Baby food indonesia

Indonesia Baby Food Market - Forecasts from 2022 to 2027

The market growth is attributed to the rising awareness of infant health and a healthy diet, along with increasing economic affluence in the country.

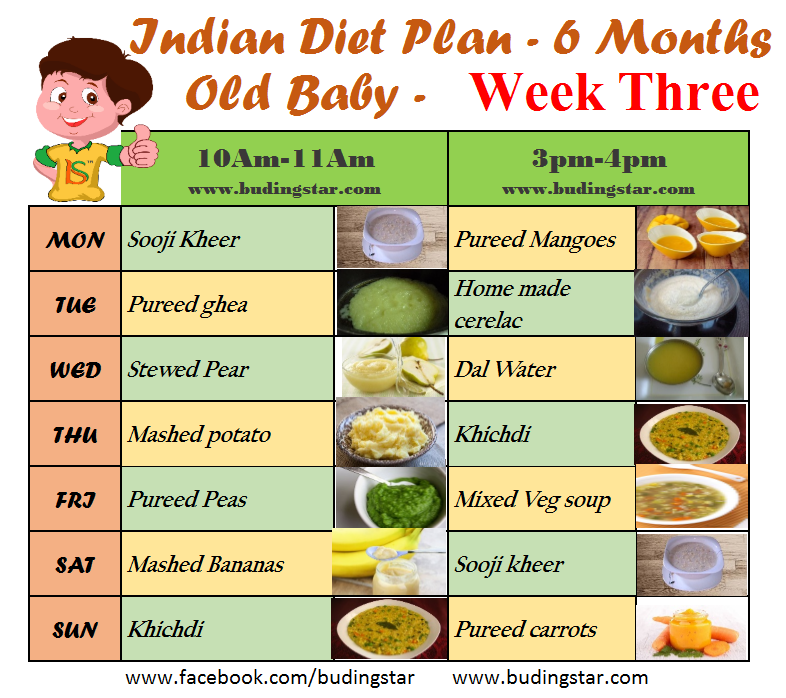

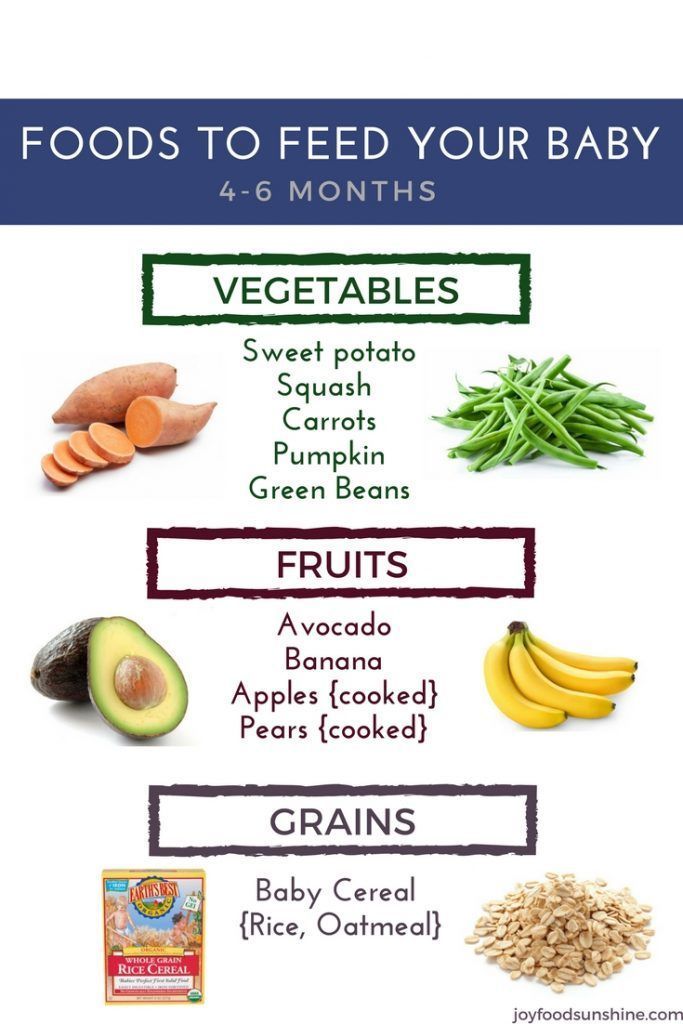

Indonesia's traditional diet relies on rice, vegetables, and fresh fruits. Baby food also includes fruits, vegetables, and cereals. These foods promote the overall development of the child. Especially with infants, this food acts as a substitute for breast milk. They are generally used for children from the age group of 6 months to 4 years. They come in organic and non-organic types of food.

Key market drivers

The baby food market in Indonesia is attributed to several factors. One of the major factors is population. With Indonesia being one of the largest populated countries, the market is set to grow at a significant rate. in the year 2020 according to World Bank data, the total population of the country was 273,523,621. And it is expected to show steady growth during the forecast period. With the growing population, the working population, that is, labour force is also marked as growing, that is 134,616,083 in the year 2020. Moreover, in 2019, there was around 39% growth in the working women’s population in Indonesia.

Hence, the growing birth rate and population have raised the demand for infant diets in Indonesia. Along with this, growth in the working women’s population is also expected to decline in breastfeeding. Thus, baby food products, due to their advertisements and strategies by market players, are the best substitute for breastfeeding. Therefore,

The demand for the baby food market in Indonesia has increased and is expected to show the same steady growth in upcoming years.

Restraints in the market

Though the percentage of the labour force increased in the year 2020, the overall ratio of employment to population declined in 2020. According to the world bank data, the employment ratio in 2019 was 57. 5% while in 2020 it declined to 54.8%. Thus, the population is in a rush to reduce or cut down on extra and unnecessary expenses. This can also hamper the growth of the baby food market in Indonesia due to a downfall in demand, especially from the rural areas.

5% while in 2020 it declined to 54.8%. Thus, the population is in a rush to reduce or cut down on extra and unnecessary expenses. This can also hamper the growth of the baby food market in Indonesia due to a downfall in demand, especially from the rural areas.

Regional overview

The expansion of the baby food market is dependent on urbanization. Due to a lack of awareness about the product in rural areas, as well as a preference for the traditional diet, demand for a baby food product in rural areas is lower than in provinces such as Jakarta, Bali, and many other cities. Jakarta holds a significant market share in the baby food market and is expected to grow in upcoming years with the expansion of its urbanization.

COVID-19 impacts on the Indonesian baby food market

Due to the outbreak of the COVID-19 pandemic. The industrial sector was severely affected in the country. With the restrictions imposed by the government, the supply chain, retail sales, and import-export also got disrupted. However, with the increase in population and strategies by key market players, the baby food market is estimated to grow by 2020 and is projected to grow at a steady pace during the forecast period.

However, with the increase in population and strategies by key market players, the baby food market is estimated to grow by 2020 and is projected to grow at a steady pace during the forecast period.

Market Segmentation:

By Type

- Organic baby food

- Non-organic baby food

By Product Type

- Dried baby food

- Milk formula

- Prepared baby food

- Others

By Distribution Channel

- Online

- Offline

What is the estimated value of the Indonesian Baby Food Market?

The Indonesian Baby Food Market was estimated to be valued at $1.55 billion in 2020.

What is the growth rate of the Indonesian Baby Food Market?

The growth rate of the Indonesian Baby Food Market is 6.7%, with an estimated value of $2.44 billion by 2027.

What is the forecasted size of the Indonesian Baby Food Market?

The Indonesian Baby Food Market is estimated to be worth $2. 44 billion by 2027.

44 billion by 2027.

Who are the key companies in the Indonesian Baby Food Market?

Key companies in the Indonesian Baby Food Market include Danone Indonesia, Nestle Indonesia, Abbott Indonesia and Saipro Biotech Private Limited.

Indonesia Baby Food Market Size: Industry Report, 2022-2027

The Indonesian baby food market was valued at US$1.545 billion in 2020 and is expected to grow and reach a market size of US$2.440 billion in 2027 at a CAGR of 6.75%.

The market growth is attributed to the rising awareness of infant health and a healthy diet, along with increasing economic affluence in the country.

Indonesia's traditional diet relies on rice, vegetables, and fresh fruits. Baby food also includes fruits, vegetables, and cereals. These foods promote the overall development of the child. Especially with infants, this food acts as a substitute for breast milk. They are generally used for children from the age group of 6 months to 4 years. They come in organic and non-organic types of food.

They come in organic and non-organic types of food.

Key market drivers

The baby food market in Indonesia is attributed to several factors. One of the major factors is population. With Indonesia being one of the largest populated countries, the market is set to grow at a significant rate. In the year 2020 according to World Bank data, the total population of the country was 273,523,621. And it is expected to show steady growth during the forecast period. With the growing population, the working population, that is, labour force is also marked as growing, that is 134,616,083 in the year 2020. Moreover, in 2019, there was around 39% growth in the working women’s population in Indonesia.

Hence, the growing birth rate and population have raised the demand for infant diets in Indonesia. Along with this, growth in the working women’s population is also expected to decline in breastfeeding. Thus, baby food products, due to their advertisements and strategies by market players, are the best substitute for breastfeeding. Therefore,

Therefore,

The demand for the baby food market in Indonesia has increased and is expected to show the same steady growth in upcoming years.

Restraints in the market

Though the percentage of the labour force increased in the year 2020, the overall ratio of employment to population declined in 2020. According to the world bank data, the employment ratio in 2019 was 57.5% while in 2020 it declined to 54.8%. Thus, the population is in a rush to reduce or cut down on extra and unnecessary expenses. This can also hamper the growth of the baby food market in Indonesia due to a downfall in demand, especially from the rural areas.

Regional overview

The expansion of the baby food market is dependent on urbanization. Due to a lack of awareness about the product in rural areas, as well as a preference for the traditional diet, demand for a baby food product in rural areas is lower than in provinces such as Jakarta, Bali, and many other cities. Jakarta holds a significant market share in the baby food market and is expected to grow in upcoming years with the expansion of its urbanization.

Jakarta holds a significant market share in the baby food market and is expected to grow in upcoming years with the expansion of its urbanization.

COVID-19 impacts on the Indonesian baby food market

Due to the outbreak of the COVID-19 pandemic. The industrial sector was severely affected in the country. With the restrictions imposed by the government, the supply chain, retail sales, and import-export also got disrupted. However, with the increase in population and strategies by key market players, the baby food market is estimated to grow by 2020 and is projected to grow at a steady pace during the forecast period.

Indonesia Baby Food Market Scope:| Report Metric | Details |

| Market size value in 2020 | US$1.545 billion |

| Market size value in 2027 | US$2.440 billion |

| Growth Rate | CAGR of 6. 75% from 2020 to 2027 75% from 2020 to 2027 |

| Base year | 2020 |

| Forecast period | 2022–2027 |

| Forecast Unit (Value) | USD Billion |

| Segments covered | Type, Product Type, And Distribution Channel |

| Companies covered | Danone Indonesia, Nestle Indonesia, Abbott Indonesia, PT INDOFOOD SUKSES MAKMUR Tbk, Saipro Biotech Private Limited |

| Customization scope | Free report customization with purchase |

Market Segmentation

- By Type

- Organic baby food

- Non-organic baby food

- By Product Type

- Dried baby food

- Milk formula

- Prepared baby food

- Others

- By Distribution Channel

- Online

- Offline

1. Introduction

1. 1. Market Definition

1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Research Data

2.2. Assumptions

3. Executive Summary

3.1. Research Highlights

4. Market Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of End-Users

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Indonesia Baby Food Market Analysis, by Type

5.1. Introduction

5.2. Organic baby food

5.3. Non-organic baby food

6. Indonesia Baby Food Market Analysis, by Product

6.1. Introduction

6.2. Dried baby food

6.3. Milk formula

6.4. Prepared baby food

6.5. Others

7. Indonesia Baby Food market, by Distribution Channel

7. 1. Introduction

1. Introduction

7.2. Online

7.3. Offline

8. Competitive landscape and analysis

8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. Companies mentioned

9.1. Danone Indonesia

9.2. Nestle Indonesia

9.3. Abbott Indonesia

9.4. PT INDOFOOD SUKSES MAKMUR Tbk

9.5. Saipro Biotech Private Limited

Danone Indonesia

Nestle Indonesia

Abbott Indonesia

PT INDOFOOD SUKSES MAKMUR Tbk

Saipro Biotech Private Limited

Childhood import

We are unlikely to be able to answer the eternal question, where does childhood go, but we definitely know where it comes from. FESCO experts in a new article on our blog talked about the import of toys, diapers and baby food to Russia.

Toys

On the market you can find a wide variety of toys for children: for any age, gender and mentality of the child. However, only a third of this abundance comes from the shops of domestic producers, the rest - from abroad.

However, only a third of this abundance comes from the shops of domestic producers, the rest - from abroad.

As for the import of toys, we believe it is no secret to anyone that it mainly comes from China. And yet, the share of 86% cannot but surprise! It is from China that manufacturers of well-known brands such as Habro, Play the Game, Barbi and others supply their products to Russia.

An exception to the general rule is the LEGO Group, whose toys are supplied directly from the Czech Republic. The fact is that one of the main plants of the company is located in the Czech Republic, which produces more than a third of all products.

The main part of the toys is transported in containers: through the Russian Far East and through the Suez Canal. However, part of the goods from China and all imports from Europe are delivered by road.

Diapers

In the early 2000s, there were no Russian diapers on the market. In shops it was possible to buy only imported ones! Everything changed in 2005, when Procter & Gamble opened Russia's first diaper production facility (TM Pampers) in Novomoskovsk. Over the past 15 years, the market has been actively developing: not only new factories of international companies have opened, but also domestic manufacturers have appeared. However, without imports, it is still impossible to provide the market with the necessary goods.

Over the past 15 years, the market has been actively developing: not only new factories of international companies have opened, but also domestic manufacturers have appeared. However, without imports, it is still impossible to provide the market with the necessary goods.

The opening of factories in Russia, it would seem, should reduce production costs and increase competitiveness with foreign goods, but high import duties, for example, on absorbent materials (which are not produced in Russia), do not remain without traces.

Today, two types of trademarks are mainly imported into Russia. The first is the brands of large foreign companies that are not produced in Russia - these are Japanese Merries and Moony. The second is the brands of Russian companies, which, through simple calculations, realized that starting a complex production of diapers in Russia from scratch is not an easy task, and decided to start production in China, where, thanks to many years of experience, the factories reached the “Japanese” level. It is this trend that laid down the current structure of imports: 48% comes from China, 36% from Japan.

It is this trend that laid down the current structure of imports: 48% comes from China, 36% from Japan.

Diapers, just like toys, are easily containerized, so all shipments from Asian countries go in containers.

Baby food

The Russian authorities pay special attention to the import of baby food, both in order to maintain the high quality of products and in an attempt to make domestic companies more competitive. Tightening the norms of veterinary control, attempts to introduce quotas - these measures are taken due to the fact that imports occupy the prevailing part of the market and in some categories reach 95%.

The fact is that in Russia there is no necessary scientific and technical base to produce, for example, therapeutic baby food or mixtures - breast milk substitutes. Therefore, these products are imported from abroad by the French company Danone and the Swiss Nestle, which practically divide the Russian baby food market between themselves.

All products, unlike imports of diapers and toys, come to Russia from Europe, and countries such as Switzerland, the Netherlands, Ireland and Spain account for 65% of all baby food supplies. This also affects logistics: most of the goods are transported by road.

Holidays with Biblio-Globus in Russia, Europe, America and Asia: tours, tickets, hotels, excursions Therapeutic resorts of the Caucasian mineral water

dated 23978

*

from 19.02.2023 for 10 nights, 3 , without power

Sochi

047

*Turkey

-

from 18.

02.2023 for 1 night, 3 , breakfast

02.2023 for 1 night, 3 , breakfast tours to Antalya

dated 412209000

C 9000,0003

9000. .2023 for 3 nights, 3 , breakfasttours to Istanbul

dated 44868*

Egypt

-

since 18.02.2023 for 3 nights, 3 , all inclusive

Tours to Egypt. Sharm El Sheikh

dated 96378*

-

from 02/19/2023 for 8 nights, 3 , all included

tours to Egypt.

dated 77626 Sharm El Sheikh

Sharm El Sheikh *

Abkhazia

-

from 18.02.2023 for 4 nights, 3 , without power

Rest in Abkhazia from 02.20.2023 for 4 nights, 3 , breakfast

Tours to Seychelles (direct flight)

dated 100545*

-

from 24.02.2023 for 3 NOCK, 3 , 3 Breakfast

tours to Seychelles (direct flight)

dated 108379*

-

from 02.

27.2023 for 4 nights, 3,, breakfasts

27.2023 for 4 nights, 3,, breakfasts rounds in the Seychelles

dated 110551*

Thailand

-

from 02/18/2023 for 9 nights, 3 , breakfasts in Pattaya 9,0004

United Arab Emirates

-

from 18.02.2023 for 1 night, 3 , breakfast

tours in the UAE

dated 47703*

-

from 19.

02.2023 for 9 nights, 3 , without power

02.2023 for 9 nights, 3 , without power tours in the UAE

dated 113513

* 9000 from 20.02.2023 9 С Night, 3 , breakfast

tours in the UAE

dated 49637

*

Maldives

- from 18.02.2023 for 4 nights, 3 , breakfasts , breakfasts , breakfasts , breakfasts 0002 Rest in the Maldives (direct flight/guaranteed places/luggage 23 kg) of 123081

*

-

from 02/19/2023 for 4 nights, 3 , breakfast

Rests on the Maldives ( Direct flight/guaranteed places/luggage 23 kg)

dated 121073*

-

from 02.

20.2023 for 4 nights, 3 , breakfasts

20.2023 for 4 nights, 3 , breakfasts Rest in the Maldives (direct flight/guaranteed places /luggage 23 kg)

dated 102135*

Sri Lanka

-

from 19.02.2023 for 9 nights, 3 , without power

Sri Lank 23 kg)

dated 103847*

-

from 02.20.2023 for 5 nights, 3 , without power

Sri-Lanka

of 983919004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9004 9ATH0050 *

-

from 02.

21.2023 for 9 nights, 3 , without power

21.2023 for 9 nights, 3 , without power Sri Lanka (direct flight/guaranteed places/luggage 23 kg)

dated 870989000 9000 9000

India

-

from 18.02.2023 for 12 nights, 3 , breakfasts

Goa (direct flight)

dated 99336* 9000

From 19.02.2023 for 11 nights, 3 , breakfasts

GOA (direct flight)

dated 92574*

-

from 22.

, breakfasts , breakfasts 02.2023 for 8 nights, 3 , breakfasts

02.2023 for 8 nights, 3 , breakfasts Goa (direct flight)

dated 77487*

Oman

-

from 19.02.2023 for 4 nights, 3,, breakfast

rounds of

of of 0045 99008*

-

from 02.20.2023 for 5 nights, 3,, breakfasts

rounds in Oman

dated 1013699000 9003 9003 9003 9000 * 9000 * 9000 * 9000 * .

2023 for 4 nights, 3 , breakfast

2023 for 4 nights, 3 , breakfast tours to Oman

dated 99008*

Tanzania

-

from 20.02.2023 on 5 at night, 3 9 9 9 9 9 9 9 9 9 , breakfasts

Tours on the island. Zanzibar

dated 93233*

-

from 02.22.2023 for 6 nights, 3 , breakfast

tours per about. Zanzibar

dated 95231*

-

from 02.

24.2023 for 6 nights, 3 , breakfast

24.2023 for 6 nights, 3 , breakfast tours per about. Zanzibar

from 95231*

Cyprus

-

from 18.02.2023 per 1 night, 3 , breakfasts

Tubile service

dated 2822

* - from 19.02.20120120 3 , breakfasts

ground service

dated 2822*

-

from 20.

02.2023 per 1 night, 3 , breakfasts

02.2023 per 1 night, 3 , breakfasts ground service

dated 2822*

Israel

-

from 18.02.2023 per 1 night, 3

GUENDARY CARAS

of 6128

9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000

-

from 02/19/2023 for 1 night, 3 , without power

ground service

dated 6128*

- dated 1996

*

-

from 20.

02.2023 for 1 night, 3 , breakfast

02.2023 for 1 night, 3 , breakfast Tubule service

dated 19969000 9000 9000 *

Ground

-

from 18.02.2023 for 1 night, 3 , breakfasts

ground service

dated 4035*

-

from 19.02.2023 for 1 night, 3 , breakfasts

Ground service

dated 4035*

-

from 20.

02.2023 for 1 night, 3 , breakfasts

02.2023 for 1 night, 3 , breakfasts Twent Service

dated 4035*

Armenia

-

from 02/18/2023 for 4 nights, 3 , without power

tours to Armenia 9From 18.02.2023 for 4 nights, 3 , breakfast

tours in Baku

dated 45627*

-

from 19.02.2023 for 4 nights, 3 , breakfasts

TUR In Baku

dated 45627*

-

from 02.

-