Baby food market segmentation

Base Oil Market Size | Industry Report 2029

Base Oil Market Size | Industry Report 2029Global Economic Impact

Request Insights

Despite Inflation & Fearing Recession, Businesses Across the Globe Expected to Do Better in 2023

In 2023, market players might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain.

Controlling Inflation has become the first priority for global economies from last quarter of 2022 and to be followed in 2023. With skewed economic situations, rise in interest rate by governments to control spending and inflation, spiked oil and gas prices, high inflation, geo-political issues including U.S. & China trade war, Russia-Ukraine conflict to intensify the global economic issues.

The interest rates in the U.S. may be less sensitive in 2023 as compared to 2022; sigh of relief for businesses. Positive business sentiments, healthy business balance sheets, growth in construction spending (private construction value in 2022 stood at $1,429.2 billion, 11.7 percent (±1.0 percent) above the $1,279.5 billion spent in 2021, Residential construction in 2022 was $899.1 billion, up by 13.3 percent (±2.1 percent) from $793.7 billion in 2021, non-residential construction touched $530.1 billion, 9.1 percent (±1.0 percent) above the $485.8 billion in 2021.) showcases minimal impact of recession in the country.

Similarly, spiked spending in the European and major Asia economics including, India, China & Japan to showcase less impact on the global demand.

In The News

Introduction to Baby Food

The baby food products are food items for the consumption of the new born babies. It is consumed easily in comparison to other food products. The baby food items consists of high nutrient content and it is available in the different flavors. The baby foods are either soft or liquid paste which can be easily chewed by the babies.

There are two different types of baby food including homemade and commercial baby food items. The homemade baby food items are less expensive in comparison to the other food items. The different types of baby foods are cereals, fruits and vegetables.

Market Size and Forecast

The global baby food items are witnessing robust growth on the account of increasing disposable income of the population across the globe. The increasing health concern among the population regarding the infants is expected to drive the market growth of the baby food globally. Additionally, the rising cases of the malnutrition among the children is also major factor for the increasing growth of the baby food products. For instance, according to WHO 52 million children under the age of 5 years are weak.

The increasing health concern among the population regarding the infants is expected to drive the market growth of the baby food globally. Additionally, the rising cases of the malnutrition among the children is also major factor for the increasing growth of the baby food products. For instance, according to WHO 52 million children under the age of 5 years are weak.

Baby food Market is anticipated to record a CAGR of 6.5% over the forecast period. It is expected to reach the total market size of USD 113 billion by 2027.The baby food market is expected to showcase a vibrant growth by the end of the forecast period. The market is segmented on the basis of type and sales channel. On the basis of type, it is sub-segmented into milk formula, dried baby food, prepared baby food and others. Milk formula is expected to be the leading sub-segment during the forecast period. The increasing income of the population coupled with the rising spending towards milk formula is anticipated to be the major factor driving the market growth of the sub-segment during the forecast period. On the basis of sales channel, it is sub-segmented into supermarkets/hypermarkets, convenience stores, pharmacies and others. Supermarkets/Hypermarkets sub-segment is anticipated to hold the largest market share during the forecast period. The increasing urbanization coupled with the rapidly expanding retail sector is expected to drive the market growth of the baby food products during the forecast period. Additionally, the increasing trends of online purchasing is expected to drive the growth of the overall baby food market during the forecast period.

On the basis of sales channel, it is sub-segmented into supermarkets/hypermarkets, convenience stores, pharmacies and others. Supermarkets/Hypermarkets sub-segment is anticipated to hold the largest market share during the forecast period. The increasing urbanization coupled with the rapidly expanding retail sector is expected to drive the market growth of the baby food products during the forecast period. Additionally, the increasing trends of online purchasing is expected to drive the growth of the overall baby food market during the forecast period.

Get more information on this report: Download Sample PDF

Growth Drivers

Increasing purchasing power

The growing disposable income of the population across the globe coupled with the rising industrialization is anticipated to drive the overall baby food market during the forecast period. Additionally, the increasing income of the population coupled with high spending towards the different food items is anticipated to foster the growth of the overall market. For instance, according to Eurostat the purchasing power standard has increased from 23,295 to 23,638 .Thus the growing purchasing power is expected to increase the market growth of the baby food products during the forecast period.

Additionally, the increasing income of the population coupled with high spending towards the different food items is anticipated to foster the growth of the overall market. For instance, according to Eurostat the purchasing power standard has increased from 23,295 to 23,638 .Thus the growing purchasing power is expected to increase the market growth of the baby food products during the forecast period.

Growing awareness about proper nutritional diet

The growing demand for the packaged food items on the account of growing awareness is anticipated to drive the overall baby food market during the forecast period. The manufacturers are continuously developing food items which has adequate amount of the nutrients. Thus, it is anticipated to foster the growth of the overall baby food market during the forecast period.

Restraints

High cost of foods items

The high cost associated with the packaged food items is anticipated to hinder the growth of the overall baby food market during the forecast period.

Get more information on this report: Request Sample PDF

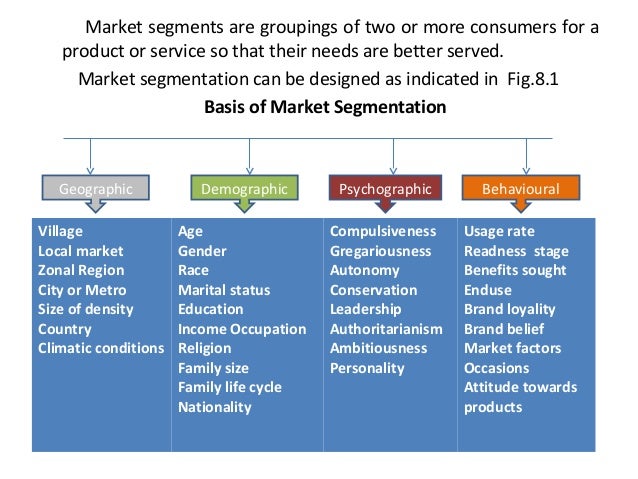

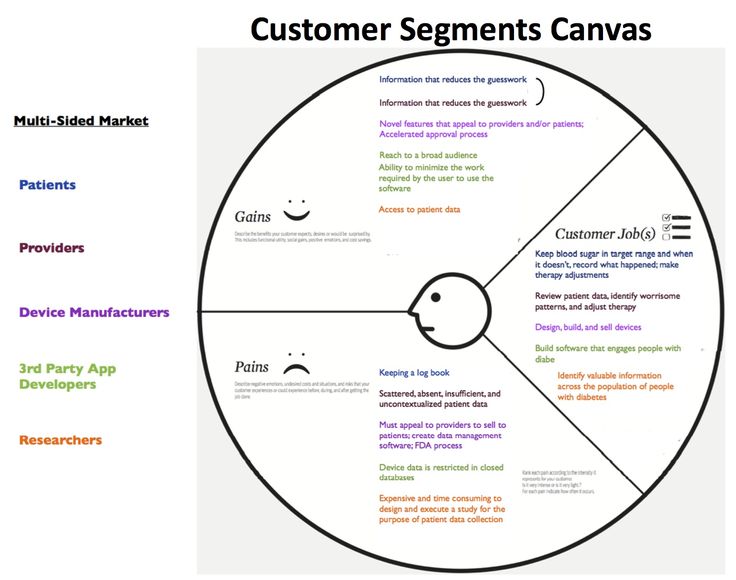

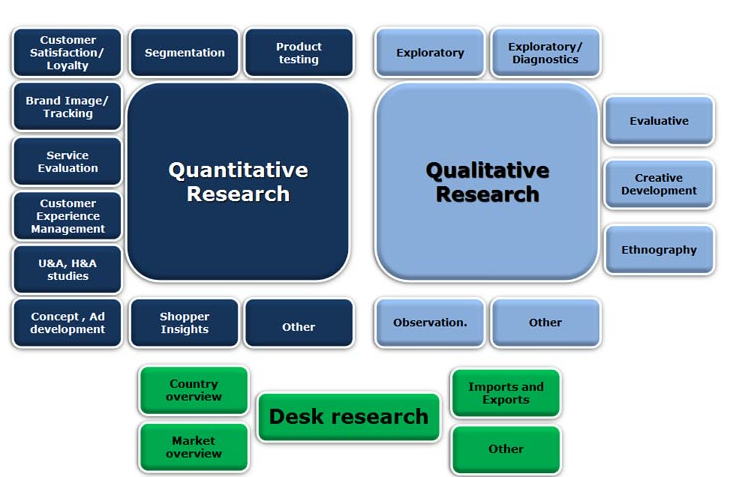

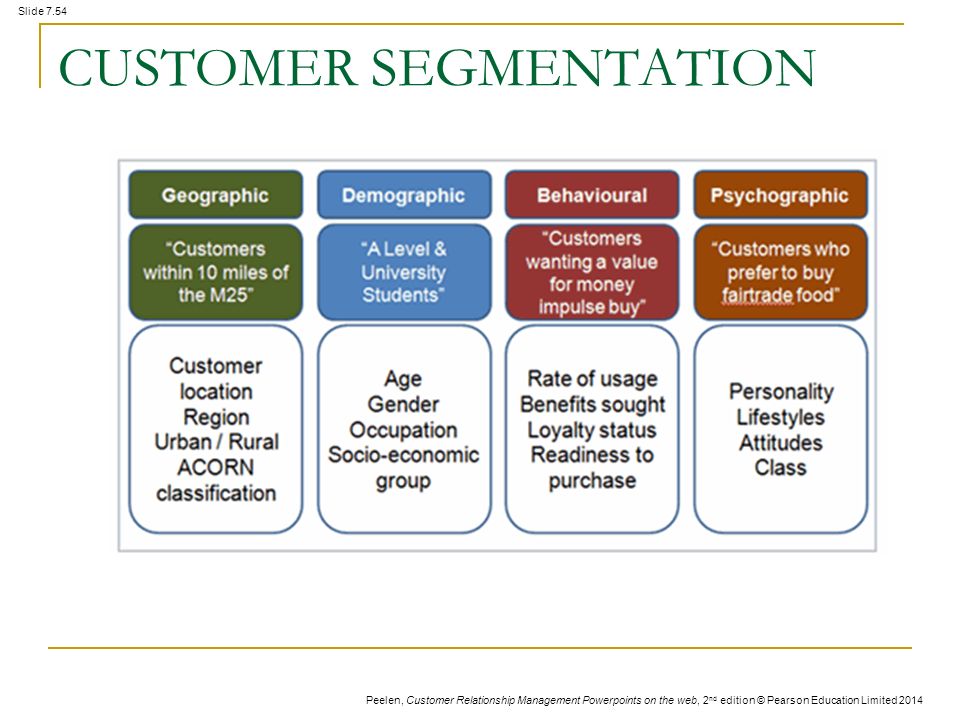

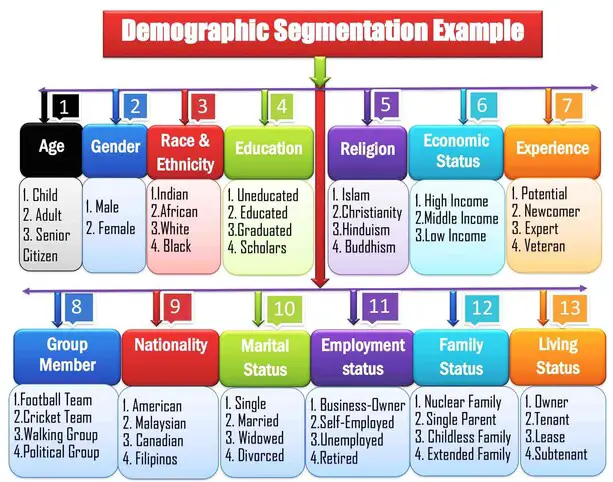

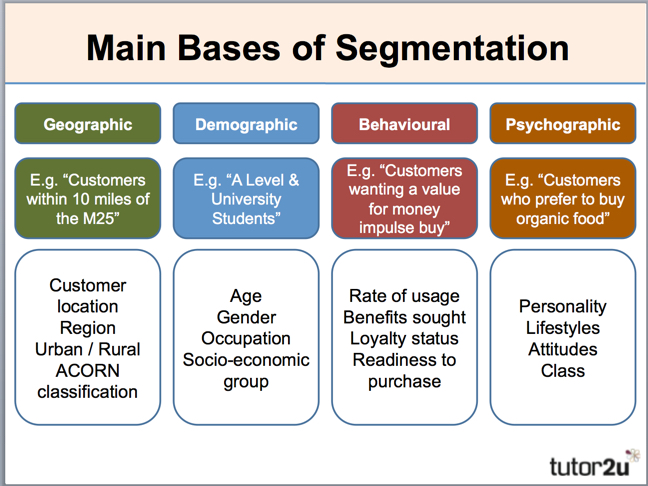

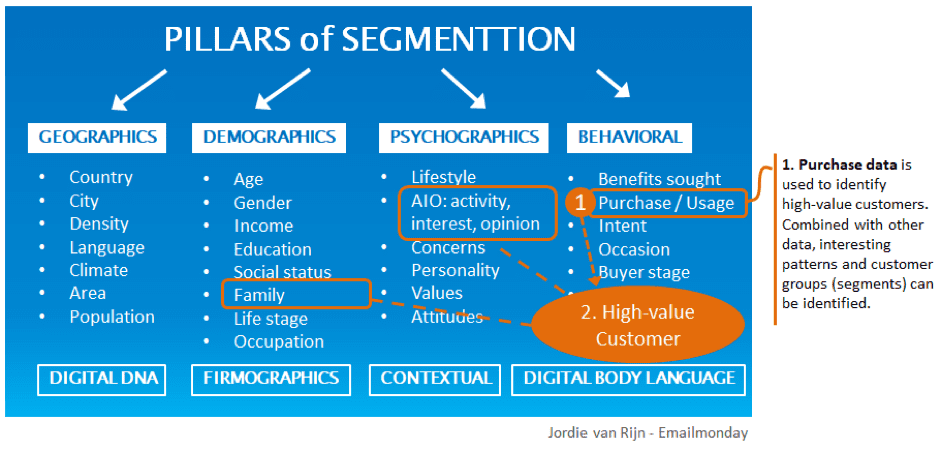

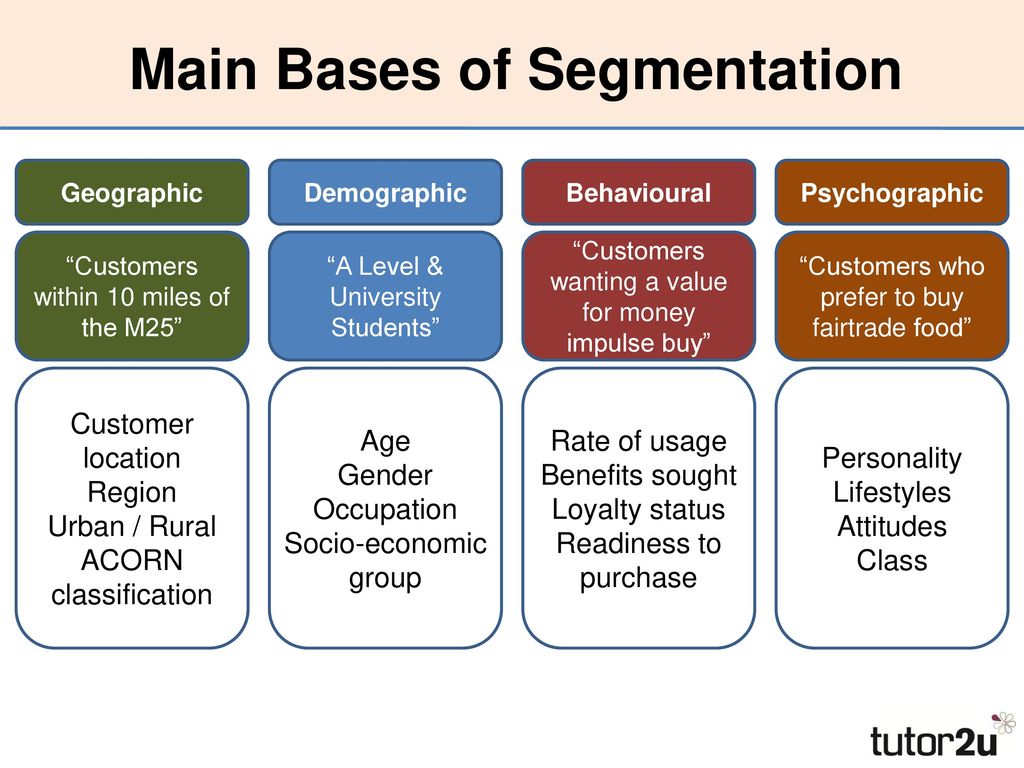

Market Segmentation

Our-in depth analysis of the global baby food market includes the following segments:

By Type

- Milk formula

- Dried baby food

- Prepared baby food

- Others

By Sales Channel

- Supermarkets/Hypermarkets

- Convenience stores

- Pharmacies

- Others

By Region

On the basis of regional analysis, global baby food market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Asia-Pacific region is anticipated to lead the overall market during the forecast period. The growing population of the infants in the region coupled with the increasing urbanization is anticipated to increase market growth of the baby food market in the region. Europe is anticipated to showcase substantial growth during the forecast period. The presence of key manufacturers in the region is expected to boost the growth of the overall baby food market in the region.

The growing population of the infants in the region coupled with the increasing urbanization is anticipated to increase market growth of the baby food market in the region. Europe is anticipated to showcase substantial growth during the forecast period. The presence of key manufacturers in the region is expected to boost the growth of the overall baby food market in the region.

Global baby food market is further classified on the basis of region as follows:

- North America (U.S. & Canada) Market size, Y-O-Y growth & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market size, Y-O-Y growth & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, NORDIC, Poland, Turkey, Russia, Rest of Europe) Market size, Y-O-Y growth & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market size, Y-O-Y growth & Opportunity Analysis.

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market size, Y-O-Y growth & Opportunity Analysis

Get more information on this report: Request Sample PDF

Top Featured Companies Dominating The Market

- Nestle

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mead Johnson

- Danone

- Hero-Group

- Abbott laboratories

- Bellamy Organics

- Perrigo Company

- Campbell soups

- Hain Celestial Group

- Friesland Campina

Baby Food Market Size, Share and Forecast to 2030

Baby Food Market: Information by Product Type (Dried Baby Food, Milk Formula, Prepared Baby Food), Distribution Channels (Supermarkets, Hypermarkets), and Region — Forecast till 2030

The global baby food market size was valued at USD 74 billion in 2021. It is projected to reach USD 128 billion by 2030, growing at a CAGR of 6.2% during the forecast period (2022–2030). Baby food is soft and easily consumed food prepared for infants aged four to six months until two years. In underdeveloped and developing countries, infants with low household incomes are fed with soft home-cooked baby food. However, in developing countries, prepared baby foods have witnessed increased demand due to urbanization and rising disposable income. Additionally, growing awareness of nutrition, improved organized retail marketing channels, and a rising number of women professionals further boost the baby food market.

It is projected to reach USD 128 billion by 2030, growing at a CAGR of 6.2% during the forecast period (2022–2030). Baby food is soft and easily consumed food prepared for infants aged four to six months until two years. In underdeveloped and developing countries, infants with low household incomes are fed with soft home-cooked baby food. However, in developing countries, prepared baby foods have witnessed increased demand due to urbanization and rising disposable income. Additionally, growing awareness of nutrition, improved organized retail marketing channels, and a rising number of women professionals further boost the baby food market.

Get more information on this report Download Sample Report

Market Dynamics

Drivers: Surge in Women Professionals

According to the United Nations, there has been a steep rise in the number of working women during the last decade. In 2019, the female employment rate stood at 47.8%, an increase in the trend over the past few years. The fast-paced, hectic lifestyle of women professionals leaves less time to breastfeed their babies or prepare healthy baby foods at home. This significantly increases the adoption of prepared baby food among working professionals.

The fast-paced, hectic lifestyle of women professionals leaves less time to breastfeed their babies or prepare healthy baby foods at home. This significantly increases the adoption of prepared baby food among working professionals.

Drivers: Improved Awareness of Adequate Nutrition

Dietary practices adopted by mothers are the key factor in shaping a baby's health. The rise in the literacy rate of females in developing and developed countries has increased the awareness of the nutritional requirements of newborn babies. In some developed countries, delayed weaning was observed among infants aged 6–7 months. However, these cases of delayed weaning are expected to decrease with the rising awareness among parents.

Drivers: Growing Retail Industry in Emerging Economies

The retail industry has become more organized in Asian countries, especially India and China. Improving economic conditions and changing lifestyles of consumers have increased the popularity of supermarkets and other organized retail structures. In 2019, supermarkets and health & beauty retail outlets accounted for maximum sales of baby food products in the Asia-Pacific. Hence, such factors are expected to drive market growth.

In 2019, supermarkets and health & beauty retail outlets accounted for maximum sales of baby food products in the Asia-Pacific. Hence, such factors are expected to drive market growth.

Stringent quality checks and strict mandates by governments and food departments pose significant restraints for the baby food market. Companies must adhere to safety guidelines to ensure the optimal quality of products. This leads to a higher cost of products, owing to competitive pricing, which, in turn, reduces companies' profit margins. Therefore, these factors hamper market growth.

Opportunities: Product Innovations and Innovative Packaging Strategies

Product innovations play an essential role in the growth of the baby food market. Intensive research and development activities have facilitated the launch of innovative products in the market. In addition, the safety of baby food is the prime concern among consumers and manufacturers. Tamper-proof packaging of baby food products ensures optimal safety of its contents. Innovations in improving the safety of these products through process improvements and technological advancements drive the growth of the baby food market.

Tamper-proof packaging of baby food products ensures optimal safety of its contents. Innovations in improving the safety of these products through process improvements and technological advancements drive the growth of the baby food market.

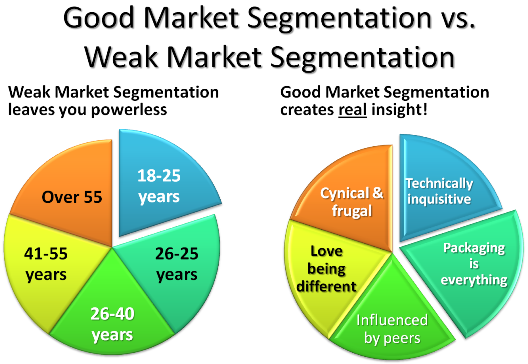

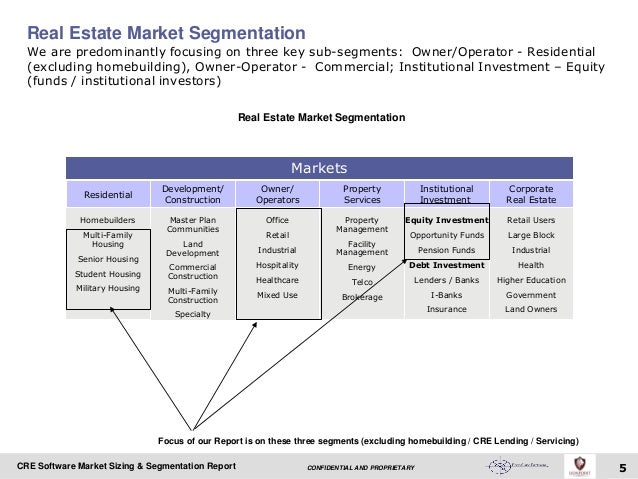

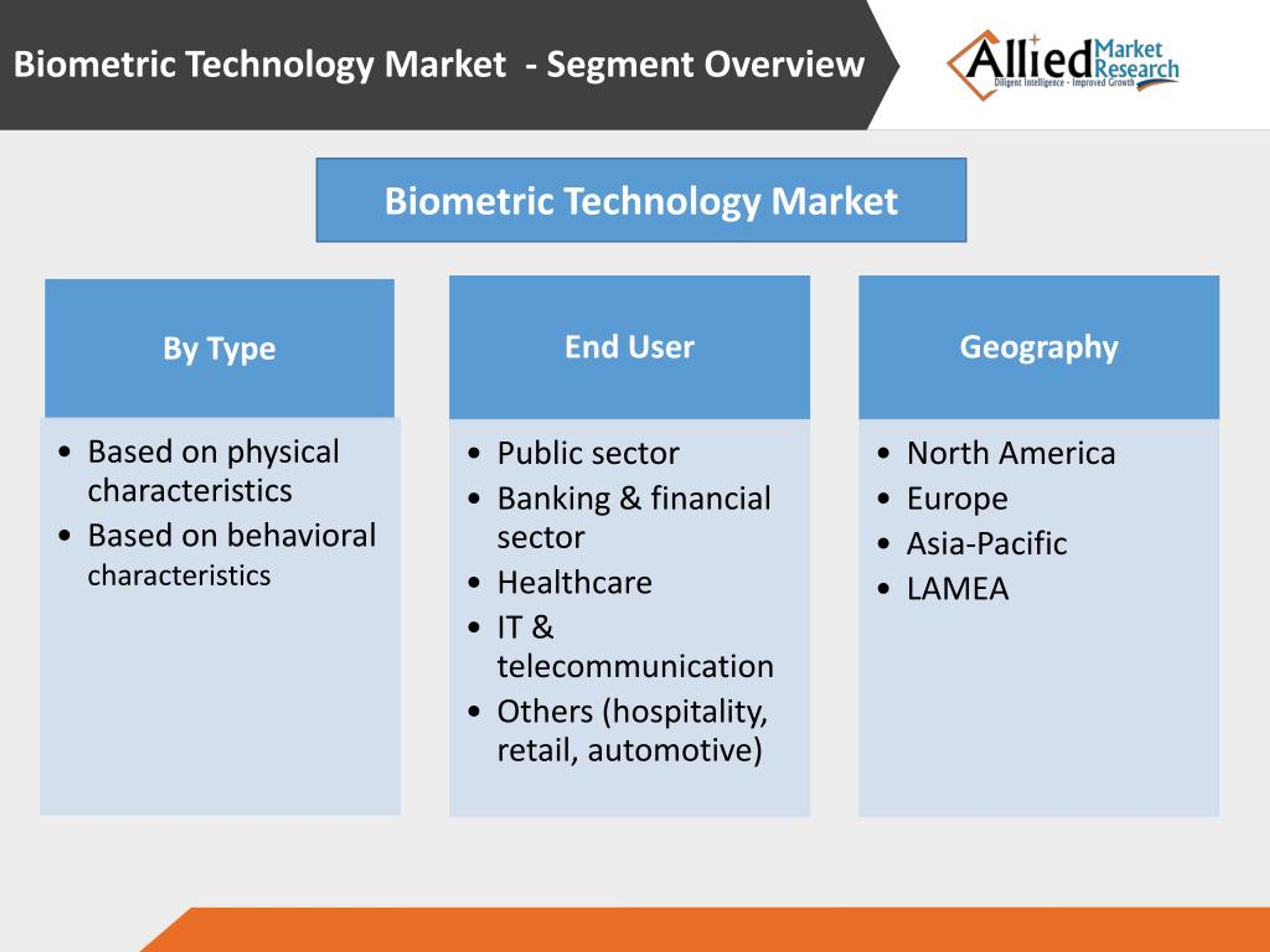

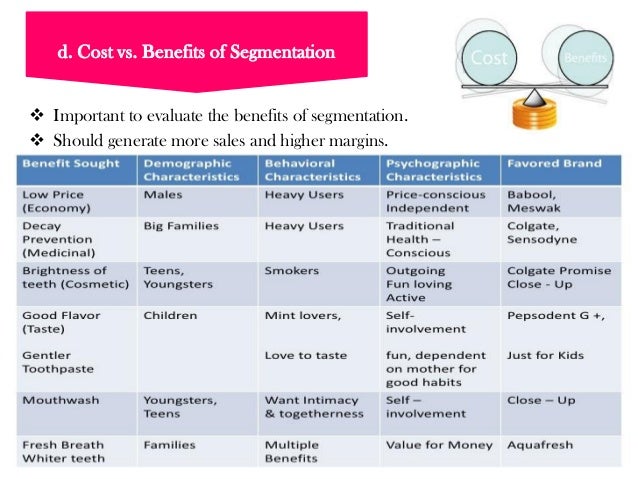

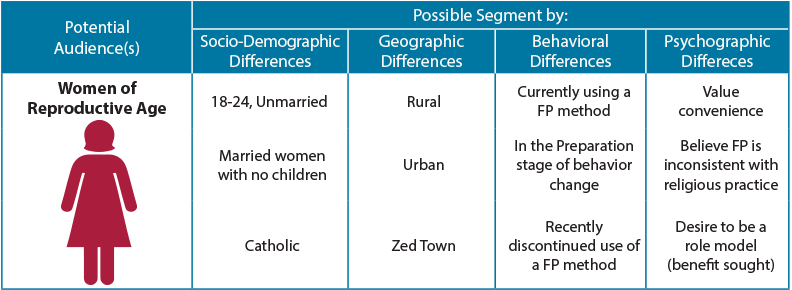

Segmental Analysis

The global baby food market share is segmented by product type, distribution channel, and region.

Product type-wise, the global baby food market is bifurcated into Dried Baby Food, Milk Formula, Prepared Baby Food, and Others.

The Milk Formula segment is the highest contributor to the market and is estimated to grow at a CAGR of 5.8% during the forecast period. Breastfeeding problems in women are the primary factor driving the market growth. Nowadays, women professionals prefer prepared milk-based baby food, owing to lack of time. Additionally, several producers advertise artificial formulas as a complement to breast milk. As a result, businesses are releasing milk formulations in various tastes and flavors to raise customer awareness of their brands.

The Dried Baby Food segment is the fastest growing. Due to increasing knowledge of the advantages of providing babies with a balanced diet, there has been significant growth in the demand for dried baby food over the years. Dried baby food products partly drive the market with longer shelf life. Market leaders offer a variety of goods enhanced with fruit components, such as bananas, tropical mangoes, apples, and dry fruits. The baby food business has expanded due to evolving socioeconomic variables and an improved standard of life brought on by a significant increase in disposable income. Furthermore, dried baby food prices are lower than prepared baby foods and milk formulations.

Prepared Baby Food holds the second-largest market share. This is attributed to new flavors and the need for nutritious ready-to-eat baby foods. The packaging of food products also plays a crucial role in overall sales. For instance, zip-lock pouches and handy containers are widely accepted as they are easy to carry, store, and use. These products describe the list of ingredients and the number of nutrients in the product. Additionally, packaged food products offer the convenience of preparing food while traveling and the inaccessibility of preparing home-cooked food.

These products describe the list of ingredients and the number of nutrients in the product. Additionally, packaged food products offer the convenience of preparing food while traveling and the inaccessibility of preparing home-cooked food.

Distribution channel-wise, the global baby food market is bifurcated into Supermarkets, Hypermarkets, Small Grocery Retailers, and Health & Beauty Retailers.

The Supermarket segment is the highest contributor to the market and is estimated to grow at a CAGR of 5.4% during the forecast period. Improved lifestyle due to a considerable increase in disposable income, coupled with the influence of western culture, are the significant factors contributing to the growth of this segment. Supermarkets are becoming increasingly popular because they offer a wide variety of consumer items in one location, have enough parking, and have convenient operating hours. Additionally, some supermarkets have company representatives to assist consumers in selecting baby food products. Hence, these factors propel market growth.

Hence, these factors propel market growth.

Small Grocery Retailers are the fastest-growing segment. In India, the trend of buying groceries from small grocery retail outlets is high compared to other countries. Small grocery retailers are the highest revenue-generating distribution networks in the baby food product in the Asia-Pacific. Supermarkets and hypermarkets pose a significant threat to these retailers. However, small grocery retailers have the advantages of being present at convenient locations and the availability of products in small quantities. They also provide free home delivery services, in turn increasing their popularity. Supermarkets & hypermarkets have their presence restricted to urban areas. This gives a competitive edge to small grocery retailers to maintain their dominance in rural and semi-urban areas.

The Health & Beauty Retailers are the second-largest segment. According to the WHO, in 2019, around the globe, 45% of child deaths occurred due to malnutrition. These mainly occur in low-and middle-income countries. At the same time, in these countries, childhood overweight and obesity rates were on the rise. Growing concerns among parents regarding child malnutrition propels the growth of the baby food market. Health & beauty retailers offer professional consulting services to consumers for choosing appropriate baby food products.

These mainly occur in low-and middle-income countries. At the same time, in these countries, childhood overweight and obesity rates were on the rise. Growing concerns among parents regarding child malnutrition propels the growth of the baby food market. Health & beauty retailers offer professional consulting services to consumers for choosing appropriate baby food products.

Regional Analysis

Region-wise, the global baby food market is segmented across North America, Europe, Asia-Pacific, and LAMEA.

Regional Growth Insights Request Sample Pages

Predominance of Asia-Pacific in the Global Market

Asia-Pacific is the highest shareholder and is estimated to grow at a CAGR of 5.6% during the forecast period. The high birth rate and improving population purchasing power in Asia-Pacific have significantly increased the demand for baby food and milk formula-based products in this region. Intensive R&D activities in the baby food segment are expected to help companies offer affordable baby food products in this region. Baby food products include milk powder, cereals, snacks, ready-to-drink fresh fruits, and vegetable juices.

Baby food products include milk powder, cereals, snacks, ready-to-drink fresh fruits, and vegetable juices.

Urbanization, improving lifestyle, and active women participation in the workplace are primary driving forces of the Asia-Pacific baby food market. Additionally, companies operating in this region focus on venturing into emerging markets and introducing innovative products based on regional requirements. Hong Kong is expected to be the fastest-growing market for the infant milk formula segment during the forecast period.

LAMEA is the fastest-growing region. The decline in poverty rates and disposable income in Latin American countries have increased the adoption of baby food products in this region. Baby food manufacturers have primarily focused on packaging aspects of products to prolong shelf life and minimize the risks of product contamination. Global baby food companies focus on the emerging LAMEA region, especially Brazil. An increase in the population of women professionals, high disposable income, and time constraints for cooking majorly boosts the baby food market growth in this region. In addition, an increase in organized retailing has facilitated the launch of innovative and new products in the market.

In addition, an increase in organized retailing has facilitated the launch of innovative and new products in the market.

Europe is the second-largest region and is projected to reach USD 310 million by 2030, growing at a CAGR of 6.4%. According to the Food Safety Agency (SFA), a food trade association in France, food products consumed by adults are inappropriate for babies as they could adversely affect their health. Additionally, traditional foods do not fulfill the nutritional requirements of babies. Manufacturers are refining recipes with more organic and naturally healthy ingredients to improve their customer base.

An increase in purchasing power of consumers has also led to growth in overall sales of baby food products. Europe is witnessing moderate growth in the baby food market, owing to sluggish growth in population, coupled with the low birth rate in countries such as Italy, Germany, and the UK. Western Europe has witnessed a decline in retail sales of baby food products in the past few years. However, sales of baby food products are projected to grow in Germany, owing to the rise in the spending capacity of consumers and growth in awareness of proper nutrition for babies.

However, sales of baby food products are projected to grow in Germany, owing to the rise in the spending capacity of consumers and growth in awareness of proper nutrition for babies.

Competitive Landscape

The key players in the global baby food market are Nestlé, Danone, Perrigo Company Plc, Mead Johnson & Company LLC, Abbott Laboratories, Hero Group, Bellamy Organics, Hain Celestial Group, Campbell Soups, and Friesland Campina.

Recent Developments

- June 2022 - De Nieuwe Melkboer (The New Milkman) and FrieslandCampina joined forces to develop a local chain for plant-based dairy alternatives with a good earnings model for the farmer. De Nieuwe Melkboer, an initiative of a FrieslandCampina member, supplies the first soy-based alternatives for milk and yogurt from Dutch soil. The partnership enables De Nieuwe Melkboer to make use of FrieslandCampina's knowledge and expertise and, by doing that, to continue to grow and develop.

- June 2022 - The climate targets set by FrieslandCampina were approved by the highly regarded Science-Based Targets project (SBTi).

FrieslandCampina announced its climate strategy with specific reduction objectives for glasshouse gas emissions since the company shares the goal of keeping global warming to a maximum of 1.5 degrees Celsius. Now that SBTi has verified it, FrieslandCampina's 2030 climate targets* conform with the Paris Climate Agreement's upper limit of 1.5 degrees Celsius warming.

FrieslandCampina announced its climate strategy with specific reduction objectives for glasshouse gas emissions since the company shares the goal of keeping global warming to a maximum of 1.5 degrees Celsius. Now that SBTi has verified it, FrieslandCampina's 2030 climate targets* conform with the Paris Climate Agreement's upper limit of 1.5 degrees Celsius warming. - February 2022 - To usher in a new era of comprehensive diabetes management care, Abbott, the world leader in healthcare, announced new partnerships with critical health-tech partners BeatO and Sugar Fit, PharmEasy, GOQii, 1MG, Zyla Health, HealthifyMe, and Fitterfly. Abbott hopes to reach 8 million people with diabetes through these partnerships, 6.5 million of whom will be able to access these solutions through PharmEasy and 1MG. Along with remote consultations, coaching tailored specifically for people with diabetes, and meal planning, the business focuses on maintaining an adequate glucose level.

Market Segmentation

By Product Type

- Dried Baby Food

- Milk Formula

- Prepared Baby Food

- Other Baby Food

By Distribution Channel

- Supermarkets

- Hypermarkets

- Small Grocery Retailers

- Health & Beauty Retailers

- Others

By Regions

- North America

- Europe

- Asia-Pacific

- LAMEA

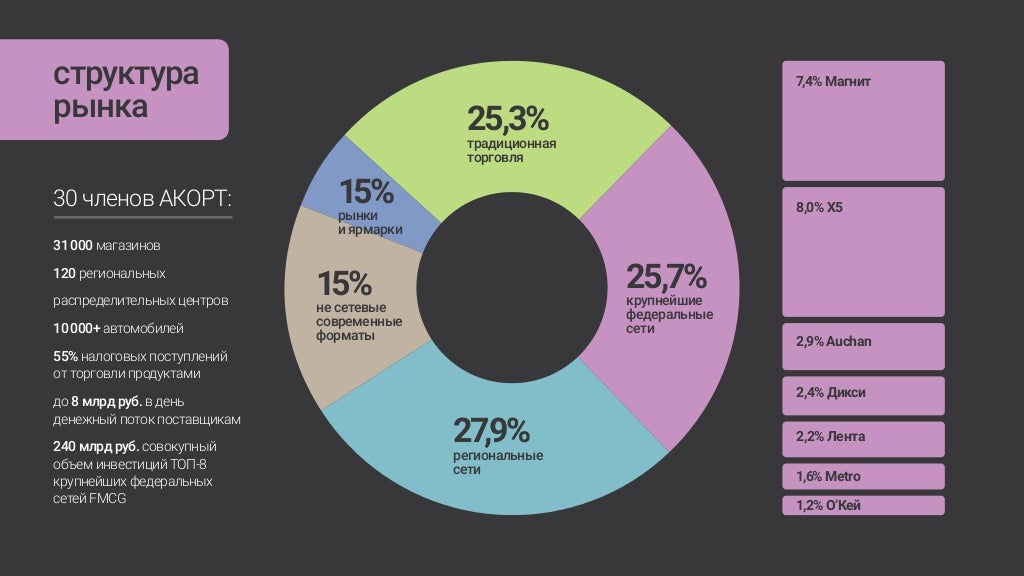

Marketing research of the food market for children in Russia, 2012

DESCRIPTION OF THE WORK

The analysis contains analytical information on the state of the baby food market, namely fruit puree in the North Caucasus Federal District of the Russian Federation, the indicators of import, export of products, the main Russian producers of puree .

Also analyzed: the demographic situation in Russia, the size of the baby food market, market segmentation was carried out, the market structure, volumes and nature of production were described, market trends were analyzed, competitive analysis was carried out, consumers and product consumption sectors were described;

Structural report includes summary and recommendations, baby food market profile, baby food production, baby food export and import, competitive and consumer analysis.

EXTRACTS FROM THE TEXT

In 2011, the volume of retail sales of baby products in Russia increased by 24% compared to 2007, amounting to almost 1.5 million tons. In 2008-2009, sales of baby food in Russia decreased by 0.1 and 3%, respectively. The reason for the decline in sales was the sharp rise in prices for the main food groups for children. Since 2010, baby food sales have resumed growth.

There are three main price segments on the baby food market: low price segment (products of Wimm-Bill-Dann, Unimilk and other domestic manufacturers), middle price segment (Heinz, Nutricia, Nestle), high price segment ( Semper, Hipp, Gerber).

For the first quarter of 2012, the largest share in the cost structure of production is occupied by the Lipetsk region (87.2%). In the remaining 13%, which fall on production in other subjects of the Russian Federation, the largest part is occupied by the Krasnodar and Stavropol Territories - 23 and 22%, respectively, and the Ivanovo Region with 16%.

Decline in the profitability of baby food production for the period from 2008 to 2011 is observed in the Stavropol Territory, Lipetsk Territory (despite the largest share of production in the Russian Federation - 87.2%).

For the period from 2007 to 2011 the value turnover of baby food exports from Russia increased by 25.3%. Ukraine occupies the largest share in the export of baby food from Russia among countries….. Negative dynamics of exports to such countries as Kyrgyzstan…

The share of imports in 2011 among adapted dry mixes is 91%, among vegetable purees…

The top five importers of homogenized finished products to Russia for the first two quarters are:

- Poland……thous.

The competitive situation in the baby food market is quite tense. Several companies of both foreign and Russian origin are in the leadership zone at once.

In the structure of spending on goods for children (excluding durable goods), baby food occupies a leading position. In the first year of a child's life, parents spend more than on food (26.1% of all costs) only on diapers (30.6%).

In the first year of a child's life, parents spend more than on food (26.1% of all costs) only on diapers (30.6%).

Prices for baby food show an annual increase. The cheapest segment on the market is canned fruit. The price for them from 2006 to 2010. increased by 54%: from 132 to 204 rubles per kg.

Baby food became the fastest growing segment

Russia 29.01.2009

Source: businesspress.ru

ENRU

(MOSCOW, 29.01.09, DAIRYNEWS) From the first day of his life, the child feeds on milk. A little later, he starts drinking juice and eating porridge. It would seem that the most familiar products. Therefore, there is an opinion that food for children is ordinary adult food, only more tender and well chopped.

It would seem that the most familiar products. Therefore, there is an opinion that food for children is ordinary adult food, only more tender and well chopped.

(MOSCOW, 29.01.09, DAIRYNEWS) From the first day of his life, the child feeds on milk. A little later, he starts drinking juice and eating porridge. It would seem that the most familiar products. Therefore, there is an opinion that food for children is ordinary adult food, only more tender and well chopped. Meanwhile, this is a very dangerous delusion. The child is actively growing and developing - in other words, processes are going on in the baby's body that have long been completed in the body of an adult. Therefore, the need for nutrients and their balance in children is completely different. And only special children's products made from special raw materials and adapted to the needs of the child's body can satisfy this need. Improper nutrition can lead to a weakened immune system, dysbacteriosis, allergies and a general deterioration in health. The smaller the child, the more he needs products adapted for him. Previously, pediatricians were of the opinion that from the age of one and a half, a baby can be gradually transferred to a “common table”, but now more and more doctors are inclined to think that a child needs specialized products for at least three years. The health of “urban” children requires special care, which is significantly affected by the unfavorable environmental situation in large Russian cities.

The smaller the child, the more he needs products adapted for him. Previously, pediatricians were of the opinion that from the age of one and a half, a baby can be gradually transferred to a “common table”, but now more and more doctors are inclined to think that a child needs specialized products for at least three years. The health of “urban” children requires special care, which is significantly affected by the unfavorable environmental situation in large Russian cities.

Several decades ago in our country, in addition to large factories and specialized workshops, there was a network of children's dairy kitchens, designed to meet local needs. In fact, the kitchens were mini-factories that produced a limited range of children's dairy products on simple low-performance equipment. The kitchen system was well developed and satisfied a significant part of the demand. However, in the mid-1990s, a significant reduction in budget funding followed, and the system of kitchens based on state orders almost completely collapsed. In addition, kitchen equipment was outdated and, more importantly, did not meet the stringent hygiene standards for baby food production. Large enterprises that managed to receive and install modern equipment were privatized and continued to produce children's products. However, it was sorely lacking. In the first half of 19In the 1990s, the market was almost completely occupied by imports. Nevertheless, the existing market opportunities provided an opportunity for business development for both foreign and Russian players.

In addition, kitchen equipment was outdated and, more importantly, did not meet the stringent hygiene standards for baby food production. Large enterprises that managed to receive and install modern equipment were privatized and continued to produce children's products. However, it was sorely lacking. In the first half of 19In the 1990s, the market was almost completely occupied by imports. Nevertheless, the existing market opportunities provided an opportunity for business development for both foreign and Russian players.

Today, both worldwide and in Russia, the baby food segment has become the fastest growing compared to other product groups. In Russia, this is explained by the fact that state support for large families has been introduced in the country, birth rates and consumer welfare are growing. Segment "baby food" for 2005-2006. grew by 8%. The highest overall growth of this product group was mainly due to the positive dynamics of the formula milk category, which was distinguished by high growth rates in the Asia-Pacific region, South America and emerging markets - by 24%, 21% and 20%, respectively.

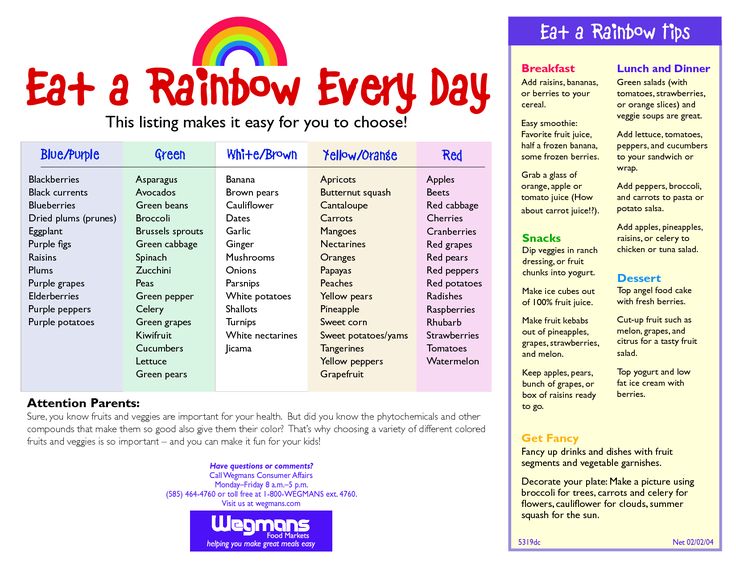

In Russia, the baby food product section includes three major categories: baby food, baby juices and juice drinks, and breast milk substitutes. For 2005-2006 this segment increased by 20% in value terms (Diagram 1), due to strong dynamics in the category "children's juices and juice drinks", which grew by 33%. The category "baby food" grew by 19%, while the category "breast milk substitutes" grew by 25% over the same period.

According to experts, the Russian baby food submarket is at the stage of active development. Its main feature is the constant expansion and updating of the assortment, taking into account modern scientific recommendations and consumer priorities. Moreover, in general, in the food industry, the Russian baby food market is one of the most dynamically developing segments. At the moment, the Russian baby food market is represented by two main segments: mother's milk substitutes (dry and liquid, 21% of the market) and complementary foods (79% of the market). The latter include both cereals, meat, vegetable and fruit purees, as well as natural juices, baby water and desserts.

The latter include both cereals, meat, vegetable and fruit purees, as well as natural juices, baby water and desserts.

The most significant segments of the baby food market in terms of volume are purees (46%) breast milk substitutes (21%), as well as juices and cereals (15% and 14% respectively). Biscuits and tea are rather new products for the Russian market - they account for 3% and 1% respectively.

However, sales of these products are developing quite dynamically, and we can say that the volume of these segments will increase soon.

In addition, other baby food products are presented on the Russian market, which are produced by both domestic and foreign companies: muesli, cereal, cream, cottage cheese, water. By the way, baby water is still an “untested” product, although for sanitary reasons it should be sold in a set with breast milk substitutes, for which, in fact, it is intended. This is water that does not require boiling and is recommended for children from the first week of life. It goes through a modern multi-stage level of technological processing, is characterized by an optimal salt composition.

Experts say that in the future the market will continue to develop and new positions will be introduced to it in the categories of baby food. The assortment of baby food will become more diverse. To date, the main market share is made up of products of low and medium price levels, and the premium segment accounts for about 20%.

The rapid growth of the market attracts producers of dairy and juice products, actively developing a new segment of baby food. Baby food producers report a significant increase in revenue in 2007, which is due to the increase in sales volumes and an increase in average selling prices. Leading market players note an increase in physical sales of baby food by 20-35%.

At the same time, new players face intense competition from both foreign and domestic manufacturers. About 60% of the market in monetary terms is controlled by 3 companies: Nestle, Nutricia and Nutritek. In the segment of breast milk substitutes, which has the most difficult barriers to entry, the share of these players is 85%.

According to INFOLine, the share of imports among adapted dry mixes is more than 90%, the same is among vegetable purees, and about 50% among fruit purees. Among the most notable foreign participants in the Russian baby food market, researchers name the companies Nestle (Switzerland), Hipp (Austria), Nutricia (Holland), Kolinska (Slovenia), Heinz (Germany) (based on the site http://www.recipe.ru /analitika/detskoe-pitanie-spros-i-potrebitelskie-prioritetyi.html). Thus, on average, the share of imported food products for babies is about 50-60%, it dominates in the segments of dry milk formulas and cereals, as well as vegetable puree and canned meat / fish products of a high price level. Apparently, foreign manufacturers are placing big bets on Russia. As a result, in the last two or three years, competition has sharply intensified, and the process of consolidation of the leading players has intensified. Thus, Nestle and Nutricia, which are still unconditionally ahead of competitors in the segment of breast milk substitutes and have good positions in other categories, carried out strategically important financial transactions in 2007. Nestle acquired the American company Gerber, known in Russia primarily for its baby puree. And baby food company Nutricia, previously owned by the Dutch concern Royal Numico, became the property of the French Group Danone. The cost of the transaction is 12.3 billion euros (three times more than Nestle paid for Gerber). The Russian division of Nutricia has a plant in the city of Istra and a network of regional offices throughout the country. Thanks to the purchase of this enterprise, Danone immediately acquired about 20% of the Russian market for food products for young children.

At the end of 2007 The strongest negative pressure on the baby food market came from the dairy products market. The reasons were high inflation and a shift in consumer preferences towards traditional low-price products. This year, according to experts, the situation in the dairy segment has stabilized, and the costs of baby food producers for raw materials have slightly decreased (in March 2008, prices for raw milk fell by about 10% compared to December 2007).

The rapid growth of the baby food market is driven by a number of factors. One of the main reasons for the positive dynamics of the market is the growth in consumption of baby food. According to RosBusinessConsulting estimates, in 2007 the growth in the average expenses of parents on food for children aged 0-4 exceeded 12%. According to Express-Obzor, the share of expenses for the purchase of baby food in Moscow is 16 times higher than the Russian average.

At the same time, according to experts, the baby food market is far from being saturated and will maintain high development dynamics in the future. As noted in a study by RosBusinessConsulting "Russian market of baby food", in the medium term, the volume of the Russian market may grow to $ 2 billion. At the same time, in 2007, the volume of the baby food market. according to the estimates of the same company amounted to 880 million dollars.

Among the reasons for such forecasts is the extremely low level of consumption of baby food compared to European countries. In Russia, this figure is only 12 kg per child per year and is significantly inferior to the indicators of Western European countries, where on average 22 kg of baby food is consumed per child.

The future of the market is associated with an increase in the birth rate, as well as with a shift in consumer preferences towards finished products of industrial production. In general, as indicated in the study “Russian Baby Food Market” by RosBusinessConsulting, against the backdrop of an improvement in the demographic situation and the emergence of new baby food products, a long-term market growth rate of at least 15% per year is expected.

As mentioned above, the demand for baby food in Russia has been steadily increasing for several years. According to the State Statistics Committee, the birth rate growth in Russia in January-February 2008 amounted to 31% of the same indicators in 2007. A "jump" in the birth rate, income growth and an increase in the standard of living of the population are the main reasons for the increase in demand for a variety of children's industrial products.

In addition, the increase in the employment of young parents in large cities of Russia also leads to the growth of this market segment. According to Comcon's TGI Baby study in 2007, an increasing number of mothers are choosing specialized baby products. The most popular among consumers are fruit purees (54.6%), vegetable purees (54.4%) and meat purees (38.2%).

According to analytical information about consumer preferences of children and parents, and according to Comcon research, when choosing baby food, mothers are guided by:

• non-allergenicity - 80%,

• child's preferences - 72%,

• 51.7% of mothers noted that the absence of genetically modified ingredients in baby food is important.

In 2007, retail sales of these and other baby products increased by 14% compared to 2006. As in 2006, in 2007 the segment of juices remained the growth leader. Sales of juice products for children increased by 30% and reached 137 million liters. Russian manufacturers have significantly increased production volumes and hold leading positions in this segment: the share of imported brands did not exceed 4%. It should be noted that the segment of juices for children is consolidated. The products of its four main players - OJSC Lebedyansky, OJSC Sady Pridonya, CJSC Multon and OJSC Wimm-BillDann - together occupy 85% of the market.

Puree segment (15%) and liquid dairy products segment (9%) also showed high growth rates. Thus, the prospects for the market of products for children and, above all, dairy products, are obvious. According to Comcon, 82% of Moscow mothers buy specialized baby milk and kefir for their babies. In St. Petersburg this figure is 43%, while in large regional centers it is only 10%. This variation in demand is largely due to the presence of the product on the shelf. If in Moscow and St. Petersburg milk for children is listed in the assortment of 85% and 57% of stores of modern formats, respectively, then, for example, in Yekaterinburg, baby milk can be bought only in 30% of stores. There is an obvious need for specialized children's functional dairy products: according to the TGI Baby study, 14% of Russian mothers with babies under three years of age feed them functional dairy products intended for adults.

According to experts, the most attractive places to buy baby food in the 0-3 years old segment are specialized stores for children's goods, such as Healthy Baby, Detsky Mir, as well as chain retailers - Pyaterochka, Magnit, Auchan. The format of the specialized store includes, in addition to baby food, the following groups of products for children: toys, shoes, clothes, underwear, etc.

Currently, the baby food market continues to grow. Baby food shows the highest growth dynamics in the Russian FMCG market - from 15% to 30% per year (depending on the category) and has great potential for further growth. At the same time, the Russian baby food market is currently at the initial stage of development. Even by 2010, the consumption of baby food in Russia will not be able to reach today's indicators in Western Europe. One of the main reasons for this growth is the socio-demographic changes in recent years, the increase in the birth rate and the increase in the target audience. The culture of consumption is changing - if earlier a woman believed that no one would cook food for a child better than herself, now she trusts the manufacturer more and more. Lifestyle is also changing: female employment is growing, and hence the need for ready-made baby food - high-quality, varied, convenient and safe. Another important factor is the general growth in the purchasing power of the population. This means that parents can afford to spend more on caring for their beloved child. According to experts, the logic of further development of the domestic market for children's products will be subject to modern global trends.

First of all, this concerns the development of the segment of ready-to-eat products in portioned packaging - adapted milk mixtures and liquid cereals. Now children's cereals in Russia are a "dry formula": a powder that must be diluted with water or milk. This method of preparation limits the ability of mobile urban mothers to use the product. Ready-made porridge can be fed to a child without any problems even while walking in the park or in a car on the way to grandma. Another interesting category, not yet represented in Russia, is liquid fortified cereal mixtures based on milk juice, which significantly enrich the child's diet.

Main conclusions:

• The surge in the birth rate and the growth of the population's ability to pay in Russia contributed to the rapid development of the baby food market. Consumers tend to move away from homemade products in favor of high-quality commercially produced baby food. Experts agree in positive forecasts for the development of this market - about 15% per year.

• Currently, both domestic and foreign manufacturers are present on the market. According to research companies, the share of imports is quite high among adapted dry mixes, vegetable and fruit purees. The positions of Russian players are strong in the segment of children's juices, meat purees, liquid and pasty dairy products.

• Whereas before baby food was available only in specialized stores or in children's dairy kitchens, now shops and supermarkets have also become part of this market: according to research companies, for half of young parents they have already become the most popular place to buy baby food .

• Consumers are increasingly demanding baby food: they want high quality, variety, convenience and safety. Therefore, the price has long ceased to be a decisive factor in the choice. The main criteria for choosing baby food are now the composition, non-allergenicity, enrichment of the product with vitamins and minerals.

• Experts believe that more expensive brands will appear on the market, and the quality of not only the product, but also the packaging will become important. The development of segments and the introduction of new positions in the categories of baby food will continue.

Popular topics

hot topic

22.02.2023

Animal by-products law: how knowledgeable and prepared are farmers?

On March 1, 2023, a new law on animal by-products will come into force in Russia. The DairyNews tried to figure out what milk producers expect from the innovation, how much they are aware of the new law, whether they plan to change the protocols for working with manure on farms, whether they understand how the new rules will work and whether they are afraid of fines for violations.

Read moreAnalytics

02/22/2023

Dairy price index at GDT trading decreased by 1.5%

02/20/2023

Dairy Index DIA remained at the level of the previous week - 35. 55 rubles/kg

02/16/2023 Volume

sales of Nestle dairy products in 2022 amounted to 11.3 billion Swiss francs

Analytics

Tatyana Gordeeva, Director of Development and Sales Department, Neos-Ingredients LLC

If earlier most of the modified starches were imported from Europe, then at the time of their inclusion in the sanctions list, no one could figure out what to do next. Because, in principle, modified starches were not imported into Russia from countries other than European ones.

Andrey Dakhnovich, Chairman of the Board of Directors of the Elansky and Semikarakorsky cheese-making plants

We see that if there are no shocks in the market, then the existing trends - the growth of milk production, the weak purchasing power of the population, the virtual absence of exports of dairy products to non-CIS countries - will lead to a decrease in the purchase cost of milk.

Igor Baringolts, Chairman of the Board of Directors, RM-Agro

We are developing a project for a hay dehydration plant, which is being promoted by the Association of Hay and Feed Exporters - we see the future behind this, because high-quality hay allows us to make high-quality feed for animal health and increase milk yield. At the same time, today a ton of hay costs twice as much as a ton of grain - this is also a separate type of business.

Igor Moskovtsev, General Director of JSC "Korenovsky MKK"

The production of cheese curds is loaded at 100%. And we plan to increase production volumes, carry out reconstruction, install new equipment in order to maintain the entire range of produced curds in the right amount. This category is fresh, expiration dates are limited, so you need to produce everything at once. I think we'll manage.

Igor Eliseenko, General Director of MolSib

In milk production among farms, the process of consolidation has been going on for a long time, and nothing will change radically. Small and inefficient farms will either be sold or abandon animal husbandry in favor of crop production. As for processing, in my opinion, we should not expect a serious reduction in enterprises here. Everyone prepared for the situation in whatever way they could, huddled, found their own ways to sell products, perhaps even gray schemes.

Alexander Zernov, General Director of Pöttinger LLC

In order not to find yourself in a situation where your expansion is hindered by the level of equipment, you must take as a basis the goals that the economy sets for 3-5 years. This is the optimal horizon, taking into account the depreciation of equipment and the development of technologies. The realistic life of the equipment is 7 years, the maximum is about 10.

Elena Kruk, Head of Communications Department, JSC Zolotye Meadows

Many suppliers of packaging and spare parts for equipment have switched to prepaid relationships with manufacturers, which entails additional unforeseen costs on the part of the dairymen. We had to revise budgets in order to purchase packaging. The cost of packaging has doubled, its cost reaches 15% depending on the product.

Dmitry Mironchikov, independent dairy market consultant

Everyone has their own vision of milk prices: processors want a lower price, producers want a higher one. It's always like that. Personally, I do not see any prerequisites for a rise in prices for raw milk next year, but I do not see any reasons for a decrease either. There should be some stability in general, at least the first three quarters.

Alena Krekoten, chief technologist of Ice Plus LLP

At first, the farmers did not understand what we wanted from them at all. What kind of indicators are these: somatic cells, QMAFAnM, bacteria contamination ... But over time they got used to it, got involved. And those who do not pass in terms of quality were eliminated on their own, because they began to pay less. And for high-quality milk, on the contrary, we raised the price. And the producers have a healthy motivation. Any sane person understands: "Why "chemical" when you can make normal milk - and get a good price?"

Svetlana Kuzmicheva, Development Director, MLK Group

We do not accumulate anything in an attempt to "catch the wave" of prices. We have our own development strategy, we clearly understand that there are stock fluctuations, but keeping something in stock and then trying to sell it is not about us. In our opinion, it is not very expedient to keep money in warehouses.

Armen Khurshudyan, Production Director of Ice LLP

Of course, genetics plays a very important role. But genetic potential is one thing, and how it is realized is another. And it depends on how good farmers we are. The fact that we took the best genetics does not mean that the cow should give us something. If you asked me what the biggest problem of all cows is, I would say that they are farmers. We create most of the existing problems for the cows ourselves.

Gennady Zenchenko, Chairman of the Board of the Meat and Dairy Union of Kazakhstan

Who from the Ministry of Agriculture even thought - who will work? Where are the doctors in the countryside? Where is the person who will go directly to the cow? We have one farm after another "burning" from brucellosis, from foot-and-mouth disease - without having time to receive subsidies to the end.

Vladimir Labinov, Minister of Agriculture of the Republic of Karelia

Identification must be - this is an axiom that is not subject to discussion. We will try to keep up in this direction, support it in every possible way and implement it at home. In Karelia, the livestock is small, it has long been identified. We have no problems with this at the level of the republic. Another thing is how this system will work on a national scale.

Igor Eliseenko, General Director of Molsib

I do not know a single leader in the industry who would throw up their hands and say that they will not do anything else. A business can be closed, but it is almost impossible to restore it, especially for dairy farms where livestock is kept and trained personnel work.

Lyubov Guseva, director of Liton

Now we have switched completely to Russian raw materials. We tried to level out all the shortcomings in the film, since this is a rather capricious package, with its own shortcomings, for example, when welding. We did everything to level out shortcomings in equipment, in the qualifications of personnel at dairy plants. That is, the efforts of both sides were required here, and the film also had to be slightly adapted at the dairy plant.

Olga Kosnikova, food technologist, popularizer of science

It often happens that ordinary employees, not technologists, do not have sufficient knowledge about the product, simply because their activities have a different specificity. It is also important to tell employees about what consumers may ask, what they are interested in, what the product actually consists of.

Andrea Paoletti, Export Manager Ave Technologies

In the 1990s, we visited dairies in Italy to convince them to try bottling in PET bottles - none of them used to bottle in PET, they used glass, film, cardboard. From that moment on, we began to supply them with equipment for filling milk in PET. Today in Italy we supply 80% of PET filling equipment to dairies.

Alexey Komarovskikh, General Director of A7 Agro Holding

We do not have good high-performance solutions here and now. We understand that if the situation persists, in 2-3 years we will not have spare parts for milking parlors, parallels, production lines. I really wish our agricultural machine builders to catch up. It is important to catch up not only in terms of price, but also in terms of the quality of equipment.

Ildar Faizullin, General Director of Ufagormolzavod

For a number of equipment, the purchase and modernization of lines have been postponed. For example, we have postponed the increase in the capacity of the curd lines, because the Tetra Pak company refused to supply them - despite the fact that we paid the bill back in March. We were told in plain text - look for alternative suppliers.

Alikhan Smailov, Prime Minister of the Republic of Kazakhstan

We see serious distortions in the exchange rates between our national currencies, which are determined through cross rates against the US currency.