Organic baby food industry

Organic Baby Food Market Size, Share & Growth Report [2028]

The global organic baby food market size was USD 5.55 billion in 2020. The market is projected to grow from USD 6.05 billion in 2021 to USD 12.22 billion in 2028 growing at a CAGR of 10.58% during the 2021-2028 period. The global impact of COVID-19 has been unprecedented and staggering, with witnessing a negative impact on demand across all regions amid the pandemic. Based on our analysis, the global market exhibited a lower growth of -7.46% in 2020 as compared to the average year-on-year growth during 2017-2019. The rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

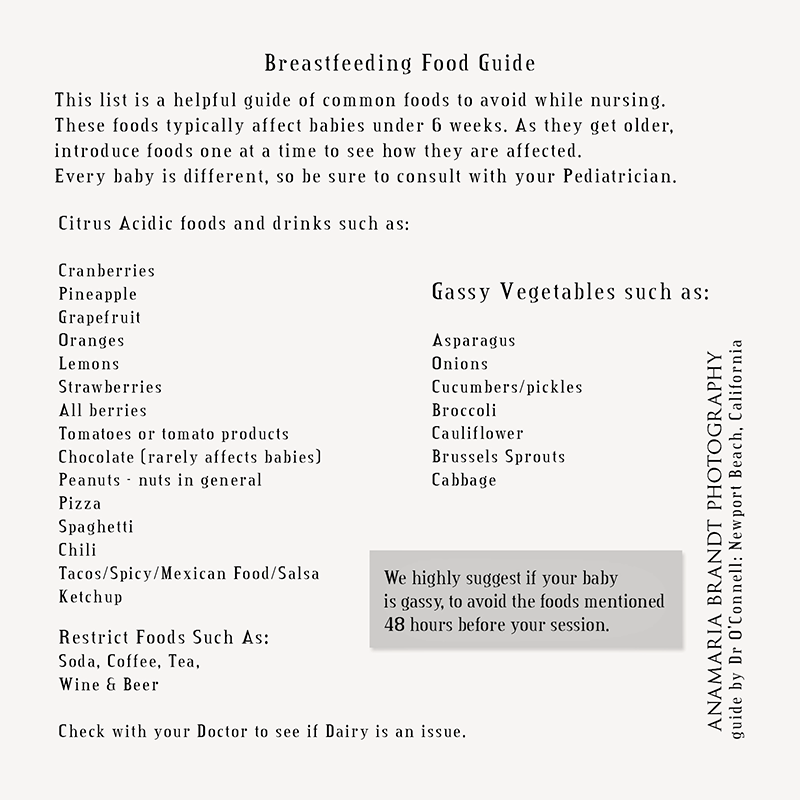

This market is witnessing progressive growth due to the rising demand for organic baby food products such as milk formulas and cereals. There is an increase in the variety of organic food products available at mainstream supermarkets. Moreover, many food manufacturers are acquiring other small food businesses and promoting their lines of products. In addition, there is rapid evolution of the baby food industry and novel preparations. It is expected to increase the demand for these items in the coming years.

Worldwide Demand & Supply Imbalance amid COVID-19 to Hinder Market Growth

The baby food industry has experienced a sudden disruption amidst the outbreak of the COVID-19 pandemic due to significant shift in demand dynamics. Lockdowns worldwide have led to the shutdown of manufacturing industries in the 2nd quarter of FY 2020, which significantly reduced the demand for processed food items, including baby food products.

According to World Health Organization (WHO), disruptions were observed in health services between mid-2020 in almost 90% of the countries. Moreover, in more than half of the nations, there were disruptions in antenatal care, management of malnutrition, and sick child services in 2020. Furthermore, 70% of countries also reported disruptions in routine immunization. Due to the factors mentioned above, supply chain management and products’ availability were deficient, impacting the sales of organic baby food products.

Due to the factors mentioned above, supply chain management and products’ availability were deficient, impacting the sales of organic baby food products.

LATEST TRENDS

Request a Free sample to learn more about this report.

Evolving Trend of Organic Milk Formulas to Sustain Market Development

With the increase in number of working women, consumer preference toward buying milk formulas has increased over the last few years. However, it has been observed that infant formulas with artificial ingredients do not contain the immunity-boosting elements present in breast milk. Still, organic milk formulas are developed using natural ingredients that can provide those elements; hence, consumer preference for these milk formulas is increasing. These milk formulas help in supporting babies who have specific dietary needs. A baby who has unique nutritional needs can get specialized milk formula products. With numerous benefits associated with organic ingredients, milk formulas are becoming the first choice by consumers, mainly in developed countries.

DRIVING FACTORS

Concerns Related to Child Health Stimulate Consumers to Purchase Organic Food Products

The concern about consuming artificial ingredients infused food products by infants and young children has grown over the few years. Parents have become more aware of different food ingredients and are more concerned about what their babies and toddlers consume than what they, as an adult, consume. With rapid internet penetration, parents know what’s new in the market and suitable for their kids and are ready to spend more on baby food than adult food. Moreover, the availability of organic products in smaller towns is also increasing, and this factor is playing a significant role in driving the market growth.

Organic baby food products have gained popularity mainly since the 1990s. Thus, major food manufacturers are interested in these products, considering their popularity in the baby food category. At that time, H.J. Heinz, one of the largest baby food companies, acquired Earth’s Best baby food in March 1996. After that, Gerber launched its organic baby foods by the name ‘Tender Harvest’ in October 1997. Since then, many key players in this market have entered this market, and various products are available. This increased penetration of organic products in tier 2 and tier 3 cities has also helped the market to grow in smaller towns. This factor is also expected to prosper the market growth in the coming years.

After that, Gerber launched its organic baby foods by the name ‘Tender Harvest’ in October 1997. Since then, many key players in this market have entered this market, and various products are available. This increased penetration of organic products in tier 2 and tier 3 cities has also helped the market to grow in smaller towns. This factor is also expected to prosper the market growth in the coming years.

Promotion and Marketing in Mainstream Distribution Channels Driving the Market

The market growth of organic baby food products has seen an upward trend in the last few years. The market is transforming slowly from niche category to significant industry category. The availability of products differs widely with each country depending on the market environment. In developed countries, such as Germany, the market for organic baby food products is strong as large retail chains account for about 70% of products sold in Germany. Although these products are costlier than conventional products, retailers apply higher discounts, which make the consumer buy the products. Expansion of supermarkets and hypermarkets in tier 2 and tier 3 cities is a major driving factor for the growth of the market in developing countries as consumers are aware of the products and are buying them for the last few years. With the expansion of supermarkets/hypermarkets during upcoming years, the market is expected to boost.

Expansion of supermarkets and hypermarkets in tier 2 and tier 3 cities is a major driving factor for the growth of the market in developing countries as consumers are aware of the products and are buying them for the last few years. With the expansion of supermarkets/hypermarkets during upcoming years, the market is expected to boost.

RESTRAINING FACTORS

High Costs Related to Organic Products to Hinder Market Growth

The adoption rate of organic food products is comparatively slow in the developing market, mainly in South Asia and Africa. Lack of awareness and knowledge among majority consumers creates temporary demand from a limited income group. This further affects the growth of the industry. In developing countries, the concern for safe food is far away for the majority of the consumers. Majority of the developing countries are price-sensitive nations, with wide diversity in earning power. Organic food is costlier in price than conventional food products. Consumers who are unaware of these products hesitate to spend that much on food. This vast difference between the prices poses challenges for organic products in these countries. This factor is expected to act as a significant challenge for the market growth in developing countries.

Consumers who are unaware of these products hesitate to spend that much on food. This vast difference between the prices poses challenges for organic products in these countries. This factor is expected to act as a significant challenge for the market growth in developing countries.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Wet Food Holds Major Organic Baby Food Market Share owing to Wide Range of Products Availability

The market is segmented into wet food, infant milk formula, and dry food based on type. Parents of infants and toddlers mainly prefer liquid food as they are easy to eat and digest; hence, market players also have 60-70% of products in the wet food category in their portfolio. With more players entering the market and introducing a variety of fruit flavors in puree blends, this segment is expected to retain its dominance in the type segment.

The infant milk formula segment is expected to grow with the highest CAGR as there is an increase in the working women population worldwide. As the number of working women is increasing, the need to provide more nutritionally stable food to the kids is increasing, and thus milk formulas are becoming popular. Dry food will grow with a steady CAGR as dry organic baby food demand is stable and rising slowly.

By Distribution Channel Analysis

Broader Availability of Products & Freedom to Purchase to Promote Sales via Supermarkets/Hypermarkets

By distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, online sales channels, and others. Supermarkets/hypermarkets are expanding rapidly. Supermarkets are now limited to only rich consumers, and over the past few years, supermarket chains have been spreading from wealthy areas of big cities to much smaller towns. Rising incomes, rapid urbanization, increase in female participation in the labor force, and adoption of western culture are the major factors that are helping the supermarkets industry to expand so rapidly. The factors mentioned above would prevail in the coming years, and thus this segment is expected to dominate the market during the forecast period.

The factors mentioned above would prevail in the coming years, and thus this segment is expected to dominate the market during the forecast period.

The online sales channels segment is expected to grow with the highest CAGR owing to easy accessibility due to the increasing internet penetration worldwide. Specialty stores and other segments will experience slower growth owing to lower discount offers.

REGIONAL INSIGHTS

North America Organic Baby Food Market Size, 2020 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

North America remains the dominant region in the market due to significant market players and higher spend capacity of consumers in these regions. Booming organic food sector in the region has contributed to the increasing demand for several baby food products. In addition, leading brands are also using strategic activities to increase the sale of their line of baby food products in these regions. The entry on newer, smaller players is intensifying the market competition in the region

The entry on newer, smaller players is intensifying the market competition in the region

Europe is expected to record a notable CAGR, owing to the growing demand for clean-label and sustainable baby food products. Consumer preferences regarding baby food have shifted toward buying safer, healthier, and organic products over the past few years. Thus, the increasing demand for organic, non-GMO, lactose-free, and plant-based products will drive the regional growth over 2021-2028. Many consumers in Europe are willing to pay a premium price for organic baby food products. They are aware of the positive impact on personal health, environment, food safety, taste, and appearance of organic products and have higher spending capacity.

Asia Pacific is one of the fastest developing regions owing to changing consumer preferences towards organic products. Increasing disposable incomes of consumers and changing lifestyles are driving organic product consumption. Moreover, the expansion of the supermarket sector across developing Asia Pacific countries will strengthen the regional outlook.

To know how our report can help streamline your business, Speak to Analyst

The markets in the Middle East & Africa and South America will record slow growth in the market owing to lower penetration of organic products. Brazil is anticipated to dominate the market share in South America. In the Middle East & Africa, the increasing lifestyle of middle-income groups is expected to boost the market with steady market growth.

KEY INDUSTRY PLAYERS

Nestle Focused on Expanding Its Line of Organic Baby Food Products in New and Developing Markets

Nestle is a major player in the baby food industry with its portfolio having a wide variety of products. Nestle is continuously looking to expand its reach in newer markets globally and bolster its presence in the market. In 2019, Nestle India launched an organic product within its Ceregrow brand of cereals. These products are specially made for children over the age of 12 months and are made using 100% organic wheat, milk, ragi, and rice.

The organic baby food market growth is expected to escalate as infant food products are expected to expand into more households. Considering this factor, Nestle is looking forward to making the most of it by strengthening its market position in the developing markets. Apart from this, other market players are also looking at India as a prominent market. In January 2021, India’s baby food brand “Timios” unveiled a new manufacturing model expected to meet the demand for organic baby products. It launched 12 varieties of baby porridge range aimed at babies and toddlers between 6 and 18 months.

LIST OF KEY COMPANIES PROFILED:

- Kraft Heinz Canada ULC (Illinois, U.S.)

- Nestlé S.A. (Vevey, Switzerland)

- Danone S.A. (Paris, France)

- Plum Organics (California, U.S.)

- HiPP GmbH & Co. Vertrieb KG (Pfaffenhofen, Germany)

- Pristine Organics Pvt Ltd. (Bengaluru, India)

- Yashili International Group Co.

, Ltd. (Guangdong, China)

, Ltd. (Guangdong, China) - GMP Dairy (Auckland, New Zealand)

- Arla Foods (Central Denmark Region, Denmark)

- Kewpie Corporation (Tokyo, Japan)

KEY INDUSTRY DEVELOPMENTS:

- April 2021 –Happy Family Organics launched a new pouch line, Happy Baby Savory Blends. These products are specially made for infants and toddlers over 6 months.

- March 2021 – Sun-Maid Growers of California acquired Plum Organics, which is a leading premium, organic baby food, and kid’s snacks brand from Campbell Soup Company. Through this acquisition, Sun-Maid is focusing on strengthening its market position in the baby food industry.

REPORT COVERAGE

An Infographic Representation of Organic Baby Food Market

View Full Infographic

To get information on various segments, share your queries with us

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading product distribution channels. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation:

ATTRIBUTE | DETAILS |

Study Period | 2017-2028 |

Base Year | 2020 |

Estimated Year | 2021 |

Forecast Period | 2021-2028 |

Historical Period | 2017-2019 |

Unit | Value (USD Billion) |

By Type |

|

By Distribution Channel |

|

By Geography |

|

Organic Baby Food Market Size, Share

2022

Organic Baby Food Market

P

by Product (Prepared Baby Food, Dried Baby Food, Infant Milk Formula, and Others) and Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Department Stores, E-Commerce, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

COVID-19

Pandemic disrupted the entire world and affected many industries.

Get detailed COVID-19 impact analysis on the Organic Baby Food Market

Request Now !

The global organic baby food market size was valued at $8,715.0 million in 2020, and is estimated to reach $34,818.7 million by 2031, registering a CAGR of 13.7% from 2022 to 2031.

The outbreak of the COVID-19 diseases and its rapid spread across the globe resulted in the implementation of the lockdown measures by the government. The lockdown rules implemented by the government resulted in the supply chain disruptions and the complete or partial closure of the manufacturing facilities and retail stores had adversely impacted the global organic baby food industry to a certain extent. However, there was a sudden spike in the sales of the organic baby food owing to the panic buying due to the stay at home orders by the government

The organic baby food is gaining rapid traction among the baby boomers across the globe owing to the surging awareness regarding the health benefits of organic food products and rise in health consciousness among consumers. The organic baby food products gains steady share in the retail sector. The easy availability of organic baby food across the popular sales channels, such as supermarkets, hypermarkets, e-commerce, and departmental stores significantly fosters the market growth across the globe. Various government initiatives related to organic food production, increase in working women, and growth of nuclear families propel the organic baby food market growth. However, due to certain government regulations with respect to labeling of these organic baby food products and the premium price of the products hamper the growth of the organic baby food market.

The organic baby food products gains steady share in the retail sector. The easy availability of organic baby food across the popular sales channels, such as supermarkets, hypermarkets, e-commerce, and departmental stores significantly fosters the market growth across the globe. Various government initiatives related to organic food production, increase in working women, and growth of nuclear families propel the organic baby food market growth. However, due to certain government regulations with respect to labeling of these organic baby food products and the premium price of the products hamper the growth of the organic baby food market.

The organic food products are gaining rapid traction among consumers, especially in the developed markets of North America and Europe. According to the Organic Trade Association, the U.S. witnessed a huge spike in the demand for the organic products in the U.S. in 2020, with an all-time high sales of organic products that exceeded $60 billion. Therefore, the increased awareness regarding harmful effects of the conventional chemically processed products on the environment and the human health has significantly surged the demand for organic products, especially among consumers. Furthermore, the strict regulations and certifications pertaining to the organic food and beverages ensure the safety and authenticity of organic products, which further supports the growth of the global organic baby food market.

Therefore, the increased awareness regarding harmful effects of the conventional chemically processed products on the environment and the human health has significantly surged the demand for organic products, especially among consumers. Furthermore, the strict regulations and certifications pertaining to the organic food and beverages ensure the safety and authenticity of organic products, which further supports the growth of the global organic baby food market.

According to the organic baby food market analysis, the market is segmented on the basis of product, distribution channel, and region. On the basis of product, it is divided into prepared baby food, dried baby food, infant milk formula, and others. On the basis of distribution channel, it is bifurcated into supermarkets/hypermarkets, pharmacies, department stores, e-commerce, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, United Arab Emirates, South Africa, Saudi Arabia, and rest of LAMEA).

Organic Baby Food Market

By Product

Prepared Baby Food segment held the major share of 72.2% in 2020

Get more information on this report : Request Sample Pages

On the basis of product, the prepared baby food was the leading segment, garnering around 72.2% of the organic baby food market share in 2020. The prepared baby foods are rich in vitamins and include antioxidants, which nurture a baby’s health, thus, driving parents to purchase these nutritional products. Owing to increase in working women and growth of nuclear families, customers tend to prefer the less processed prepared food for their baby to avoid effects of harmful chemicals.

On the basis of distribution channel, the e-commerce is expected to be the fastest-growing segment during the forecast segment. The easy accessibility offered by online platforms boosts their adoption in the organic baby food market, thus becoming a popular medium for the purchase of organic baby food. Easy availability of information about ingredients used in organic products, time-saving feature, and the facility of home delivery contribute to the growth of online sales.

Organic Baby Food Market

By Distribution Channel

Supermarkets/Hypermarkets segment held the major share of 30.8% in 2020

Get more information on this report : Request Sample Pages

On the basis of region, North America was the dominant organic baby food market in 2020. Change in lifestyle patterns of consumers and increase in participation of women in workforce fuel the market growth. Parents prefer to feed organic baby products to their infants, as they contain all the necessary nutrients, iron, vitamins, and proteins necessary for baby’s growth.

The key players operating in the market include Abbott laboratories, Nestlé S.A., Hero Group, Amara Organics, Danone, Plum organics, The Hein celestial group, North Castle Partners, LLC. HiPP, and Baby Gourmet Foods Inc. Market estimations of each segment support to analyze the key investment pockets of the industry.

Organic Baby Food Market

By Region

2031

North America

Europe

Asia-pacific

Lamea

North America segment held the major share of 33.

4% in 2020

4% in 2020Get more information on this report : Request Sample Pages

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging organic baby food market trends and opportunities.

- The report provides detailed qualitative and quantitative analysis of the current trends and future estimations that help evaluate the prevailing organic baby food market opportunities in the market.

- The organic baby food market forecast is offered along with information related to key drivers, restraints, and opportunities.

- The market analysis is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential and niche segments or regions exhibiting favorable growth.

Organic Baby Food Market Report Highlights

| Aspects | Details |

|---|---|

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

Loading Table Of Content...

The global organic baby food market provides lucrative opportunities to market players, owing to rise in awareness about the consumption of organic foods, especially in Asia-Pacific and LAMEA. Plum Organics and Earth’s Best offer different variants of purees and vegetable & fruit blends, which contain organically-grown ingredients. Moreover, parents prefer organic baby food due to low or no chemical content as compared to conventional baby foods and as they help in providing nutrition. Major players in the market are developing various techniques to spread awareness about the benefits of organic baby foods, thereby increasing the market growth.

The labor workforce of women has increased over the past few years due to rise in literacy rate. The ratio is estimated to increase in the near future, owing to the supportive government policies. The ease and convenience provided by these baby products offer parents lesser time in manual preparation of baby foods and simultaneously take care of the babies, which is expected to boost the market growth during the forecast period.

Furthermore, the rise in penetration of e-commerce channels in the baby food market provides a regular revenue stream to the organic baby food manufacturers. The e-commerce platforms, such as Happa and Pristine, who specialize to provide organic baby food are expected to penetrate in the market at a rapid rate and contribute to the market growth during the forecast period.

HiPP: the highest quality organic baby food

We know that many mothers cringe at the thought of canned baby food, preferring zucchini, broccoli or bananas from the nearest market.

But what do you know about store-bought zucchini, "farm" broccoli and "bio" beef from even the so-called "eco" meat department? Are there any guarantees of quality when the Russian market is simply in trouble with organic vegetables and fruits?

But what do you know about store-bought zucchini, "farm" broccoli and "bio" beef from even the so-called "eco" meat department? Are there any guarantees of quality when the Russian market is simply in trouble with organic vegetables and fruits?

The choice of the first feeding method is always up to the mother. Yes, baby food standards are now strict in Russia and are met by all manufacturers. Despite this, baby food standards allow the use of chemicals and pesticides in minimal doses that are not considered to affect the baby's body. Organic baby food means that the ingredients are grown without the use of pesticides, chemical fertilizers and growth hormones.

In the case of HiPP baby food, this also means that each jar passed 260 checks along the way. Two hundred and sixty! But first things first.

HiPP: over 60 years of experience in the production of organic baby food

For more than 60 years, HiPP organic baby food of the highest quality has been produced in the Bavarian town of Pfaffenhofen. It all started even earlier and literally with crackers - in 1899, Josef Hipp in his HiPP confectionery made the first children's porridge from crackers, milk and water. Over time, the brand has gradually become the market leader in baby food in Germany: still a family business, the HiPP group under the leadership of Dr. Klaus Hipp and his son Stefan has become the No. 1 brand in organic baby food in the world.

It all started even earlier and literally with crackers - in 1899, Josef Hipp in his HiPP confectionery made the first children's porridge from crackers, milk and water. Over time, the brand has gradually become the market leader in baby food in Germany: still a family business, the HiPP group under the leadership of Dr. Klaus Hipp and his son Stefan has become the No. 1 brand in organic baby food in the world.

In Russian reality, HiPP and its production facilities appeared much later. In 2007, construction began on a plant in Mamonovo, 60 kilometers from Kaliningrad. Five years after the opening of the enterprise in 2014, a food embargo struck, and production was on the verge of closing. Read more about how HiPP in Russia survived the hard times in the report by Natalia Paramonova.

At present, the 11,000-square-meter facility in Mamonovo, certified according to the European standard, produces HiPP organic baby food, which is then shipped throughout Russia and Belarus.

Where do carrots come from?

To call a product organic, it is not surprising that organic raw materials are also needed – in the case of HiPP, these are vegetables, fruits and meat for mono- and mixed purees. For organic products, the land for sowing is carefully selected, fruits and vegetables ripen naturally without the use of mineral fertilizers and pesticides. The same care is taken with the animals whose meat is used for the production of HiPP organic menus. All animals - turkeys, pigs, cows or chickens - are kept in the natural environment for each species, they eat organic food. If desired, the origin of each animal can be documented.

In addition to the benefits for babies and peace of mind for mothers, one cannot but note the value of organic products for nature - over 8,000 farmers produce organic quality products for HiPP, annually 80,000 hectares of soil and groundwater are not treated with chemical fertilizers and pesticides.

At the moment, vegetables are supplied to HiPP’s Russian production from Poland, Germany and Austria, fruits are from Italy, Spain, Germany, South Africa and Costa Rica, beef is grown in a certified farm in the Kaluga region, potatoes go to Kaliningrad with organic farm in the Tula region. Produced in HiPP's own factory in Hungary, fish "dishes" are sourced from the North Atlantic, certified by the Marine Resources Council (MSC), and the "Responsible Fishing" label on the packaging ensures that the fish are caught in a sustainable manner. respect for the environment while preserving the natural resources of fishing.

Produced in HiPP's own factory in Hungary, fish "dishes" are sourced from the North Atlantic, certified by the Marine Resources Council (MSC), and the "Responsible Fishing" label on the packaging ensures that the fish are caught in a sustainable manner. respect for the environment while preserving the natural resources of fishing.

For the production of baby food, frozen vegetables are used, since shock freezing retains all the beneficial properties and taste, while increasing the shelf life, and, accordingly, the shelf life of the finished product.

See packaging

How do you know if a product is organic? Are there any special labeling requirements?

Euroleaf (European Union) means that it is a certified organic product, i.e. methods of obtaining raw materials, production, processing, storage and transportation and quality characteristics of the final product meet the requirements of the EU organic standard.

HiPP ORGANIC means that HiPP has even more stringent requirements for the production of organic food than prescribed by EU legislation and organic standards.

When choosing a product, also pay attention to the age recommendations of the manufacturer and the degree of grinding of the product: the words “homogenized”, “mashed” and “coarsely ground” indicate the degree of grinding of the puree: a homogeneous consistency or with pieces.

Let's go back to our "zucchini" and the widespread question of mothers: "Where can I find fruits and vegetables grown without pesticides, chemicals and growth hormones"? We repeat that the choice is, of course, yours, and we, who are all for organic, are pleased that HiPP produces premium organic baby food in our country and for our children. And this certified organic quality moms can trust one hundred percent.

organic baby food. Organic fruits organic meat, raw materials for baby food

If you have a small child who you occasionally feed with canned baby food, HiPP is familiar to you. Looking at the jar, most likely you did not pay attention to the round HiPP BIO sign placed on the label. What is this sign and why does it deserve special attention?

What is this sign and why does it deserve special attention?

Organic farming - a source of organic raw materials

Surely you have already met the term "organic farming" - a way of farming without the use of synthetic fertilizers, pesticides, plant growth regulators, which uses only organic fertilizers and competent crop rotation, as well as biological pest control methods. For example, with a five-year crop rotation cycle, clover, wheat, oats, buckwheat, vegetables are alternately grown on the field - and then clover again. This reduces the clogging of the soil with weeds, provides it with various nutrients and reduces the degree of natural soil depletion. Manure is used as a fertilizer in the fields to enrich the soil and increase productivity.

Growing grains and vegetables organically is more labor intensive. Of course, modern mechanical methods of weed control are actively used, but at some stages manual labor is also required.

Since the use of insecticides in organic farming is prohibited, insect pests are controlled by natural methods - creating favorable conditions for beneficial insects and birds. For example, grain harvesting is not carried out in the middle of the day, when bees are most active, because. mechanical harvesting can kill a large number of beneficial insects. And Colorado beetles are fought with the help of neem tree oil.

In organic agriculture, cattle graze most of the year on natural pastures in the open. This allows the animals to be strong and healthy, as well as to consume a more varied diet. Poultry is also raised in free-range conditions. In the cold season, animals receive biofeed grown in organic fields - the same clover used in the crop rotation system, as well as various grains and straw.

Why is it important to use organic products in baby food?

In addition to the fact that organic farming does not degrade the quality of the soil, groundwater is not polluted - i. e. the ecological state of the environment does not suffer, organically grown products have a natural taste and are more beneficial to human health.

e. the ecological state of the environment does not suffer, organically grown products have a natural taste and are more beneficial to human health.

Infants and young children are especially vulnerable - even pesticide residues from food can adversely affect the health of the baby. Therefore The use of organic products in baby food is the key to future health .

HiPP Raw Materials Sources

HiPP has a long history of working closely with organic farmers whose farming practices produce the best raw materials while intelligently adapting to the natural cycle. For the production of baby food, HiPP uses only raw materials grown in accordance with the European legislation on organic production, which contains clear requirements for the cultivation and production of organic products . The quality of HiPP BIO goes beyond the general legal requirements for bio products - for this, additional checks of raw materials and products are carried out at different stages of production.

More than 8,000 organic farmers around the world produce organic fruit, organic vegetables and organic meat for HiPP. When purchasing raw materials that do not grow in the local latitudes, such as bananas, high organic quality is also emphasized.

To secure its own natural bananas, HiPP has established its own direct import system, which includes farms located in the pristine high jungles of Costa Rica. Plants in such farms do not grow crowded, but at a distance from each other - in a completely different way than on ordinary plantations. No pesticides or plant protection products are used in the cultivation of these bananas. If a plant is affected by a fungal or other disease, it is enough to remove the diseased branch to avoid the spread of the disease.

Quality control of raw materials and finished products - a guarantee of safety

Immediately after the delivery of raw materials intended for the production of HiPP baby food, the first checks for the presence of harmful substances are carried out, and if there are complaints, the goods are not accepted. Only raw materials that have been tested for the absence of about 1,200 prohibited residues enter the production. Only ingredients that have passed through a multi-level quality control system enter the jars. And only after that the jar receives the HiPP BIO organic quality mark.

Only raw materials that have been tested for the absence of about 1,200 prohibited residues enter the production. Only ingredients that have passed through a multi-level quality control system enter the jars. And only after that the jar receives the HiPP BIO organic quality mark.

HiPP baby food is produced in several factories throughout Europe. In 2009, plant HiPP appeared in Russia - in the Kaliningrad region. Currently, this is the only organic baby food production in the Russian Federation with its own vegetable store, microbiological laboratories and autonomous water supply.

All HiPP products that left the assembly line of the Russian factory, are manufactured according to the same company standards , complying with the requirements of European legislation for organic products. A significant part of the raw materials for the production of baby food at the Kaliningrad plant is produced outside of Russia. Only a small part of it is supplied by Russian farmers - these are potatoes, carrots, parsnips. In the near future, domestic organic beef will begin to be used - bulls have already been grown, production is currently being certified.

Only a small part of it is supplied by Russian farmers - these are potatoes, carrots, parsnips. In the near future, domestic organic beef will begin to be used - bulls have already been grown, production is currently being certified.

Raw materials and finished products in the Russian Federation go through the same quality control stages as at each HiPP plant. The contents of each jar are controlled more than 260 times - up to checking the finished product before shipment to the client.

But why HiPP?

The Hipp company dates back to the end of the 19th century, when the hereditary German confectioner Josef Hipp created children's porridge for his own children - from ground crackers and milk. Kasha gained fame among the neighbors and laid the foundation for a family business. In 1956, one of the sons of Josef Hipp began the industrial production of baby food in jars - first in cans, and then in glass ones. At the same time, the family farm gradually began to switch to organic farming.

S. (By Distribution Channel)

S. (By Distribution Channel) S., Canada, Mexico)

S., Canada, Mexico)