Baby food gst rate

GST on Food: Rates on Food

- Home

- GST

- GST On Food

Introduction

GST is the Goods and Service tax that is the new tax regime for indirect taxation. This tax regime was introduced by the government in order to centralize the indirect taxation process and make it common for all the states throughout the country. The previous tax regime had multiple taxes levied on all the products and services in India. These taxes were levied at multiple points of sale or transfer of such goods and services.

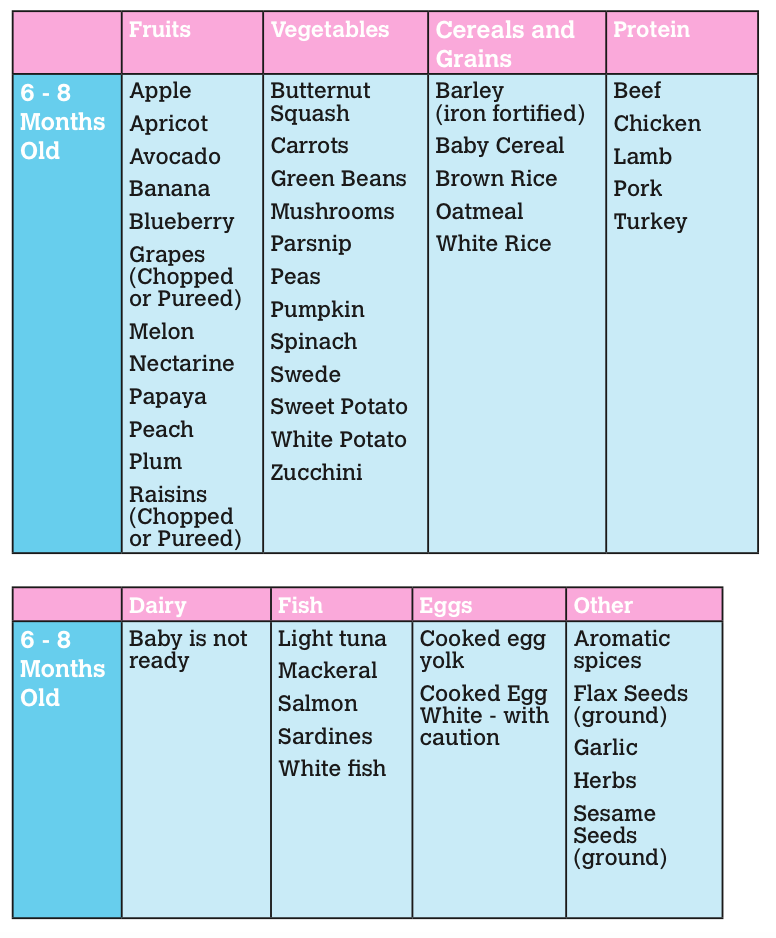

Food is one of the many segments where GST is applicable and is liable for charge of indirect tax under GST laws. The details of GST that is levied on food and the associated details regarding the applicability of GST and non applicability of GST are mentioned below.

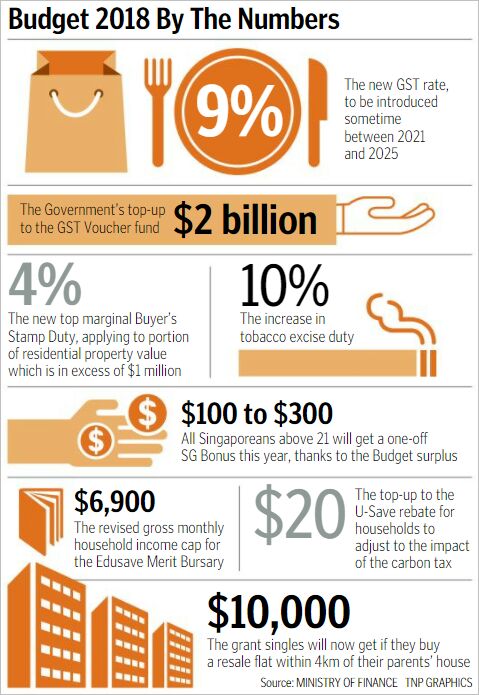

GST Rates on Food Products

The GST tax structure has multiple rates of GST applicable to the food segment. The rates of taxation range from 5% to the highest bracket under GST i.e. 28%. Many commodities under the food segment are also exempted from the levy of GST. Majority of staple foods and basic foods are free from taxation under the GST tax regime.

Given below is an inclusive list of some of the items or commodities that are free from the levy of GST under the new indirect tax regime.

- milk, cream, cheese and eggs

- meats for people to eat (except prepared meals or snacks)

- spices and sauces

- rice, cooked or uncooked (but not hot)

- baby food and infant formula

- cooking ingredients such as flour, sugar and cake mixes

- fruit juice containing at least 90% by volume of juice

- fats and oils for cooking

- bread and bread rolls without icing or filling

- bottled drinking water

- tea and coffee (unless it’s ready to drink)

- fruit, vegetables, fish and soup

- spreads, such as honey, jam and peanut butter

- breakfast cereals

However, there are situations when a food item that is free of GST becomes taxable under the GST tax laws. For example, GST has to be paid for the sale of seeds or planters and when the producer or the butcher will sell their goods, the GST credit can be claimed by such persons. When such persons sell their produce, there is no incidence of GST.

For example, GST has to be paid for the sale of seeds or planters and when the producer or the butcher will sell their goods, the GST credit can be claimed by such persons. When such persons sell their produce, there is no incidence of GST.

GST, however, is levied on free food items depending on the place of sale or in any place connected with leisure, sport or entertainment.

- restaurant or cafe

- museum

- amusement park

- cinema

- gallery

- sport ground

- gym

- snack bar or stand

- racecourse

- theatre

- golf course

Apart from the above scenario of food items that do not attract GST, there are also many food items where GST is levied starting from 5% to 28%. Given below are the details of the same.

Given above is the general idea of taxability of food items and beverages based on the place of providing such food and its implications.

Apart from the above tax scenario of the various food items according to their tax brackets is mentioned below.

Impact of GST on Food

GST has had a significant impact on the food segment with respect to the customers and manufacturers or producers and procurers in the food industry. The impact of GST in this industry can be best explained with the perspective of the customers and restaurant owners or procurers of the food segment.

Impact on Customers

The introduction of GST on the food segment has simplified the billing process. It has foregone the many cess and taxes levied on the food segment and has replaced it with a single tax i.e. the GST. After the implementation of GST on food, the customers have gained a direct benefit of the reduction in the tax structure. However, such reduction in cost has been marginal and moreover, there has been no reduction or change in the service charge that has to be paid by the customers on the overall bill which is inclusive of GST.

Impact on Restaurant Owners

Under the GST regime, the restaurant owners are allowed to take the credit of the input tax paid. This was intended to make an impact on their daily working capital needs direct by increasing the availability of funds. However, the current GST tax structure provides the benefit of input tax credit can be availed only by the restaurant owners and outlets that charge 18% GST under the new tax regime. Whereas, the outlets or restaurants that charge GST at the rate of 5% do not get the benefit of the input tax credit. This limits the benefits available under the GST tax regime for the small businesses in the food industry.

This was intended to make an impact on their daily working capital needs direct by increasing the availability of funds. However, the current GST tax structure provides the benefit of input tax credit can be availed only by the restaurant owners and outlets that charge 18% GST under the new tax regime. Whereas, the outlets or restaurants that charge GST at the rate of 5% do not get the benefit of the input tax credit. This limits the benefits available under the GST tax regime for the small businesses in the food industry.

The GST tax structure was introduced with a view to reduce the overall taxes on food and food products. Hence, the revised tax structure does not have any food or related products under the highest tax slab of this tax structure as of now. Therefore, GST has not significantly impacted or introduced any major rate changes in the food industry as much as it has in other sectors or industries.

The rate of taxes across all the food segments has been subject to revision from time to time and such change will be duly announced by the government from time to time.

FAQs – GST on Food

1. What is the highest rate of GST that is applicable on the food segment?

The highest rate of taxation under GST is 28%. Under the current GST laws, there are no food items that are taxed under this highest bracket of GST. Hence, the highest applicable rate under GST for the food segment is currently 18%.

2. Are there any food items with nil charge of GST?

Yes. There are many food items that fall under the NIL charge of GST as per the current tax structure. Government had introduced the GST regime with the intention to reduce the burden of taxes on the food items especially on the essential or basic food commodities. Some of the examples of the food items available under the NIL charge are mentioned below.

- fresh vegetables and chilled vegetables

- non-container packed dried leguminous vegetables whether skinned or split or not

- container packed vegetables (uncooked/steamed/boiled)

- meat

- eggs in shell

- fresh fruits, fresh or dried coconuts

- unsweetened milk (pasteurised/unpasteurised), cream, etc.

- vegetables preserved using brine/other means unsuitable for immediate human consumption

3. Can food items free of GST charge be subsequently taxed?

Yes. Food items that were earlier not liable for GST can later be taxed under the GST tax regime. The instances of these cases are when the GST free food items are sold in a restaurant or cafe or a snack bar or a stand or any other venue that is in relation to a place of leisure, sport or entertainment.

4. What is the rate of GST applicable on chocolate and cocoa products?

Chocolate and cocoa products are not considered under the essential commodities. Hence, the rate of GST applicable on chocolate and cocoa products is the highest applicable rate under GST for the food segment or food industry i.e. 18%.

5. What is the rate of taxation on eggs not in shell/egg yolks boiled or cooked by steaming?

The rate of taxation under GST in case of eggs not in shell/egg yolks boiled or cooked by steaming is 5%.

×Thank you! Your comment will be reviewed and posted shortly.

Check Credit Score for FREE in 1 min

It will not affect your score

CreditMantri will never ask you to make a payment anywhere outside the secure CreditMantri website. DO NOT make payment to any other bank account or wallet or divulge your bank/card details to fraudsters and imposters claiming to be operating on our behalf. We do not sell any loans on our own and do not charge any fee from our customers/viewers for the purpose of loan application

GST Rate & HSN Code for Dairy produce; birds eggs; natural honey; edibal product of aanimal origin, not elsewhere spcified or inculded

GST Rates & HSN Codes on Edible Animal Products - Egss, Honey & Milk Products like Cheese, Curd and Cream - Chapter 4

| HSN Code | Description | Rate (%) | CESS (%) | Effective Date | Rate Revision |

|---|---|---|---|---|---|

| 257 | MILK AND CREAM, NOT CONCENTRATED NOR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER | 5% | 01/07/2017 | ||

| 257 | Fresh milk and pasteurised milk, including separated milk, milk and cream, not concentrated nor containing added sugar or other sweetening matter, excluding Ultra High Temperature (UHT) milk | 0% | 01/07/2017 | ||

| 1053184 | MILK AND CREAM-FAT CONTENT, BY WEIGHT, | 5% | 01/07/2017 | ||

| 1053696 | MILK AND CREAM-FAT CONTENT, BY WEIGHT >1% | 5% | 01/07/2017 | ||

| 1054720 | MILK AND CREAM, NOT CONCENTRATED NOR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER - OF A FAT CONTENT, BY WEIGHT, EXCEEDING 6% BUT NOT EXCEEDING 10% | 5% | 01/07/2017 | ||

| 1055232 | MILK AND CREAM, NOT CONCENTRATED NOR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER - OF A FAT CONTENT, BY WEIGHT, EXCEEDING 10% | 5% | 01/07/2017 | ||

| 258 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER | 5% | 01/07/2017 | ||

| 1057288 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER SKIMMED IN POWDER, GRANULES OR OTHER SOLID FORMS, OF A FAT CONTENT, BY WEIGHT NOT EXCEEDING 1. 5% : SKIMMED MILK 5% : SKIMMED MILK | 5% | 01/07/2017 | ||

| 1057296 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER IN POWDER, GRANULES OR OTHER SOLID FORMS, OF A FAT CONTENT, BY WEIGHT NOT EXCEEDING 1.5% : MILK FOOD FOR BABIES | 5% | 01/07/2017 | ||

| 4021090.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER IN POWDER, GRANULES OR OTHER SOLID FORMS, OF A FAT CONTENT, BY WEIGHT NOT EXCEEDING 1.5% : OTHER | 5% | 01/07/2017 | ||

| 1057856 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER IN POWDER, GRANULES OR OTHER SOLID FORMS, OF A FAT CONTENT, BY WEIGHT EXCEEDING 1.5% : NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER. | 5% | 01/07/2017 | ||

4022910. 0 0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER WHOLE MILK | 5% | 01/07/2017 | ||

| 4022920.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER MILK FOR BABIES | 5% | 01/07/2017 | ||

| 4022990.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OTHER | 5% | 01/07/2017 | ||

| 4029110.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTEROTHER : NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER : CONDENSED MILK | 12% | 15/11/2017 | ||

| 4029190.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTEROTHER : NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER : OTHER | 5% | 01/07/2017 | ||

4029910. 0 0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTEROTHER : OTHER : WHOLE MILK | 5% | 01/07/2017 | ||

| 4029920.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTEROTHER : OTHER : CONDENSED MILK | 12% | 15/11/2017 | ||

| 4029990.0 | MILK AND CREAM, CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTEROTHER : OTHER : OTHER | 5% | 01/07/2017 | ||

| 259 | BUTTER MILK, CURDLED MILK AND CREAM, YOGURT, KEPHIR AND OTHER FERMENTED OR ACIDIFIED MILK AND CREAM, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED OR CONTAINING ADDED FRUIT, NUTS OR COCOA | 5% | 01/07/2017 | ||

| 259 | BUTTER MILK, CURDLED MILK AND CREAM, YOGURT, KEPHIR AND OTHER FERMENTED OR ACIDIFIED MILK AND CREAM, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED OR CONTAINING ADDED FRUIT, NUTS OR COCOA | 0% | 01/07/2017 | ||

| 1061376 | BUTTERMILK, CURDLED MILK AND CREAM, YOGURT, KEPHIR AND OTHER FERMENTED OR ACIDIFIED MILK AND CREAM, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED OR CONTAINING ADDED FRUIT, NUTS OR COCOA YOGURT | 5% | 01/07/2017 | ||

4039010. 0 0 | BUTTERMILK, CURDLED MILK AND CREAM, YOGURT, KEPHIR AND OTHER FERMENTED OR ACIDIFIED MILK AND CREAM, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED OR CONTAINING ADDED FRUIT, NUTS OR COCOA OTHER BUTTER MILK | 5% | 01/07/2017 | ||

| 4039090.0 | BUTTERMILK, CURDLED MILK AND CREAM, YOGURT, KEPHIR AND OTHER FERMENTED OR ACIDIFIED MILK AND CREAM, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED OR CONTAINING ADDED FRUIT, NUTS OR COCOA OTHER OTHER | 5% | 01/07/2017 | ||

| 260 | WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; PRODUCTS CONSISTING OF NATURAL MILK CONSTITUENTS, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER, NOT ELSEWHERE SPECIFIED OR INCLUDED | 5% | 01/07/2017 | ||

| 1065480 | WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; PRODUCTS CONSISTING OF NATURAL MILK CONSTITUENTS, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER, NOT ELSEWHERE SPECIFIED OR INCLUDED WHEY AND MODIFI | 5% | 01/07/2017 | ||

| 1065488 | WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; PRODUCTS CONSISTING OF NATURAL MILK CONSTITUENTS, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER, NOT ELSEWHERE SPECIFIED OR INCLUDED WHEY AND MODIFI | 5% | 01/07/2017 | ||

4041090. 0 0 | WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; PRODUCTS CONSISTING OF NATURAL MILK CONSTITUENTS, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER, NOT ELSEWHERE SPECIFIED OR INCLUDED WHEY AND MODIFI | 5% | 01/07/2017 | ||

| 4049000.0 | WHEY, WHETHER OR NOT CONCENTRATED OR CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER; PRODUCTS CONSISTING OF NATURAL MILK CONSTITUENTS, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER, NOT ELSEWHERE SPECIFIED OR INCLUDED WHEY AND MODIFI | 5% | 01/07/2017 | ||

| 261 | BUTTER AND OTHER FATS AND OILS DERIVED FROM MILK; DAIRY SPREADS | 12% | 01/07/2017 | ||

| 1069568 | BUTTER AND OTHER FATS AND OILS DERIVED FROM MILK; DAIRY SPREADS BUTTER | 12% | 01/07/2017 | ||

| 1070080 | BUTTER AND OTHER FATS AND OILS DERIVED FROM MILK; DAIRY SPREADS DAIRY SPREADS | 12% | 01/07/2017 | ||

4059010. 0 0 | BUTTER AND OTHER FATS AND OILS DERIVED FROM MILK; DAIRY SPREADS OTHER : BUTTER OIL | 12% | 01/07/2017 | ||

| 4059020.0 | BUTTER AND OTHER FATS AND OILS DERIVED FROM MILK; DAIRY SPREADS OTHER GHEE | 12% | 01/07/2017 | ||

| 4059090.0 | BUTTER AND OTHER FATS AND OILS DERIVED FROM MILK; DAIRY SPREADS OTHER OTHER | 12% | 01/07/2017 | ||

| 262 | Chena or paneer put up in unit container and,- (a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or any enforceable right in respect of such brand name has been voluntarily foregone, subject to the conditions as in the ANNEXURE] | 5% | 01/07/2017 | ||

| 262 | CHEESE AND CURD | 12% | 01/07/2017 | ||

| 262 | CHEESE AND CURD | 0% | 01/07/2017 | ||

| 1073664 | CHEESE AND CURD FRESH (UNRIPENED OR UNCURED) CHEESE, INCLUDING WHEY CHEESE AND CURD | 12% | 01/07/2017 | ||

| 1074176 | CHEESE AND CURD GRATED OR POWDERED CHEESE, OF ALL KINDS | 12% | 01/07/2017 | ||

| 1074688 | CHEESE AND CURD PROCESSED CHEESE NOT GRATED OR POWDERED | 12% | 01/07/2017 | ||

| 1075200 | CHEESE AND CURD BLUE-VEINED CHEESE AND OTHER CHEESE CONTAINING VEINS PRODUCED BY PENICILLIUM ROQUEFORTI | 12% | 01/07/2017 | ||

4069000. 0 0 | CHEESE AND CURD OTHER CHEESE | 12% | 01/07/2017 | ||

| 263 | BIRDS EGGS, IN SHELL, FRESH, PRESERVED OR COOKED | Nil | 01/07/2017 | ||

| 1077824 | OF FOWLS OF THE SPECIES GALLUS DOMESTICUS | Nil | 01/07/2017 | ||

| 4071910.0 | OF DUCKS | Nil | 01/07/2017 | ||

| 4071990.0 | OTHER OTHER FRESH EGGS : | Nil | 01/07/2017 | ||

| 1078336 | OF FOWLS OF THE SPECIES GALLUS DOMESTICUS | Nil | 01/07/2017 | ||

| 4072900.0 | OTHER | Nil | 01/07/2017 | ||

408. 0 0 | BIRDS EGGS, NOT IN SHELL, AND EGG YOLKS, FRESH, DRIED, COOKED BY STEAMING OR BY BOILING IN WATER, MOULDED, FROZEN OR OTHERWISE PRESERVED, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER - EGG YOLKS : | 5% | 01/07/2017 | ||

| 4081100.0 | BIRDS EGGS, NOT IN SHELL, AND EGG YOLKS, FRESH, DRIED, COOKED BY STEAMING OR BY BOILING IN WATER, MOULDED, FROZEN OR OTHERWISE PRESERVED, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTEREGG YOLKS : DRIED | 5% | 01/07/2017 | ||

| 4081900.0 | BIRDS EGGS, NOT IN SHELL, AND EGG YOLKS, FRESH, DRIED, COOKED BY STEAMING OR BY BOILING IN WATER, MOULDED, FROZEN OR OTHERWISE PRESERVED, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER EGG YOLKS : OTHER | 5% | 01/07/2017 | ||

4089100. 0 0 | BIRDS EGGS, NOT IN SHELL, AND EGG YOLKS, FRESH, DRIED, COOKED BY STEAMING OR BY BOILING IN WATER, MOULDED, FROZEN OR OTHERWISE PRESERVED, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OTHER : DRIED | 5% | 01/07/2017 | ||

| 4089900.0 | BIRDS EGGS, NOT IN SHELL, AND EGG YOLKS, FRESH, DRIED, COOKED BY STEAMING OR BY BOILING IN WATER, MOULDED, FROZEN OR OTHERWISE PRESERVED, WHETHER OR NOT CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OTHER : OTHER | 5% | 01/07/2017 | ||

| 409.0 | NATURAL HONEY | 5% | 01/07/2017 | ||

| 409.0 | NATURAL HONEY | 0% | 01/07/2017 | ||

| 4090000.0 | NATURAL HONEY | 5% | 01/07/2017 | ||

| 264 | EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED | 5% | 01/07/2017 | ||

| 1081352 | EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED : OF WILD ANIMALS | 5% | 01/07/2017 | ||

| 1081360 | EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED : OF WILD ANIMALS TURTLE EGGS AND SALANGANES NESTS (BIRDS NESTS) | 5% | 01/07/2017 | ||

4100090. 0 0 | EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED : OTHER | 5% | 01/07/2017 |

Disclaimer:Rates given above are updated up to the GST (Rate) notification no. 05/2020 dated 16th October 2020 to the best of our information. We have sourced the HSN code information from the master codes published on the NIC's GST e-Invoice system. There may be variations due to updates by the government. Kindly note that we are not responsible for any wrong information. If you need information about the "Effective Date" for every GST or cess rates, then please visit the CBIC website.

Do much more than verifying HSN/SAC codes with ClearTax GST, India's most trusted billing and GST solution where reconciliation is made easy through intelligent inbuilt validations and tools.

Calculate monthly Pension & Tax Benefits through Cleartax NPS Calculator

Browse by Chapters

- Live Animals; Animal products

- Meat and edible meat offal

- Fish and crustaceans, molluscs and other aquatic invertebrates

- Dairy produce; birds eggs; natural honey; edibal product of aanimal origin, not elsewhere spcified or inculded

- Products of animal origin, not elsewhere spcified or inculded

- Vegetable products

- Edible vegetables and certain roots and tubers

- Edible fruit and nuts; peel of citrus fruit or melons

- Coffee, tea, mate and spices

- Cereals

- Products of the milling industry; malt; starches; inulin; wheat gluten

- Oil seeds and oleaginous fruits, miscellaneous grains,seeds and fruit; industrial or medical plants; straw and fodder

- Lac; gums, resins and other vegetable saps and extracts

- Vegetable plaiting materials; vegetable product not elsewhere specified

- Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes

- Preparations of meat, of fish or of crustaceans, molluscs or other aquatic invertebrates

- Sugars and sugar confectionery

- Cocoa and cocoa preparations

- Preparations of cereals, flour, starch or milk; pastrycooks products

- Preparations of vegetables, fruit, nuts or other parts of plants

- Miscellaneous edible preparations

- Beverages, spirits and vinegar

- Residues and waste from the food industries; prepared animal fodder

- Tobacco and manufactured tobacco substitutes

- Mineral Products-Salt; sulphur; earths and stone; plastering materials, lime and cement

- Ores, slag and ash

- Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes

- Inorganic chemicals, organic or inorganic compounds of precious metals, of rare-earth metals, of radioactive

- elements or of isotopes

- Pharmaceutical products

- Fertilizers

- Tanning or dyeing extracts; tannins and their derivatives; dyes, pigments and other colouring matter; paints and varnishes; putty and other mastics; inks

- Essential oils and resinoids, perfumery, cosmetic or toilet preparations

- Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial waxes, prepared waxes, polishing or scouring preparations, candles and similar rticles, modelling pastes, dental waxes and dental preparations with a basis o

- Albuminoidal substances; modified starches; glues; enzymes

- Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations

- Photographic or cinematographic goods

- Miscellaneous chemical products

- Plastics and articles thereof

- Rubber and articles thereof

- Raw hides and skins (other than furskins) and leather

- Articles of leather; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silkworm gut)

- Furskins and artificial fur; manufactures thereof

- Wood and articles of wood; wood charcoal

- Cork and articles of cork

- Manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork

- Pulp of wood or of other fibrous cellulosic material; recovered

- (waste and scrap) paper or paperboard

- Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans

- Textiles And Textile Articles

- Wool, fine or coarse animal hair; horsehair yarn and woven fabric

- Cotton

- Other vegetable textile fibres; paper yarn and woven fabrics of paper yarn

- Man-made filaments; strip and the like of man-made textile materials

- Man-made staple fibres

- Wadding, felt and nonwovens; special yarns; twine, cordage, ropes and cables and articles thereof

- Carpets and other textile floor coverings

- Special woven fabrics; tufted textile fabrics; lace; tapestries; trimmings; embroidery

- Impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use

- Knitted or crocheted fabrics

- Articles of apparel and clothing accessories, knitted or crocheted

- Articles of apparel and clothing accessories, not knitted or crocheted

- Other made up textile articles; sets; worn clothing and worn textile articles; rags

- Footwear, gaiters and the like; parts of such articles

- Headgear and parts thereof

- Umbrellas, sun umbrellas, walking-sticks, seat-sticks, whips, riding-crops and parts thereof

- Prepared feathers and down and articles made of feathers or of down; artificial flowers; articles of human hair

- Articles of stone, plaster, cement, asbestos, mica or similar materials

- Ceramic products

- Glass and glassware

- Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewelry; coin

- Iron and steel

- Articles of iron or steel

- Copper and articles thereof

- Nickel and articles thereof

- Aluminium and articles thereof

- (Reserved for possible future use)

- Lead and articles thereof

- Zinc and articles thereof

- Tin and articles thereof

- Other base metals; cermets; articles thereof

- Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal

- Miscellaneous articles of base metal

- Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

- Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles

- Railway or tramway locomotives, rolling-stock and parts thereof; railway or tramway track fixtures and fittings and parts thereof; mechanical (including electro-mechanical) traffic signalling equipment of all kinds

- Vehicles other than railway or tramway rolling-stock, and parts and accessories thereof

- Aircraft, spacecraft, and parts thereof

- Ships, boats and floating structures

- Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof

- Clocks and watches and parts thereof

- Musical instruments; parts and accessories of such articles

- Arms and ammunition; parts and accessories thereof

- Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishing; lamps and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated building

- Toys, games and sports requisites; parts and accessories thereof

- Miscellaneous manufactured articles

- Works of art, collectors' pieces and antiques

- Project imports; laboratory chemicals; passengers' baggage, personal importations by air or post; ship stores

- Services

At what VAT rate is the sale of children's drinking water

At what VAT rate is the sale of children's drinking water - BUKH. 1C, website to help the accountant

1C, website to help the accountant News for an accountant, accounting, taxation, reporting, FSB, traceability and labeling, 1C: Accounting

- News

- Articles

- FAQ

- Videos

- Forum

08/13/2021

The Ministry of Finance clarified at what rate VAT is levied on the sale of children's drinking water. These clarifications are provided in the letter dated July 30, 2021 No. 03-07-11/61168.

Here, the department indicated that the sale of baby food and diabetic food is subject to VAT at a preferential, reduced rate of 10% (clause 1, clause 2, article 164 of the Tax Code of the Russian Federation).

At the same time, the list of codes for types of food products, including baby and diabetic food in accordance with OKPD 2, subject to VAT at a tax rate of 10% upon sale, approved. Decree of the Government of the Russian Federation of December 31, 2004 No. 908.

908.

Specialized food products subject to VAT at a reduced rate include food products for baby food, including drinking water for baby food. Considering the above, the VAT rate of 10% is applied to the sale of children's drinking water.

Topics: VAT rate, reduced rate, 10% VAT, 10% VAT rate

Heading: Value Added Tax (VAT)

Subscribe to comments

Write a comment

How to reflect the import of goods through a commission agent in "1C: Accounting 8" Software Developers Expanded VAT Benefits Exporters will be transferred to a simplified justification for a zero VAT rate New income tax incentives, a simplified justification for the 0% VAT rate and a 12-day personal income tax refund: the best news of the week A video recording of a lecture about the new in "1C: Accounting 8" has been published - an overview of current updates, versions 3. 0.123 - 3.0.126 nine0028

0.123 - 3.0.126 nine0028

Polls

Transition to new tax payment and reporting rules

Are you experiencing difficulties with the transition to new tax payment and reporting rules?

Yes, we have not quite figured out the transition to the EPP and the new reporting.

No, everything is already clear to me, and I know how to pay taxes and submit reports in 2023.

We haven't studied the new rules for paying taxes yet. We'll figure it out in 2023. nine0003

Events

| January 31, 2023 - February 01, 2023 — Twenty-third International Scientific and Practical Conference "New Information Technologies in Education" | 1C: Lecture hall: December 22, 2022 (Thursday, beginning at 12:00) — Possibilities of "1C: Accounting 8" for effective accounting 1C: Lecture hall: December 22, 2022 (Thursday) - Overview of HR functionality in "1C: ZUP 8 CORP" (rev. |

All events

Letter of the Ministry of Finance of Russia dated September 13, 2019 No. 03-07-14/70431 "". Customs documents

Question:

On the application of the 10% VAT rate for the sale of juices intended for feeding children of preschool and school age. nine0003

Answer:

In connection with the letter on the application of value added tax in the situation and under the conditions set out in the letter, the Department of Tax and Customs Policy informs that in accordance with the Regulations of the Ministry of Finance of the Russian Federation, approved by order of the Ministry of Finance of Russia dated September 14, 2018 N 194n, the appeals of organizations for the assessment of specific economic situations in the Ministry of Finance of Russia are not considered and consulting services are not provided. nine0003

nine0003

At the same time, it is reported that in accordance with subparagraph 1 of paragraph 2 of Article 164 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), value added tax is taxed at a tax rate of 10 percent when selling baby food and diabetic food.

According to the last paragraph of the said paragraph of Article 164 of the Code, the codes for the types of the above products in accordance with the All-Russian Classifier of Products by Type of Economic Activity (OKPD 2), as well as the Commodity Nomenclature of Foreign Economic Activity, are determined by the Government of the Russian Federation. nine0003

Decree of the Government of the Russian Federation of December 31, 2004 N 908 approved the List of codes for types of food products, including children's and diabetic food, in accordance with OKPD 2, subject to value added tax at a tax rate of 10 percent upon sale.

Taking into account the above, the value added tax rate of 10 percent is applied to the sale of baby food, the codes of which, according to OKPD 2, correspond to the codes of OKPD 2, given in the List. nine0003

nine0003

On July 1, 2013, the Technical Regulations of the Customs Union "Technical Regulations for Juice Products from Fruits and Vegetables" (TR CU 023/2011, hereinafter referred to as the Regulations), adopted by the decision of the Commission of the Customs Union dated December 9, 2011 N 882, came into force

Subparagraph 13 of Article 2 of the Regulations determines that juice products from fruits and (or) vegetables for baby food include juices intended for nutrition of young children (up to 3 years old), preschool children (from 3 to 6 years old) and school children. age (from 6 years and older) and meeting the physiological needs of the body of children of the corresponding age groups. At the same time, in accordance with Article 5 of the Regulations, on the consumer packaging of juice products from fruits and (or) vegetables for baby food, the name of such products or in its immediate vicinity must contain the words "for baby food" or other words reflecting the purpose of such products for nutrition children of the word, as well as information on the age category of children for whom such products are intended, and recommendations on the conditions and shelf life of such products after opening their consumer packaging. nine0003

nine0003

In addition, on the basis of subparagraph 9 of Article 8 of the Regulation, specialized juice products from fruits and (or) vegetables for baby food are subject to state registration with a certificate of state registration in a single form approved by the decision of the Commission of the Customs Union dated May 28, 2010 N 299. When issuing a certificate of state registration, it is assigned a number that contains 9 to 11 characters of a three-digit numeric code established in accordance with the unified classifier of products. For baby food products, the specified classifier set the value of code 005.

Based on the information provided by the authorized bodies and institutions of the Customs Union member states that issue state registration certificates, the Eurasian Economic Commission maintains the Register of State Registration Certificates (hereinafter referred to as the Register). The information of the Register is publicly available and posted on the official website of the Customs Union on the Internet www. eurasiancommission.org.

Given the above, the belonging of juices intended for nutrition of preschool children (from 3 to 6 years old) and school age children (from 6 years old and older) to baby food products can be confirmed by the information of the electronic database of the Register on the official website of the Customs Union in the network Internet, as well as the presence of an indication in the documents confirming the purchase of goods, and (or) other accompanying documentation, the number and date of issue of the certificate of state registration, if information is available in the Register. nine0003

Thus, if all the above conditions are met, when selling juices intended for feeding children of preschool age (from 3 to 6 years old) and school age (from 6 years old and older), a value-added tax rate of 10 percent is applied.

This letter does not contain legal norms or general rules specifying normative prescriptions and is not a normative legal act. In accordance with the letter of the Ministry of Finance of Russia dated August 7, 2007 N 03-02-07 / 2-138, the sent letter is of an informational and explanatory nature on the application of the legislation of the Russian Federation on taxes and fees and does not prevent one from being guided by the norms of the legislation on taxes and fees in understanding that differs from the interpretation set forth in this letter.

3). Possibilities of personnel EDI in programs 1C

3). Possibilities of personnel EDI in programs 1C