smaller product segments which none of the other third-party reports have done so far.

Request Sample Click on image to enlargeGet online access to the report on the World's First Market Intelligence Cloud

Scope of the Report

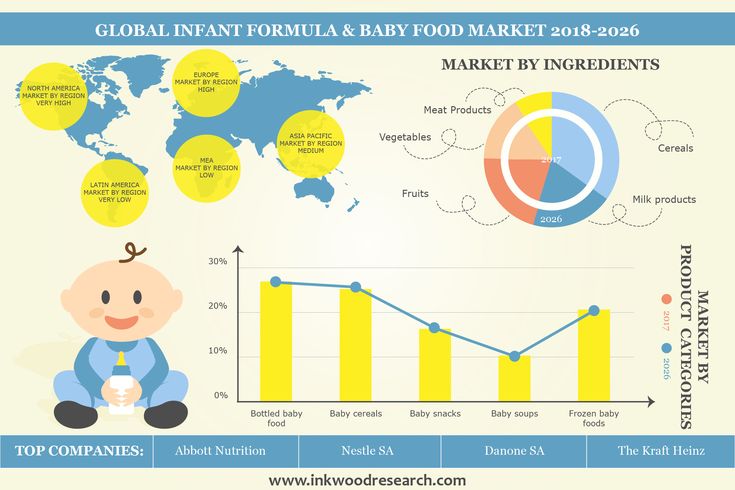

This report highlights the basic structure of the baby food market and its various sub-segments based on products, ingredients, and health benefits. These individual markets are further broken down into their respective sub-segments. The products segment for example covers the markets for bottled baby food, baby cereals, baby snacks, baby soups, and frozen baby food.

These individual markets are further broken down into their respective sub-segments. The products segment for example covers the markets for bottled baby food, baby cereals, baby snacks, baby soups, and frozen baby food.

The report will size all the submarkets and will also give a detailed geographic split among the four major markets of U.S., Europe, Asia, and Rest of the World (ROW). We will provide market trends and forecasts supported by the drivers and inhibitors for each sub-segment. More than 100 market tables and 30 company profiles will provide a deeper insight into the market and the competitive landscape as well. The market tables will also be categorized as per geographic region, ingredients, health benefits, and products.

In addition to the market size, data trends, and forecasts, the report will also highlight key opportunity areas for the relevant stakeholders. We will analyze new product launches in the baby food market and submarkets and profile key market developments of the top 30 companies in this market and its sub-segments while drawing a competitive landscape.

What makes our reports unique?

- We provide the longest market segmentation chain in the industry with our three-level market breakdown and our analysis of minimum 40 collectively exhaustive and mutually exclusive micro markets.

- We provide 10% customization to ensure that our clients find the specific market intelligence they need.

- Each report is about 150 pages, featuring 30+ market data tables, 30+ company profiles, and an analysis of 200 patents.

- No single report by any other publisher provides market data for all market segments (i.e. products, services, applications, ingredients, and technology) covering the four geographies of North America, Europe, Asia Pacific, and ROW.

- 15 pages of high level analysis identifying opportunities, best practices, entry strategies, benchmarking strategies, market positioning, product positioning, and competitive positioning.

Key questions answered

- Which are the high-growth segments and how is the market segmented in terms of applications, products, services, ingredients, technologies, stakeholders?

- What are market estimates and forecasts; which markets are doing well and which are not?

- Where are the gaps and opportunities; what factors are driving market growth?

- Which are the key playing fields and winning-edge imperatives?

- What is the competitive landscape; who are the main players in each segment; what are their strategic directives, operational strengths, key selling products, and product pipelines? Who is doing what?

Powerful Research and analysis

The analysts working with MarketsandMarkets come from renowned publishers and market research firms globally, adding their expertise and domain understanding. We get the facts from over 22,000 news and information sources, a huge database of key industry participants and draw on our relationships with more than 900 market research companies.

We get the facts from over 22,000 news and information sources, a huge database of key industry participants and draw on our relationships with more than 900 market research companies.

Baby Food Article

The target consumers of commercially-available baby food range from infants (babies aged 6 to 12 months) to toddlers (children up to three years old). Baby food is available in various flavors and in both solid and liquid form. Modern-day time constraints have reduced the use of homemade baby food in both developed as well as developing nations. While U.S. and Europe hold a major share of the global baby food market, emerging economies such as China, India, Brazil, Russia, and Romania also represent a high growth rate.

The baby food market is getting a big boost from the increasing awareness about the role it plays in meeting the nutritional needs of infants and toddlers. The major challenges for the baby food industry are low birth rates, static market conditions in developed countries, and milk intolerance in babies. However, opportunities for the baby food market is immense, as there is large untapped market in developing economies and as evolving food technology and new product developments are expected to attract more customers in future.

However, opportunities for the baby food market is immense, as there is large untapped market in developing economies and as evolving food technology and new product developments are expected to attract more customers in future.

The global baby food market is expected to be worth US$37.6 billion by 2014, growing at an estimated CAGR of 5.0% from 2009 to 2014. Bottled baby food forms the largest market segment; and is expected to reach US$9.9 billion by 2014 at a CAGR of 4.9% for the same period. The segment with the highest growth potential is expected to be frozen baby food followed by bottled baby food products and baby cereals. Nestl SA is the market leader in the global baby food products market. The other key market players are H.J. Heinz, Bristol-Myers Squibb, DANONE and Hero.

The major segments in the baby food product market are baby cereals, bottled baby foods, frozen baby foods, baby snacks and soups. Companies are focusing mainly on developing easily digestible and competitively priced fortified baby food. Evolving food technologies are enabling the market players to offer quality products with enhanced benefits like optimum nutrients content for babies. The growth in the baby food market is primarily due to the increasing demand from the Asian countries.

Evolving food technologies are enabling the market players to offer quality products with enhanced benefits like optimum nutrients content for babies. The growth in the baby food market is primarily due to the increasing demand from the Asian countries.

Source: MarketsandMarkets

The accompanying table indicates the estimated market size of baby food products in 2009. The market for bottled baby foods is expected to enjoy the maximum market share followed by the baby cereals. The patent analysis of baby food products indicates that maximum number of patents has been registered for bottled baby food, which accounts for 70% of the total number of patents registered. Baby cereals is second with 16%, followed by baby snacks with 12% of the total patents registered. Geography-wise, the U.S. accounts for 58% of the total patents registered in baby food products followed by Europe with 30%.

1 INTRODUCTION

1.1 Key take-aways

1.2 Report description

1. 3 Markets covered

3 Markets covered

1.4 Stakeholders

2 SUMMARY

3 MARKET OVERVIEW

3.1 Evolution of the baby food market

3.2 Trends in the baby food product and ingredient markets

3.3 Lactose intolerance: population analysis

3.4 Driving factor analysis for baby food market

3.4.1 Supply-side drivers

3.4.2 Demand-side drivers

3.4.3 Restraints

3.4.4 Opportunities

3.5 Market Definitions

3.6 Consumption pattern of baby food by age group

3.7 Decision influencers for baby food products

3.8 Comparative analysis baby food market size vs CAGR (2009-2014)

3.9 Age-wise baby food market analysis

3.9.1 Drivers

3.9.1.1 Changing socio-economic trends and increasing consumer awareness

3.9.1.2 Innovative products and packaging

3.9.2 Inhibitors

3.9.2.1 Static market conditions and variation in costs of raw material

3. 9.2.2 Food safety issues

9.2.2 Food safety issues

3.9.3 Opportunities

3.9.3.1 Large untapped market in developing countries

3.9.3.2 Organic baby food attracting consumer attention

3.9.3.3 Enriched baby food products gaining popularity

4 BABY FOOD MARKET BY PRODUCTS

4.1 Bottled baby food market

4.1.1 Drivers

4.1.1.1 Bottled baby food caters to babies of all age groups

4.1.2 Inhibitors

4.1.2.1 Shorter life span and safety concerns

4.1.3 Opportunities

4.1.3.1 Largest potential customer base

4.1.4 Baby juice market

4.1.5 Drivers

4.1.5.1 Easy to consume: available in many varieties

4.1.6 Inhibitors

4.1.6.1 Low shelf-life

4.1.7 Opportunities

4.1.7.1 Enriched and enhanced juices

4.1.7.2 Key players

4.1.7.3 Baby fruit juice

4.1.7.4 Baby vegetable juices

4.1.7.5 Mixed juices

4. 1.8 Pureed baby food

1.8 Pureed baby food

4.1.8.1 Drivers

4.1.8.2 Inhibitors

4.1.8.3 Baby fruit puree

4.1.8.4 Baby vegetable puree

4.1.9 Baby milk products

4.1.9.1 Drivers and opportunities

4.1.9.2 Inhibitors

4.1.9.3 Animal milk

4.1.9.4 Yogurt

4.1.9.5 Desserts

4.2 Baby food cereals market

4.2.1 Drivers

4.2.2 Inhibitors

4.3 Baby food snacks market

4.3.1 Drivers and opportunities

4.3.2 Inhibitors

4.3.3 Key players

4.3.4 Puffs

4.3.5 Biscuit/cookies

4.3.6 Rusks

4.4 Baby Food Soup market

4.4.1 Drivers and inhibitors

4.4.2 Non-vegetarian soup

4.4.3 Vegetarian soup

4.5 Frozen baby food market

4.5.1 Drivers

4.5.2 Inhibitors

4.5.3 Frozen non-vegetarian baby food

4.5.3.1 Market drivers and inhibitors

4.5.4 Frozen vegetarian baby food

4. 5.4.1 Drivers

5.4.1 Drivers

4.5.5 Frozen fruits baby food

5 BABY FOOD MARKET BY HEALTH BENEFITS

5.1 Immune system

5.2 Brain and eye development

5.3 Muscular growth

5.4 Bones and teeth development

5.5 Blood enhancement

5.6 Nervous system

5.7 Vascular system

5.8 Body energy

5.9 Other benefits

6 INGREDIENTS

6.1 Change in trends in consumption patterns

6.2 Cereals

6.2.1 Oatmeal

6.2.2 Rice

6.2.3 Barley

6.2.4 Mixed

6.3 Milk products

6.3.1 Animal milk

6.3.2 Yogurt

6.4 Fruits

6.5 Vegetables

6.6 Meat products

7 GEOGRAPHIC ANALYSIS OF BABY FOOD MARKET

7.1 U.S. baby food market

7.2 European baby food market

7.3 Asian baby food market

8 COMPANY PROFILES

8.1 ABBOTT NUTRITION

8.2 BABYNAT

8.3 BEECH NUT

8. 4 BRISTOL-MYERS SQUIBB

4 BRISTOL-MYERS SQUIBB

8.5 DANONE DUMEX

8.6 DUTCH LADY

8.7 EARTHS BEST

8.8 ELLA'S KITCHEN

8.9 FASSKA

8.10 H.J. HEINZ CO

8.11 HALAL BABY FOOD

8.12 HEALTHY SPROUTS FOODS INC

8.13 HERO

8.14 HIPP ORGANIC BABY FOOD

8.15 LITTLE DISH

8.16 PLASMON

8.17 PLUM MUMS

8.18 PLUM ORGANIC

8.19 SMA NUTRITION

8.20 STAGESFOOD

8.21 SWEET PEA BABY FOOD COMPANY

8.22 TASTYBABY LLC

8.23 STONYFIELD FARM

8.24 YUBAO GOAT DAIRY CO, LTD

8.25 NESTL

8.26 BABY ORGANIX

8.27 BABYLICIOUS LTD.

8.28 PBM NUTRITIONAL

8.29 WYETH

8.30 ORGANIC BUBS

8.31 PETER RABBIT ORGANICS

9 PATENT ANALYSIS

APPENDIX

U.S. Bottled Baby Food Patents

U.S. Baby Cereals Food Patents

U.S. Milk Products Food Patents

U.S. Baby Snacks and Baby Soup Food Patents

U.S. Fruits and Vegetables Food Patents

EUROPE Baby Food Patents

JAPAN Baby Food Patents

Nutritional Content of Baby Food Ingredients

Dry Rice Cereal for Baby Food

Dry Oatmeal Cereal for Baby Food

Dry Barley Cereal for Baby Food

Dry Whole Milk for Baby Food

Plain Yogurt (Whole Milk) for Baby Food

Strained Banana for Baby Food

Plums with Tapioca for Baby Food

Mango with Tapioca for Baby Food

Strained Pineapple Dessert for Baby Food

Strained Sweet Potatoes for Baby Food

Strained and Creamed Spinach for Baby Food

Strained Carrots for Baby Food

Strained Peas for Baby Food

Strained Beef for Baby Food

Strained Chicken for Baby Food

LIST OF TABLES

Summary Table Global Baby Food Market, By Products 2007 2014 ($Millions)

1 Global bottled baby food market, by products 2007 2014 ($Millions)

2 Global bottled baby food market, by geography 2007 2014 ($Millions)

3 Major players and developments

4 Global baby juice market, by products 2007 2014 ($Millions)

5 Global baby juice market, by geography 2007 2014 ($Millions)

6 Major players and developments

7 Global baby fruit juice market, by geography 2007 2014 ($Millions)

8 Major players and developments

9 Global baby vegetable juices market, by geography 2007 2014 ($Millions)

10 Major players and developments

11 Global baby mix juices food market, by geography 2007 2014 ($Millions)

12 Global pureed baby food market, by products 2007 2014 ($Millions)

13 Global pureed baby market, by geography 2007 2014 ($Millions)

14 Major players and developments

15 Global pureed fruit baby food market, by geography 2007 2014 ($Millions)

16 Major players and developments

17 Global pureed vegetable baby food market, by geography 2007 2014 ($Millions)

18 Major players and developments

19 Global baby milk products market, by products 2007 2014 ($Millions)

20 Global baby milk products market, by geography 2007 2014 ($Millions)

21 Major players and developments

22 Global baby animal milk market, by geography 2007 2014 ($Millions)

23 Major players and developments

24 Global baby yogurt market, by geography 2007 2014 ($Millions)

25 Major players and developments

26 Global baby desserts market, by geography 2007 2014 ($Millions)

27 Major players and developments

28 Global baby food cereals market, by geography 2007 2014 ($Millions)

29 Major players and developments

30 Global baby food snacks market, by products 2007 2014 ($Millions)

31 Global baby food snacks market, by geography 2007 2014 ($Millions)

32 Major players and developments

33 Global baby food puffs market, by geography 2007 2014 ($Millions)

34 Major players and developments

35 Global baby food biscuit/cookies market, by geography 2007 2014 ($Millions)

36 Major players and developments

37 Global baby food rusks market, by geography 2007 2014 ($Millions)

38 Major players and developments

39 Global baby food soup market, by products 2007 2014 ($Millions)

40 Global baby food soup market, by geography 2007 2014 ($Millions)

41 Major players and developments

42 Global non-vegetarian baby soup market, by geography 2007 2014 ($Millions)

43 Global vegetarian baby soup market, by geography 2007 2014 ($Millions)

44 Global frozen baby food market, by products 2007 2014 ($Millions)

45 Global frozen baby food market, by geography 2007 2014 ($Millions)

46 Major players and developments

47 Global non-vegetarian frozen baby food market by geography 2007 2014 ($Millions)

48 Major players and developments

49 Global vegetarian frozen baby food market 2007 2014 ($Millions)

50 Major players and developments

51 Global frozen fruits baby food market, by geography 2007 2014 ($Millions)

52 Global baby food market, by health benefits 2007 2014 ($Millions)

53 Global baby food market for immune system 2007 2014 ($Millions)

54 Global baby food market for brain and eye development 2007 2014 ($Millions)

55 Global baby food market for muscular growth 2007 2014 ($Millions)

56 Global baby food market for bones and teeth development 2007 2014 ($Millions)

57 Global baby food market for blood enhancement 2007 2014 ($Millions)

58 Global baby food market for nervous system 2007 2014 ($Millions)

59 Global baby food market for body energy 2007 2014 ($Millions)

60 Global baby food market, by ingredients 2007 2014 ($Millions)

61 Global baby food cereals market, by products 2007 2014 ($Millions)

62 Global baby food milk products market, by products 2007 2014 ($Millions)

63 Lactose intolerance country-wise

64 Global fruit market for baby food, by types 2007 2014 ($Millions)

65 Global vegetable market for baby food, by types 2007 2014 ($Millions)

66 Global non-vegetarian market for baby food, by types 2007 2014 ($Millions)

67 Global baby food market, by geography 2007 2014 ($Millions)

68 U. S. baby food market, by products 2007 2014 ($Millions)

S. baby food market, by products 2007 2014 ($Millions)

69 European baby food market, by products 2007 2014 ($Millions)

70 Asian baby food market, by products 2007 2014 ($Millions)

71 Abbott nutrition product portfolio

72 Abbott nutrition new product portfolio

73 Babynat product portfolio

74 Beech nut product portfolio

75 Beech nut new product portfolio

76 Bristol-myers squibb product portfolio

77 Bristol-myers squibb new product portfolio

78 Danone dumex product portfolio

79 Dutch lady Product Portfolio

80 Earths best product portfolio

81 Earths best new product portfolio

82 Ella's kitchen product portfolio

83 Ella's kitchen new product portfolio

84 Fasska product portfolio

85 H.J. heinz co product portfolio

86 Halal baby food product portfolio

87 Healthy sprouts product portfolio

88 Hero product portfolio

89 Hipp organic baby food product portfolio

90 Little dish product portfolio

91 Plasmon product portfolio

92 Plum mums product portfolio

93 Plum mums new product portfolio

94 Plum organic product portfolio

95 Plum organic new product portfolio

96 SMA nutrition product portfolio

97 Stagesfood product portfolio

98 Sweet pea product portfolio

99 Tastybaby product portfolio

100 Stonyfield farm product portfolio

101 Yubao goat dairy product portfolio

102 Nestl product portfolio

103 Baby organix product portfolio

104 Babylicious product portfolio

105 PBM nutritional product portfolio

106 Wyeth product portfolio

107 Organic bubs product portfolio

108 Peter rabbit organics product portfolio

LIST OF FIGURES

1 Parental structure of baby food market

2 Evolution of baby food market

3 Product and ingredient trend analysis

4 Lactose intolerance: population analysis

5 Factors affecting the baby food market

6 Age-wise consumption pattern of baby food

7 Current favorability for baby food market

8 Market potential for baby food micro-markets

9 R&D trends in the baby food market

10 Decision influencers for baby food products

11 Market size vs CAGR (2009-2014) of baby food age-wise baby food market analysis

12 Comparative analysis of baby food market by target age group

13 Market segmentation of baby food

14 Market segmentation of infant food

15 Market segmentation of toddler baby food

16 Market segmentation of pre-schooler baby food

17 Common attributes of baby snacks

18 Consumption patterns of ingredients

19 Country-wise consumption of oatmeal

20 Country-wise consumption of rice

21 Country-wise consumption of barley

22 Global baby food patents by geography

23 Global baby food patents by product

24 U. S. patents by product

S. patents by product

25 Europe patents by product

26 Japan patents by product

Request for detailed methodology, assumptions & how numbers were triangulated.

baby food ads discriminated against men and grandmothers

Analysts of the SlickJump platform received unexpected results, who, using Google's socio-demographic algorithms, analyzed the interest of the Internet audience in the topic of baby food. It turned out that manufacturers and advertising agencies often ignored a significant part of the potential buyers of mixtures, juices and purees - men.

The baby food market is now gradually shrinking due to the negative impact of the pandemic. Worst of all were milk formulas (-13.5%), instant drinks (-11.1%) and dry cereals (-9,five%).

Researchers note that the decline in sales is a consequence of the pandemic and the subsequent quarantine measures that forced consumers to change the way children eat. In turn, SlickJump also notes errors in targeting baby food ads. Analysts have noticed that manufacturers and advertising agencies, quite often, when choosing a target audience, focus only on young mothers (from 25 to 34 years old), in fact, ignoring the interest in baby food from men in general and women over 45 years old. nine0003

Analysts have noticed that manufacturers and advertising agencies, quite often, when choosing a target audience, focus only on young mothers (from 25 to 34 years old), in fact, ignoring the interest in baby food from men in general and women over 45 years old. nine0003

But recent data indicate that the topic of baby food is of great interest to men as well. To test this, SlickJump used Google's socio-demographic tools to analyze data from tens of thousands of visitors to articles about baby food on RuNet. The gender of readers was determined in 76% of cases, and the proportion of men was 17.3%. Analysts drew attention to the fact that women aged 25-34 among readers - 44.4%, aged 35 to 45 years - 21.65%, and the remaining ~ 34% are outside the age range of the target audience. Thus, it can be argued that targeting baby food advertising solely on socio-demographic parameters can reduce the volume of available paying audience by more than 58%. Given the fall in demand for baby food, this figure can be called shocking. nine0003

nine0003

Losses are made up of age restrictions of the target audience (34%), gender restrictions of the target audience (18%) and the technical limit of reliability for determining social parameters (24-28%).

It can be assumed that the target audience of baby food buyers does not include people over 45 years of age. This conclusion can be drawn on the basis of studies and surveys that guide manufacturers. Thus, the Eurasian Union of Scientists published the results of a study of consumer preferences when purchasing baby food. It turned out that the main target audience for advertising baby food is people aged 25-35 years (78%), another 11% - from 36 to 45 years. Thus, people over 45 years old practically do not fall into the target audience of baby food buyers. nine0003

The authors of the study note that the figures reflect the real advertising strategy in Runet by baby food manufacturers, retail chains and their advertising agencies.

And this strategy can be considered as discriminatory and ineffective, because a fairly large part of Internet users do not see the advertising offers of baby food manufacturers and sellers, and are less oriented when choosing this product on the Internet.

Share on social networks:

Baby food market - AIM

Economic instability in 2009 has already affected childbearing in Ukraine. and, therefore, in the baby food market. So, in January-April of this year, 7.5 thousand fewer babies were born than in the same period last year. This immediately affected the production and sale of baby food in the first half of 2010.

According to the State Statistics Committee, in January-May 2010, compared with January-May 2009, the output of children's food in the country (excluding liquid dairy products) almost halved - from 4.5 thousand tons to 2, 5 thousand tons, in particular juices - from 2.1 thousand tons to 0.7 thousand tons. even reduced them. At best, domestic child-breadwinners hope in 2010 to reach the indicators of 2009, which was not entirely successful for them.

Production and market

The baby food market includes such product categories as dry breast milk substitutes, dry cereals, milk liquid baby food with a short shelf life (milk, kefirs, yogurts, curds), canned fruits and vegetables and juices for kids. Data on the volume of this market are quite contradictory. Some researchers, when calculating the market volume, take into account, for example, only juices for children under 1 year old, others - up to 3 years old.90; unites 10 manufacturers of baby food), in 2009, compared to 2008, the production of baby food in Ukraine increased by 5%, to 23.5 thousand tons.

Data on the volume of this market are quite contradictory. Some researchers, when calculating the market volume, take into account, for example, only juices for children under 1 year old, others - up to 3 years old.90; unites 10 manufacturers of baby food), in 2009, compared to 2008, the production of baby food in Ukraine increased by 5%, to 23.5 thousand tons.

According to Vyacheslav Dmukhovsky, analyst for market research of packaging and glass industry in the CIS countries of the Industrial Marketing Agency (Kyiv; marketing consulting and market research; since 1997; 13 people), baby food production in Ukraine in 2009. increased by 9% - up to 16.8 thousand tons.

The share of imports in the Ukrainian baby food market is high: according to various estimates, it is 40-50% in physical terms (depending on the segment). Last year, due to the growth of the dollar and the reduction in the purchasing power of our citizens, the volume of sales of foreign children's food decreased. For example, the import of baby food packaged for retail trade (the main volume is imported under the UKT VED code 190110000), decreased from 7 thousand tons in 2008 to 5.7 thousand tons in 2009 (see “Import of products ... "). domestic production and sales If earlier retail chains were reluctant to take relevant Ukrainian products for sale, since the state limits the trade margin on them as socially important goods (10-25% depending on the region), then in the period of decreasing purchasing activity, retail is interested in the sale of albeit less profitable, but fast-moving goods.However, this did not save the market from falling in physical terms.

According to Natalia Sinelnik, Director of HiPP Ukraine LLC, in 2009, compared to 2008, the volume of the baby food market decreased by 3% in physical terms and increased by 27% in money terms. Last year, both foreign baby food and Ukrainian food went up in price.

The first - due to the growth of the foreign exchange rate, the second - as a result of an increase in the price of milk and energy.