Baby food expenses

Budgeting for New Baby: Ongoing & One-Time Expenses

The arrival of a new baby can be both exciting and financially overwhelming. A tiny new baby can mean big changes and major expenses for new parents. How much money can you expect to spend on your little one in the first year? What financial tools should you consider creating? Here we'll show you how to financially prepare for your family's newest addition before they arrive.

Key Takeaways

- One of the largest expenses for new parents can be the delivery—the cost of which depends on the location and health insurance policy.

- One-time costs often include travel, home needs, and nursing/feeding.

- Other things to consider include the cost of child care and savings plans.

- It's important to have an emergency fund if one parent decides to stay home.

One-Time Expenses

In this scenario, we look at the first baby. That means starting from scratch in many areas such as furniture, strollers, and cribs. There is, of course, also the one-time medical expense of delivering a baby in the United States. As we'll see, this expense is by far the hardest to pin down in any meaningful way.

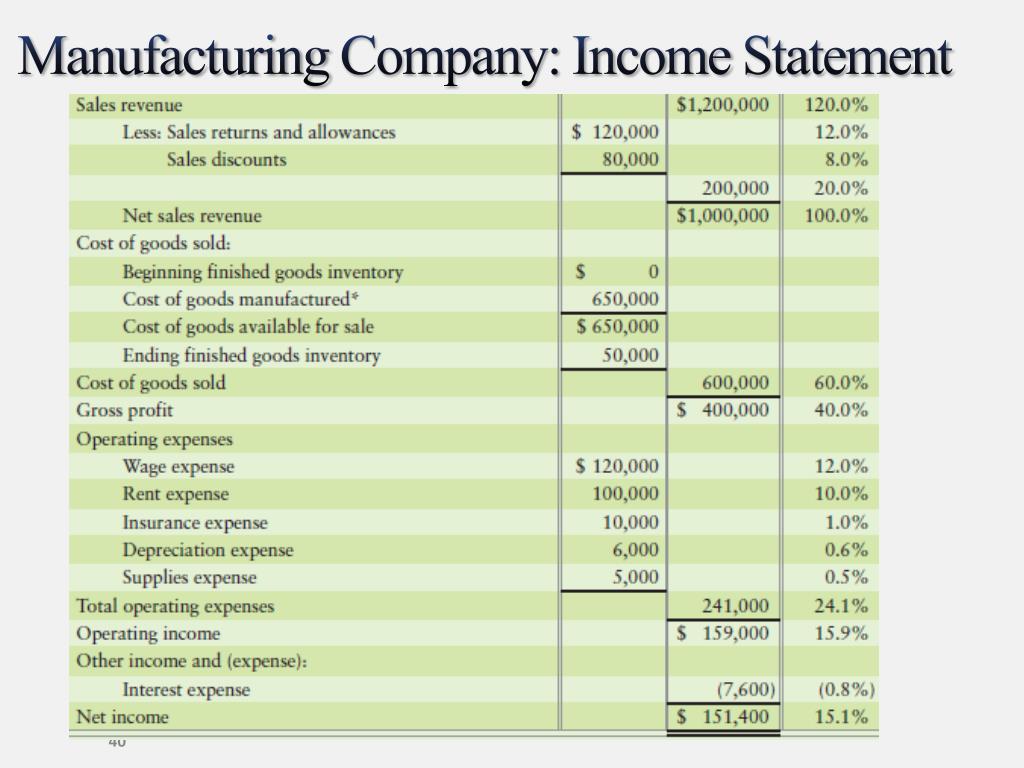

Medical Bills

In the U.S., the average new parent with insurance coverage can expect to pay almost $14,000 for their labor and delivery, according to a 2020 research article published by the Healthcare Cost Institute. Vaginal deliveries can cost from $7,000 in Arkansas to $17,000 in New York. Interestingly, out-of-pocket costs also exhibited a wide range, from $1,000 in D.C. to $2,400 in South Carolina. (2017 was the most recent year for which data was available.)

It is important to keep in mind that the cost of routine birthing care is highly variable based on your location and your insurance coverage. Review your policy to find out what your out-of-pocket costs are for prenatal care, hospital stay, tests, and postpartum care. Unfortunately, it's nearly impossible to make an accurate prediction about how much you'll pay without reviewing your health coverage.

Your insurance policy and location are important factors when determining how much the delivery of a baby will cost.

Baby Stuff

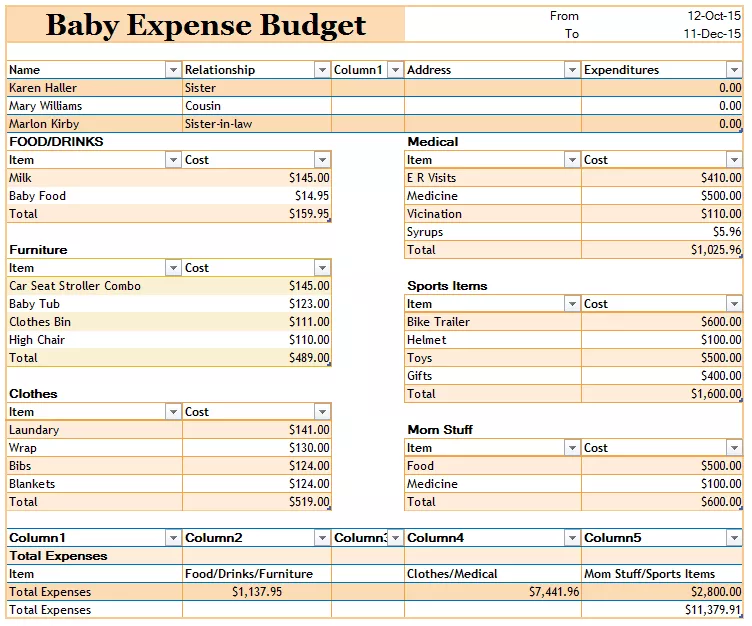

The one-time purchases for babies are as variable as the medical costs above, but for different reasons. This category can go up exponentially depending on the wants of the parent. For example:

- Travel Needs: To get out and about you will most likely want to purchase a stroller, an infant car seat (required by law), a baby carrier, and a diaper bag. If you plan on being out a lot, a portable playpen and/or bassinet may make sense. Like many of the things on this list, there is a wide range of costs. Buying an adapter, snuggle bags, and another option for some brands of strollers can be a $1,000 price tag without taking in the cost of the stroller itself. On the other end of that range, a seat and stroller combo can still be purchased new for under $150, and used equipment or hand-me-downs can fill in for all the others.

It is worth noting that, at the very least, it is worth buying a new infant car seat. There is no foolproof way to ensure a used one hasn't been compromised in a previous accident or through hard use.

It is worth noting that, at the very least, it is worth buying a new infant car seat. There is no foolproof way to ensure a used one hasn't been compromised in a previous accident or through hard use. - Home Needs: To keep your child occupied, you may want to consider a portable swing, bouncy seat, play mat, and/or jump seat. You may also want to have a crib and/or bassinet, crib mattress, basic bedding with blankets, changing table, small dresser, rocking chair, monitor, and a diaper pail. Again, this is an area where personal preference dictates cost. Unlike car seats, everything is for use at home, meaning that you can buy it used or even acquire it through one of the many share and swap groups you'll find online.

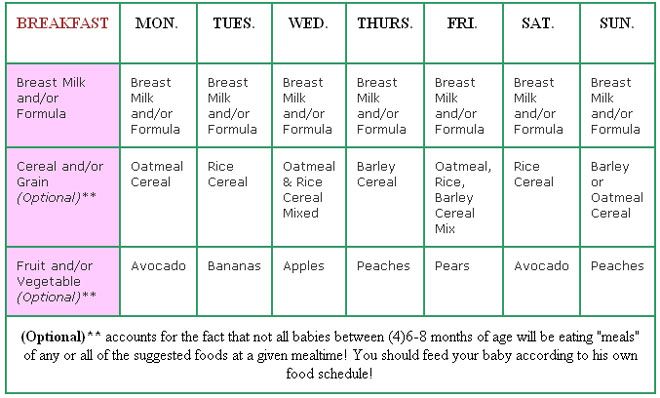

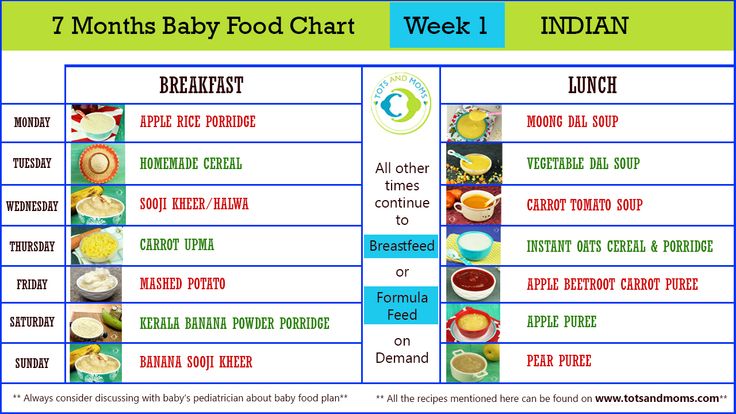

- Nursing and Feeding: Feeding costs for your new infant do, of course, vary like everything else based on your particular situation. A birthing parent who is able to stay at home and has no issues breastfeeding around the clock will see very minimal costs for months before a high chair and dishes are required.

In that situation, some things like a breastfeeding pillow, burp cloths, or even a cape are more than enough. If the parent will be storing breast milk for use, then items like bottles, nipples, cleaning equipment, and a single or dual breast pump come into play and your budget will increase. If breastfeeding isn't possible, formula feeding will add significant costs to your first year of parenting.

In that situation, some things like a breastfeeding pillow, burp cloths, or even a cape are more than enough. If the parent will be storing breast milk for use, then items like bottles, nipples, cleaning equipment, and a single or dual breast pump come into play and your budget will increase. If breastfeeding isn't possible, formula feeding will add significant costs to your first year of parenting.

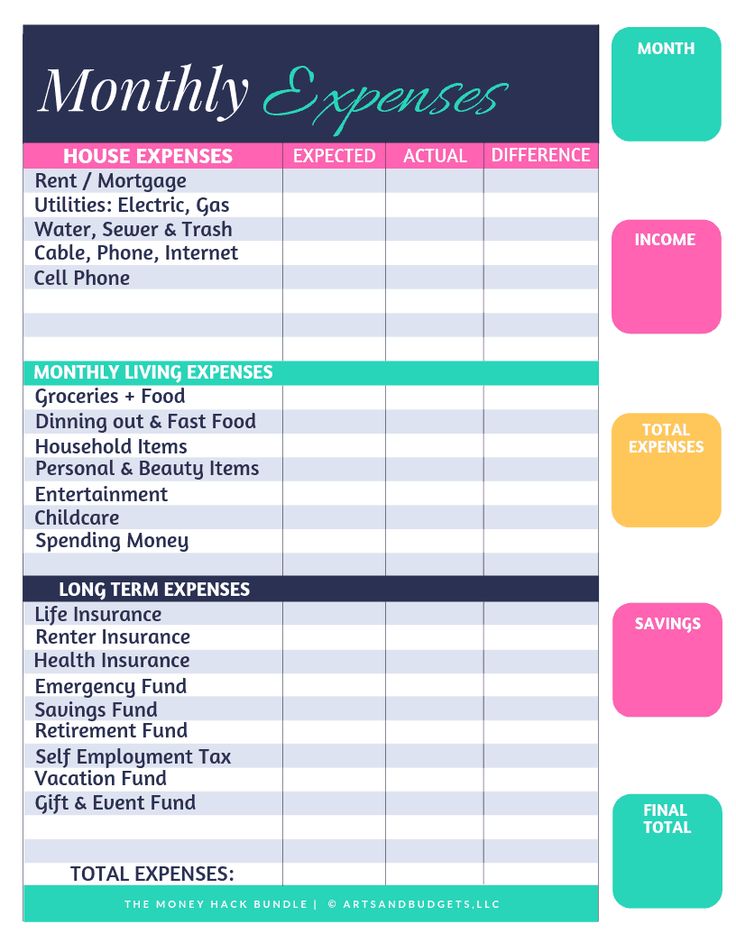

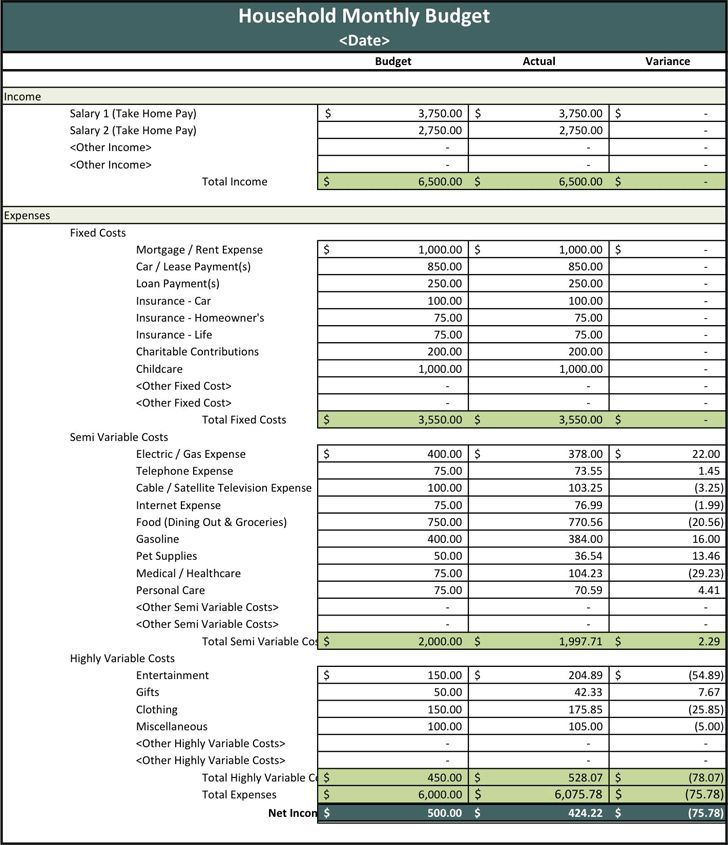

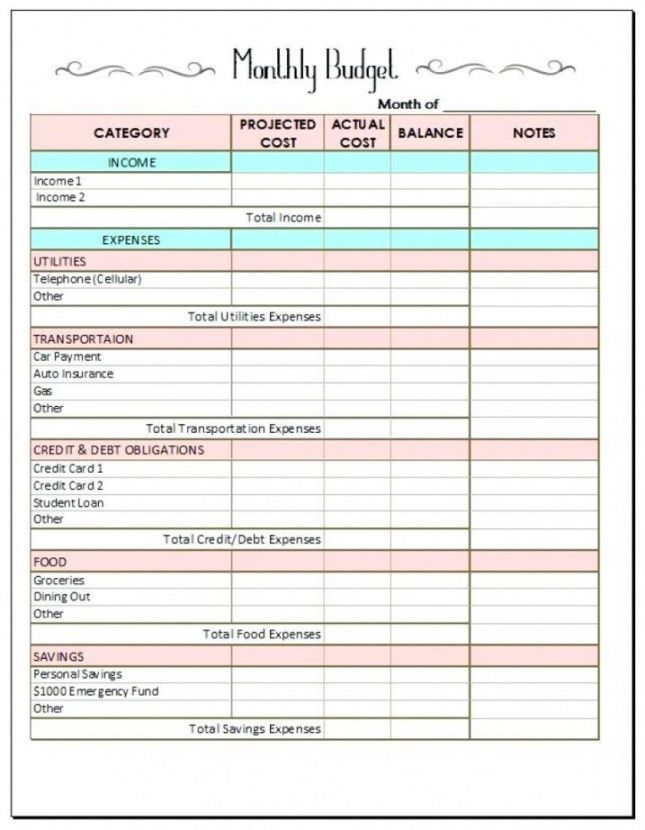

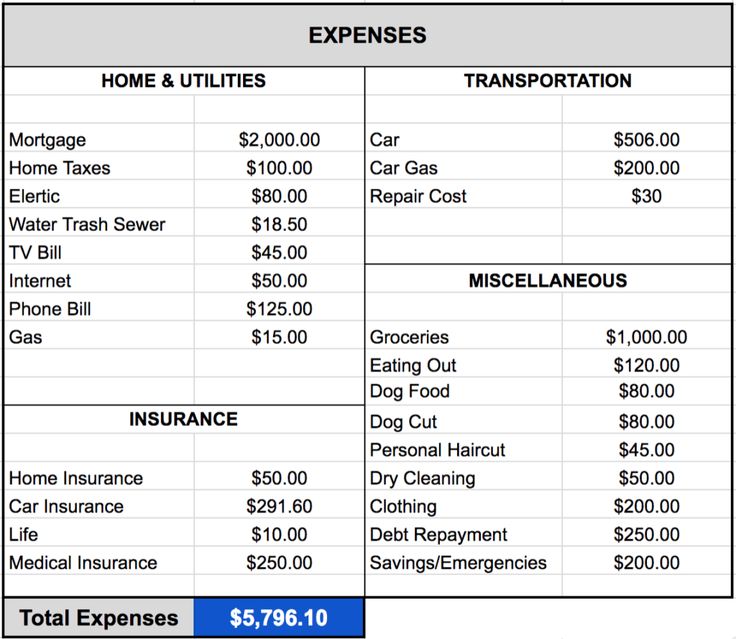

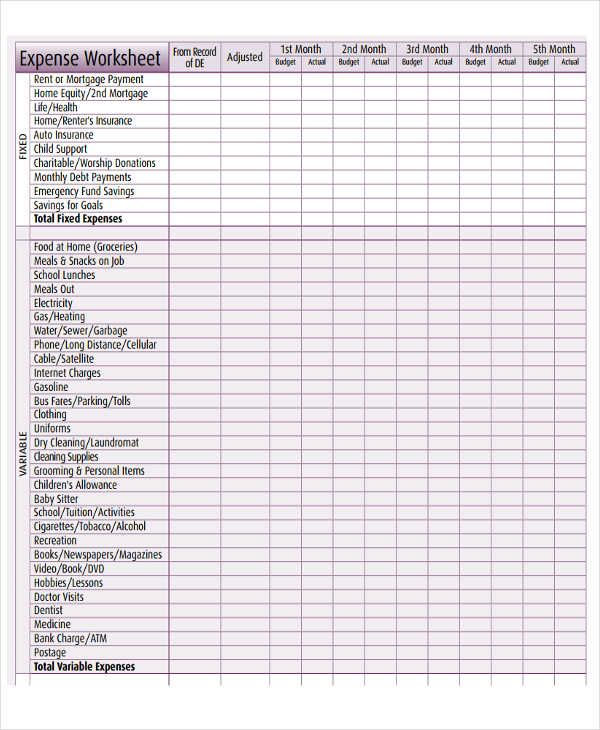

On top of these one-time costs, there is the potential loss of income if you and/or your partner take unpaid leave. Under the Family Medical Leave Act (FMLA), your employer may grant you up 12 work-weeks of unpaid leave for your baby's arrival. Here again, nothing is set in stone as small businesses do not fall under the FMLA. So check to see what type of leave you may qualify for with your employer. If you take unpaid leave, calculate your regular expenses during that period—mortgage, utilities, insurance, groceries, etc.—and determine how you will meet those costs.

Ongoing Expenses

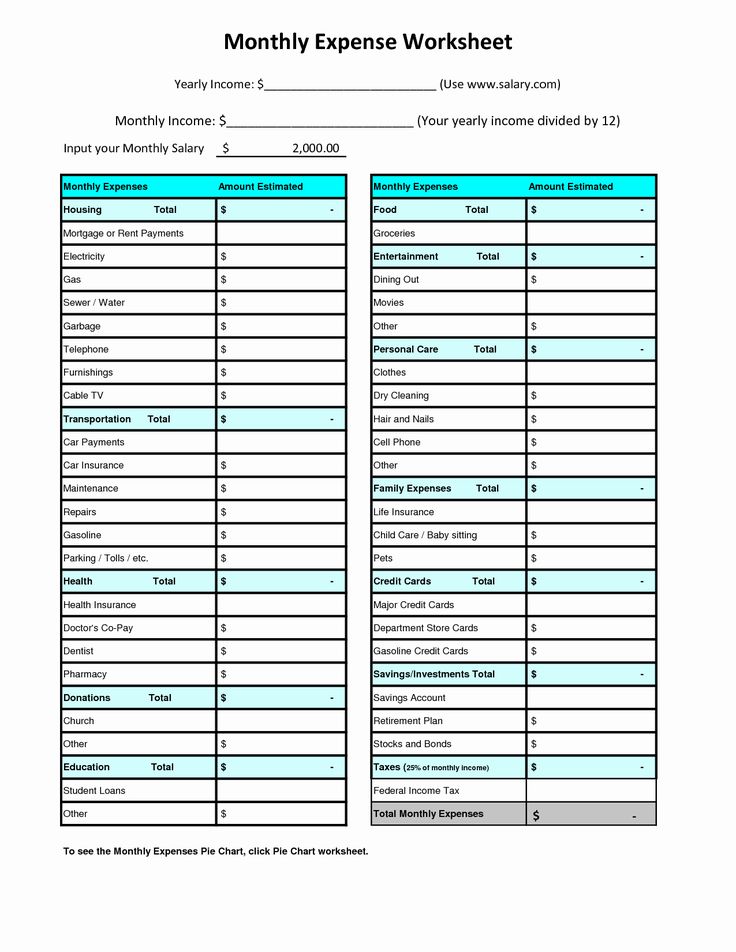

Once your baby arrives, the regular expenses to care for your little one kick in. Factor the following costs into your budget:

Factor the following costs into your budget:

- Child care: If both you and your spouse will work after your baby's arrival, your single biggest budget item will be child care. Your child care costs vary by where you live, the age of your child, how much care you require, and what type of care you use. The Care Index pegs in-center child care costs at just under $10,000 per year. The average cost of a nanny or other in-home care is around $28,350 a year, but again that can be higher or lower based on location and so on. Keep in mind, though, some costs might be offset by various tax credits, such as the child and dependent care credit. Be sure to confirm if you are eligible.

- Necessities: Food, such as Gerber formula, clothing, and diapers make up most of the necessities in the ongoing costs.

- Clothing: According to the USDA's most recent The Cost of Raising a Child report, it's advised that new parents should estimate clothing costs at around $670 up to $1,110 for the first two years.

The amount ranges greatly based on personal preference and budget, but the lower end falls around $56 a month.

The amount ranges greatly based on personal preference and budget, but the lower end falls around $56 a month. - Diapers: Diapers also vary in cost, but experts advise that you should budget at least $1000 for diapers and $450 for wipes for the first year alone. That's approximately $120 a month. Parents who choose to use disposable diapers should also expect to go through as many as 3,500 diapers in their child's first year alone.

- Food: Once you begin feeding your child solid food, you can expect to spend roughly $100 a month. The early food costs for children are relatively small compared to what you will see from a teenager.

- The Doctor Part 2: Plan on six wellness visits the first year for evaluations, immunizations, etc., and a few additional visits for illnesses. Check your health insurance policy for your rates.

If One Parent Stays at Home

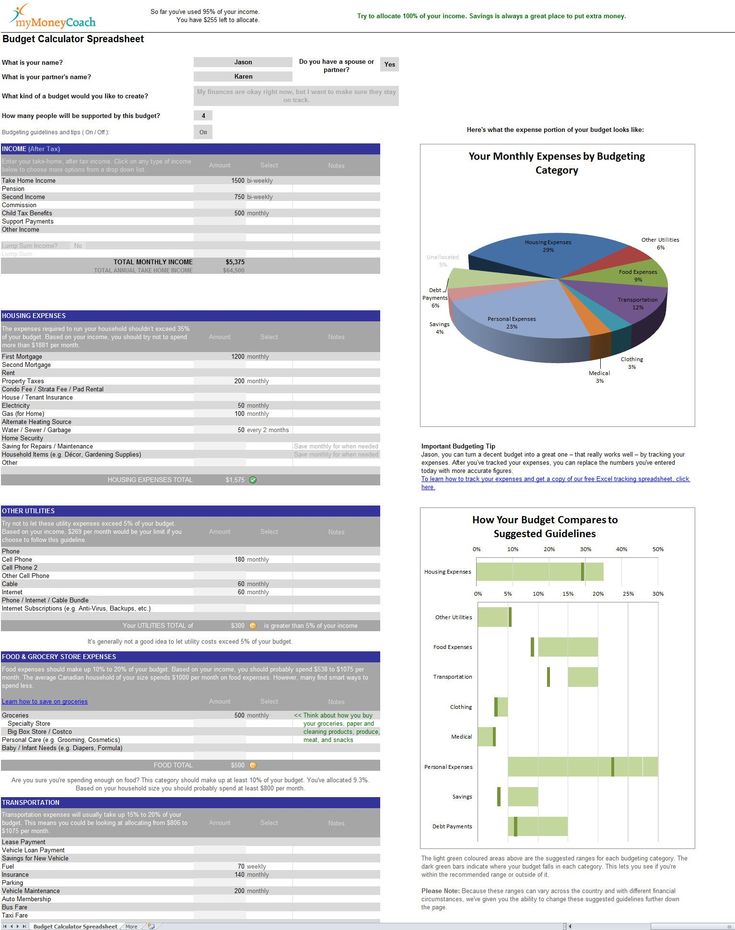

If one of you becomes a stay-at-home parent, there are important budget changes to consider—the most obvious is reduced family income. Despite the high cost of child care, the cost of one partner leaving an income behind to commit to full-time parenting can be much higher in terms of lost income, benefits, and investment.

Despite the high cost of child care, the cost of one partner leaving an income behind to commit to full-time parenting can be much higher in terms of lost income, benefits, and investment.

This is compounded by diminished earning potential if that partner decides to resume their career. The decision to stay home can be personal or financial—at lower income levels, even government programs cannot balance the high costs in some regions. If it is for personal reasons, however, a couple can at least try the one-income budget prior to the birth to get an idea for it while building an emergency fund with the second income at the same time.

Financial Tools to Consider

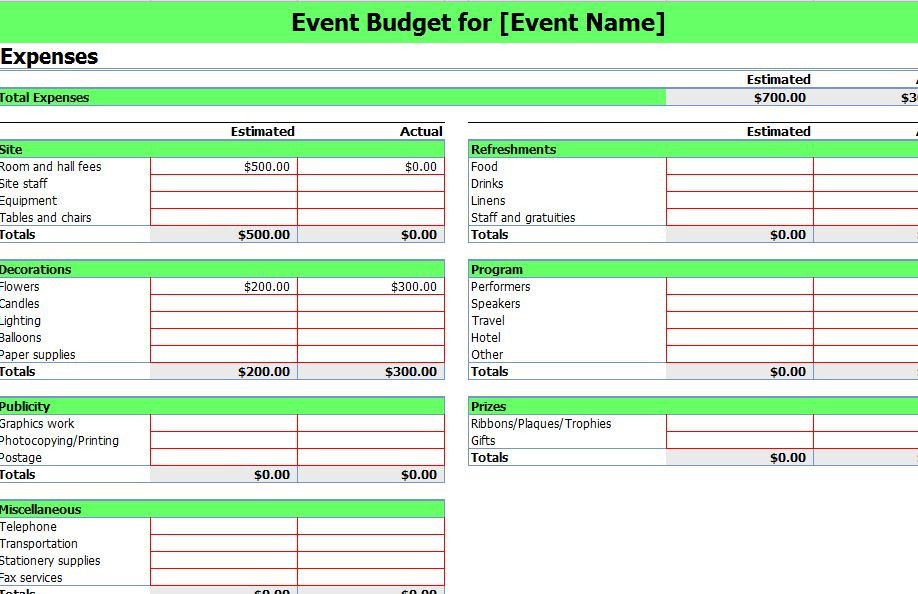

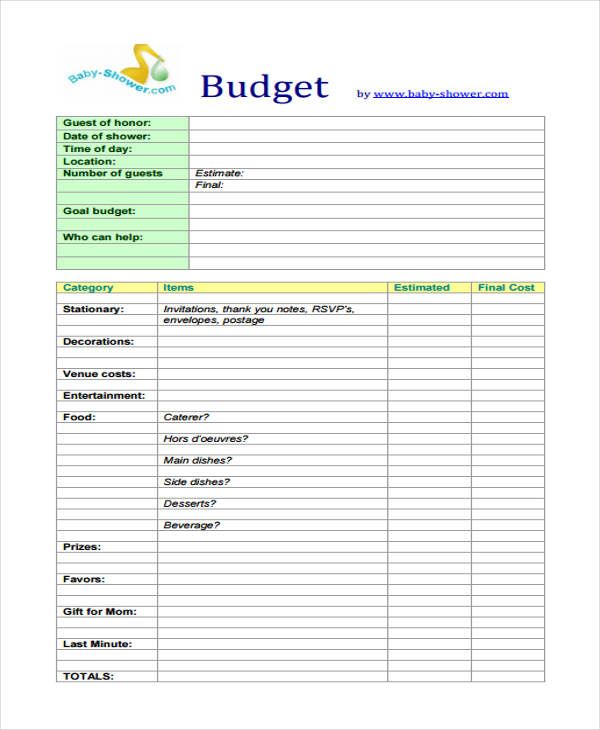

With your child's arrival, you'll want to create financial tools to help provide for your child's future. Review the following checklist to determine your priorities and begin budgeting:

- College Savings Tools: According to the College Board Report, the average cost per year for college in 2021 to 2022 ranged between $10,740 to attend a public four-year in-state school and $38,070 for a private four-year education.

Start saving now through one of several college education investment tools, such as a 529 plan, Coverdell Education Savings Account, or UGMA/UTMA account. There have also been some changes to the way some accounts can be used—namely the 529 plan. The Tax Cuts and Jobs Act (TCJA) of 2017 and the Setting Every Community Up for Retirement Enhancement Act (SECURE) of 2019 have expanded the use of 529 plans to include K to 12 education, apprenticeship programs, and the ability to pay down student debt.

Start saving now through one of several college education investment tools, such as a 529 plan, Coverdell Education Savings Account, or UGMA/UTMA account. There have also been some changes to the way some accounts can be used—namely the 529 plan. The Tax Cuts and Jobs Act (TCJA) of 2017 and the Setting Every Community Up for Retirement Enhancement Act (SECURE) of 2019 have expanded the use of 529 plans to include K to 12 education, apprenticeship programs, and the ability to pay down student debt. - Life Insurance: If you do not have life insurance, now is the time to buy it if you can afford to do so. For just a few dollars a month you can be assured that your child will have financial resources if you and/or your partner were to die unexpectedly. Talk to your employer or insurance agent for options on both life insurance and disability insurance.

- Health Insurance: Without health insurance, just one serious accident or illness could deplete your savings and put you in significant debt.

Investigate your insurance options if you don't already have coverage, or budget for the increased monthly premium to add your child to your policy.

Investigate your insurance options if you don't already have coverage, or budget for the increased monthly premium to add your child to your policy. - Flexible Spending Accounts (FSAs): FSAs enable you to use pretax dollars to pay for important family budget items, like child care and healthcare expenses. Talk with your employer or financial advisor about setting up a dependent-care FSA and/or healthcare FSA.

Ways to Save Money

No matter your income, however, there are numerous ways to meet your new baby's needs without breaking the bank that we've hinted at throughout. Namely:

- Consignment/Thrift Stores: Babies grow quickly. Instead of paying full price for their clothing, check out gently used and even new items at your local consignment or thrift store. Many stores will also buy back items after your child has outgrown them for cash or store credit. Online swap groups and parent networks can also provide quality goods for cheap—and sometimes even free.

- Family/Friends for Back-Up Daycare: Instead of having to take a day off (possibly without pay) when your child is sick, make arrangements for family or friends to help out with emergency back-up daycare.

- Borrow Items From Friends: Ask friends with young children if you could borrow items—particularly big-ticket items they're not using, like a crib, high chair, or rocking chair.

- Baby Shower Gifts: Register so that party-goers can buy what you really need and avoid ending up with multiple baby rattles and photo albums.

- Downgrading Lifestyle: Having a child is going to change a lot of things, including your financial priorities. After reviewing your new budget, you may not be able to make the numbers add up. Consider closing the gap by downgrading in a few key areas. For example, think about trading in a large car for a more affordable model, shopping at less expensive stores or buying more generic items.

The Bottom Line

Children are a wonderful gift—if sometimes an expensive one. The main thing to keep in mind is that averages don't mean much when the range is as wide as it is with costs around a baby. Good health insurance can protect you from hospital bills for the most part, but only planning and budgeting can help you handle the rest. The Finnish practice of sending birthing parents home with a simple starter box that can double as a baby bed shows that many of the thousands of dollars spent on our children's first years are more for our status than their well-being.

How much does a baby cost per month?

It's hard to figure out exactly how much it costs to have a baby, since it can vary so much depending on where you live and your circumstances. Some of the biggest costs for new parents include healthcare (including birth), diapers, formula, childcare, baby gear, clothes, food, and toys. In fact, you can anticipate spending between $9,300 and $23,380 per year per child. It's scary to think about how to support a baby financially, but there are many ways to save.

It's scary to think about how to support a baby financially, but there are many ways to save.

How much does it cost to have a baby?

Raising a baby isn't cheap! (Check out our Baby Costs Calculator to see how it all adds up over the first year.)

On average, a child costs two-parent families in the U.S. between $9,300 and $23,380 every year, according to the U.S. Department of Agriculture. (That number is in 2015 dollars, the latest data available.) This wide range accounts for various factors such as income level, where you live, as well as the age of your child.

Of course, the total cost you can expect to pay also depends on your lifestyle and how much money you choose to spend on necessary items such as housing and food. Certain expenses are out of your control, such as how much childcare costs in your area and the price of your family's health insurance plan (through an employer or otherwise). But there are some simple ways to cut costs; for instance, you may have family nearby who can help watch your child a few days a week, or you may be able to breastfeed to save money on formula.

It's definitely scary to think about having enough money to meet your baby's needs, but luckily, there are ways to make these costs more manageable. Planning ahead and setting a budget as new parents certainly helps; there are also resources available for those in a lower income bracket who need financial help for a new baby.

Cost of childbirth and healthcare

Cost: Giving birth in a hospital in the United States is expensive. The national average as of 2020 was $13,811 with employer-sponsored health insurance, or an average of $3,000 out of pocket for both a mom and her baby's hospital stays. Hospital bills could exceed $10,000 out of pocket if your baby spends time in the NICU.

The exact cost of childbirth is hard to quantify because expenses vary widely based primarily on whether or not you're insured, as well as what state you live in, how long you stay in the hospital, and the type of birth you have. C-sections are notoriously more expensive than vaginal births, costing a national average of about $17,004 vs. $12,235, respectively. Check with your insurance carrier around your third trimester to get an idea of the approximate costs you can expect to pay out of pocket for your baby's birth.

$12,235, respectively. Check with your insurance carrier around your third trimester to get an idea of the approximate costs you can expect to pay out of pocket for your baby's birth.

Even with insurance, most pregnant women have to pay for healthcare costs associated with their prenatal care, such as insurance co-pays and deductibles. The labor and delivery itself is the biggest expense in pregnancy, as you (and your insurer) will need to pay for things like the practitioner and the actual hospital fees. The costs may be even higher if you're medically induced, if you have a complicated delivery, or if your baby needs to stay in the NICU.

If you don't have health insurance, having a baby could run you between $9,000 and $17,000 for a vaginal birth or $14,000 to $25,000 for a C-section. Luckily though, many states make it easier for pregnant women to enroll in Medicaid or a state-sponsored health insurance program, through which all of your healthcare would be free or available at a very low cost.

Ways to save: If you're uninsured, look into health insurance options right away. Also, if your pregnancy isn't high risk, you can consider having a midwife rather than an ob-gyn deliver your baby. (Midwifery services are about $2,000 less than an obstetrician's fees, on average.) Before you go this route though, confirm that your insurance (if you're insured) covers midwifery services, as most but not all do. Also, if you're paying out-of-pocket, many hospitals and healthcare providers will work with you on a discounted package rate for your prenatal and labor and delivery services. And always double-check all bills and paperwork to make sure there are no errors or hidden, unexpected fees.

Cost of formula per month

Cost: $400 to $800 is the average monthly cost for powdered formula for babies who are formula-fed exclusively. The cost will be lower if you supplement with breast milk and higher if you give your baby more expensive brands or ready-to-feed formula. Monthly formula costs could spike if your baby needs a special hypoallergenic formula or if there's a formula recall or shortage.

Monthly formula costs could spike if your baby needs a special hypoallergenic formula or if there's a formula recall or shortage.

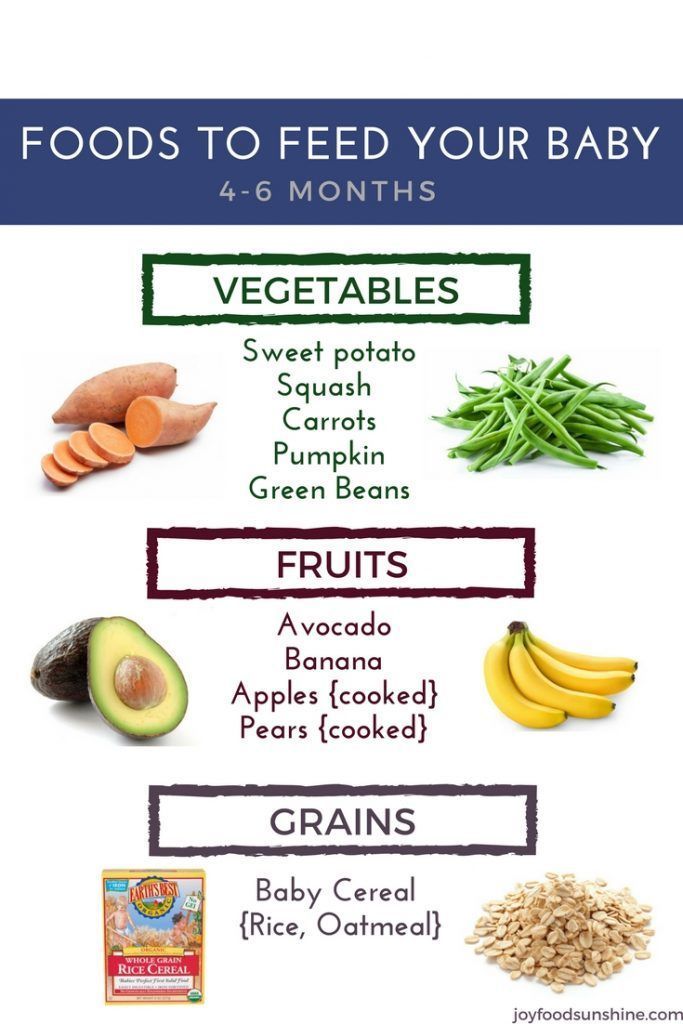

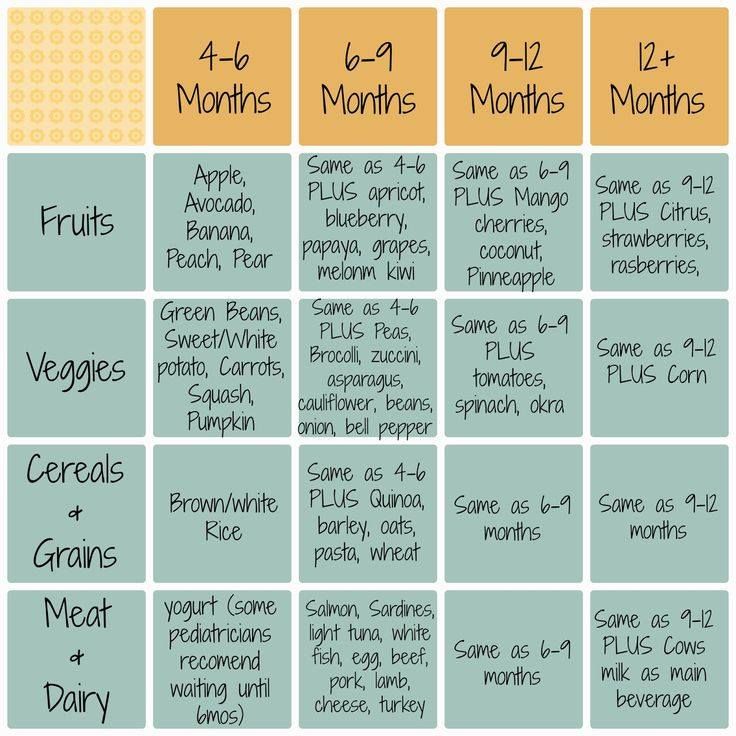

As your child gets older, formula costs will lessen as the amount of formula they'll need daily decreases, especially once you start introducing solid foods around six months of age. By 12 months old, your pediatrician will likely recommend that you switch your baby from formula to regular cow's milk, assuming your baby doesn't have any allergies or health concerns.

Ways to save: Breastfeed if you can. If you're not breastfeeding or are supplementing, use powdered formula, which costs less than ready-to-use or liquid concentrate. Though this may be difficult now due to the nationwide formula shortage, consider purchasing store brand or generic formulas, which meet the same federal nutrient requirements as brand-name formulas but are less expensive.

If you do buy brand-name formulas, sign up to receive coupons or become a rewards member to get discounts on the manufacturers' websites. After you're sure that your baby tolerates a particular formula well, buy it in bulk at warehouse stores or online. You can also ask moms you know or post in a local moms' group on social media to see if anyone is giving away or selling the formula your baby drinks for a discounted price; just make sure the cans or samples you get are unopened and not expired.

After you're sure that your baby tolerates a particular formula well, buy it in bulk at warehouse stores or online. You can also ask moms you know or post in a local moms' group on social media to see if anyone is giving away or selling the formula your baby drinks for a discounted price; just make sure the cans or samples you get are unopened and not expired.

Cost of diapers per month

Cost: $70 to $80 per month for disposable diapers, averaging out to about 29 cents each. The cost will vary depending on the brand you use and where you purchase the diapers. Infants require up to 12 diapers a day for the first year and toddlers need about 8, which is a total of about 2,500 to 3,000 diapers a year.

Ways to save: Try to purchase most of your baby's diapers at a "big box" chain store or warehouse store instead of a local convenience store, which is more likely to mark up prices. Buying diapers in bulk online is also a good way to save. Sign up at diaper manufacturers' websites to get coupons, and stock up when diapers are on sale. Alternatively, you may want to consider cloth diapers, which are gaining popularity with many budget-minded parents. They could save you about 27 percent a year vs. disposable diapers, plus there are a lot of cute and convenient cloth diapers on the market to choose from.

Alternatively, you may want to consider cloth diapers, which are gaining popularity with many budget-minded parents. They could save you about 27 percent a year vs. disposable diapers, plus there are a lot of cute and convenient cloth diapers on the market to choose from.

Cost of childcare per month

Cost: Varies according to which type of childcare you choose: daycare center, home daycare, relative care, nanny care, babysitter, or au pair. Childcare costs also fluctuate wildly based on where you live, how old your child is, and whether you need part-time or full-time childcare. The average monthly cost of daycare in the U.S. is around $850, while hiring a private nanny costs around $2,450 a month. You or your partner may choose to be a stay-at-home parent, in which case you may not require childcare. (But keep in mind this can impact your career and lifetime earnings potential.) Learn more about the pros and cons of all your childcare options.

Ways to save: For full-time care, consider asking a trusted relative or friend who may charge less than a traditional daycare center. Home daycares and nanny sharing with a neighbor or friend can also save cash. For occasional babysitting, trade time with another parent who's a neighbor or friend, or hire a responsible student. If possible, coordinate work schedules with your partner so you can each cover some of your child's care. Finally, consider enrolling in a flexible spending account for childcare expenses if your employer offers one – this means you can put your pre-tax money toward dependent care expenses.

Home daycares and nanny sharing with a neighbor or friend can also save cash. For occasional babysitting, trade time with another parent who's a neighbor or friend, or hire a responsible student. If possible, coordinate work schedules with your partner so you can each cover some of your child's care. Finally, consider enrolling in a flexible spending account for childcare expenses if your employer offers one – this means you can put your pre-tax money toward dependent care expenses.

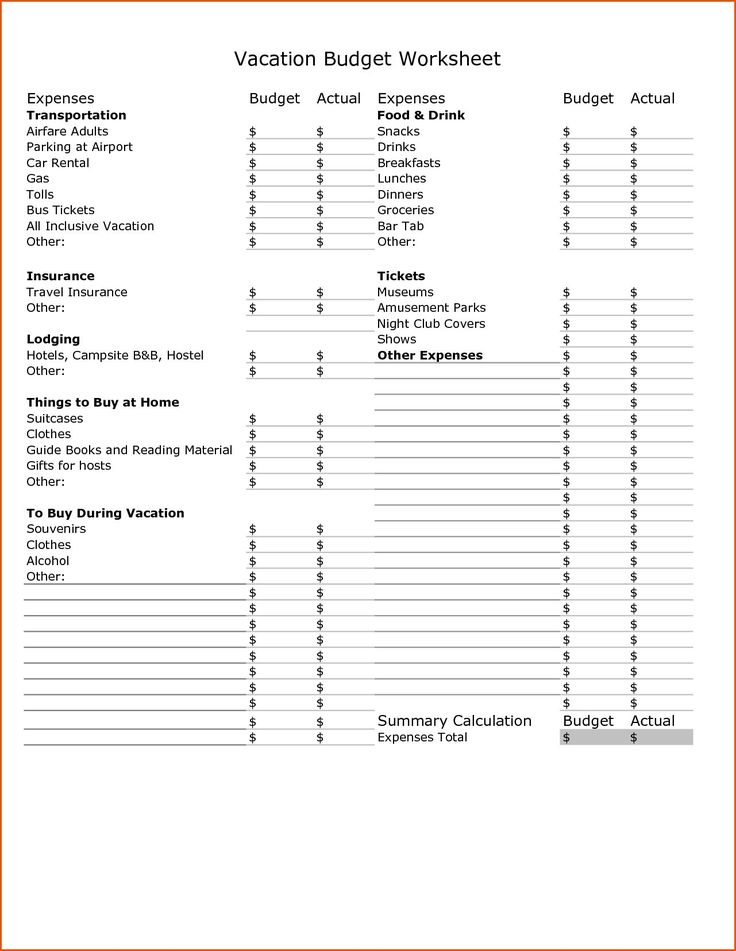

Cost of baby gear

Cost: Varies according to which items you buy. Babies need a lot of stuff, but some items are must-haves, while others are nice-to-have extras. The basic baby gear you'll need during your baby's first year includes a crib (with mattress) or play yard, a stroller, a car seat, bottles and/or breastfeeding accessories, a baby bathtub, toiletries such as a hairbrush and first aid kit, and toys. As your baby gets older and more mobile, you'll also need safety gear such as babyproofing tools and safety gates, as well as a high chair and other feeding accessories like spoons and cups.

There are plenty of baby gear "add-ons" that are nice to have but not necessary – for instance a bottle warmer, a rocker or glider, a changing table, various baby carriers, and different large baby toys like a bouncer, activity center, and swing. (Of course, for some families these are essentials – the tricky part is knowing what you and your baby will love.)

Ways to save: Create a baby registry so friends and family members can help with the big purchases. Start with the basics – a good car seat, stroller, and play yard with bassinet, for example – and wait to buy other things. You may be able to try out a friend's activity center or swing to see if your baby likes it before buying one. Although it's important to buy your car seat new, check for other items at garage sales and secondhand stores, on community websites, and used from friends and relatives.

Cost of baby clothes

Cost: $20 to $50 (or more) per month on average, depending on where (and how often) you shop. Throughout the first twelve months, babies outgrow clothing very quickly, so you'll be buying more clothes in infancy than when they're older. You'll also need to stock up on baby clothes for the first six weeks, especially comfy pajamas, onesies, and sleepers. To start off your baby's wardrobe, consider getting a few outfits in the 3-6 month and 6-9 month size ranges. There are endless amounts of baby clothes to choose from, but check out our list of the best baby clothing brands to help you narrow it down.

Throughout the first twelve months, babies outgrow clothing very quickly, so you'll be buying more clothes in infancy than when they're older. You'll also need to stock up on baby clothes for the first six weeks, especially comfy pajamas, onesies, and sleepers. To start off your baby's wardrobe, consider getting a few outfits in the 3-6 month and 6-9 month size ranges. There are endless amounts of baby clothes to choose from, but check out our list of the best baby clothing brands to help you narrow it down.

Ways to save: Many first-time parents find they receive enough gifts to keep their baby clothed for the first few months. After that, watch for store sales and online deals, and accept hand-me-downs from friends and relatives. Get gently used items from consignment stores, thrift shops, community websites, garage sales, and sites and apps that sell secondhand baby clothes. If your baby is in between sizes, consider buying clothes one size up so your child can grow into the items and wear them for longer. Finally, treat your baby's soiled clothes with stain remover and wash with a good baby detergent so they can be worn again (or handed down).

Finally, treat your baby's soiled clothes with stain remover and wash with a good baby detergent so they can be worn again (or handed down).

Cost of baby food

Cost: $98 to $230 per month after your baby starts solid food. Food costs about 18 percent of the total cost of raising a child, second only to housing. Your baby may eat a lot of the same food you eat, especially if you're introducing solid foods via baby-led weaning, but they'll probably still require some foods that are specific to babies and toddlers. Depending on your baby's age, some packaged foods you may choose to purchase include jarred fruits and vegetables, baby food pouches, teething crackers, and puffs.

Ways to save: If possible, make your own baby food. A hand blender is all you really need to whip up fruits, veggies, and other foods you serve your family into a consistency that's safe for babies. You can even freeze the extras to serve later on. For those times when you do buy prepared baby food, use coupons and buy in bulk, especially if the item is on sale. And if you don't mind, opt for non-organic products, which are less expensive but just as delicious.

And if you don't mind, opt for non-organic products, which are less expensive but just as delicious.

Cost of baby toys and books

Cost: $30 to $50 per month on average. Each household is different, but the average family spends about $580 on toys a year, or up to $6,000 before a child reaches their teenage years. Toys aren't a necessity, per se, but play is an important part of your baby's development. There are many games you can play with your baby – with and without toys – to help your little one learn about the world. Reading to your newborn is also an important part of development, and it can help lay the groundwork for vocabulary, reading, and comprehension skills.

Ways to save: Let your child play with safe household items; For example, whisks, containers, pots and pans, and hairbrushes are always a hit with little ones. Buy toys secondhand, borrow books from the library, ask friends for hand-me-downs, and consider setting up a toy and book exchange with friends or neighbors who have babies around the same age.

Some websites let you trade in toys, and you can use that money earned toward newer items. If you do buy brand-new toys, even if just for special occasions like birthdays or holidays, look for sales and manufacturers' coupons for brands you like. Also consider joining the loyalty program at your favorite retailer, or searching the toy section at discount stores.

advertisement | page continues below

Expenses for a child in the first year of life

How much does the first year of a child’s life cost

Even when preparing for a joyful event, you will have to spend money on clothes for the expectant mother and the necessary “dowry” for the baby in the first months of life.

Clothing and footwear

You should buy clothes in advance: sliders, bodysuits, undershirts, blouses, socks. Do not forget about warm clothes: the child needs warm overalls, hats and booties. Around the age of 11-12 months, it will be time to choose the first shoes.

Furniture

When planning the cost of money for a child in the first year of life, do not forget about furniture. Buy a crib with an orthopedic mattress and a set of linen. A changing chest or board will help to remove the extra load from the back of a young mother. A high chair makes life much easier, but it will come in handy from about six months. This purchase can be postponed a little, but it is not worth saving on it.

Buy a crib with an orthopedic mattress and a set of linen. A changing chest or board will help to remove the extra load from the back of a young mother. A high chair makes life much easier, but it will come in handy from about six months. This purchase can be postponed a little, but it is not worth saving on it.

Stroller and car seat

To ensure the comfort of your child on a walk, be careful when choosing a stroller. Modern 2 in 1 models combine a bassinet and seat unit, and a car seat has also been added to the 3 in 1 set. Please note that it is not allowed to transport children in a car without a restraint, so a car seat is a mandatory purchase. You can buy it separately or together with the stroller, but don't skimp on safety.

Care and hygiene

For a newborn, you will need to purchase an impressive list of hygiene products: diapers, wet wipes, powders, creams and ointments, bath foam and baby soap. For bathing, you will need a baby bath and a special water thermometer.

Nutrition

When you calculate how much money you need for a child under 1 year old, do not forget to take into account the cost of baby food. Breastfeeding your baby can help save money.

Starting from six months, complementary foods in the form of cereals and mashed potatoes are introduced into the diet. Since it is optimal to feed with special baby purees of industrial production, this will become a separate item of expenditure for a child.

Toys

Do not rush to buy expensive mechanized toys or a children's play center - a newborn will do without them. However, it should still be borne in mind that several bright comfortable rattles will be needed already in the first half of the year - by about the fourth or fifth months of the baby's life.

How to budget for a baby in the first year of life

Use common sense. Choose quality products, but do not overpay. On the Internet, it is easy to find a calculator in which you can select expense items at your discretion. The cost calculator for a child in the first year of life will help you calculate how much you will spend on a child. If you are just planning a pregnancy, start saving money for upcoming expenses in advance.

The cost calculator for a child in the first year of life will help you calculate how much you will spend on a child. If you are just planning a pregnancy, start saving money for upcoming expenses in advance.

Savings

Smart savings will help reduce the cost of a child in the first year of life.

- Some things can be bought from ads or "wear" for acquaintances, of course, subject to hygienic safety measures.

- If you think over your purchases in advance, you can save a lot by buying on sales.

- Do not buy a lot of clothes and shoes. Toddlers grow up fast and don't have time to try on the whole wardrobe.

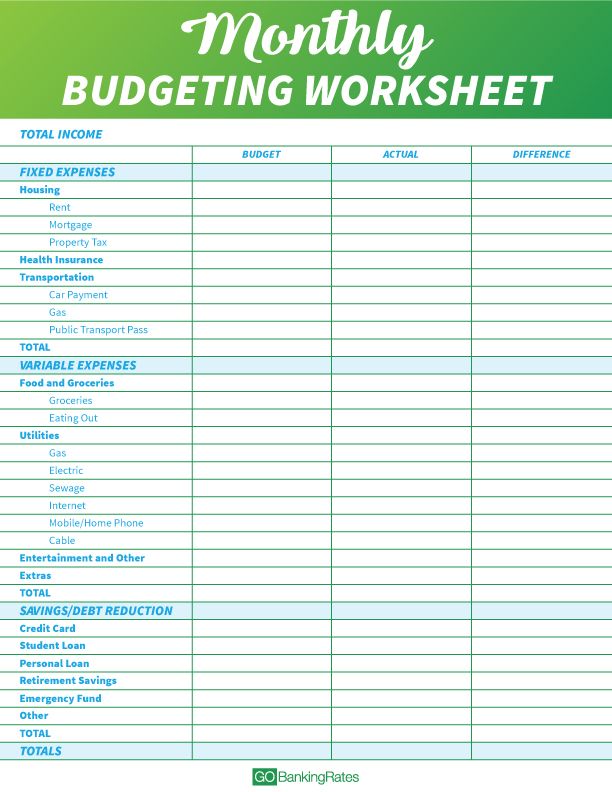

- Plan your budget. Make a list of everything you need in advance and gradually enter the prices in the table.

- Shop while pregnant. At this stage, you can pick up things with pleasure and leisurely. Moreover, purchases cheer up, and this is so important for a future mother. It is possible that after the birth of the baby there will be no time for a thoughtful choice.

- Make a list of things your baby needs. Relatives and friends who want to make a useful present for you or a child will be happy to choose something from your wish list. This will make it easier for loved ones to choose, avoid unnecessary or duplicate gifts, and reduce your spending on a baby.

Children's budget

- 2021

- 2020

- 2019

- Reference materials

-

Infographics for all regions

Rating of subjects of the Russian Federation by social spending on children

Social spending on children by regions of the Russian Federation

Map of social spending on children by regions of the Russian Federation (general)

Map of expenses for children's education by regions of the Russian Federation

Map of expenses for children's health care by regions of the Russian Federation

Map of expenses for social support of children by regions of the Russian Federation by regions of the Russian Federation

Map of expenses for children in the field of culture by regions of the Russian Federation

Map of expenses for children in the field of physical culture and sports by regions of the Russian Federation

Map of spending on youth policy by regions of the Russian Federation

-

Infographics for all regions

Total expenditures on children of the consolidated budgets of the constituent entities of the Russian Federation

Regional budget expenditures on children as part of the implementation of national projects

Regional budget expenditures on children as part of the implementation of the Decade 9002

002 Expenses of regional budgets for children by certain categories of recipients

-

Total expenditures on children of the consolidated budgets of the subjects of the Russian Federation

Regional budget expenditures on children as part of the implementation of national projects

Regional budget expenditures on children as part of the implementation of the Decade of Childhood

Regional budget expenditures on certain categories of children recipients

-

Foreign experience in the formation of children's budget

"Children's budget" is the cost of the state for children, their health, education, cultural and physical development, including for children who for various reasons were left without parental care, the cost of social support for families at birth and raising children , support for motherhood and fertility.

In 2020, specialists from the NIFI, the Department of Budget Policy in the Sphere of Labor and Social Protection of the Ministry of Finance of Russia (Department) and financial authorities worked to form the so-called "Children's Budget" of the country. If until that time the Department formed the federal "Children's Budget", then this year the structure and methodology for collecting the necessary data from the "Children's Budget" at the regional level was developed. As a result, a full-fledged document was formed, which collected the maximum possible data on the expenditures of regions and municipalities on state support for families and children.

This work is not the first attempt to create such a document. In the mid-2000s, the experiment was conducted in Moscow, and today - in a number of regions (St. Petersburg, the Republic of Karelia, Volgograd, Moscow, Smolensk, Ivanovo and Chelyabinsk regions), the laws on regional budgets already contain an analytical section, which presents data on budget expenditures for childhood.

The regions have different approaches to the formation of the children's budget.

Ivanovo region presents expenditures broken down by state programs, subprograms, regional projects and major events. At the same time, both regional and federal funds are indicated.

Volgograd region generates expenses for childhood in 10 tables by areas: in the field of transport services; in the field of providing citizens with affordable and comfortable housing; in the field of construction; in the field of employment of the population; in the health sector; in the field of culture; in the field of mass media; in the field of physical culture and sports; in the field of social support of the population; in education and youth policy. Inside, for each area, directions for spending budget funds (specific measures) and the category of recipients of these funds (individuals, subordinate institutions, organizations implementing these measures) are indicated.

The Moscow region uses the departmental classification of budget expenditures by sections, subsections and target items (state programs, subprograms and main events).

The Republic of Karelia presents data broken down by state programs, subprograms, major activities and activities (types of expenditure). The Smolensk region presents the same data within the framework of the functional classification. And the Chelyabinsk region - in the context of state programs, subprograms, events, but indicating only targeted articles.

The federal "Children's budget" is formed in the program and non-program part of the costs. The program part reflects the costs of the state program and specific activities. The non-programme part of the expenditures is presented in the context of the expenditures of state bodies on ensuring the activities (rendering of services) of state institutions (for example, general education) and social support for their employees.

All approaches have the right to exist, but they (except for the federal one) are absolutely clear only to those who form and approve the budget (since they are formed in terms and rules of the budget, this is very convenient), but in most cases they are completely incomprehensible to other citizens.

The format, which was developed by the Ministry of Finance of Russia and NIFI, was adapted as much as possible (as far as possible) to present the "Children's Budget" to the general public.

Information on the amount of budget appropriations of the consolidated budget of the constituent entities of the Russian Federation directed to state support for families and children is presented in the form of four tables.

Table No. 1 ( 2019 ., 2020 ) "Information on the volume of budgetary allocations of the consolidated budget of the constituent entity of the Russian Federation allocated to state support for families and children" is a summary table that presents data in general for the entire "Children's Budget" The remaining tables reflect the same expenses in different sections (important for deputies).

Table No. 2 ( 2019 ., 2020 ) "Report on the participation of the constituent entity of the Russian Federation in the implementation of national projects and on plans for participation in the implementation of national projects in the current and subsequent period in terms of the implementation of activities aimed at supporting children and families with children (consolidated budget of a constituent entity of the Russian Federation).

Table No. 3 ( 2019 , 2020 ) "Report on the expenditures of the consolidated budget of the subject of the Russian Federation for the implementation of the Action Plan for the implementation of the Decade of Childhood (Approved by the decision of the Government of the Russian Federation of July 6, 2018 No. 1375-r) (in terms of activities, the number of responsible executors of which includes the subjects of the Russian Federation)”.

Table No. 4 ( 2019 ., 2020 ) "Information on the volume of budgetary allocations of the consolidated budget of the constituent entity of the Russian Federation directed to payments and benefits provided to certain categories of recipients."

The tables include information on the expenditures of the subject of the Russian Federation and the budgets of municipalities allocated for state support of families and children. Thus, almost all state expenses are subject to accounting, since the federal and even more so regional budgets are not formed in the context of individual services and activities. It is practically impossible to isolate the expenses that go specifically to the family and children, for example, in a city clinic, hospital, library, sports complex or theater, unless these are specialized children's institutions. In this regard, of course, a certain amount of conventionality in the generated data will be present. In order to solve this problem, it will be necessary to make significant changes to the budget classification.

It is practically impossible to isolate the expenses that go specifically to the family and children, for example, in a city clinic, hospital, library, sports complex or theater, unless these are specialized children's institutions. In this regard, of course, a certain amount of conventionality in the generated data will be present. In order to solve this problem, it will be necessary to make significant changes to the budget classification.

Education measures included expenses for pre-school, general, vocational and additional education, as well as expenses for social support measures administered by educational authorities - school meals (hot meals) and compensation of parental fees for childcare and care.

In terms of health care measures, only those expenses incurred by the consolidated budget of the region for the maintenance and development of state and municipal medical organizations (institutions) that provide services to families with children and children, that is, without taking into account compulsory medical insurance funds, were taken into account. It also presents the costs of social support measures that are administered by the health authorities - drug provision of children, vaccination of children, provision of special and dairy products for children under 3 years of age, pregnant women and nursing mothers, provision of families with newborn children with gift sets of children's accessories.

It also presents the costs of social support measures that are administered by the health authorities - drug provision of children, vaccination of children, provision of special and dairy products for children under 3 years of age, pregnant women and nursing mothers, provision of families with newborn children with gift sets of children's accessories.

To assess the costs of social support for children and families with children, a list of social support measures was used, which is the same for all regions. Costs for measures that are specific to the region were included in the general line. In addition, the costs of maintaining and developing social service institutions and organizations that provide certain services to children and families with children were subject to assessment.

Expenses for orphans and children left without parental care, in particular, the volume of financial support for educational organizations for orphans, medical organizations for orphans and organizations providing social services for orphans, are subject to a separate assessment. In addition, data was collected on key areas of social support:

In addition, data was collected on key areas of social support:

a) payments (allowances, compensations, scholarships, etc.) and in-kind assistance to orphans and children left without parental care;

b) payments (allowances, compensations, etc.) and assistance in kind to guardians, trustees, foster parents, adoptive parents;

c) providing housing for orphans and persons from among orphans and children left without parental care.

Also, special attention was paid to the costs of the implementation of activities, payments and benefits provided to specific categories of recipients, such as: large families, young families, disabled children and families with children with disabilities or children with disabilities, students and student families , low-income families, families with children who do not have preferential status, which reflects approaches to the amount of funding for certain areas of state policy (Table 4 of the "Children's Budget").

Comparative analysis of data on the "children's budget" among the regions in 2020

for state support for families and children.

Figure 1 - Spending by the constituent entities of the Russian Federation on state support for families and children in 2020

Figure 2 - Examples of the structure of expenditures of constituent entities of the Russian Federation on state support for families and children in 2020

Source: Calculated by the authors based on the data provided by the constituent entities of the Russian Federation to the Ministry of Finance of Russia as part of the “Information on the volume of budget allocations of the consolidated budget of the constituent entities of the Russian Federation directed to state support for families and children”.

Figure 3 - Spending by the constituent entities of the Russian Federation on state support for families and children in 2020: education

Source: Calculated by the authors based on the data provided by the constituent entities of the Russian Federation to the Ministry of Finance of Russia as part of the “Information on the volume of budgetary appropriations of the consolidated budget of the constituent entities of the Russian Federation directed to state support for families and children. ”

”

Figure 4 - Spending by the constituent entities of the Russian Federation on state support for families and children in 2020: healthcare

Source: Calculated by the authors based on the data provided by the constituent entities of the Russian Federation to the Ministry of Finance of Russia as part of the “Information on the volume of budgetary appropriations of the consolidated budget of the constituent entities of the Russian Federation directed to state support for families and children.”

Figure 5 - Spending by the constituent entities of the Russian Federation on state support for families and children in 2020: social support for the population

appropriations of the consolidated budget of the constituent entities of the Russian Federation allocated for state support of families and children.

Figure 6 - The expenses of the constituent entities of the Russian Federation for state support for family and children in 2020: Active employment policy

Source: designed by authors according to the data submitted by the constituent entities of the Russian Federation to the Ministry of Finance of Russia as part of "Information on the volume of budget allocated allocations the budget of the constituent entities of the Russian Federation allocated for state support of families and children.