Baby food manufacturers usa

World's Top 10 Infant Formula Manufacturers

post

Breastfeeding is one of the important components of a new baby’s life. Breastfeeding helps in giving all the essential nutrients to the babies. The high protein content of breast milk is one of the major reasons why it is strongly recommended by doctors across the globe. As infants need a high protein liquid diet in their early days, women are encouraged to go for breastfeeding but for those women who are unable to breastfeed are offered the solution of infant formula made by the leading infant formula manufacturers.

The infant formula is the best alternative for infants if they cannot be given the breastmilk. As breastmilk is natural, nothing can replace it. Yet in certain cases it cannot be done so the products made by infant formula manufacturers come in very handy.

Products from infant formula manufacturers are undergoing mainstream adoption due to their excellent quality products. Moreover, the infant formula manufacturers are certified by the major governing bodies overlooking the infant related subjects.

According to the Global Infant Formula Manufacturers’ Market Report, made by Verified market Research experts, this market was valued at USD 17.36 billion in 2019. As the demand is growing, the market indicators are projecting the value to reach USD 31.67 billion by 2027. This jump in market value is equal to a CAGR of 9.1% from 2020 to 2027. Download the sample copy here.

The products from the major infant formula manufacturers are increasingly gaining the market share due to their high protein content. Let’s look at the major players of the infant formula industry.

Top 10 infant formula manufacturers in the world

Infant formulas are gaining ground due to their protein content. Moreover, the high-rated products delivered by the leading manufacturers have proven to be a good substitute for breastfeeding. This industry has helped many women to help feed their babies with the most nutritious food during the growing years.

This industry has helped many women to help feed their babies with the most nutritious food during the growing years.

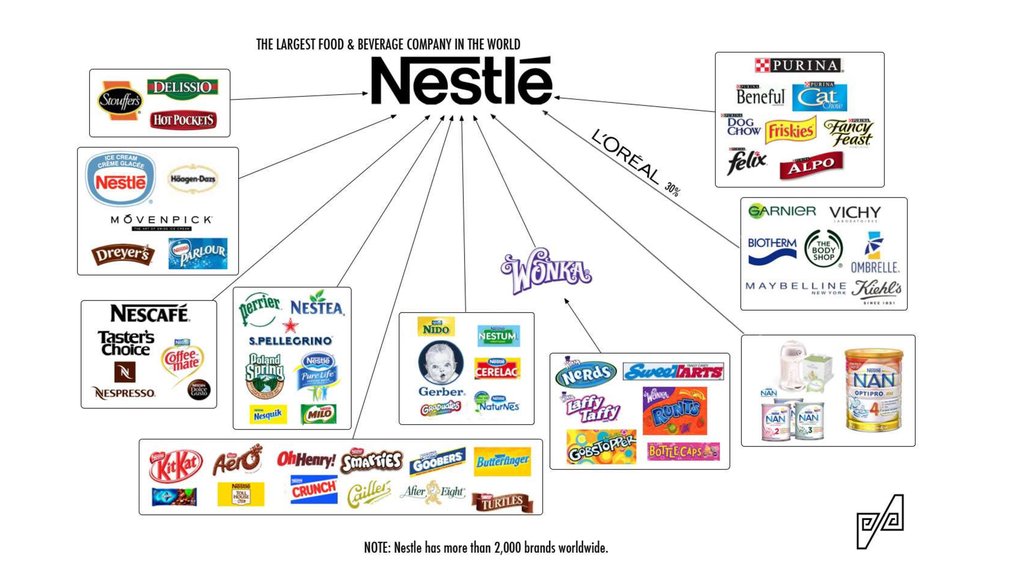

Nestle

Nestle is the most famous and renowned brand in child nutritional products. The company was founded by Henri Nestle in 1866 and is headquartered in Vevey, Switzerland. The quality of milk products of infant nutrition has made them a brand known in every household.

Nestle is one of the prominent members of this list. It has become a household name across the globe due to its high rated products that are loved by individuals of all age groups. Currently, the brand’s focus is on the infant formula manufacturers’ industry.

Danone

Danone is a multinational food product company headquartered in Paris, France. With regular transformation, the company has bought finest quality baby nutritional products. With the motto of best quality, Danone is now one of the leading manufacturers of infant nutrition.

Danone is a French multinational food-products corporation. The company has become the face of the infant formula manufacturers’ market. It is progressing towards becoming one of the most successful brands in the history of the infant formula industry.

Reckitt Benckiser

Reckitt Benckiser was founded by Isaac Reckitt, Jeremiah Colman and Johann Benckiser in 1814. The company headquartered in Slough, England, UK with diversified production. It is now well known for trusted hygiene, health and infant nutrition.

Reckitt Benckiser is a British multinational consumer goods company. It is the dominant player across Europe. The company’s line of products are one of the only brands with the highest quality certifications among the chief infant formula manufacturers.

Abbott Nutrition

Abbott Nutrition was founded by Wallace Calvin Abbott in 1888 and is headquartered in Abbott Park, Illinois, United States. The company is into medical devices and healthcare products. It is providing best quality products to support immune system in infants as well as in adults.

It is providing best quality products to support immune system in infants as well as in adults.

Abbott Nutrition is a global healthcare company that has been operating since 1903. The company is dedicated to work and develop the most promising healthcare products. With this aim in mind, the scientists of Abbott Nutrition have come up with the most nutritious line of products – largest among the leading infant formula manufacturers.

FrieslandCampina

FrieslandCampina is a Dutch multinational company headquartered at Amersfoort, Netherlands. It was founded in 2008 with the merger of Friesland Foods and Campina. The company has diverse its operations in infant nutrition also. Although the company is not so old, but is very qualitative in food products.

FrieslandCampina is a Dutch multinational dairy cooperative. It is one of the youngest members of this list yet it has managed to achieve spot among the leading infant formula manufacturers.

Bellamy’s Organic

Bellamy’s Organic is a concern company of Mengniu dairy China. It was founded in 2003 and is headquartered in Launceston, Australia. The company produces organic infant formula and baby food. They have a passionate team for creating high quality, nutritionally balanced and delicious infant food.

It was founded in 2003 and is headquartered in Launceston, Australia. The company produces organic infant formula and baby food. They have a passionate team for creating high quality, nutritionally balanced and delicious infant food.

Bellamy’s Organic is one of the major organic infant formula and baby food producer that is known for its high rated products in the industry. It is one of the leading organizations in the global infant formula manufacturers’ industry.

Kraft Heinz

Kraft Heinz was formed by the merger of Kraft Foods and Heinz. The company was founded in 2015 and is headquartered in Chicago, United States. It offers a variety of products for child nutrition and has always been coming up with new infant products.

Kraft Heinz is an American multinational that delivers its products across the world. It is the flag bearer of the infant formula manufacturers’ market.

HiPP

HiPP was founded in 1932 by George Hipp and is headquartered in Germany. The company’s major products are infant formula, Paps, drinks, teas, baby skin care and many more. It is manufacturing extraordinary organic products without genetically modified organism.

The company’s major products are infant formula, Paps, drinks, teas, baby skin care and many more. It is manufacturing extraordinary organic products without genetically modified organism.

HiPP has been a pioneer in organic farming. It is one of the oldest members on this list. With a century of experience, the company has stepped into the infant formula industry. The company is dedicated to making people aware about the benefits of organic products.

Perrigo

Perrigo is an American- Irish registered manufacturer of pharmaceuticals and nutritional products. The company was founded existence in 1887 and is headquartered in Dublin, Ireland. Perrigo is a leading supplier of store brand self-care nutrition products. The products include infant and toddler formulas, pediatric and adult nutrition drinks.

Perrigo is an American Irish–registered manufacturer that is popular due to its flagship products. It is one of the most reliable brands in the American market when it comes to infant formulae.

Arla Foods

Arla Foods was founded in 2000 and is headquartered in Viby, Denmark. It was formed with the merger of Swedish co-operative dairy Arla and Danish company MD Foods. The company is into manufacturing of infant products with natural goodness of organic elements.

Arla Foods is a Danish multinational cooperative. The organization is dedicated to leave a positive impact on the society and regularly works towards building a sustainable future for its consumers across the world.

Top Trending Blogs

Nike: World’s largest shoe company World’s top 10 dairy companies

Share on

Please login for comment

Related Articles

VMR has consistently provided accurate and research-intensive reports aiding businesses of all sizes and geographies Our reports cover several parameters that remarkably help businesses during decision-making scenarios. We concentrate on several prominent regions, countries, market drivers and ongoing trends which influence major market conditions.

View All Reports

Our experienced team of consultants are available with their strategic expertise to help solve existing issues or derive future market analysis in a personalized manner. Our customized consulting services help organizations take strategic business decisions for future horizons.

Know More

With VM Intelligence the perfect visualization is just a click away. Understand your business needs with VMR’s advanced analytical capabilities that use comprehensive suite of enterprise visualization solutions. Our advanced tools and business intelligence developers help organizations of any size to analyze and visualize data.

Visualize Your Market

Our comprehensive syndicate market report database underpins elaborative data analysis regarding a number of sectors and consumers spanning across continents. We utilize cutting-edge analytical methodologies to gauge industry dynamics and further provide well-designed report solutions to drive successful business decisions.

View Report Store

GET IN TOUCH

North America Baby Food Market Analysis - Industry Report

North America Baby Food Market Analysis - Industry Report - Trends, Size & ShareNorth America Baby Food Industry Overview

| Study Period: | 2017-2027 |

| CAGR: | 5.25 % |

Major Players*Disclaimer: Major Players sorted in no particular order |

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

North America Baby Food Market Analysis

The North American baby food market is projected to register a CAGR of 5.25% over the next five years.

- Today's young American parents want the best food to be served to their children and are conscious of the nutrient content their children take, irrespective of the product's cost. Infants and children are vulnerable to foodborne illnesses because their immune systems are not fully developed to fight infections.

Thus, factors like premium quality products and their safety are among the essential criteria influencing the buyer's decision. Due to the convenience and improved nutrition that packaged baby food provides, parents have increasingly adopted it over the past few years.

Thus, factors like premium quality products and their safety are among the essential criteria influencing the buyer's decision. Due to the convenience and improved nutrition that packaged baby food provides, parents have increasingly adopted it over the past few years. - A rise in public knowledge of the numerous health benefits of feeding newborn baby food has significantly fueled the growth of the baby food market in North America. It's not surprising that parents choose organic, GMO-free, and additive/preservative-free items for their children as consumers choose fewer processed foods.

- Although parents desire greater flavor, they do not desire additional sugar and are monitoring their child's calorie intake. Instead, parents concur that producers can enhance cereal's flavor and nutritional value by incorporating superfoods like blueberries and pomegranates and a wider choice of whole grains.

- There's plenty at stake for the baby care manufacturers, as the competition in the baby care markets is stiff due to the presence of numerous branded and store-brand products offering their products at a competitive price.

The existing baby food manufacturers have expanded their product ranges to include organic variants, sometimes through mergers and acquisitions. New entrants have also forayed into this sector with specialized offerings to tap the vast potential.

The existing baby food manufacturers have expanded their product ranges to include organic variants, sometimes through mergers and acquisitions. New entrants have also forayed into this sector with specialized offerings to tap the vast potential. - For instance, in July 2020, the early childhood nutrition leader, Gerber, expanded its organic snacks line with the introduction of Gerber Organic BabyPops™, new puffed corn and oat snack in a fun, popcorn-like shape made just the right size for little fingers learning to pick up. BabyPops come in three varieties – peanut, tomato and banana raspberry – and do not contain any added sweetener or salt, plus organic is always non-GMO..

North America Baby Food Industry Segments

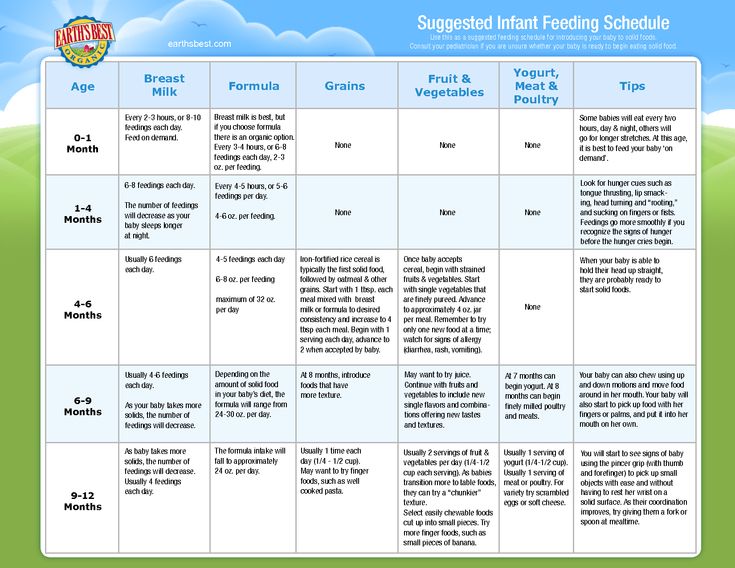

Baby food is any readily digestible, soft meal created specifically for infants between the ages of four to six months and two years old. It does not include breastmilk or infant formula.

The North American baby food market is segmented by product type, distribution channel, and geography. The baby food market, by product type, is segmented as milk formula, dried baby food, prepared baby food, and other product types. By distribution channel, the market is segmented into hypermarkets/supermarkets, convenience stores, drug/pharmacies, online retail stores, and other distribution channels. By geography, the market is segmented into the United States, Canada, Mexico, and the Rest of North America.

The baby food market, by product type, is segmented as milk formula, dried baby food, prepared baby food, and other product types. By distribution channel, the market is segmented into hypermarkets/supermarkets, convenience stores, drug/pharmacies, online retail stores, and other distribution channels. By geography, the market is segmented into the United States, Canada, Mexico, and the Rest of North America.

For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| Product Type | |

| Milk Formula | |

| Dried Baby Food | |

| Prepared Baby Food | |

| Other Product Types |

| Distribution Channel | |

| Hypermarket/Supermarket | |

| Drugstores/Pharmacies | |

| Convenience Stores | |

| Online Retail Stores | |

| Other Distribution Channels |

| Geography | |

| United States | |

| Canada | |

| Mexico | |

| Rest of North America |

Report scope can be customized per your requirements. Click here.

Click here.

North America Baby Food Market Trends

This section covers the major market trends shaping the North America Baby Food Market according to our research experts:

Busy Lifestyle of Parents Fostering RTE Product Adaptation

- The role of a parent or mother/father is considered vital for a baby's overall development, especially regarding dietary and nutritional requirements. The changing societal landscape worldwide has ensured that the contribution of women toward the workforce and the economy is ever-increasing.

- For instance, according to the Bureau of Labor Statistics, the female participation rate in the labour force of the United States increased to 56.1% in 2021. It became challenging for working parents to take their time preparing regular meals for their babies. Thus, in the United States, where the female labour force participation rate is one of the highest globally, the demand for commercial baby food formulations is increasing in this regard due to the busy lifestyles of parents.

Parents of 18- to 34-year-olds are North America's most significant demographic group of organic food buyers.

Parents of 18- to 34-year-olds are North America's most significant demographic group of organic food buyers. - Moreover, convenient packaging in the form of spouted squeeze pouches, which can be consumed straight from the refrigerator or by heating minimally in the microwave, is one of the major factors adding to the comfort of providing ready-to-eat baby foods. Manufacturers are increasingly offering baby food to restore the nutritional value of fruits and vegetables added to these ready-to-eat products.

- Packaging sustainability, now ranked highly by consumers at large, is also taking up its parts. At the same time, innovation, wherein in 2020, Nestlé launched a single-material pouch for its baby food products designed for the future of recycling. It will be 100% recyclable through Gerber's national recycling program with TerraCycle.

To understand key trends, Download Sample Report

United States dominates the North America Baby Food Market

- In North America, the baby care industry is highly regulated, so consumers are conscious that their baby food products will be safe and nutritious.

The United States was the dominant segment in the studied market, and the country accounted for a significant market share due to rising demand driven by a high birth rate.

The United States was the dominant segment in the studied market, and the country accounted for a significant market share due to rising demand driven by a high birth rate. - For instance, according to US Census Bureau, in 2021, the Hinesville metro area in Georgia ranked first with 20.4 births per 1,000 residents , followed by Odessa in Texas with 18.99 births per 1,000 residents.

- Additionally, changing lifestyles due to rising living standards and consumer awareness about nutritional diets for babies are expected to propel regional market growth further. Moreover, online channels are anticipated to experience encouraging expansion throughout the analysis. E-commerce websites are becoming increasingly popular with American customers. Growing modernization and many internet users are accelerating the expansion of online channels that sell infant food.

- Furthermore, the market has strong penetration of prepared organic baby food among United States consumers due to growth in dual-income families that has led convenience to be an integral part of the diet.

The same can be seen in the ready meal segment growth. For organic baby foods, the growing demand for pouches and cup holders has been prominent over the past years.

The same can be seen in the ready meal segment growth. For organic baby foods, the growing demand for pouches and cup holders has been prominent over the past years.

To understand geography trends, Download Sample Report

North America Baby Food Market Competitor Analysis

The North American baby food market is competitive, with various operating players and many new entrants registering to grab the market share. Companies are focusing on expanding facilities and product portfolios due to the growing demand for baby food. Some of the major key players in the North American baby food market are Hero Group (Beech-Nut Nutrition Corporation), Nestlé S.A., Danone S.A., Abbott Laboratories, and Hain Celestial Group, Inc. Mergers and acquisitions and partnerships are the two other strategies that are being widely witnessed in the market. Companies adopted these strategies to compete with the other players, expand their global presence, and broaden their product range.

North America Baby Food Market Top Players

Hero Group (Beech-Nut Nutrition Corporation)

Nestlé S.A.

Danone S.A.

Abbott Laboratories

Hain Celestial Group, Inc.

*Disclaimer: Major Players sorted in no particular order

North America Baby Food Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Deliverables

1.2 Study Assumptions

1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

3.1 Market Overview

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Force Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.

3.5 Intensity of Competitive Rivalry

3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 Product Type

5.1.1 Milk Formula

5.1.2 Dried Baby Food

5.1.3 Prepared Baby Food

5.1.4 Other Product Types

5.2 Distribution Channel

5.2.1 Hypermarket/Supermarket

5.2.2 Drugstores/Pharmacies

5.2.3 Convenience Stores

5.2.4 Online Retail Stores

5.2.5 Other Distribution Channels

5.3 Geography

5.3.1 United States

5.3.2 Canada

5.3.3 Mexico

5.3.4 Rest of North America

6. COMPETITIVE LANDSCAPE

6.1 Market Share Analysis

6.2 Most Adopted Strategies

6.3 Company Profiles

6.3.1 Kraft Heinz Company

6.3.2 Abbott Laboratories

6.3.3 Hero Group (Beech-Nut Nutrition Corporation)

6.

3.4 Hain Celestial Group, Inc.

3.4 Hain Celestial Group, Inc.6.3.5 Nestlé S.A.

6.3.6 Reckitt Benckiser Group plc (Mead Johnson & Company, LLC)

6.3.7 Amara Organics Foods

6.3.8 Danone S.A.

6.3.9 Lactalis (Stonyfield Farm, Inc.)

6.3.10 Sun-Maid Growers of California

*List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

**Subject to Availability

You can also purchase parts of this report. Do you want to check out a section wise price list?North America Baby Food Market Research FAQs

What is the study period of this market?

The North America Baby Food Market market is studied from 2017 - 2027.

What is the growth rate of North America Baby Food Market?

The North America Baby Food Market is growing at a CAGR of 5.25% over the next 5 years.

Who are the key players in North America Baby Food Market?

Hero Group (Beech-Nut Nutrition Corporation), Nestlé S. A., Danone S.A., Abbott Laboratories, Hain Celestial Group, Inc. are the major companies operating in North America Baby Food Market.

A., Danone S.A., Abbott Laboratories, Hain Celestial Group, Inc. are the major companies operating in North America Baby Food Market.

North America Baby Food Industry Reports

In-depth industry statistics and market share insights of the North America Baby Food Market sector for 2020, 2021, and 2022. The North America Baby Food Market research report provides a comprehensive outlook of the market size and an industry growth forecast for 2023 to 2028. Available to download is a free sample file of the North America Baby Food Market report PDF.

Business Email

Message

Thank You!

Thank you for your Purchase. Your payment is successful. The Report will be delivered in 24 - 72 hours. Our sales representative will reach you shortly with the details.

Please be sure to check your spam folder too.

Sorry

"Sorry! Payment Failed. Please check with your bank for further details. "

"

There is a severe shortage of powdered infant formula in America

Society 1673

Share

The situation with infant formula has become so critical that Senator Tom Cotton has already called it a "national crisis", Congress began an investigation, and President Biden was forced to announce measures to curb the deficit.

Deliveries of infant formula to stores have been so reduced that large retail chains and pharmacies are forced to limit the number of cans "in one hand." For example, CVS and Walgreens only sell three packages of dry mix at a time. According to Datasembly, a company that tracks price indexes and sales of various products, in the first week of May, the lack of milk formula in warehouses across the country was 43% (for comparison, in April - 40%, and in November last year - 11%). Worst of all is the situation with warehouses in the states of Iowa, South Dakota, North Dakota, Missouri, Texas and Tennessee. Accordingly, prices rose sharply - by 18%. On eBay, some savvy sellers offer a $200 can of powdered formula, and there are sure to be buyers: in the US, three-quarters of children receive either full or partial formula in their first six months of life. Worst of all are those families whose children, for medical reasons, cannot eat anything other than these mixtures.

Worst of all are those families whose children, for medical reasons, cannot eat anything other than these mixtures.

Abbott fights bacteria

What caused this crisis? The official version, which we already wrote about: in February, the Food and Drug Administration (FDA) stated that certain mixtures of Similac (Similac), Alimentum (Alimentum) and EleCare (EleCare) are contaminated with the dangerous bacterium Cronobacter sakazakii, which can lead to death. Four kids were hospitalized, two died. Abbott Nutrition has announced a voluntary recall of some batches of this baby food that was produced at its plant in Sturgis, Michigan (these powdered formulas were found to be contaminated). In early March, several more dry mixes produced at the same plant were recalled due to Salmonella contamination.

Bacteria in baby food is not uncommon. Back in 2004, the Codex Committee on Food Hygiene (CCFA) of the World Health Organization revised the International Code of Hygienic Practice for Foods for Infants and Older Children, tightening the requirements, including due to cases of contamination of mixtures with bacteria. A review of Abbott's records shows that the company has had to destroy batches of premixed formulas in the past due to the presence of Cronobacter. In addition, in February, the FDA emphasized that the recall only applies to dry powder from certain batches, and does not apply to liquid infant formula and other baby foods manufactured by Abbott Nutrition. In other words, it is hard to imagine that a temporary shutdown of the production line of several (!) dry mixes at one plant can lead to such a large-scale national crisis. Not to mention the fact that other manufacturing companies were not affected by the recall, and they continue to produce their products.

A review of Abbott's records shows that the company has had to destroy batches of premixed formulas in the past due to the presence of Cronobacter. In addition, in February, the FDA emphasized that the recall only applies to dry powder from certain batches, and does not apply to liquid infant formula and other baby foods manufactured by Abbott Nutrition. In other words, it is hard to imagine that a temporary shutdown of the production line of several (!) dry mixes at one plant can lead to such a large-scale national crisis. Not to mention the fact that other manufacturing companies were not affected by the recall, and they continue to produce their products.

Furthermore, the company's official statement dated May 11 states: “After a close examination of the situation, there is no evidence that these cases [infant deaths - Ed.] are related to the consumption of our baby food; the bacterium Cronobacter sakazakii, which was found during testing, was in areas not in contact with products. The bacterial samples found at the plant did not match the strains found in the babies' tests. An Abbott spokesperson also said that all products tested for Cronobacter sakazakii and Salmonella were negative and that no Salmonella was found at the Sturgis facility during the investigation.

The bacterial samples found at the plant did not match the strains found in the babies' tests. An Abbott spokesperson also said that all products tested for Cronobacter sakazakii and Salmonella were negative and that no Salmonella was found at the Sturgis facility during the investigation.

However, the FDA insisted that infant formula was produced in unsanitary conditions, and Abbott's internal records showed that the company destroyed some of its products due to bacteria in the factory. On May 16, Abbot reached an agreement with the FDA that allowed the production lines to restart. The company reportedly acknowledged the unsanitary conditions at the plant and is committed to rectifying the shortcomings. In addition, Abbott has agreed to engage external experts who will develop a plan to reduce the risk of bacterial contamination at the plant and conduct periodic assessments to ensure the company is in compliance. In the event that any products again test positive for bacteria, the company will be required to dispose of them and stop work until the source of infection is eliminated. If Abbott does not comply, it faces $30,000 in damages per day of violation (up to $5 million in annual fines). The terms of the agreement are valid for at least 5 years.

If Abbott does not comply, it faces $30,000 in damages per day of violation (up to $5 million in annual fines). The terms of the agreement are valid for at least 5 years.

FDA chief Robert Kaliff stated, "The public can be assured that our FDA will do everything possible to ensure that baby food continues to meet safety and quality standards." The agreement between Abbott and the FDA has been approved by the US District Court for the Western District of Michigan. However, it’s too early for parents to rejoice: Abbot said that a restart is possible within two weeks, and mixtures will appear on store shelves no earlier than in 6-8 weeks.

Broken logistics and monopolies

Another reason that is less talked about is disruptions in the supply chain. Everything affects: a critical shortage of labor (which we have already written about more than once), problems with the production of packaging and transportation. All this together affects the production and distribution of goods. According to Datasembly CEO Ben Reich, "the economic situation affects this category of goods more than others."

According to Datasembly CEO Ben Reich, "the economic situation affects this category of goods more than others."

The crisis has reached such proportions that even the federal authorities were forced to react. On May 12, President Joe Biden met with representatives from Walmart, Target, Reckitt and Gerber to discuss ways to reduce the deficit. He also instructed the Federal Trade Commission to use its powers to monitor allegations of price gouging and the Justice Department to work with state attorneys general to crack down on retailers who took advantage of the situation.

On May 13, the House Oversight Committee announced that it had launched an investigation into the baby food situation. Letters were sent to all four manufacturers asking them to explain how they plan to handle the crisis and what they are doing to prevent this from happening in the future. In addition, the Committee will also investigate allegations received from consumers of price gouging. The meeting of the Committee on this issue is scheduled for May 26.

At the same time, the recall of goods for one reason or another is a common occurrence. Thousands of medicines and products are withdrawn from sale every year, and yet there is no nationwide crisis, and sellers do not restrict the sale of essential items in the spirit of Soviet trade.

Four large companies now control 90% of America's supply of infant formula: Abbott, Mead Johnson, Gerber and Perrigo Nutritionals. Abbott, which makes Similac, and Mead Johnson, which makes Enfamil, have nearly 80% of the market. Mead Johnson has already stated, “We have taken steps to ramp up production of Enfamil and are currently shipping 50% more products to address consumer concerns as quickly as possible.” Considering how the prices for dry mixes have risen, the crisis is beneficial for all manufacturing companies.

Importing baby food will be easier

Another factor in the crisis is America's regulatory and trade policies. The FDA regulation of infant formula is so strict that most products coming from Europe cannot be bought here due to technical issues such as labeling requirements. There is no question about the quality of European blends: studies have shown that in some respects they can even be better than American ones, because the European Union bans certain types of sugar (for example, corn syrup). The US also restricts the import of formulas that comply with FDA regulations. For large volumes, the import tax for mixtures can exceed 17%. Currently up to 98% of the baby food on the market is made in the USA. And during a crisis, the lack of alternative supplies becomes a rather big problem.

There is no question about the quality of European blends: studies have shown that in some respects they can even be better than American ones, because the European Union bans certain types of sugar (for example, corn syrup). The US also restricts the import of formulas that comply with FDA regulations. For large volumes, the import tax for mixtures can exceed 17%. Currently up to 98% of the baby food on the market is made in the USA. And during a crisis, the lack of alternative supplies becomes a rather big problem.

Therefore, for the first time, an unprecedented step is announced - the US intends to increase imports of infant formula in order to reduce the nationwide shortage. Potential importers in the FDA are manufacturers from Australia, New Zealand, the UK and the Netherlands. On May 16, the FDA called on foreign manufacturers to apply to import their products into the United States. It is reported (however, without going into details) that the verification process will be "optimized". White House press secretary Karine Jean-Pierre said that "priority will be given to applications from those companies most likely to be able to prove product quality and be able to get the most baby food to American stores as quickly as possible." Thus, the advantage will be given to large manufacturing companies, which will be able to quickly cover the shortage that has arisen.

White House press secretary Karine Jean-Pierre said that "priority will be given to applications from those companies most likely to be able to prove product quality and be able to get the most baby food to American stores as quickly as possible." Thus, the advantage will be given to large manufacturing companies, which will be able to quickly cover the shortage that has arisen.

However, even if import applications and related documentation confirming the safety of mixtures are submitted, relatively speaking, tomorrow, it may be weeks before the products reach the stores. Once the application is filed, the FDA will still need to review the baby food to ensure quality control to American standards. The import facilitation policy was adopted as a temporary measure for the next six months.

In the meantime, parents of babies rush about in search of baby food, politicians from all sides have decided to use the crisis to their advantage. So, Republican Congresswoman Kat Cammack posted a video on her Facebook account about how the federal authorities send packages of baby food to the border with Mexico: “American stores have empty shelves, there is no shortage at the border. ” Cammack said the Biden administration should not put the needs of illegal immigrants ahead of the interests of American citizens. Another Republican politician, Rep. Eliza Stefanik, also said it was "absolutely unacceptable" and drew a parallel with Trump's famous slogan, "America continues to be put last." In turn, Democratic politicians Eric Svolvell and Ruben Gallego accused Eliza of wanting to "starve babies" in border centers where illegal immigrants are detained.

” Cammack said the Biden administration should not put the needs of illegal immigrants ahead of the interests of American citizens. Another Republican politician, Rep. Eliza Stefanik, also said it was "absolutely unacceptable" and drew a parallel with Trump's famous slogan, "America continues to be put last." In turn, Democratic politicians Eric Svolvell and Ruben Gallego accused Eliza of wanting to "starve babies" in border centers where illegal immigrants are detained.

Only one thing can be said with certainty: even with the increase in production and the green light for imports, the situation with the shortage of infant formula will not change in the next couple of weeks.

Subscribe

Authors:

- Victoria Averbukh

Ministry of Justice USA New Zealand Great Britain Mexico Australia

- 2 Mar

Impaza: please your partner

- 2 Mar

Attention to hormones: what testosterone will tell

- 2 Mar

Calmness, only calmness!

What else to read

-

SHOT: four unidentified aircraft spotted in New Moscow

23867

Artem Koshelenko

-

A former commando explained the insidious plan of the general of the Armed Forces of Ukraine: the counterattack was postponed

12677

Lina Korsak

-

Podolyak named the date of the start of the counter-offensive of the Armed Forces of Ukraine

21318

Artem Koshelenko

-

Voenkor Sladkov called the condition for the unification of the Armed Forces of Ukraine with the Russian Federation in the fight against the West

20733

Evgeny Hakobyan

-

Mummies of mother and daughter found in house before demolition

33759

Stanislav Yuriev

What to read:More materials

In the regions

-

A film about the life of the Russian Crimea was shown in Paris

Photo 48913

Crimeaphoto: MK in Crimea

-

Plant an onion the Chinese way: it will grow surprisingly large and juicy

20274

Kalmykia -

Don't Eat This: One Part of Apples Was Called Deadly by Doctors

9497

Pskov -

American journalist compared Crimea with Texas

Photo Video 9424

CrimeaDenis Pronichev photo: crimea.

mk.ru

mk.ru -

Scandal in Shchelkovo: officials did not let widows and mothers of dead soldiers to the monument

Photo 8438

Moscow regionElena BEREZINA

-

Who are Ryodan PMCs and what are they doing in Karelia

5251

KareliaVladimir Pospelov

In the regions:More materials

90,000 delivery of children's food from the EU to the United States took up the Pentagon - DW - 23. 05.2022

05.2022 Derived in the United States on a military aircraft, baby food photo: Jon Cherry/Getty Images

Health

23 23 23 23 23 23 23 23 23 May 2022

There is a severe shortage of infant formula in the United States due to supply chain disruption and the closure of a Michigan factory. The scarce product was brought on a military transport plane from Germany.

https://p.dw.com/p/4BiEV

Advertisement

A US military aircraft loaded with over 31 tons of scarce infant formula landed in Indiana on Sunday, May 22. It arrived from the American air base "Ramstein", located in the west of Germany, in the federal state of Rhineland-Palatinate. The baby food brought in is enough to fill more than half a million bottles.

Out of stock - for a variety of reasons

There has been an acute shortage of infant formula in the US for several months now. The reason for this is a number of circumstances. Initially, powdered baby food production declined due to supply chain disruption and staffing shortages due to the COVID-19 pandemic.. Then in February, US pharmaceutical company Abbott was forced to close a Michigan baby food plant after the death of two babies.

The reason for this is a number of circumstances. Initially, powdered baby food production declined due to supply chain disruption and staffing shortages due to the COVID-19 pandemic.. Then in February, US pharmaceutical company Abbott was forced to close a Michigan baby food plant after the death of two babies.

The tragedy allegedly occurred due to infection with pathogenic bacteria. However, a review by the Food and Drug Administration showed that the product was in order, and an agreement was reached last week to resume production at Abbott. However, it will be several weeks before dry mix appears on supermarket shelves.

The first batch covered 15 percent of needs

Therefore, US President Joseph Biden ordered that baby food be delivered by US military transport aircraft from Europe. On Sunday evening, on Twitter, he announced the second such flight, which will bring baby food from the Swiss company Nestlé to the United States.

The first shipment of milk formula from the EU covered about 15 percent of emergency needs, Brian Deese, political and economic adviser to the President of the United States, told CNN.