Baby food manufacturers in europe

Four European Organic Baby Food Brands

Industry Insights · 11min read

The European baby food market is expected to grow at a CAGR of 5.2% until 2025 to reach a total of 9.2 billion Euros. The largest market shares are currently held by Germany, Russia, and the United Kingdom. While this number in itself does not represent staggering growth expectancies for the upcoming years, industry experts are seeing a significant increase in the demand for sustainable baby foods. As adult consumers become more aware of the personal health benefits and environmental benefits of consuming natural and organic foods, it is no surprise that the demand for products in these categories in the baby food industry mirrors these trends. An increasing number of parents are conscious of the nutritional content in their baby food and concerned by the prospect of exposing their babies’ growing bodies and minds to chemicals or pesticides. Thus we took the opportunity to highlight four exciting brands that are bringing sustainable and organic baby foods to shelves across Europe.

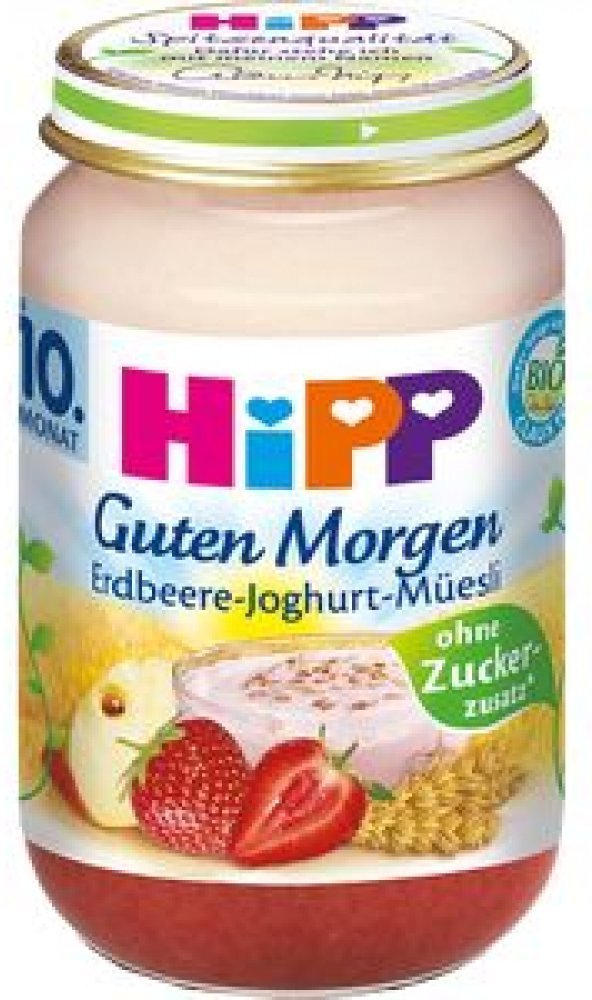

HiPP is an internationally established, family-owned business currently in its fourth generation. For over 60 years, the Hipp family has been committed to organic and sustainable farming practices which include free-roaming livestock alongside pesticide-free, specially selected fruits and vegetables. Built on the belief that ‘green is good’, the HiPP brand proves its commitment to the environment time and time again by consistently exceeding EU organic standards. With 260+ self-imposed quality controls in place, parents can feel confident in the safety, nutritional value, and flavours in every spoonful of HiPP. Artificial preservatives, sweeteners, or colourants will never find their way into these natural and wholesome meals. Today, HiPP’s established baby and toddler food portfolio encompasses around 50 products, categorised by age (4 months to 3 years) and product type (jars, trays, pouches, cereals).

“From clean air and water to happy, healthy animals and tasty fruit and vegetables, it matters to us that working with nature, rather than against it, can provide us with everything we need.

”

As a pioneer for sustainability in the industry, HiPP takes pride in its wide-ranging environmental efforts. The brand’s commitment to animal welfare includes gentle and species-appropriate animal husbandry techniques as well as the protection of pollinators and promotion of biodiversity. Out on the fields, HiPP seeks to maintain rich and fertile farmland for future generations through a number of methods, such as crop rotations and maintaining close relationships with its farmers. The brand also does its part to reduce food waste by utilising fruits and vegetables that supermarkets deem too little, large, or ‘ugly’ for sales.

Learn more on hipp.co.uk

Holle (Demeter)

Holle has been dedicated to natural ingredients since its founding 85+ years ago and therefore always prohibited the use of pesticides or chemical fertilisers. The Swiss brand’s baby and toddler portfolio features a diverse range of porridges, mueslis, pouches, cereals, and jars. Today, the ingredients in Holle’s baby food are cultivated using a mix of biodynamic and organic farming techniques. While Holle sources some of its crops, such as grains, from Demeter-certified farms in Germany, others are grown on organic farms in other parts of Europe, such as Italy or Hungary.

Today, the ingredients in Holle’s baby food are cultivated using a mix of biodynamic and organic farming techniques. While Holle sources some of its crops, such as grains, from Demeter-certified farms in Germany, others are grown on organic farms in other parts of Europe, such as Italy or Hungary.

Biodynamic farming merges organic practices with esoteric growing cycle concepts. Thus, all actors in the agricultural system—including seeds, plants, animals, and humans—are considered to have unique and significant roles to play. The result is a balanced space in which all organisms coexist to make up one whole, living organism, namely the farm itself. Within this approach, the use of synthetic fertilisers and pesticides and GMO technologies is prohibited. Hence, parents can trust that the ingredients in Holle’s baby foods are both ethically farmed and natural. Holle’s further commitments also include a number of social responsibility and climate protection measures, such as the introduction of CO2 neutral baby porridges and projects that promote biodiversity.

Learn more on gb.holle.ch

Nuri

Founded in 2017 by Jana Lange and Josephine Bayer, over the past three years, Nuri has proven itself as a promising innovator in the baby food industry. In contrast to conventional baby foods, which utilise heating techniques for food conservation, Nuri relies on shock freezing technology to maximise the nutrient, flavour, colour, and consistency retention of ingredients. The Berlin-based brand’s frozen, organic baby food currently consists of mash in three categories (fruit, vegetables, meat/fish) and will soon also expand its range to include a selection of finger foods. Nuri’s baby foods do not contain any salt, sugar, spices, additives, thickeners, or preservatives. It specifically targets health-conscious parents who express scepticism about conventional baby foods but do not have the time to cook nourishing, fresh foods for their babies on a daily basis.

Beyond the commitment to 100% organic and natural ingredients, Nuri’s sustainability efforts include 100% recyclable packaging and reduction of CO2 emissions by refraining from utilising glass (which is heavy to transport) alongside a list of renewable energy commitments. Furthermore, by portioning foods into 10 g pellets that can be kept in the freezer for up to 15 months, parents are empowered to portion their baby’s meals according to their age and eating habits which ultimately results in the reduction of food waste.

Furthermore, by portioning foods into 10 g pellets that can be kept in the freezer for up to 15 months, parents are empowered to portion their baby’s meals according to their age and eating habits which ultimately results in the reduction of food waste.

Learn more on nuriforbabies.de

Little Tummy

Guided by the motto ‘Mums Empowering Mums’, Little Tummy was founded by Nadine Hellmann and Dr. Sophie Niedermaier-Patramani after the duo recognised the lack of availability of ready-made yet fresh and organic meals for babies in the United Kingdom. Sophie is not only a mother herself but incidentally also a LMU and Harvard-trained paediatrician. Therefore, not only does she truly understand the importance of nurturing baby’s growing minds and bodies from a medical perspective but her qualifications equipped her with the knowledge and skills to carefully research and test hundreds of ingredients for the development of Little Tummy’s cold-pressed, organic baby food meals. Hence, Little Tummy utilises a cold pressure technology called High-Pressure Processing (HPP) to ensure the safety of their foods while maximising the retention of the nutritional content, flavours, and textures.

Hence, Little Tummy utilises a cold pressure technology called High-Pressure Processing (HPP) to ensure the safety of their foods while maximising the retention of the nutritional content, flavours, and textures.

“We are here to change baby food for the better! With Little Tummy we support you to nurture your baby’s nutritional needs during the most critical time in their lives ” - Sophie & Nadine

Little Tummy exclusively sources 100% organic ingredients from the United Kingdom and European Union and all its products are certified with the EU organic seal as a proof of commitment to the highest quality standards. Little Tummy’s pots are made from toxin-free and BPA-free plastics. The brand’s packaging, including its cool packs and insulation used for transportation, is 100% recyclable. Moreover, product deliveries are only initiated once a week to help decrease the brand’s CO2 footprint. In 2019, Little Tummy received a gold medal at the Absolutely Mama Awards.

Learn more on littletummy.co

Imagery: (1) Patrick Fore via unsplash.com, (2) HiPP, (3) Holle, (4) Nuri, (5) Little Tummy

Europe Baby Food Market Analysis - Industry Report

Europe Baby Food Market Analysis - Industry Report - Trends, Size & ShareEurope Baby Food Industry Overview

| Study Period: | 2017-2027 |

| CAGR: | 5.2 % |

Major Players*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Europe Baby Food Market Analysis

The Europe baby food market is expected to register a CAGR of 5.2% during the forecasted period.

- The demand for convenience, variety, and more nutritional baby food is a factor driving the increasing consumption of baby food. The growth of the middle class and the rising working female population are also factors boosting the market.

Consumers are more conscious about the baby's health, which increases demand for natural, vegan, and organic baby food. In response to the growing demand for organic and vegan baby foods, manufacturers are developing new products to expand their market share.

Consumers are more conscious about the baby's health, which increases demand for natural, vegan, and organic baby food. In response to the growing demand for organic and vegan baby foods, manufacturers are developing new products to expand their market share. - For instance, in June 2021, Heinz announced the launch of a plant-based baby food line in the United Kingdom that is 100% natural. The Heinz for baby pulses line has three options: saucy pasta stars with beans & carrots, potato bake with green beans & sweet garden peas, and risotto with chickpeas & pumpkin. None of the three options contain added sugar or salt.

- Furthermore, safety measures in terms of baby food packaging are a significant concern among young mothers. Eco-friendly packaging is gaining traction, supporting various major companies to discriminate the products in the market. Moreover, the trend of baby food in ready meals is expected to witness a strong penetration rate over the years.

- The European baby food market is highly regulated, which makes baby food the safest to consume.

Stringent and changing regulations have also caused distortions in the market Germany, Russia, and the United Kingdom hold a significant share of the European baby food market.

Stringent and changing regulations have also caused distortions in the market Germany, Russia, and the United Kingdom hold a significant share of the European baby food market.

Europe Baby Food Industry Segments

Baby food can be described as soft and easily consumed food manufactured from natural or organic ingredients or formula.

The market is segmented by type, distribution channel, and country. Based on type, the market is segmented into milk formula, dried baby food, prepared baby food, and other types. Based on the distribution channel, the market is segmented into hypermarkets/supermarkets, drugstores/pharmacies, and convenience stores. The study also covers the European market analysis of the major regions, including Spain, the United Kingdom, Germany, France, Italy, Russia, and the Rest of Europe.

For each segment, the market sizing and forecasts have been done based on value (in USD Million).

| Product Type | |

| Milk Formula | |

| Dried Baby Food | |

| Prepared Baby Food | |

| Other Product Types |

| Distribution Channel | |

| Supermarkets/Hypermarkets | |

| Pharmacies And Drug Stores | |

| Convenience Stores | |

| Online Retail Stores | |

| Other Distribution Channels |

| Country | |

| Spain | |

| United Kingdom | |

| Germany | |

| France | |

| Italy | |

| Russia | |

| Rest of Europe |

Report scope can be customized per your requirements. Click here.

Click here.

Europe Baby Food Market Trends

This section covers the major market trends shaping the Europe Baby Food Market according to our research experts:

Growing Demand for Organic Food Aiding the Demand Organic Baby Foods

- With the rising awareness regarding the effects of chemicals, fertilizers, pesticides, etc., consumers are opting for foods that are free from these. Thus, organic foods are finding an increased demand in the European market.

- With the increasing number of women working in Germany, Italy, the United Kingdom, France, and other regions, the need for organic baby foods has risen. Thus, the baby food market is propelling stronger growth in these regions. The innovative packaging and incorporation of special ingredients that give an additional benefit to the product are also driving the market.

- The existing players are expanding their product portfolio, including organic foods, to their product range to gain a competitive advantage and strengthen their position in the market.

Parents are increasingly opting for healthy and ready-to-eat food offerings, such as instant milk formula and snacks, which require needless or no preparation time and can be instantly provided to the baby.

Parents are increasingly opting for healthy and ready-to-eat food offerings, such as instant milk formula and snacks, which require needless or no preparation time and can be instantly provided to the baby. - Major players in the infant food market are eyeing Russia in terms of organic and natural infant food to strengthen their position in the Russian market.

To understand key trends, Download Sample Report

United Kingdom Dominates the Market

- The major drivers of the market are the increasing number of working women population and the awareness regarding the nutritional factors of processed baby food. The growing awareness regarding the long-term effects of packed baby foods is a major market restraint. Technological developments in baby foods such as infant formula, cereal-based products, and other fortified products are trending in the market.

- Organic baby food is also gaining attraction in the United Kingdom's baby food market.

Danone, Nestle, and H.J. Heinz are the major players in the market. Cow & Gate, Ella’s Kitchen, Heinz, Plum baby, and Organix are the other players in the market.

Danone, Nestle, and H.J. Heinz are the major players in the market. Cow & Gate, Ella’s Kitchen, Heinz, Plum baby, and Organix are the other players in the market. - Moreover, players are launching their products with sustainable packaging options due to growing consumer awareness about the environmental issues related to the product's packaging.

- For instance, In July 2022, a new pouch was launched by Little Freddie's featuring the OPRL label, which enables the pouch to be sent home for recycling. This is the first recycling of baby food pouches in the United Kingdom, developed for council collection. The new material will have a significant impact on total climate footprints.

To understand geography trends, Download Sample Report

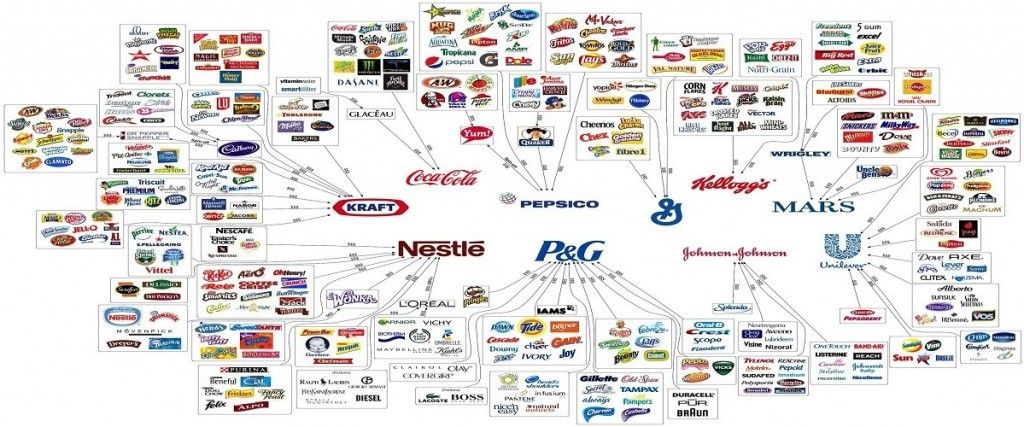

Europe Baby Food Market Competitor Analysis

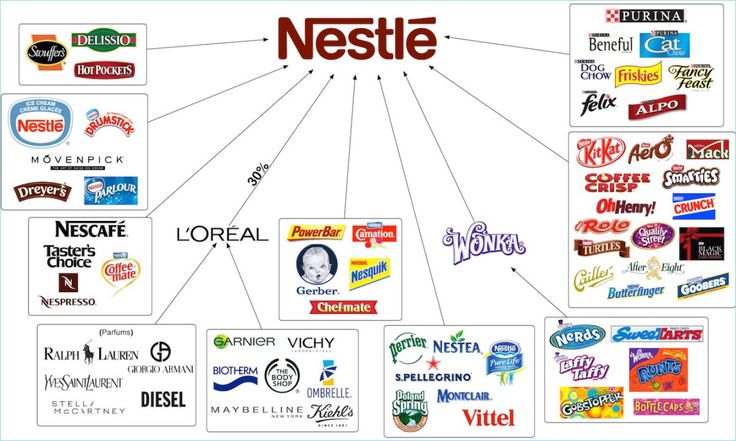

The European baby food market is highly competitive, with a few top players holding a significant market share. In the regions, Danone S.A., Hipp GmbH & Co Vertrieb KG, Nestle SA, Organix, and H.J. Heinz are among the major players in the market. Players are expanding their product ranges and entering the organic baby food segment trending in the market. The manufacturers are majorly concentrating on enhancing their product quality through mergers and acquisitions and product innovation to obtain a competitive edge over other players in the market. Advanced distribution networks and manufacturing expertise give the manufacturers an advantage in expanding their range of products across the European market.

In the regions, Danone S.A., Hipp GmbH & Co Vertrieb KG, Nestle SA, Organix, and H.J. Heinz are among the major players in the market. Players are expanding their product ranges and entering the organic baby food segment trending in the market. The manufacturers are majorly concentrating on enhancing their product quality through mergers and acquisitions and product innovation to obtain a competitive edge over other players in the market. Advanced distribution networks and manufacturing expertise give the manufacturers an advantage in expanding their range of products across the European market.

Europe Baby Food Market Top Players

Nestle SA

Hipp GmbH & Co Vertrieb KG

Danone S.A.

Organix Brands Company

Bledina Company

*Disclaimer: Major Players sorted in no particular order

Europe Baby Food Market Report - Table of Contents

1. INTRODUCTION

1.

1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 Product Type

5.1.1 Milk Formula

5.1.2 Dried Baby Food

5.1.3 Prepared Baby Food

5.1.4 Other Product Types

5.2 Distribution Channel

5.2.1 Supermarkets/Hypermarkets

5.2.2 Pharmacies And Drug Stores

5.2.3 Convenience Stores

5.

2.4 Online Retail Stores

2.4 Online Retail Stores5.2.5 Other Distribution Channels

5.3 Country

5.3.1 Spain

5.3.2 United Kingdom

5.3.3 Germany

5.3.4 France

5.3.5 Italy

5.3.6 Russia

5.3.7 Rest of Europe

6. COMPETITIVE LANDSCAPE

6.1 Most Adopted Strategies

6.2 Market Share Analysis

6.3 Company Profiles

6.3.1 Nestle SA

6.3.2 Hipp GmbH & Co Vertrieb KG

6.3.3 Organix Brands Company

6.3.4 H. J. Heinz Company

6.3.5 Danone SA.

6.3.6 Ella's Kitchen (Hain Celestial Group)

6.3.7 Oliver's Cupboard Brand Ltd

6.3.8 Abbott Nutrition

6.3.9 DANA Dairy Group LTD

6.3.10 Holle baby food GmbH

*List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

**Subject to Availability

You can also purchase parts of this report. Do you want to check out a section wise price list?

Do you want to check out a section wise price list? Europe Baby Food Market Research FAQs

What is the study period of this market?

The Europe Baby Food Market market is studied from 2017 - 2027.

What is the growth rate of Europe Baby Food Market?

The Europe Baby Food Market is growing at a CAGR of 5.2% over the next 5 years.

Who are the key players in Europe Baby Food Market?

Nestle SA, Hipp GmbH & Co Vertrieb KG, Danone S.A., Organix Brands Company, Bledina Company are the major companies operating in Europe Baby Food Market.

Europe Baby Food Industry Reports

In-depth industry statistics and market share insights of the Europe Baby Food Market sector for 2020, 2021, and 2022. The Europe Baby Food Market research report provides a comprehensive outlook of the market size and an industry growth forecast for 2023 to 2028. Available to download is a free sample file of the Europe Baby Food Market report PDF.

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

Please enter a valid email id!

Please enter a valid message!

Download Free Sample Now

First Name

Mr/MsMr.Mrs.Dr.Ms.

Last Name

Your Email

By submitting, you confirm that you agree to our privacy policy

Download Free Sample Now

Your Email

By submitting, you confirm that you agree to our privacy policy

Message

By submitting, you confirm that you agree to our privacy policy

Thank You!

Thank you for your Purchase. Your payment is successful. The Report will be delivered in 24 - 72 hours. Our sales representative will reach you shortly with the details.

Please be sure to check your spam folder too.

Sorry

"Sorry! Payment Failed. Please check with your bank for further details."

rating of the top 10 Russian and foreign brands with reviews according to KP

Goods for children are always under special quality control. Including food. After all, food for a baby is not only a way to satisfy hunger, but also acquaintance with different tastes and a guarantee of healthy development (1). Today there are many different brands. Among them, we selected the best manufacturers of baby food, based on the reviews of parents and expert opinions.

Including food. After all, food for a baby is not only a way to satisfy hunger, but also acquaintance with different tastes and a guarantee of healthy development (1). Today there are many different brands. Among them, we selected the best manufacturers of baby food, based on the reviews of parents and expert opinions.

Rating of the top 5 Russian baby food manufacturers according to KP

There are many popular brands among Russian manufacturers of baby food. Basically, various purees, juices, cereals and dairy products are presented on the market. There are also formulas for babies, but in smaller quantities. The popularity of food is due to high quality and rather low (in comparison with foreign analogues) price.

1. "Agusha"

"Agusha". Photo: yandex.market.ru Agusha is one of the most popular manufacturers of baby food in Russia. The trademark appeared in 1992 and has a wide range of products for children of all ages. Newborns are offered powdered milk formulas, babies from 4 months - a variety of purees, sour-milk products, water, older children - ready-made cereals (both dairy and non-dairy), juices, fruit drinks, compotes and fruit bars for a snack.

Thanks to the availability and variety of products, the manufacturer is confidently holding onto the Russian market. The safety and quality of Agushi is also confirmed by some neutral studies. For example, fruit cottage cheese, as well as kefir from this brand, received the highest rating from Roskachestvo (2, 3).

However, some parents are confused by the rather high price of certain items.

The main characteristics

| Manufacturer | Pepsico Russia | |||

| Assortment | puree, dried milk mixtures, cereals, fruit bars | Recommended age | C Founded | 1992 |

Pros and cons

There are mixtures in the product line; a wide range of.

High price for some items.

2. FrutoNyanya

FrutoNyanya. Photo: yandex.market.ru FrutoNyanya baby food brand products are distinguished by a wide range and wide distribution in stores. Among the products of the brand you can find: a variety of cereals (with additives in the form, for example, pieces of fruit or without them), vegetable, fruit and meat purees, water, dairy products, juices, fruit drinks and nectars, snacks. For children prone to acute reactions to certain products, a special line of hypoallergenic food is offered.

For children prone to acute reactions to certain products, a special line of hypoallergenic food is offered.

Some of the brand's products have received high ratings from Roskachestvo, for example, biocurd, buckwheat porridge (4, 5).

Nutrition from this brand is designed for both the first complementary foods and for babies after a year. The composition contains salt and sugar, which are not recommended for children under one year old.

Main characteristics

| Manufacturer | Progress |

| Assortment | purees, drinks, soups, snacks, cereals, snacks, water |

| Recommended age | from 0 months |

| Founded | 2000 |

Pros and cons

May contain allergenic ingredients (eg sugar).

3. "Grandmother's Lukoshko"

"Grandmother's Lukoshko". Photo: yandex.market. ru

ru The manufacturer has been present on the Russian market since 1999. The main product is a variety of purees, which are available in glass jars and soft packs. For example, apple puree from this brand received the highest rating from Roskachestvo in all analysis criteria and was awarded the Quality Mark (6).

For older children, prepared meals, meatballs, healthy snacks such as fruit lozenges and biscuits are available. Also, "Babushkino Lukoshko" produces children's herbal teas. Salt in some products is not always welcomed by parents.

Main characteristics

| Manufacturer | "Sivma" |

| Assortment | puree, finished lunch, drinks, fruit stucks |

| Recommended age | from 4 months |

| Founded | 1999 |

Pros and cons

Relatively low price in the segment; varied products.

There may be undesirable auxiliary components in the formulation (eg salt).

4. "Subject"

"Subject". Photo: yandex.market.ru"Theme" offers products for children from 4 months to 3 years. The assortment includes a variety of meat, fish and vegetable purees, dairy products, ready meals and juices. But fruit purees are not presented. Packaging 一 is one of the distinguishing features of the brand. Thanks to special tin cans, the products are reliably protected from sunlight, which prolongs the shelf life. Also, many products of the brand are available in non-spill packages, so it is convenient to take them with you on the road. According to the results of the research, cottage cheese and juice "Theme" received the highest rating from Roskachestvo (7, 8).

The main characteristics

| Manufacturer | "Danon Russia" |

| Assortment | puree, dairy products |

Pros and cons

Innovative packaging; high meat content.

There are no fruit products in the assortment.

5. Diaper

Diaper. Photo: market.yandex.ruAll ingredients for production are supplied from our own farm. The manufacturer claims that thanks to this, it is possible to set fairly low prices for products.

The potential buyer is offered fruit and vegetable purees (some with cottage cheese), soups, various juices and fruit drinks, as well as water. Some of the products are hypoallergenic. The composition does not contain unnecessary components: salt, sugar and preservatives. Meat and fish products are not represented in the product line.

Main characteristics

| Manufacturer | "Gardens Podonya" | |||

| Assortment | puree, cream-soups, porridge | |||

| Recommended age | Site | from 4 months | S. | 2005 |

Pros and cons

Low price in the segment; simple and clear structure.

Lack of meat and fish products in the assortment.

Rating of the top 5 foreign manufacturers of baby food according to KP

There are many foreign companies that produce baby food on the Russian market. A century of history, many years of experience and a good reputation helps to supply the market with quality products, which are preferred by many parents.

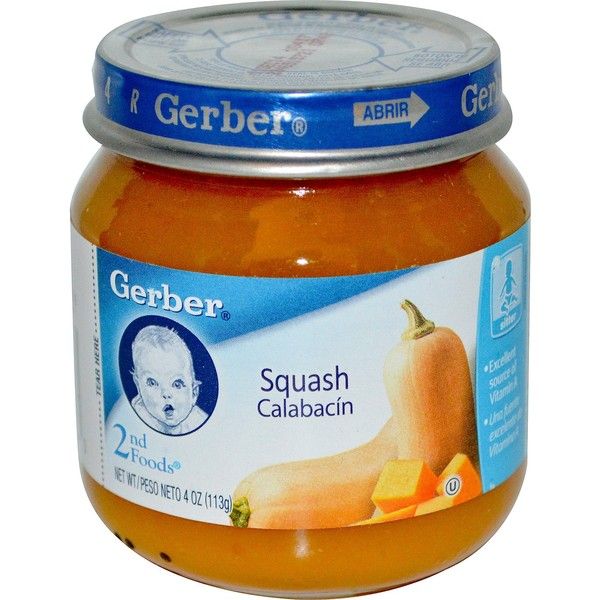

1. Gerber

Gerber. Photo: yandex.market.ruThe assortment of the American manufacturer includes products for children from 4 months. In supermarkets and online sites, you can find vegetable and fruit purees, cereals, healthy snacks, juices, and desserts (cottage cheese treats, smoothies, and others). Hypoallergenic food is also provided. For example, dairy-free buckwheat porridge of this brand is highly appreciated by Roskachestvo experts, who noted the safe composition of the product without dangerous and harmful substances, including no added sugars (9).

The manufacturer claims that the high prices are due to the corresponding quality, which is ensured by strict standards and adherence to technology.

Main characteristics

| Manufacturer | Nestle |

| Assortment | pure, Joks, snacks, desserts | SECULATION OF THE |

| Founded | 1927 |

Pros and cons

Hypoallergenic products; natural composition; high quality.

High price in the baby food segment.

2. HiPP

HiPP. Photo: yandex.market.ruGerman manufacturer's products are suitable for children from birth. Infants are offered hypoallergenic powdered milk formulas enriched with vitamins. For feeding - various purees, cream soups, cereals, and as a snack for older children - snacks and dairy desserts.

Meals are made exclusively from natural ingredients, without added sugar. The high price, according to the manufacturer, is due to the use of special technologies and high-quality products.

Main characteristics

| Manufacturer | HIPP |

| Assortment | puree, cereals, drinks, snacks, dry dairy mixtures |

| Recommended age | 9 months 9 months 9 months 9.|

| Country of origin | Germany |

| Founded | 1957 |

Pros and cons

Natural composition; There are baby formulas in the assortment.

High price of products.

3. Fleur Alpine

Fleur Alpine. Photo: yandex.market.ruNatural baby food of premium quality. The range includes purees, cereals, cookies and juices - both regular and for children prone to allergies or intolerant to gluten. In addition to the usual products, the manufacturer offers olive oil (from 6 months) and sauces (from 3 years).

From time to time, the products of this brand come under the attention of experts from Roskachestvo and Roskontrol. For example, Three cereals porridge showed excellent results: a good composition with dietary fiber and no foreign impurities, the appropriate taste, color and smell (10), and buckwheat porridge meets the advanced standards of Roskachestvo, except for the increased protein content (11).

Not all products on the official website can be purchased in a regular store. However, they can be purchased on marketplaces.

High price; Not all brand products are easy to find on offline sites.

4. Semper

Semper. Photo: yandex.market.ruThe Swedish company offers a wide range of products for children of all ages. Dry milk formulas are suitable for newborns, and there are even specialized ones that are best used for constipation. Some of them are designed for babies older than six months. For crumbs older than 4 months, the manufacturer offers a variety of vegetable, meat, fish and fruit purees, cereals, juices and children's tea with vitamins. In addition to the usual products for children, there are wellings — oatmeal and multi-cereal porridges with natural additives, cookies, and meatballs.

Roskachestvo examined this brand's applesauce and, apart from its high carbohydrate content (higher than indicated on the packaging), found no drawbacks (12). In addition, some purees contain starch.

In addition, some purees contain starch.

The main characteristics

| Manufacturer | Hero Group |

| Assortment | Military mixtures, purers, porridge, drinks, cookies |

| Recommended age | 9 months0025|

| Country of origin | Sweden |

| Founded | 1963 |

Pros and cons

There are mixtures in the product line interesting combinations of flavors.

High price in the segment; the presence of starch in the puree; the product according to BJU may differ from that stated on the package.

5. Heinz

Heinz. Photo: yandex.market.ru American food company offers a wide range of products at affordable prices. There are fruit, vegetable and meat purees, cereals (dairy and non-dairy), soups and drinks. As a healthy snack for babies from 5 months, special cookies are suitable, and fruit and cream puddings will be a great dessert for older children. You can also find a special vermicelli that will suit crumbs from 6 months. The manufacturer's porridges received the highest rating from Roskachestvo (13). However, some products contain sugar and starch, which many parents of babies do not approve of.

You can also find a special vermicelli that will suit crumbs from 6 months. The manufacturer's porridges received the highest rating from Roskachestvo (13). However, some products contain sugar and starch, which many parents of babies do not approve of.

The main characteristics

| Manufacturer | Heinz |

| Assortment | puree, soups, vermichel, pudding, cookies, tea |

| Recommended age | 9 months with 4 months with 4 months .USA |

| Year of Manufacture | 1869 |

Pros and Cons

Product contains prebiotics; affordable price in the segment of baby food from foreign manufacturers.

Some products contain sugar and starch.

How to choose the right baby food

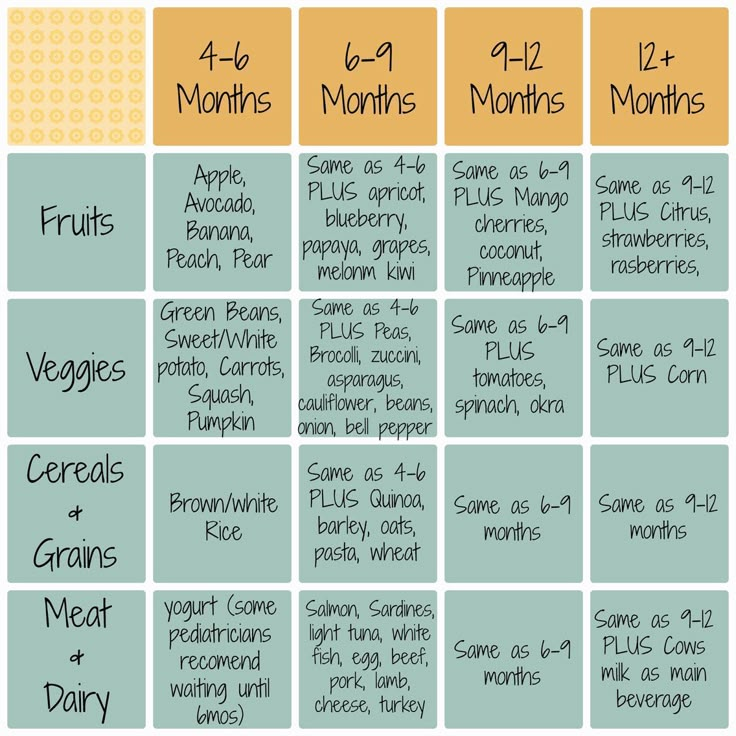

A child's menu may differ from another baby's diet, not only because of age, but also due to health conditions (for example, a tendency to constipation or a dairy allergy) and personal preferences. However, the first thing to consider is age. It’s also important to keep in mind that your baby’s diet should be free of added salt and sugar (14). Certain positions deserve some explanation.

However, the first thing to consider is age. It’s also important to keep in mind that your baby’s diet should be free of added salt and sugar (14). Certain positions deserve some explanation.

Milk formulas

Designed for feeding babies. In fact, they are designed to become an alternative to mother's milk. For the full development of the crumbs, it is necessary that vitamins and trace elements are present in the composition.

Canned puree

Introduced from 4 months. There are fruit, vegetable, meat and fish options. Combinations are also possible. For the first feeding, it is recommended to choose one-component purees from vegetables or fruits.

Porridges

Porridges, as well as mashed potatoes, are recommended to be offered to a baby from 4 months. Thanks to the special processing of cereals, baby porridge is easily boiled, which significantly saves cooking time.

Nectars, juices

You can give your baby juice or nectar from the age of 4 months. As long as it doesn't contain sugar. If available, it is better to wait at least up to 1 year.

As long as it doesn't contain sugar. If available, it is better to wait at least up to 1 year.

Reviews of doctors about manufacturers of baby food

一 Baby food is becoming an object of special attention on the part of the state and parents, 一 says pediatrician Ekaterina Mikhaltsova . - The main advantages of industrial products and dishes are ease of use, balanced composition and minimal cooking time. However, you must strictly follow the age recommendations and cooking rules indicated on the labels.

- Dairy products and baby food in particular are complex production products where quality control is essential at all stages. Therefore, it is better to trust large manufacturers, - explains sanitary doctor Nikolai Dubinin . - It is important to pay attention to the composition and, before offering the child, taste the food yourself. In general, doctors agree that commercially produced baby food is no worse than home-cooked. And some are even better, due to supplements in the form of vitamins and trace elements.

And some are even better, due to supplements in the form of vitamins and trace elements.

Popular questions and answers

We answer the most common questions about baby food together with pediatrician Ekaterina Mikhaltsova and sanitary doctor, epidemiologist Nikolai Dubinin.

How to choose food for the first feeding?

Pediatricians recommend starting the first complementary foods with vegetable puree. Fruits contain a large amount of fructose, which can irritate the lining of the stomach and other organs of the gastrointestinal tract. Of course, the parent himself can boil and grind vegetables to a puree-like consistency, but it is easier to purchase products in the store, since baby food is made in compliance with special technologies, taking into account all the rules and regulations.

Another question is how to choose a brand among such a variety of baby foods. The best solution is to stick with a well-known brand. Large companies care about their reputation, and therefore strictly follow all established quality standards and do not violate production technology.

Large companies care about their reputation, and therefore strictly follow all established quality standards and do not violate production technology.

The next step is to study the information on the label, make sure the quality, evaluate the following indicators:

• Natural composition. Preservatives, salt, sugar and other ingredients should not be present in the composition (at least in products for children under 1 year old).

• Consistency (grinding quality). A good puree should be smooth and without lumps.

• Multi or single ingredient . The first puree should contain only one ingredient. The child should get used to a certain vegetable, after which it will be possible to introduce others, adding each one in turn, so that the baby gets used to everything individually.

• Hypoallergenic product. Formula must not contain ingredients that can cause an allergic reaction.

• Package integrity . It is important to inspect the container in detail for dents, scratches or cracks (chips). Tightness must be observed. Don't forget to check the production date.

It is important to inspect the container in detail for dents, scratches or cracks (chips). Tightness must be observed. Don't forget to check the production date.

• Appropriate for the age of the child . The age for which this or that product is designed is usually indicated on the packaging in compliance with the recommendations of pediatricians.

When all these factors are taken into account, it can be said that the product is really suitable for the child and will not cause side effects (15).

Which of the Russian manufacturers should I pay attention to?

Baby food brand Agusha has been producing products for over 30 years. The assortment has everything you need for a complete diet for kids: dairy products, cereals, fruit, vegetable and meat purees, juices and compotes. The company produces safe, hypoallergenic, complete nutrition for children of all ages. High-quality substitutes for breast milk and subsequent complementary foods are also produced. It is also recommended to pay attention to the manufacturers "FrutoNyanya" and "Theme".

It is also recommended to pay attention to the manufacturers "FrutoNyanya" and "Theme".

What composition should healthy baby food contain?

When choosing puree in jars, pay attention to the composition. The ingredients should be natural, a good option (especially for younger kids) if the puree is a one-component puree - a fruit or vegetable plus water. Please note that the product does not contain salt, flour, starch, dyes and preservatives, and is not too diluted with water. The vegetable itself may contain starch, but its additional additives are very undesirable.

Sources

- Once again about baby food. Ladodo K. S. 2003.

- Roskachestvo rating. Children's cottage cheese "Agusha". URL: https://rskrf.ru/goods/tvorog-detskiy-fruktovyy-agusha-multifruktovyy-s-massovoy-doley-zhira-3-9/

- Roskachestvo rating. Children's kefir "Agusha". URL: https://rskrf.ru/goods/kefir-agusha-s-massovoy-doley-zhira-3-2-dlya-pitaniya-detey-starshe-8-mesyatsev/

- Roskachestvo rating.

Biocurd "FrutoNyanya". URL: https://rskrf.ru/goods/biotvorog-frutonyanya-yabloko-obogashchennyy-vitaminom-d3-s-massovoy-doley-zhira-4-2-dlya-pitaniya-d/

Biocurd "FrutoNyanya". URL: https://rskrf.ru/goods/biotvorog-frutonyanya-yabloko-obogashchennyy-vitaminom-d3-s-massovoy-doley-zhira-4-2-dlya-pitaniya-d/ - Roskachestvo rating. Buckwheat porridge "FrutoNyanya". URL: https://rskrf.ru/goods/frutonyanya-pervyy-vybor-grechnevaya-kasha/

- Roskachestvo rating. Apple puree "Babushkino Lukoshko" URL: https://rskrf.ru/goods/pyure-fruktovoe-gomogenizirovannoe-sterilizovannoe-dlya-pitaniya-detey-rannego-vozrasta-s-4-mesyatse/

- Roskachestvo rating. Biocurd "Theme". URL: https://rskrf.ru/goods/biotvorog-tyema-obogashchennyy-bifidobakteriyami-s-grushey-dlya-detskogo-pitaniya-massovaya-dolya-zh/

- Roskachestvo rating. Apple juice "Theme". URL: https://rskrf.ru/goods/sok-yablochnyy-vostanovlennyy-osvetlennyy-dlya-detskogo-pitaniya/

- Roskachestvo rating. Buckwheat porridge Gerber. URL: https://rskrf.ru/goods/bezmolochnaya-kasha-gerber-grechnevaya/

- Roskachestvo rating. Porridge "Three cereals" Fleur Alpine.

URL: https://rskrf.ru/goods/kasha-fleur-alpine-tri-zlaka-/

URL: https://rskrf.ru/goods/kasha-fleur-alpine-tri-zlaka-/ - Roskachestvo rating. Buckwheat porridge Fleur Alpine. URL: https://rskrf.ru/goods/kasha-grechnevaya-gipoallergennaya-fleur-alpine/

- Roskachestvo rating. Applesauce Semper. URL: https://rskrf.ru/goods/pyure-iz-yablok-fruktovoe-sterilizovannoe-dlya-detskogo-pitaniya-s-4-mesyatsev-semper/

- Roskachestvo rating. Buckwheat porridge Heinz. URL: https://rskrf.ru/goods/grechnevaya-kashka-heinz-bezmolochnaya-nizkoallergennaya/

- Baby food safety. Zakharova I.N., Aisanova M.R. 2019.

- Classification of baby food products, requirements for their quality and safety. Georgieva O.V., Pyrieva E.A., Kon I.Ya. 2018.

European baby food manufacturers ask the EU to develop special rules

02/24/2015

Source: The DairyNews

ENRU

The European Commission has published a working paper on the production of baby food for children aged 1 to 3 years, involving dialogue with industry representatives, The DairyNews reports citing The Dairy Reporter.

Unlike products intended for children aged 0-6 and 6-12 years, the composition and marketing of baby food from 1-3 years is not so tightly controlled by the EU.

The new approach, developed through meetings between representatives of member countries, non-governmental organizations and other stakeholders, involves building a dialogue with business representatives about the self-regulation obligations of the baby food industry in the EU market.

“Commitments relate to the composition of products, as well as how they are marketed,” says the European Commission document.

EU Member States were asked to refrain from adopting legislation in this area at the national level, if producers adhere to their obligations.

Work on the document began in July 2014, when representatives of member countries, non-governmental organizations and industry representatives were asked to complete questionnaires, which formed the basis of a working document identifying three possible scenarios for developing requirements in the baby food market.

Patty Randell, director of policy for Baby Milk Action (BMA), commented in a blog post: “The EU has offered little strategy to curb growth in this market other than dialogue with industry about self-regulation commitments. The European Commission calls the new provisions a step forward, but it takes little account of changes in the market over the past 10 years. Companies are now marketing baby food brands for products with sugar for babies over 12 months of age, misleading the consumer.”

Representatives of the association of European milk processors, the European Dairy Association (EDA), announced the need for special rules regarding the production of baby food.

A joint statement issued in January 2015 by EDA and Specialized Nutrition Europe (SNE) highlights the need for specific regulations for the baby food industry (ages 1-3) under the Special Foods Regulation.

Popular topics

hot topic

22. 02.2023

02.2023

Animal by-products law: how knowledgeable and prepared are farmers?

On March 1, 2023, a new law on animal by-products will come into force in Russia. The DairyNews tried to figure out what milk producers expect from the innovation, how much they are aware of the new law, whether they plan to change the protocols for working with manure on farms, whether they understand how the new rules will work and whether they are afraid of fines for violations.

Read moreAnalytics

02/27/2023

IFCN: the average price for raw milk in the world in February 2023 was 43.4 USD/100 kg

27.02.2023

Milk consumption in Colombia will rise to 162 kg per capita

Analytics

Tatyana Gordeeva, Director of Development and Sales Department, Neos-Ingredients LLC

If earlier most of the modified starches were imported from Europe, then at the time of their inclusion in the sanctions list, no one could figure out what to do next. Because, in principle, modified starches were not imported into Russia from countries other than European ones.

Because, in principle, modified starches were not imported into Russia from countries other than European ones.

Andrey Dakhnovich, Chairman of the Board of Directors of the Elan and Semikarakorsk cheese-making plants

We see that if there are no shocks in the market, then the existing trends - the growth of milk production, the weak purchasing power of the population, the virtual absence of exports of dairy products to non-CIS countries - will lead to a decrease in the purchase cost of milk.

Igor Baringolts, Chairman of the Board of Directors of RM-Agro

We are developing a project for a hay dehydration plant, which is being promoted by the Association of Hay and Feed Exporters - we see the future behind this, because high-quality hay allows us to make high-quality feed for animal health and increase milk yield. At the same time, today a ton of hay costs twice as much as a ton of grain - this is also a separate type of business.

At the same time, today a ton of hay costs twice as much as a ton of grain - this is also a separate type of business.

Igor Moskovtsev, General Director of JSC "Korenovsky MKK"

The production of cheese curds is loaded at 100%. And we plan to increase production volumes, carry out reconstruction, install new equipment in order to maintain the entire range of produced curds in the right amount. This category is fresh, expiration dates are limited, so you need to produce everything at once. I think we'll manage.

Igor Eliseenko, General Director of MolSib

In milk production among farms, the process of consolidation has been going on for a long time, and nothing will change radically. Small and inefficient farms will either be sold or abandon animal husbandry in favor of crop production. As for processing, in my opinion, we should not expect a serious reduction in enterprises here. Everyone prepared for the situation in whatever way they could, huddled, found their own ways to sell products, perhaps even gray schemes.

Small and inefficient farms will either be sold or abandon animal husbandry in favor of crop production. As for processing, in my opinion, we should not expect a serious reduction in enterprises here. Everyone prepared for the situation in whatever way they could, huddled, found their own ways to sell products, perhaps even gray schemes.

Alexander Zernov, General Director of Pöttinger LLC

In order not to find yourself in a situation where your expansion is hindered by the level of equipment, you must take as a basis the goals that the economy sets for 3-5 years. This is the optimal horizon, taking into account the depreciation of equipment and the development of technologies. The realistic life of the equipment is 7 years, the maximum is about 10.

Elena Kruk, Head of Communications Department, JSC Zolotye Meadows

Many suppliers of packaging and spare parts for equipment have switched to prepaid relationships with manufacturers, which entails additional unforeseen costs on the part of the dairymen. We had to revise budgets in order to purchase packaging. The cost of packaging has doubled, its cost reaches 15% depending on the product.

We had to revise budgets in order to purchase packaging. The cost of packaging has doubled, its cost reaches 15% depending on the product.

Dmitry Mironchikov, independent consultant of the dairy market

Everyone has their own vision of milk prices: processors want a lower price, producers want a higher one. It's always like that. Personally, I do not see any prerequisites for a rise in prices for raw milk next year, but I do not see any reasons for a decrease either. There should be some stability in general, at least the first three quarters.

Alena Krekoten, chief technologist of Ice Plus LLP

At first, the farmers did not understand what we wanted from them at all. What kind of indicators are these: somatic cells, QMAFAnM, bacteria contamination ... But over time they got used to it, got involved. And those who do not pass in terms of quality were eliminated on their own, because they began to pay less. And for high-quality milk, on the contrary, we raised the price. And the producers have a healthy motivation. Any sane person understands: "Why "chemical" when you can make normal milk - and get a good price?"

What kind of indicators are these: somatic cells, QMAFAnM, bacteria contamination ... But over time they got used to it, got involved. And those who do not pass in terms of quality were eliminated on their own, because they began to pay less. And for high-quality milk, on the contrary, we raised the price. And the producers have a healthy motivation. Any sane person understands: "Why "chemical" when you can make normal milk - and get a good price?"

Svetlana Kuzmicheva, Development Director, MLK Group

We do not accumulate anything in an attempt to "catch the wave" of prices. We have our own development strategy, we clearly understand that there are stock fluctuations, but keeping something in stock and then trying to sell it is not about us. In our opinion, it is not very expedient to keep money in warehouses.

Armen Khurshudyan, production director of Ice LLP

Of course, genetics plays a very important role. But genetic potential is one thing, and how it is realized is another. And it depends on how good farmers we are. The fact that we took the best genetics does not mean that the cow should give us something. If you asked me what the biggest problem of all cows is, I would say that they are farmers. We create most of the existing problems for the cows ourselves.

Gennady Zenchenko, Chairman of the Board of the Meat and Dairy Union of Kazakhstan

Who from the Ministry of Agriculture even thought - who will work? Where are the doctors in the countryside? Where is the person who will go directly to the cow? We have one farm after another "burning" from brucellosis, from foot-and-mouth disease - without having time to receive subsidies to the end.

Vladimir Labinov, Minister of Agriculture of the Republic of Karelia

Identification must be - this is an axiom that is not subject to discussion. We will try to keep up in this direction, support it in every possible way and implement it at home. In Karelia, the livestock is small, it has long been identified. We have no problems with this at the level of the republic. Another thing is how this system will work on a national scale.

Igor Eliseenko, General Director of Molsib

I do not know a single leader in the industry who would throw up their hands and say that they will not do anything else. A business can be closed, but it is almost impossible to restore it, especially for dairy farms where livestock is kept and trained personnel work.

Lyubov Guseva, Director of Liton

Now we have switched completely to Russian raw materials. We tried to level out all the shortcomings in the film, since this is a rather capricious package, with its own shortcomings, for example, when welding. We did everything to level out shortcomings in equipment, in the qualifications of personnel at dairy plants. That is, the efforts of both parties were required here, and the film also had to be slightly adapted at the dairy plant.

Olga Kosnikova, food technologist, popularizer of science

It often happens that ordinary employees, not technologists, do not have sufficient knowledge about the product, simply because their activities have a different specificity. It is also important to tell employees about what consumers may ask, what they are interested in, what the product actually consists of.

It is also important to tell employees about what consumers may ask, what they are interested in, what the product actually consists of.

Andrea Paoletti, Export Manager Ave Technologies

In the 1990s, we visited dairies in Italy to convince them to try bottling in PET bottles - none of them used to bottle in PET, they used glass, film, cardboard. From that moment on, we began to supply them with equipment for filling milk in PET. Today in Italy we supply 80% of PET filling equipment to dairies.

Alexey Komarovskikh, General Director of A7 Agro Holding

We do not have good high-performance solutions here and now. We understand that if the situation persists, in 2-3 years we will not have spare parts for milking parlors, parallels, production lines. I really wish our agricultural machine builders to catch up. It is important to catch up not only in terms of price, but also in terms of the quality of equipment.

We understand that if the situation persists, in 2-3 years we will not have spare parts for milking parlors, parallels, production lines. I really wish our agricultural machine builders to catch up. It is important to catch up not only in terms of price, but also in terms of the quality of equipment.

Ildar Fayzullin, General Director of Ufagormolzavod

For a number of equipment, the purchase and modernization of lines have been postponed. For example, we have postponed the increase in the capacity of the curd lines, because the Tetra Pak company refused to supply them - despite the fact that we paid the bill back in March. We were told in plain text - look for alternative suppliers.

Alikhan Smailov, Prime Minister of the Republic of Kazakhstan

We see serious distortions in the exchange rates between our national currencies, which are determined through cross rates against the US currency.

0025

0025