Organic baby food trends

Organic Baby Food Market Size, Share & Growth Report [2028]

The global organic baby food market size was USD 5.55 billion in 2020. The market is projected to grow from USD 6.05 billion in 2021 to USD 12.22 billion in 2028 growing at a CAGR of 10.58% during the 2021-2028 period. The global impact of COVID-19 has been unprecedented and staggering, with witnessing a negative impact on demand across all regions amid the pandemic. Based on our analysis, the global market exhibited a lower growth of -7.46% in 2020 as compared to the average year-on-year growth during 2017-2019. The rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

This market is witnessing progressive growth due to the rising demand for organic baby food products such as milk formulas and cereals. There is an increase in the variety of organic food products available at mainstream supermarkets. Moreover, many food manufacturers are acquiring other small food businesses and promoting their lines of products. In addition, there is rapid evolution of the baby food industry and novel preparations. It is expected to increase the demand for these items in the coming years.

Worldwide Demand & Supply Imbalance amid COVID-19 to Hinder Market Growth

The baby food industry has experienced a sudden disruption amidst the outbreak of the COVID-19 pandemic due to significant shift in demand dynamics. Lockdowns worldwide have led to the shutdown of manufacturing industries in the 2nd quarter of FY 2020, which significantly reduced the demand for processed food items, including baby food products.

According to World Health Organization (WHO), disruptions were observed in health services between mid-2020 in almost 90% of the countries. Moreover, in more than half of the nations, there were disruptions in antenatal care, management of malnutrition, and sick child services in 2020. Furthermore, 70% of countries also reported disruptions in routine immunization. Due to the factors mentioned above, supply chain management and products’ availability were deficient, impacting the sales of organic baby food products.

Due to the factors mentioned above, supply chain management and products’ availability were deficient, impacting the sales of organic baby food products.

LATEST TRENDS

Request a Free sample to learn more about this report.

Evolving Trend of Organic Milk Formulas to Sustain Market Development

With the increase in number of working women, consumer preference toward buying milk formulas has increased over the last few years. However, it has been observed that infant formulas with artificial ingredients do not contain the immunity-boosting elements present in breast milk. Still, organic milk formulas are developed using natural ingredients that can provide those elements; hence, consumer preference for these milk formulas is increasing. These milk formulas help in supporting babies who have specific dietary needs. A baby who has unique nutritional needs can get specialized milk formula products. With numerous benefits associated with organic ingredients, milk formulas are becoming the first choice by consumers, mainly in developed countries.

DRIVING FACTORS

Concerns Related to Child Health Stimulate Consumers to Purchase Organic Food Products

The concern about consuming artificial ingredients infused food products by infants and young children has grown over the few years. Parents have become more aware of different food ingredients and are more concerned about what their babies and toddlers consume than what they, as an adult, consume. With rapid internet penetration, parents know what’s new in the market and suitable for their kids and are ready to spend more on baby food than adult food. Moreover, the availability of organic products in smaller towns is also increasing, and this factor is playing a significant role in driving the market growth.

Organic baby food products have gained popularity mainly since the 1990s. Thus, major food manufacturers are interested in these products, considering their popularity in the baby food category. At that time, H.J. Heinz, one of the largest baby food companies, acquired Earth’s Best baby food in March 1996. After that, Gerber launched its organic baby foods by the name ‘Tender Harvest’ in October 1997. Since then, many key players in this market have entered this market, and various products are available. This increased penetration of organic products in tier 2 and tier 3 cities has also helped the market to grow in smaller towns. This factor is also expected to prosper the market growth in the coming years.

After that, Gerber launched its organic baby foods by the name ‘Tender Harvest’ in October 1997. Since then, many key players in this market have entered this market, and various products are available. This increased penetration of organic products in tier 2 and tier 3 cities has also helped the market to grow in smaller towns. This factor is also expected to prosper the market growth in the coming years.

Promotion and Marketing in Mainstream Distribution Channels Driving the Market

The market growth of organic baby food products has seen an upward trend in the last few years. The market is transforming slowly from niche category to significant industry category. The availability of products differs widely with each country depending on the market environment. In developed countries, such as Germany, the market for organic baby food products is strong as large retail chains account for about 70% of products sold in Germany. Although these products are costlier than conventional products, retailers apply higher discounts, which make the consumer buy the products. Expansion of supermarkets and hypermarkets in tier 2 and tier 3 cities is a major driving factor for the growth of the market in developing countries as consumers are aware of the products and are buying them for the last few years. With the expansion of supermarkets/hypermarkets during upcoming years, the market is expected to boost.

Expansion of supermarkets and hypermarkets in tier 2 and tier 3 cities is a major driving factor for the growth of the market in developing countries as consumers are aware of the products and are buying them for the last few years. With the expansion of supermarkets/hypermarkets during upcoming years, the market is expected to boost.

RESTRAINING FACTORS

High Costs Related to Organic Products to Hinder Market Growth

The adoption rate of organic food products is comparatively slow in the developing market, mainly in South Asia and Africa. Lack of awareness and knowledge among majority consumers creates temporary demand from a limited income group. This further affects the growth of the industry. In developing countries, the concern for safe food is far away for the majority of the consumers. Majority of the developing countries are price-sensitive nations, with wide diversity in earning power. Organic food is costlier in price than conventional food products. Consumers who are unaware of these products hesitate to spend that much on food. This vast difference between the prices poses challenges for organic products in these countries. This factor is expected to act as a significant challenge for the market growth in developing countries.

Consumers who are unaware of these products hesitate to spend that much on food. This vast difference between the prices poses challenges for organic products in these countries. This factor is expected to act as a significant challenge for the market growth in developing countries.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Wet Food Holds Major Organic Baby Food Market Share owing to Wide Range of Products Availability

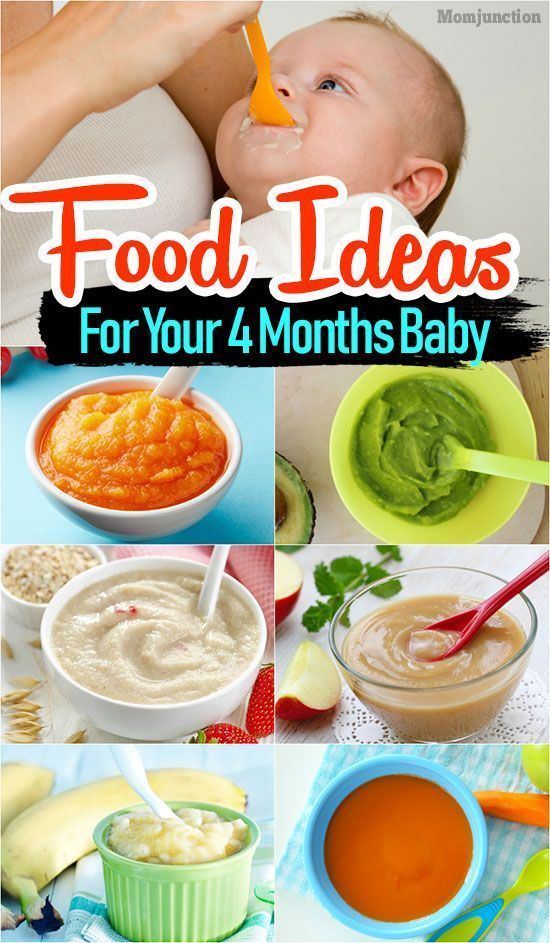

The market is segmented into wet food, infant milk formula, and dry food based on type. Parents of infants and toddlers mainly prefer liquid food as they are easy to eat and digest; hence, market players also have 60-70% of products in the wet food category in their portfolio. With more players entering the market and introducing a variety of fruit flavors in puree blends, this segment is expected to retain its dominance in the type segment.

The infant milk formula segment is expected to grow with the highest CAGR as there is an increase in the working women population worldwide. As the number of working women is increasing, the need to provide more nutritionally stable food to the kids is increasing, and thus milk formulas are becoming popular. Dry food will grow with a steady CAGR as dry organic baby food demand is stable and rising slowly.

By Distribution Channel Analysis

Broader Availability of Products & Freedom to Purchase to Promote Sales via Supermarkets/Hypermarkets

By distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, online sales channels, and others. Supermarkets/hypermarkets are expanding rapidly. Supermarkets are now limited to only rich consumers, and over the past few years, supermarket chains have been spreading from wealthy areas of big cities to much smaller towns. Rising incomes, rapid urbanization, increase in female participation in the labor force, and adoption of western culture are the major factors that are helping the supermarkets industry to expand so rapidly. The factors mentioned above would prevail in the coming years, and thus this segment is expected to dominate the market during the forecast period.

The factors mentioned above would prevail in the coming years, and thus this segment is expected to dominate the market during the forecast period.

The online sales channels segment is expected to grow with the highest CAGR owing to easy accessibility due to the increasing internet penetration worldwide. Specialty stores and other segments will experience slower growth owing to lower discount offers.

REGIONAL INSIGHTS

North America Organic Baby Food Market Size, 2020 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

North America remains the dominant region in the market due to significant market players and higher spend capacity of consumers in these regions. Booming organic food sector in the region has contributed to the increasing demand for several baby food products. In addition, leading brands are also using strategic activities to increase the sale of their line of baby food products in these regions. The entry on newer, smaller players is intensifying the market competition in the region

The entry on newer, smaller players is intensifying the market competition in the region

Europe is expected to record a notable CAGR, owing to the growing demand for clean-label and sustainable baby food products. Consumer preferences regarding baby food have shifted toward buying safer, healthier, and organic products over the past few years. Thus, the increasing demand for organic, non-GMO, lactose-free, and plant-based products will drive the regional growth over 2021-2028. Many consumers in Europe are willing to pay a premium price for organic baby food products. They are aware of the positive impact on personal health, environment, food safety, taste, and appearance of organic products and have higher spending capacity.

Asia Pacific is one of the fastest developing regions owing to changing consumer preferences towards organic products. Increasing disposable incomes of consumers and changing lifestyles are driving organic product consumption. Moreover, the expansion of the supermarket sector across developing Asia Pacific countries will strengthen the regional outlook.

To know how our report can help streamline your business, Speak to Analyst

The markets in the Middle East & Africa and South America will record slow growth in the market owing to lower penetration of organic products. Brazil is anticipated to dominate the market share in South America. In the Middle East & Africa, the increasing lifestyle of middle-income groups is expected to boost the market with steady market growth.

KEY INDUSTRY PLAYERS

Nestle Focused on Expanding Its Line of Organic Baby Food Products in New and Developing Markets

Nestle is a major player in the baby food industry with its portfolio having a wide variety of products. Nestle is continuously looking to expand its reach in newer markets globally and bolster its presence in the market. In 2019, Nestle India launched an organic product within its Ceregrow brand of cereals. These products are specially made for children over the age of 12 months and are made using 100% organic wheat, milk, ragi, and rice.

The organic baby food market growth is expected to escalate as infant food products are expected to expand into more households. Considering this factor, Nestle is looking forward to making the most of it by strengthening its market position in the developing markets. Apart from this, other market players are also looking at India as a prominent market. In January 2021, India’s baby food brand “Timios” unveiled a new manufacturing model expected to meet the demand for organic baby products. It launched 12 varieties of baby porridge range aimed at babies and toddlers between 6 and 18 months.

LIST OF KEY COMPANIES PROFILED:

- Kraft Heinz Canada ULC (Illinois, U.S.)

- Nestlé S.A. (Vevey, Switzerland)

- Danone S.A. (Paris, France)

- Plum Organics (California, U.S.)

- HiPP GmbH & Co. Vertrieb KG (Pfaffenhofen, Germany)

- Pristine Organics Pvt Ltd. (Bengaluru, India)

- Yashili International Group Co.

, Ltd. (Guangdong, China)

, Ltd. (Guangdong, China) - GMP Dairy (Auckland, New Zealand)

- Arla Foods (Central Denmark Region, Denmark)

- Kewpie Corporation (Tokyo, Japan)

KEY INDUSTRY DEVELOPMENTS:

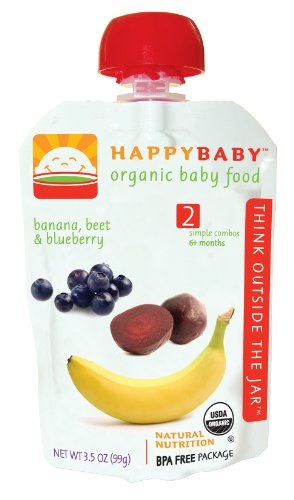

- April 2021 –Happy Family Organics launched a new pouch line, Happy Baby Savory Blends. These products are specially made for infants and toddlers over 6 months.

- March 2021 – Sun-Maid Growers of California acquired Plum Organics, which is a leading premium, organic baby food, and kid’s snacks brand from Campbell Soup Company. Through this acquisition, Sun-Maid is focusing on strengthening its market position in the baby food industry.

REPORT COVERAGE

An Infographic Representation of Organic Baby Food Market

View Full Infographic

To get information on various segments, share your queries with us

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading product distribution channels. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation:

ATTRIBUTE | DETAILS |

Study Period | 2017-2028 |

Base Year | 2020 |

Estimated Year | 2021 |

Forecast Period | 2021-2028 |

Historical Period | 2017-2019 |

Unit | Value (USD Billion) |

By Type |

|

By Distribution Channel |

|

By Geography |

|

Organic Baby Food Market Size, Share

2022

Organic Baby Food Market

P

by Product (Prepared Baby Food, Dried Baby Food, Infant Milk Formula, and Others) and Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Department Stores, E-Commerce, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031

COVID-19

Pandemic disrupted the entire world and affected many industries.

Get detailed COVID-19 impact analysis on the Organic Baby Food Market

Request Now !

The global organic baby food market size was valued at $8,715.0 million in 2020, and is estimated to reach $34,818.7 million by 2031, registering a CAGR of 13.7% from 2022 to 2031.

The outbreak of the COVID-19 diseases and its rapid spread across the globe resulted in the implementation of the lockdown measures by the government. The lockdown rules implemented by the government resulted in the supply chain disruptions and the complete or partial closure of the manufacturing facilities and retail stores had adversely impacted the global organic baby food industry to a certain extent. However, there was a sudden spike in the sales of the organic baby food owing to the panic buying due to the stay at home orders by the government

The organic baby food is gaining rapid traction among the baby boomers across the globe owing to the surging awareness regarding the health benefits of organic food products and rise in health consciousness among consumers. The organic baby food products gains steady share in the retail sector. The easy availability of organic baby food across the popular sales channels, such as supermarkets, hypermarkets, e-commerce, and departmental stores significantly fosters the market growth across the globe. Various government initiatives related to organic food production, increase in working women, and growth of nuclear families propel the organic baby food market growth. However, due to certain government regulations with respect to labeling of these organic baby food products and the premium price of the products hamper the growth of the organic baby food market.

The organic baby food products gains steady share in the retail sector. The easy availability of organic baby food across the popular sales channels, such as supermarkets, hypermarkets, e-commerce, and departmental stores significantly fosters the market growth across the globe. Various government initiatives related to organic food production, increase in working women, and growth of nuclear families propel the organic baby food market growth. However, due to certain government regulations with respect to labeling of these organic baby food products and the premium price of the products hamper the growth of the organic baby food market.

The organic food products are gaining rapid traction among consumers, especially in the developed markets of North America and Europe. According to the Organic Trade Association, the U.S. witnessed a huge spike in the demand for the organic products in the U.S. in 2020, with an all-time high sales of organic products that exceeded $60 billion. Therefore, the increased awareness regarding harmful effects of the conventional chemically processed products on the environment and the human health has significantly surged the demand for organic products, especially among consumers. Furthermore, the strict regulations and certifications pertaining to the organic food and beverages ensure the safety and authenticity of organic products, which further supports the growth of the global organic baby food market.

Therefore, the increased awareness regarding harmful effects of the conventional chemically processed products on the environment and the human health has significantly surged the demand for organic products, especially among consumers. Furthermore, the strict regulations and certifications pertaining to the organic food and beverages ensure the safety and authenticity of organic products, which further supports the growth of the global organic baby food market.

According to the organic baby food market analysis, the market is segmented on the basis of product, distribution channel, and region. On the basis of product, it is divided into prepared baby food, dried baby food, infant milk formula, and others. On the basis of distribution channel, it is bifurcated into supermarkets/hypermarkets, pharmacies, department stores, e-commerce, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, United Arab Emirates, South Africa, Saudi Arabia, and rest of LAMEA).

Organic Baby Food Market

By Product

Prepared Baby Food segment held the major share of 72.2% in 2020

Get more information on this report : Request Sample Pages

On the basis of product, the prepared baby food was the leading segment, garnering around 72.2% of the organic baby food market share in 2020. The prepared baby foods are rich in vitamins and include antioxidants, which nurture a baby’s health, thus, driving parents to purchase these nutritional products. Owing to increase in working women and growth of nuclear families, customers tend to prefer the less processed prepared food for their baby to avoid effects of harmful chemicals.

On the basis of distribution channel, the e-commerce is expected to be the fastest-growing segment during the forecast segment. The easy accessibility offered by online platforms boosts their adoption in the organic baby food market, thus becoming a popular medium for the purchase of organic baby food. Easy availability of information about ingredients used in organic products, time-saving feature, and the facility of home delivery contribute to the growth of online sales.

Organic Baby Food Market

By Distribution Channel

Supermarkets/Hypermarkets segment held the major share of 30.8% in 2020

Get more information on this report : Request Sample Pages

On the basis of region, North America was the dominant organic baby food market in 2020. Change in lifestyle patterns of consumers and increase in participation of women in workforce fuel the market growth. Parents prefer to feed organic baby products to their infants, as they contain all the necessary nutrients, iron, vitamins, and proteins necessary for baby’s growth.

The key players operating in the market include Abbott laboratories, Nestlé S.A., Hero Group, Amara Organics, Danone, Plum organics, The Hein celestial group, North Castle Partners, LLC. HiPP, and Baby Gourmet Foods Inc. Market estimations of each segment support to analyze the key investment pockets of the industry.

Organic Baby Food Market

By Region

2031

North America

Europe

Asia-pacific

Lamea

North America segment held the major share of 33.

4% in 2020

4% in 2020Get more information on this report : Request Sample Pages

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging organic baby food market trends and opportunities.

- The report provides detailed qualitative and quantitative analysis of the current trends and future estimations that help evaluate the prevailing organic baby food market opportunities in the market.

- The organic baby food market forecast is offered along with information related to key drivers, restraints, and opportunities.

- The market analysis is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential and niche segments or regions exhibiting favorable growth.

Organic Baby Food Market Report Highlights

| Aspects | Details |

|---|---|

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

Loading Table Of Content...

The global organic baby food market provides lucrative opportunities to market players, owing to rise in awareness about the consumption of organic foods, especially in Asia-Pacific and LAMEA. Plum Organics and Earth’s Best offer different variants of purees and vegetable & fruit blends, which contain organically-grown ingredients. Moreover, parents prefer organic baby food due to low or no chemical content as compared to conventional baby foods and as they help in providing nutrition. Major players in the market are developing various techniques to spread awareness about the benefits of organic baby foods, thereby increasing the market growth.

The labor workforce of women has increased over the past few years due to rise in literacy rate. The ratio is estimated to increase in the near future, owing to the supportive government policies. The ease and convenience provided by these baby products offer parents lesser time in manual preparation of baby foods and simultaneously take care of the babies, which is expected to boost the market growth during the forecast period.

Furthermore, the rise in penetration of e-commerce channels in the baby food market provides a regular revenue stream to the organic baby food manufacturers. The e-commerce platforms, such as Happa and Pristine, who specialize to provide organic baby food are expected to penetrate in the market at a rapid rate and contribute to the market growth during the forecast period.

5 trends in baby food that attract parents - Encyclopedia Baby food

Levchuk Victoria ©

Taste. Texture. Smell. It's worth thinking about all the things that are vital to a positive customer experience—things that are likely to encourage repeat purchases.

Consider baby food. What leads to a positive consumer experience? Usually, parents make purchasing decisions based on how they perceive the product and how it affects the health of the child.

Sales of baby food are not affected by factors that are usually important in other categories of consumption because parents decide what to buy based on their experience and fashion for healthy food. Of course, taste and texture are important when choosing baby food, as it can increase future purchases. Perhaps more than any other consumption category, baby food sales depend on the positive health benefits associated with the product.

Contents:

After all, the child is fed only healthy complementary foods. Below are 5 baby food trends that attract today's parents and are the main criteria when choosing complementary foods for a child.

1. Ancient Grains

Grains have long been popular in baby food. Usually, a child is fed rice, buckwheat, oatmeal from cereals. But now they are being replaced by grains that carry even more nutritional value: ancient grains. Also known as heritage grains, popular varieties include quinoa, quinoa, teff, millet, and chia.

But now they are being replaced by grains that carry even more nutritional value: ancient grains. Also known as heritage grains, popular varieties include quinoa, quinoa, teff, millet, and chia.

Ancient grains are high in protein, fiber, and several vitamins and minerals, and promote heart, gut, and immune health, among other benefits.

2. Natural nutrition

Parents do not want to feed their children food that has been synthetically developed in a laboratory or genetically engineered. Returning to a natural diet is high on the list of priorities for parents.

The concept that we should nourish children's bodies with nutrients from natural whole foods. Therefore, many parents carefully read the composition of baby food in order to choose a product without additives, without artificial or synthetic ingredients.

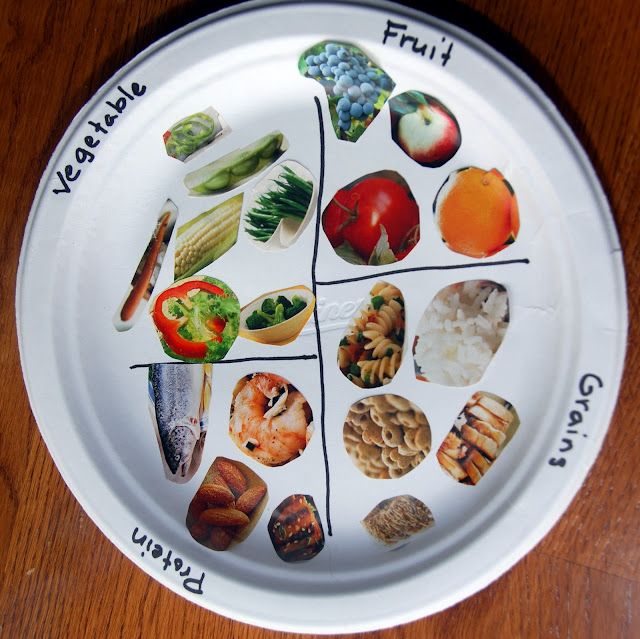

3. All the colors of the rainbow

It is important for a child to eat not only natural complementary foods, but also to choose baby food from a variety of products - a colorful variety. For the most part, the color of fruits and vegetables corresponds to specific chemical compounds in food. The color of the product that the child eats ultimately affects his health, which is why it is so important to feed the child in a colorful and varied way.

For the most part, the color of fruits and vegetables corresponds to specific chemical compounds in food. The color of the product that the child eats ultimately affects his health, which is why it is so important to feed the child in a colorful and varied way.

This is used by manufacturers of baby food. Beautiful and vibrant packaging, inspired by the colorful food it contains, helps brands stand out in aisles filled with baby food. The vibrant colors and images imply a natural connection with children, making this trend even more perfect for baby food.

Listed below are some of the health benefits that different colors of fruits and vegetables can provide.

| Blue/violet color | fights with an inflammation of Improves memory Protects cells from damage |

| yellow/orange, rises the health of the joints heart disease | |

| White color | supports bone strength helps to reduce cholesterol level Balances hormones |

| Red color | helps to reduce: - risk of diabetes 9000 - Improves skin quality |

| Green | Helps rid the body of toxins Helps heal tissue Supports a healthy immune system |

4.

Gut health

Gut health Research shows that today's babies have significantly less intestinal bacteria than they need in their first months of life. Perhaps this is due to the overuse of antibiotics in the world. Failure to obtain these bacteria—either from the mother at birth or through baby food—can lead to a variety of health conditions throughout a child's life.

A baby's digestive system develops during the first six months of life. Adding probiotics and prebiotics to baby foods can have positive effects and promote good immune health. Therefore, modern parents choose baby food with the addition of probiotics and prebiotics at an early stage of baby development.

5. Organic nutrition

There is a lot of attention now on organic nutrition, and baby food is no exception. More than ever, parents value their children's health and choose foods that are grown naturally and without chemicals. An organic history from farm to fork establishes trust and transparency.

We've listed 5 baby food trends that are appealing to today's parents. Perhaps there are more of them, perhaps parents are guided by some other factors when choosing baby food.

Perhaps there are more of them, perhaps parents are guided by some other factors when choosing baby food.

trends in baby food packaging

Baby food belongs to the essentials - it comes in special packaging that meets many requirements: the safety of the product and its taste, detailed information about the composition and possible allergic reactions. When developing the design and functionality of packaging, it is important to take into account the interests of the target audience - these are parents and children from the age of one who can already express their reactions and attitudes towards the product. Nikolay Artamonov, founder and creative director of Otlichnosti, considered several approaches to category design.

Snacks

Minimalist bright and light packages with salivary design can be considered a classic approach. Communication is aimed at basic instincts - "Your child will be very tasty." Unusual flavor combinations also stimulate the desire to try the product.

Suitable for consumers of all ages, Applesauce Adventures Organic Applesauce comes in three flavors: Spicy Apple, Straight from the Tree, and Sweet as Apple Pie. Applesauce is packaged in a squeezable bag, which allows you to eat it right away or squeeze it into a separate container.

The Applesauce Adventures

Cherub Food jars are packaged with a focus on aesthetics, with each plump glass jar featuring a minimalist label featuring a cartoon mouth with a tongue.

Cherub Food, Me + James Studio

With their simple and modern look, Cherub Food jars are eye-catching and show that only the most essential ingredients are used in the formula. Designed by Me + James Studio.

Cherub Food

Healthy products for an anxious audience

Parents are the most anxious target audience. The most important indicator for them is the usefulness of the products that they give to their babies.

Boxes and fully transparent packaging detailing the ingredients and how they are processed are used by baby food designers to convey core brand values.

UK startup Keep It Real Baby makes nutritious, clean, organic baby food that is as close to homemade as possible. The Love Mondays packaging design is inspired by the core values of the brand: be honest, stay playful, stay inclusive, and keep inspiring.

Inspired by children's books, the designers hand-created textures and paper-cut illustrations that perfectly fit the idea of fair and fun food.

Horizon is a tribute to farm to fork with the highest quality ingredients. All this is balanced with a very clean and modern branding and color coding to make it stand out on the shelf as much as possible.

Functional bonuses

When the product itself is already useful and tasty, the functional advantages of the packaging of a particular brand come into play. Convenient doypacks for feeding outside the home, mini-spoons, tight lids in case the child has not finished eating, as well as kitchen “gadgets” for making mashed potatoes on your own.

Little Spoon first introduced itself to parents as a healthy baby food brand that produces baby food formulas for different ages that prioritize freshness. With subscription and delivery options, parents choose the meal plan that best suits their schedule and their child's needs, as well as fresh, organic baby food once every two weeks.

With subscription and delivery options, parents choose the meal plan that best suits their schedule and their child's needs, as well as fresh, organic baby food once every two weeks.

Little Spoon

The brand has also taken care to include a small ergonomic spoon in each package, as the company believes it is important for children to learn to eat on their own and develop healthy eating habits from an early age.

Baby Garden Glaciers freezer trays from Cardboard Helicopter Product Design allow parents to save time and waste when preparing food.

Baby Garden Glaciers, Cardboard Helicopter Product Design

Each tray comes with six separate baby food containers that parents can store their baby food in advance. On the lids of these capsules, you can make inscriptions with markers - to comply with the shelf life.

Baby food manufacturer Plum Organics has solved the problem of feeding children on the road - for this, the company turned to the IDEO agency.

Plum Organics, IDEO

The designers have developed transparent containers - a resealable lid makes it easy for parents to store food between feedings, and the container has a feature that allows them to keep track of the day they opened the package to make sure they don't throw away the unspoiled food food.

The new pack is easy and safe to stack and has a recess in the lid for parents to place a spoon, making feeding neat and hygienic.

Plum Organics, IDEO

Creative for kids and their moms

Today's parents are yesterday's millennials. In addition to the benefits, taste, environmental friendliness and functionality of the packaging, they appreciate the creative approach in design, which is unusual for the category.

The Latin Baby is a Florida-based brand that caters to the needs and preferences of millennial parents. Unlike classic brands that have been on the market for more than a year, the company uses superfood ingredients and decorative packaging.

S. (By Distribution Channel)

S. (By Distribution Channel) S., Canada, Mexico)

S., Canada, Mexico)