Nestle baby food market share

Global Baby Food Market will reach to USD 7.12 billion by

Baby Food market are Abbott Laboratories, Bellamy’s Organic Pty Ltd., Campbell Soup Company., Danone., Hero Group., Mead Johnson & Company, LLC., Nestle S.A., Perrigo Company Plc, Royal Frieslandcampina N.V., and The Hain Celestial Group, Inc. among others.

| Source: GreyViews GreyViews

Pune India, July 28, 2022 (GLOBE NEWSWIRE) -- The market has been studied for the below mentioned-segmentation and regional analysis for North America, Europe, Asia, South America, and Middle East and Africa. These are the key regions where the Baby Food market is operating currently and is predicted to expand in the near future. The manufacturers and suppliers involved in the Baby Food market is present across various countries in the above-mentioned regions.

Get Sample Copy of This Report @ https://greyviews.com/reports/baby-food-market/86/request-sample

The report provides detailed understanding of the market segments which have been formed by combining different prospects such as the product, packaging, baby category, distribution channel, and others. Apart from this, the key driving factors, restraints, potential growth opportunities and market challenges are also discussed in the below paragraphs.

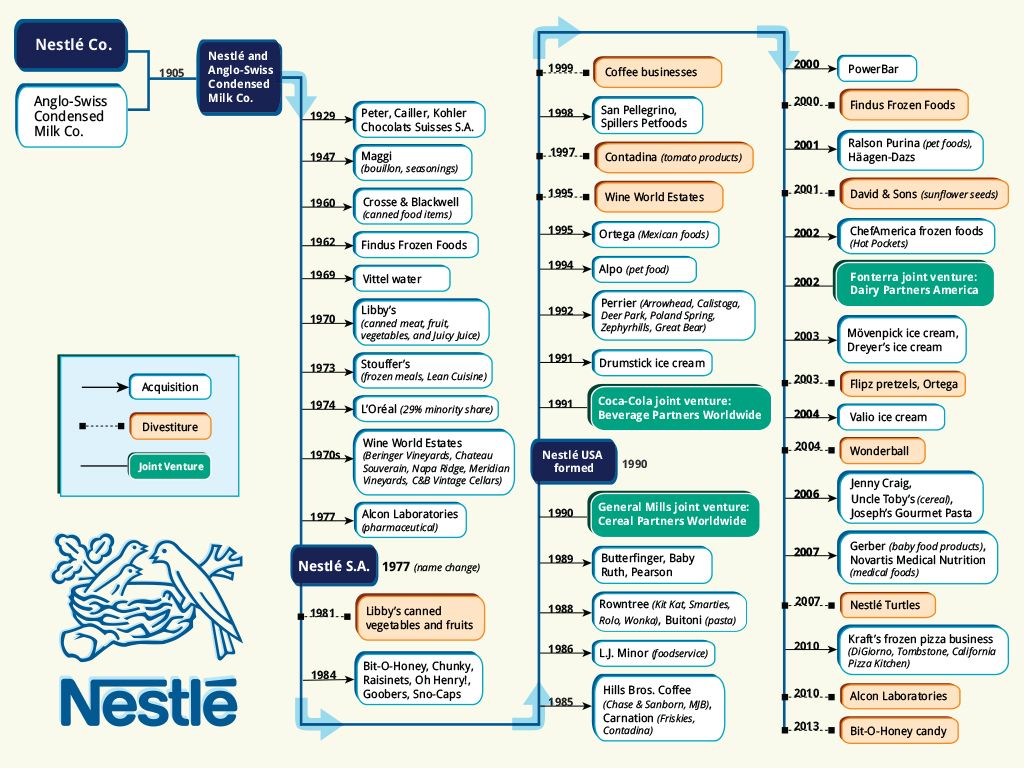

The significant players operating in the global Baby Food market are Abbott Laboratories, Bellamy’s Organic Pty Ltd., Campbell Soup Company., Danone., Hero Group., Mead Johnson & Company, LLC., Nestle S.A., Perrigo Company Plc, Royal Frieslandcampina N.V., and The Hain Celestial Group, Inc. among others. To achieve a substantial market share in the worldwide Baby Food market and strengthen their position, manufacturers are pursuing expansion methods such as current developments, mergers and acquisitions, product innovations, collaborations, and partnerships, joint ventures. Among these, Nestle S.A is one of the most significant manufacturers and distributors present in the global Baby Food market.

Among these, Nestle S.A is one of the most significant manufacturers and distributors present in the global Baby Food market.

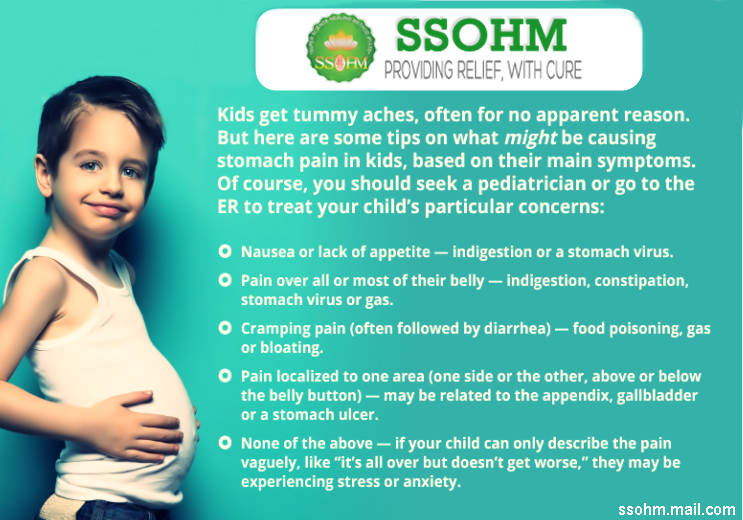

Baby foods has continued to become one of the highest-growing retail product in global food & beverage sector. The baby food products caters to the nutritional requirements of babies. Usually, the baby food is a soft and consumable food other than breastmilk which is used for feeding human babies between age of four and six months to two years old. Moreover, safety of baby food is the prime concern among consumers and manufacturers.

Emerging economies of the world offer lucrative opportunities to players operating in the baby food market. Major factors responsible for growth in such opportunities in developing economies are change in lifestyle and increase in birth-rates. As an attempt to diversify the consumer group, companies are implementing region based strategies. For instance, companies operating in India have launched affordable products to tap the lower-income groups. Companies such as Nestle S.A are investing on product development activities by setting up new R&D centres in India. Changing lifestyle and growth in working females is setting the stage for growth in demand for baby food in developing countries. Moreover, increase in birth rates in countries such as China and India further propels the market growth.

Companies such as Nestle S.A are investing on product development activities by setting up new R&D centres in India. Changing lifestyle and growth in working females is setting the stage for growth in demand for baby food in developing countries. Moreover, increase in birth rates in countries such as China and India further propels the market growth.

Enquiry Before Buying This Report @ https://greyviews.com/inquiry/86

Scope of Baby Food Market Report

| Report Metric | Information |

| Study Period | 2021-2029 |

| Base Year | 2021 |

| Forecast Period | 2022-2029 |

| Market Share Unit | USD Billion |

| Segments Covered | Product, packaging, baby category, distribution channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle-East and Africa |

| Major Players | Abbott Laboratories, Bellamy’s Organic Pty Ltd. , Campbell Soup Company., Danone., Hero Group., Mead Johnson & Company, LLC., Nestle S.A., Perrigo Company Plc, Royal Frieslandcampina N.V., and The Hain Celestial Group, Inc. among others , Campbell Soup Company., Danone., Hero Group., Mead Johnson & Company, LLC., Nestle S.A., Perrigo Company Plc, Royal Frieslandcampina N.V., and The Hain Celestial Group, Inc. among others |

Segmentation Analysis

Baby food snacks segment is expected to be the fastest growing segment in 2021.

Product segment includes baby food cereals, baby food snacks, baby food soup and milk formula, frozen baby food. Baby food snacks segment is expected to witness highest growth rate during the forecast period. Baby food snacks are delicious as well nutritious. For instance, Nestle’s Infant Snacks Puffs—Banana contains whole grains, a good source of iron and zinc. These snacks are available in different variants including My First Puffs, Sweet Potato, Peach, Banana, Strawberry, Apple and Blueberry Vanilla.

Parents prefer baby food snacks products as they contain right amount of nutritious as well as are readily consumable. In addition, key players in the market manufacture these food products made from premium quality fruits and vegetables to ensure proper nutrition to the babies. Such factors are fueling growth of this segment.

In addition, key players in the market manufacture these food products made from premium quality fruits and vegetables to ensure proper nutrition to the babies. Such factors are fueling growth of this segment.

Online segment is expected to be the fastest growing segment in 2021.

The distribution channel segment includes shopping malls, supermarkets, convenience stores, hyper markets, and online retail. Online retail segment is expected to witness highest CAGR during the forecast period. Online platform serves as a popular medium for the purchase of baby food products. This is attributed to easy availability and benefits such as information about the attributes of the products, time-saving feature, and the facility of home delivery provided by online platforms.

Regional Analysis

The regional analysis provides a detailed perception about the key regions and the countries. Some of the key countries analyzed for the Baby Food include US, Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, China, Japan India, Brazil, Peru, UAE, South Africa and Saudi Arabia.

Some of the key countries analyzed for the Baby Food include US, Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, China, Japan India, Brazil, Peru, UAE, South Africa and Saudi Arabia.

Asia-Pacific region witnessed a major share. Increased population and rising disposable income in Asia-Pacific is fueling growth of the Baby Food market. In addition, penetration of emerging market players in this region has created lucrative growth opportunities for the market. However, North America is expected to witness considerable growth rate during the forecast period. Various multinational food-manufacturing companies have their base in North American. These companies offer variety of baby food and infant formulations in the market.

Country Analysis

Germany

Germany Baby Food market size was valued at USD 0.36 billion in 2021 and is expected to reach USD 0. 70 billion by 2029, at a CAGR of 9.1% from 2022 to 2029.

70 billion by 2029, at a CAGR of 9.1% from 2022 to 2029.

Germany is one of the leading nations in the Europe Baby Food market. This is mainly attributed to changing lifestyles, increasing disposable incomes of population, and rising trend of e-commerce across the country. Sales of baby food products in this country is projected to grow due to increase in spending capacity of consumers and growth in awareness of proper nutrition for babies.

However, growth of the market in this country is slightly affected by falling birth rates and increase in breastfeeding due to strict governmental initiatives.

China

China Baby Food market size was valued at USD 0.71 billion in 2021 and is expected to reach USD 1.38 billion by 2029, at a CAGR of 8.9% from 2022 to 2029. China is one of the largest consuming as well as exporting country of baby food. The Government of China has relaxed and replaced its one-child policy with the two-child policy in 2015. This has led to the upsurge in the birth rate. This factor has further contributed to the growth of Baby Food market.

The Government of China has relaxed and replaced its one-child policy with the two-child policy in 2015. This has led to the upsurge in the birth rate. This factor has further contributed to the growth of Baby Food market.

Moreover, the factors such as rapid urbanization, rising nutrition awareness, and ongoing trend of e-commerce sales in baby care sector has further boosted growth of the market.

India

India Baby Food market size was valued at USD 0.18 billion in 2021 and is expected to reach USD 0.37 billion by 2029, at a CAGR of 9.7% from 2022 to 2029. India is one of the strongest growing economies in Asia. Significant demand for Baby Food from increasing working women professional population in the country has driven growth of the market in this country.

In addition, the country is seeing rapid growth in influence of social media and changing lifestyle. This has encouraged modern mothers to use Baby Food. On the other hand, the birth rate in this country in 2021 was about 17.377 births per 1000 people. Such factors have altogether contributed to the India Baby Food market.

Covid-19 Impact

Covid-19 had a major impact on almost all of the industries such as electronics, semiconductors, manufacturing, and, automobile, etc. However, several companies operating in consumer goods and life sciences sector has seen upsurge in their revenue due to significant changes in consumer preferences. However, the pandemic has caused decreased purchases of Baby Food from offline stores due to social distancing norms and lockdowns.

On the other hand, the pandemic has caused upsurge in online sales of Baby Food. Hence, Baby Food market is expected to witness considerable growth in the post-pandemic.

Hence, Baby Food market is expected to witness considerable growth in the post-pandemic.

Buy Now Full Report @ https://greyviews.com/checkout/86/single_user_license

Contact Us

Rocky Shah

GreyViews

Pune India

Phone: (+44) 162-237-1047

Email: [email protected]

Web: https://greyviews.com/

Browse Related Reports:

Global Baby Food Market Size by Product (Baby Food Cereals, Baby Food Snacks, Baby Food Soup and Milk Formula, Frozen Baby Food), By Packaging (Pouches, Jars, Bottles, Others), By Baby Category (Infants, Toddlers), By Distribution channel (Shopping Malls, Supermarkets, Convenience Stores, Hyper Markets, and Online Retail), Regions, Segmentation, and forecast till 2029.

https://greyviews. com/reports/baby-food-market/86

com/reports/baby-food-market/86

Global Dog Food Market Size by Product Type (Dry Dog Food, Dog Treats, and Wet Dog Food), Pricing Type (Premium Products and Mass Products), Ingredient Type (Animal Derived and Plant Derived), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, and Others)), Regions, Segmentation, and forecast till 2029.

https://greyviews.com/reports/dog-food-market/85

Global Dark Chocolate Sauce Market Size by Packaging Type (Bottles and Jars, Pouches and Sachets, Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others), Regions, Segmentation, and forecast till 2029.

https://greyviews.com/reports/dark-chocolate-sauce-market/84

Tags

Global Baby Food Market Food & Beverages Baby Food Market Baby Food Market size Baby Food Market share Baby Food Report FoodInsights on the Organic Baby Food Global Market to 2028 - Players Include Nestle, Danone, Lactalis and Hero Group - ResearchAndMarkets.

com

comDUBLIN--(BUSINESS WIRE)--The "Organic Baby Food Market Size, Share & Trends Analysis Report by Product (Infant Milk Formula, Prepared Baby Food, Dried Baby Food), by Distribution Channel (Supermarket/Hypermarkets), by Region and Segment Forecasts, 2022-2028" report has been added to ResearchAndMarkets.com's offering.

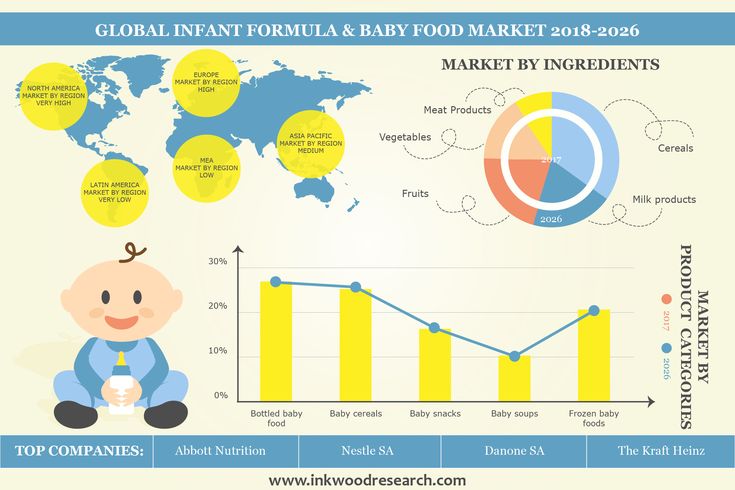

The global organic baby food market size is expected to reach USD 6.34 billion by 2028, registering a CAGR of 8.7% from 2022 to 2028.

Companies Mentioned

- Nestle SA

- Abbott Laboratories

- Danone SA

- The Kraft Heinz Company

- Mead Johnson & Company, LLC

- Lactalis

- The Hain Celestial Group Inc.

- Hero Group

- Sprout Organic Foods, Inc.

- Hipp Gmbh & Co Vertrieb KG

- Baby Gourmet Foods Inc.

- Amara Organic Foods

The rising parental concerns over the baby's health and nutrition in developing and developed countries are major driving factors of the market over the last few years. Moreover, the increasing awareness about the benefits of organic food products among consumers is further propelling the market growth.

Moreover, the increasing awareness about the benefits of organic food products among consumers is further propelling the market growth.

Moreover, a lockdown situation has been observed during the COVID-19 pandemic, and it showed a negative impact on the market due to the suspended or delayed supply of raw material used for preparing organic packaged food products. However, it significantly impacts on demand and supply chain of organic baby food products. Moreover, increasing demand for infant formula products after the COVID-19 pandemic will create opportunities for the market players.

The infant milk formula segment is expected to register the highest CAGR of 8.9% from 2022 to 2028. The increasing popularity of organic packaged food products due to chemical-free healthy food has projected market growth in the forecast period. The rising consumption of innovative organic baby food products as these products are convenient and quick sources of energy and nutrition for the babies is the major driving force of this segment.

The online retail segment is expected to grow with a higher CAGR of 9.8% from 2022 to 2028 in the global market. The growth of online distribution channels is attributed due to the availability of online platforms via shopping portals and mobile apps. It is also observed companies, distributors and retailers are adopting the online platform to sell organic baby food. As a result of this, the online segment is gaining traction compared to offline.

The Asia Pacific dominated the market with a revenue share of around 45% in 2021. Factors such as increasing per capita consumption, disposal income, and people's concern about baby's health are contributing to the growth of this market. Especially China, India, and Japan have a huge consumer base for the consumption of organic food products, which creates demand for organic baby food in the forecast period.

The market players are looking to gain customer loyalty and uphold their brand image by providing innovative products as per customer specifications and analyzing consumer behavior patterns. Manufacturers of organic baby food products are offering an innovative combination of new products and the growing trend of clean labeled production and nutritious diets of baby food which is propelling the market growth.

Manufacturers of organic baby food products are offering an innovative combination of new products and the growing trend of clean labeled production and nutritious diets of baby food which is propelling the market growth.

Organic Baby Food Market Report Highlights

- The Asia Pacific is expected to register the largest market share of around 45% in 2021 owing to the rising number of newborns in China and India

- The infant milk formula segment is expected to foresee the fastest growth, with a CAGR of 8.9% from 2022 to 2028 due to the increasing popularity of organic packaged food products owing to chemical-free healthy food.

- Supermarket/ hypermarkets distribution channel held the largest market in share in 2021, contributing more than 40% of the total revenue due to the traditional way of selling products compared to the online distribution channel

- Europe is expected to register the fastest growth of 9.1% CAGR from 2022 to 2028 due to the rising consumption of ready-to-eat products

Key Topics Covered:

Chapter 1. Methodology and Scope

Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Organic Baby Food Market Variables, Trends & Scope

3.1. Market Introduction

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Sales/Retail Channel Analysis

3.3.2. Profit Margin Analysis

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.4.4. Industry Opportunities

3.5. Business Environment Analysis

3.6. Roadmap of Organic Baby Food Market

3.7. Market Entry Strategies

3.8. Impact of COVID-19 on the Organic Baby Food Market

Chapter 4. Consumer Behavior Analysis

4.1. Consumer Trends and Preferences

4.2. Factors Affecting Buying Decision

4.3. Consumer Product Adoption

4.4. Observations & Recommendations

Chapter 5. Organic Baby Food Market: Product Estimates & Trend Analysis

Organic Baby Food Market: Product Estimates & Trend Analysis

Chapter 6. Organic Baby Food Market: Distribution Channel Estimates & Trend Analysis

Chapter 7. Organic Baby Food Market: Regional Estimates & Trend Analysis

Chapter 8. Competitive Analysis

8.1. Key global players, recent developments & their impact on the industry

8.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

8.3. Vendor Landscape

8.3.1. Key company market share analysis, 2021

Chapter 9. Company Profiles

For more information about this report visit https://www.researchandmarkets.com/r/u4rpll

What's going on in the baby food market?

- Main

- No. 79, July 20, 2022

Natalia Novinskaya [email protected]

1665

"Krasny Sever" found out how the situation is with the provision of Vologda babies with milk formulas and baby food under international sanctions.

Photo by Sergey Yurov

nine0008 Mothers need not worry - almost all major baby food suppliers continue to supply their products to Russia.Photo by Igor Aksenovskiy

Understanding the situation with the provision of infant formula and baby food in the light of sanctions pressure. As it turned out, some of the ingredients for baby food were produced abroad.

Don't panic

According to WHO, more than 60% of breastfeeding mothers worldwide transfer their children to artificial feeding, in whole or in part. nine0009

With the beginning of the imposition of sanctions in retail chains and pharmacies, there was a strong stir: mothers were actively buying up infant formula for the future, since it was not known what would happen to the supplies. The issue of providing Russian cities with baby food was discussed at meetings of the federal government and the Ministry of Agriculture.

The situation with baby formulas in Russia has always been not very favorable: until the 1990s, about a dozen factories were engaged in their production, now there are only three left with five main suppliers. nine0009

nine0009

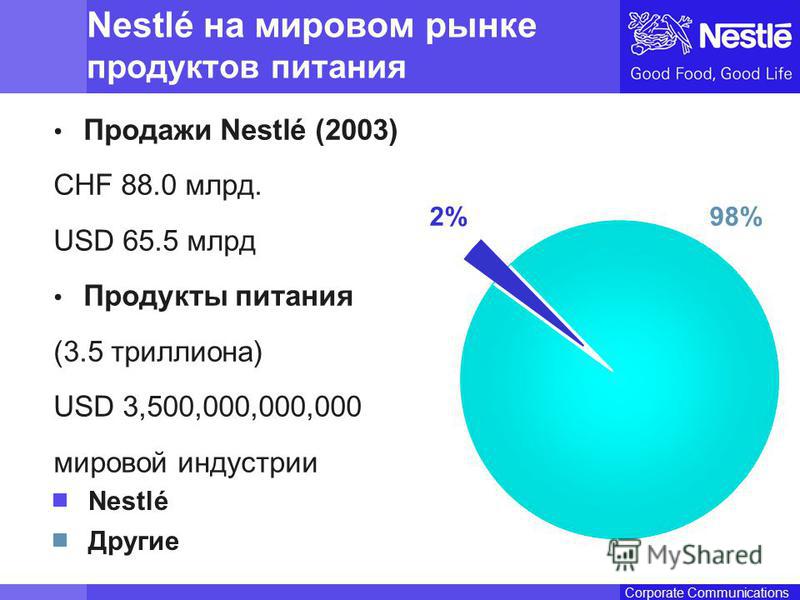

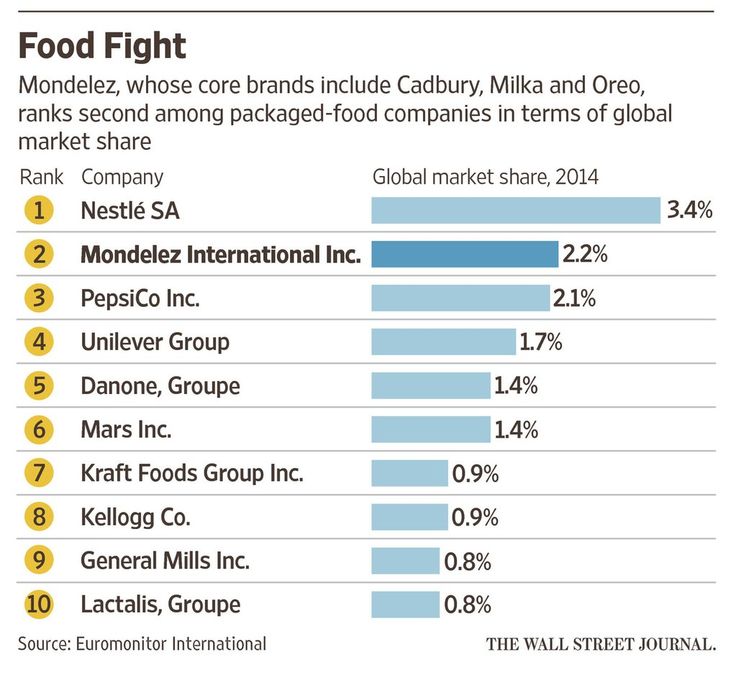

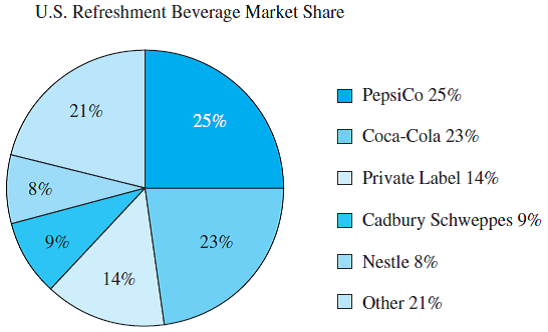

- Almost 40% of the market is occupied by Nestle, a little less - by Danon, 11% - by Abbott Lab, almost 5% - by Friesland Campina, and a little less - by other foreign manufacturers, - Sergey Maizel, head of the largest dairy production, explained at a meeting in the government "Milk Whale", initiator of the project for the production of protein components of baby food.

Domestic manufacturers occupy an insignificant share of the ready-mix market: in 2019, the share of the only Russian manufacturer, JSC Infaprim, accounted for only 6.2% of the market. But even this production partly works on imported raw materials - in Russia today there is no adequate industrial production of protein isolates of the required level of purity and safety. nine0009

When it comes to the actual pharmaceutical level of requirements, starting your own production is not so easy.

- This is a very technologically sophisticated product: with a maximum level of demineralization, with a clearly defined microbial composition, no ash content, guaranteed thermal stability. Only then can the mixture be safe enough for children under six months old, whose kidneys and intestines are not yet fully developed, - explained Alexey Lysyakov, General Director of Infaprim. nine0009

Only then can the mixture be safe enough for children under six months old, whose kidneys and intestines are not yet fully developed, - explained Alexey Lysyakov, General Director of Infaprim. nine0009

However, almost all major suppliers of baby food continue to deliver to Russia, so the situation was not so critical.

Mixtures available

- We contacted the official representative of the trademarks "Bellakt", "Infaprim", "Nutrilak" and "Vinni" in the territory of the Vologda region - this is the company "Start". According to their assurances, there will be no shortage, we are working with them, - Elena Zubachek, director of the Pharmacia company, which provides regional pharmacies with milk formulas, told Krasny Sever. nine0009

In the Vologda Oblast, free provision of infants in need of formula milk is supervised by the Department of Health. According to the conclusion of doctors, children who are on artificial and mixed feeding are provided with adapted milk mixtures. Prescriptions for free formula are issued at the medical organization to which the child is attached for observation. Mixtures for these purposes are distributed to cities and districts of the region from the 1st to the 10th day of each month.

Prescriptions for free formula are issued at the medical organization to which the child is attached for observation. Mixtures for these purposes are distributed to cities and districts of the region from the 1st to the 10th day of each month.

In the absence of a mixture from one manufacturer, it is possible to provide a mixture from another manufacturer, since all purchased mixtures comply with the above regulatory documents as part of the terms of reference. nine0009

- The availability of infant formula is now all right. Yes, delivery logistics has slightly increased, we have to wait longer for orders, but in general there are no problems with the availability of mixtures. Prices have increased by 20 - 30% for different positions, but there is a range, - Anna Larionova, commercial director of the Start company, a distributor of milk formulas in the Vologda region, specified.

Prices have increased by 20 - 30% for different positions, but there is a range, - Anna Larionova, commercial director of the Start company, a distributor of milk formulas in the Vologda region, specified.

She explained that they cooperate with all major suppliers - foreign companies Nutricia, Nestle, Abbott, as well as the Belarusian brand Belakt and Russian Infoprim and Farmalakt. None of them stopped production and continues deliveries to Russia. And the Vologda plant "Nestlé" even plans to expand production. nine0009

What about dairy kitchens?

In the distant 80s, I remember regularly going to the dairy kitchen with bottles for kefir and cottage cheese for my little sister. But in recent times, this tradition is rather rare.

The only dairy kitchen in the region is located in Vologda at the address: Pskovskaya street, house 7. Products are sold free of charge according to a special coupon, which is issued by the education department of the Vologda city administration. Also, everyone can purchase children's dairy products for a fee. nine0009

Also, everyone can purchase children's dairy products for a fee. nine0009

As the press service of the city administration explained, the situation related to sanctions and import substitution did not affect the work of the dairy kitchen in any way. Now there are no problems with packaging or ingredients.

Back in the spring, at a session of the Vologda City Duma, deputies supported the proposal of the mayor of the regional capital, Sergei Voropanov, to expand the number of recipients of dairy products, increasing production capacity by 30%. Now all children from low-income families aged 8 months to 2.5 years who do not attend kindergarten can receive dairy products for free. nine0009

In July, the children's dairy kitchen was closed for maintenance, but should reopen on August 1st. By the way, recently the products of the Vologda dairy cuisine were awarded the Russian quality mark "The Best for Children" for the sour-milk cocktail "LACT-ELITE" and drinking yogurt "Apple - Pear".

- Dairy kitchens in Cherepovets were closed a long time ago, about 10 years ago. This happened for a whole range of reasons: the most stringent hygiene requirements for production - the shelf life of finished products is estimated at several hours - and low demand for products, - explained Sergey Klimushkin, assistant to the mayor of Cherepovets for media relations. nine0009 Baby food Dairy cuisine

Why is Nestlé baby food not finding adequate demand?

According to Euromonitor, in 2018, the largest growth in sales in the infant formula segment came from specially formulated foods for babies who have just transitioned from breastfeeding to formula. 123rf.comSwiss food giant Nestlé is trying to diversify its baby food range and bring innovative products to market. The prospects here are promising. However, many critics are skeptical. And they have a reason to. nine0009 This content was published on January 10, 2020 - 11:00

Jessica Davis Pluss (Jessica Davis Pluss)

In the first weeks of life, baby Lindsay Beeson developed a rash, traces of blood on diapers, diarrhea and vomiting. Doctors diagnosed an allergy to cow's milk. Like many other mothers in her situation, Lindsey eliminated milk from her baby's diet and, in addition to breastfeeding, began to gradually introduce complementary foods with hypoallergenic infant formula. In the second year of his life, her son was switched to milk formulas specially designed for babies with allergies. “I knew that they contained a balance of proteins, fats and vitamins similar to the composition of cow's milk. And my son liked the taste,” she said in an interview with swissinfo.ch. nine0009

Doctors diagnosed an allergy to cow's milk. Like many other mothers in her situation, Lindsey eliminated milk from her baby's diet and, in addition to breastfeeding, began to gradually introduce complementary foods with hypoallergenic infant formula. In the second year of his life, her son was switched to milk formulas specially designed for babies with allergies. “I knew that they contained a balance of proteins, fats and vitamins similar to the composition of cow's milk. And my son liked the taste,” she said in an interview with swissinfo.ch. nine0009

Show more

For global food concerns such as Nestlé, the development and introduction to the market of new formulas for feeding children under one year old, including those suffering from allergic reactions, in need of special dietary nutrition, or simply picky eaters, is another and very important abroad in expanding the range of baby food.

Speaking to a group of journalists in Lausanne, Thierry Philardeau, Nestlé Senior Vice President of Strategic Dairy Business Development, recently stated: all babies and their mothers. " From a practical point of view, the concern's strategy is to fill the gaps that arise in the nutrition of mothers and their children, regardless of whether the children receive artificial feeding, natural breastfeeding or combination. nine0009

" From a practical point of view, the concern's strategy is to fill the gaps that arise in the nutrition of mothers and their children, regardless of whether the children receive artificial feeding, natural breastfeeding or combination. nine0009

The Swiss concern continues to focus on the nutrition of premature babies and children with special medical conditions. And yet, in recent years, he has consistently increased investment in research and development in order to obtain new products for the nutrition of children after the age of six months of life, that is, for a particularly difficult period when breast milk alone is no longer enough to meet the nutritional needs of a child. , and a complete transition to artificial food has not yet taken place. nine0009

Artificial demand or valuable nutritional supplement?

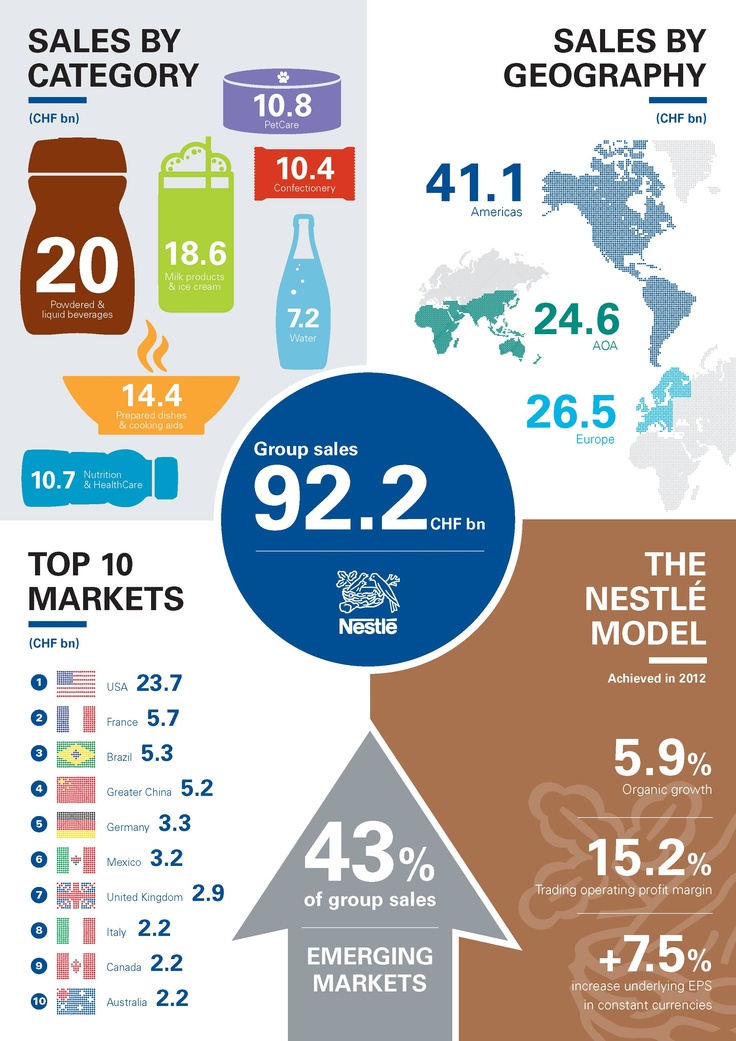

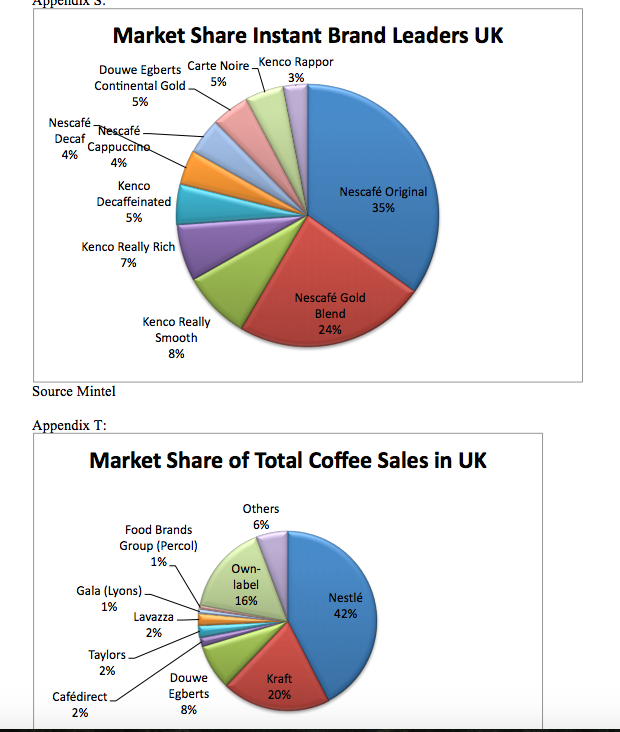

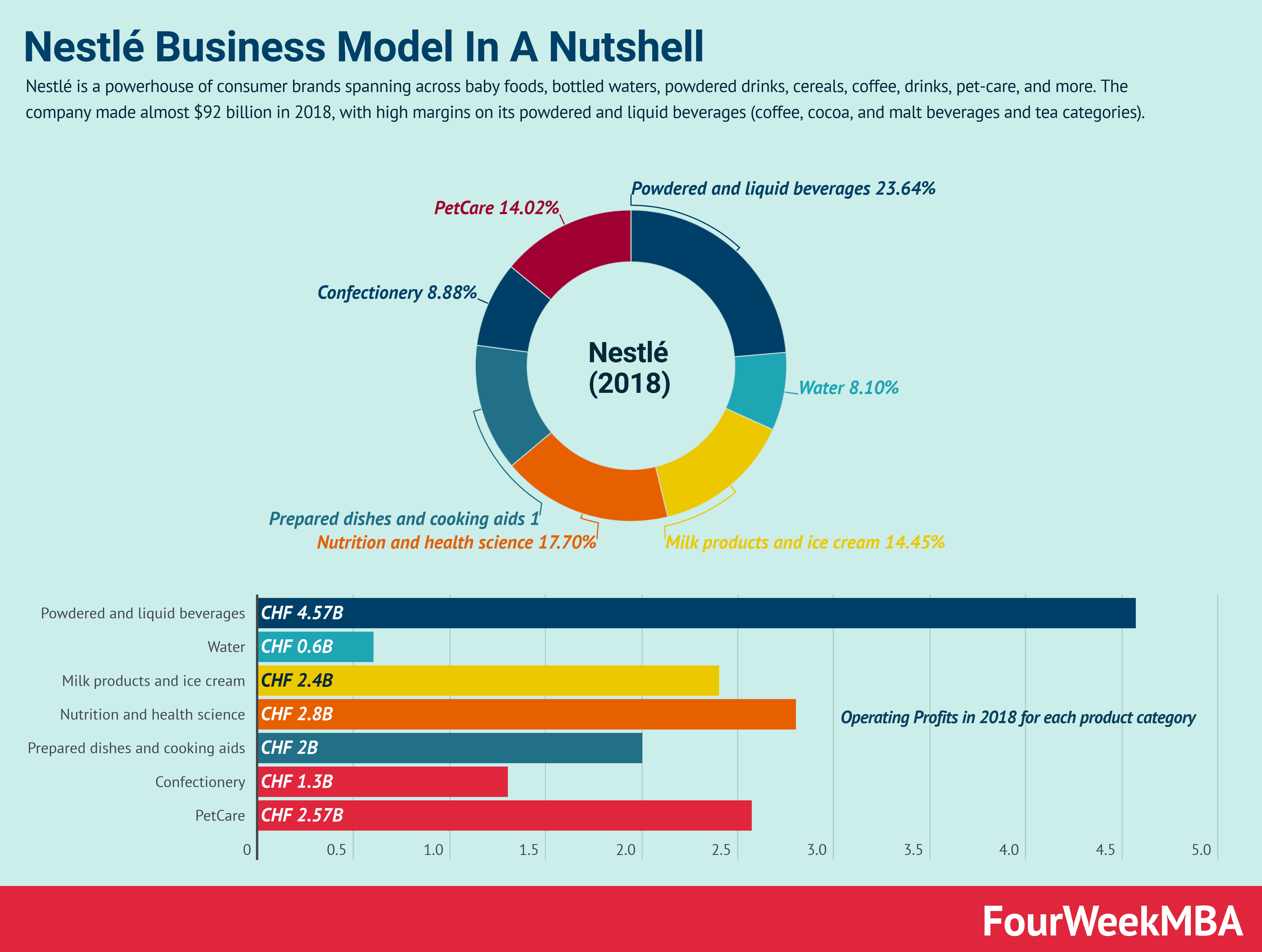

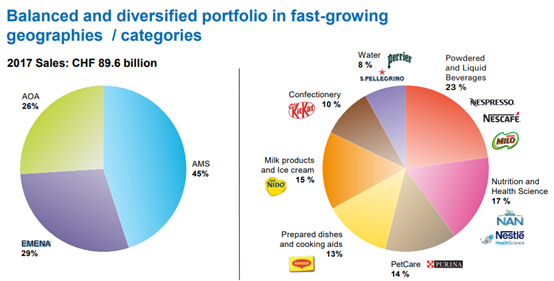

Nestlé baby food has a direct impact on the health of millions of children around the world. More than 150 years have passed since Henri Nestlé (1814-1890) invented Farine Lactée, a baby porridge to support malnourished children. Today, Nestlé is the world's largest infant formula company. It has a fifth market share, followed by Danone in second place. nine0009

Today, Nestlé is the world's largest infant formula company. It has a fifth market share, followed by Danone in second place. nine0009

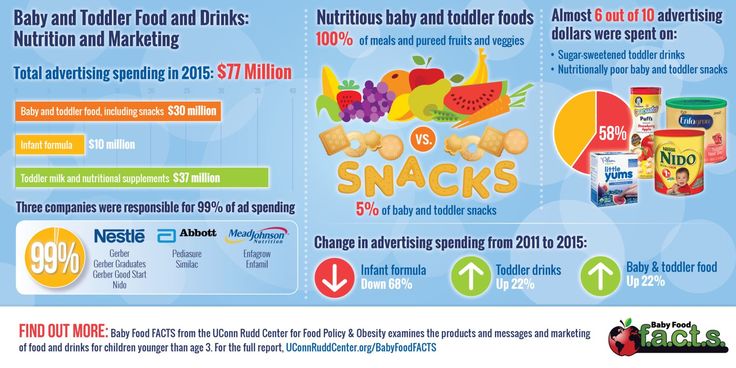

In recent years there has been a real boom in breastfeeding around the world. The profits of infant formula companies have fallen. Therefore, today these companies rely on "older babies" and on related products. According to EuromonitorExternal Link , the largest sales growth in the infant formula segment in 2018 came from specially formulated foods for babies who have just transitioned from breastfeeding to formula. nine0009 External content

Today, in supermarkets in almost every country in the world, you can find the widest range of types of milk powder, dairy product concentrates and breast milk substitutes for children under one year old. It would seem great, but not everyone is satisfied with these products. Activists such as Patti Rundall are sounding the alarm. Since the 1980s, she has served as Director of Strategic Policy for Baby Milk ActionExternal Link , an international network of baby food organizations. Since her filing, the world has experienced a number of very large litigations in connection with the production and sale of artificial nutrition from Nestlé Corporation. nine0009

Since her filing, the world has experienced a number of very large litigations in connection with the production and sale of artificial nutrition from Nestlé Corporation. nine0009

Show more

What's the problem? It turns out that, according to her, the Nestlé and Danone concerns are the main initiators of the promotion of baby food for babies and milk formulas for children aged from 6 months to 3 years and further up to the age of nine. They use the same or very similar symbols (logos) as on infant formula, so parents, when they see the brand name, believe that they have a whole product line in front of them. However, new formulas for infant formula are just a marketing ploy. nine0009

“There is nothing new in them, so all milk formulas, starting with formulas “6 months+”, as well as formulas for children from 1 year to 3 years and older, are simply not needed, they are just a way to get more money out of parents’ pockets ”, P. Randall told swissinfo.ch. “This product should be removed from the market. But the market has become so huge that no one wants to do it, although everyone knows that they are dealing with violations of the provisions of the WHO Guidelines to stop inappropriate forms of promotion of foods for infants and young children. nine0009

Randall told swissinfo.ch. “This product should be removed from the market. But the market has become so huge that no one wants to do it, although everyone knows that they are dealing with violations of the provisions of the WHO Guidelines to stop inappropriate forms of promotion of foods for infants and young children. nine0009

More precisely, we are talking about the International Code on the Marketing of Breastmilk Substitutes, adopted by WHO in 1981. This document sets standards for ethically responsible marketing, including restrictions on advertising, sponsorship, and giving away free samples of infant formula. The default document proceeds from the fact that, anyway, only breastfeeding is the ideal nutrition for a healthy baby up to six months, which, in fact, Danone, Nestlé and their opponents agree with. nine0009

Pressure from the baby food industry

Controversy arises at the gray zone stage, when complementary foods with other foods and beverages can be introduced at about six months of age and older. You can enter, but is it necessary? And this is where the problem lies. Don't concerns create artificial demand, beneficial primarily to themselves? It is really difficult to understand this, the information received by parents from baby food manufacturers, doctors and staunch opponents of factory baby food is often contradictory. nine0009

You can enter, but is it necessary? And this is where the problem lies. Don't concerns create artificial demand, beneficial primarily to themselves? It is really difficult to understand this, the information received by parents from baby food manufacturers, doctors and staunch opponents of factory baby food is often contradictory. nine0009

Some scientific studies state that so-called “Third level milk formulas” for children aged one to three years are not needed, but they can be used to compensate for nutritional deficiencies, especially in cases of malnutrition or lack of certain nutrients substances in local foods”. So what's wrong with giving kids a better chance at delicious and most importantly healthy food?

Show more

Criticism of Nestlé has a long history. About forty years ago, breastfeeding activists first vociferously accused Nestlé of using an aggressive marketing strategy that resulted in mothers declining to breastfeed in favor of infant formula. The ensuing widespread boycott of Nestlé products led to major changes in the formation of marketing strategies.

The ensuing widespread boycott of Nestlé products led to major changes in the formation of marketing strategies.

However, Catherine Watt of the Geneva group La Leche LeagueExternal link , an international public private secular organization to support breastfeeding mothers, says that many women today stop breastfeeding earlier than they should. Why? “This is happening as a result of veiled pressure from the baby food industry, which has an arsenal of advertising in favor of various types of complementary foods and infant formula,” she said. “If there are doubts about whether the baby has enough breast milk, and there is some kind of milk formula in the closet, you just try to use it. And now you are already “under the hood” of the industry.” nine0009

Show more

In developing countries, the consequences of such a move can be most dramatic. CTO of the Breastfeeding Promotion Network of India BPNIExternal link JP Dadhich is particularly concerned about the high cost of these products, their negative environmental impact and potential risks of infection.

“We can't be sure about the quality of the water that these formulas are based on, which increases the risk of diarrhea. And this is in conditions when there is now enough milk of animal origin in India. After boiling, it is completely safe, in addition, it is quite acceptable here, taking into account the cultural traditions of the country. For children, it is better to use complementary foods from quality local products, continuing to breastfeed the child after 6 months.” nine0009

The World Health Organization (WHO) is also concerned that infant formula designed specifically for babies after one year of age can shorten the duration of breastfeeding by depriving the baby of important nutrients, especially if the products are labeled similarly and are promoted as more healthy alternative to breastfeeding due to the increased content of vitamins and minerals.

The devil is in the details

All this has caused and continues to cause heated discussions between governments and food company lobbyists. Some governments would like to ban these formulas so as not to completely “kill” the motivation to breastfeed, while other countries want to leave the choice to consumers. India is a country with some of the most stringent regulations. Here, any products intended specifically for children under the age of two years are categorized as breast milk substitutes and thus fall under the international “Code of Regulations” of WHO. Group NestléExternal link says it has gone further than many other players in the industry by operating under European Union rules coming into effect in 2020. At the same time, Nestlé opposes any additional regulation, arguing, based on studies already conducted in many countries, that any artificial nutrition alternative will still be less healthy than any mixture. Nestlé recognizes that it needs to proceed with caution given its history of high-profile scandals. “It’s not for you to sell chocolate, we have a huge responsibility. Every year we produce formula for 15 million children, which is equal to the population of the Netherlands,” says T. Filardo. At the same time, the company has already updated its marketing policy several times by creating a system for reporting violations and annually providing reports on compliance with its obligations. nine0009 Unlike the pre-1980s era, the company is very clear that "breastfeeding is the best feeding option." At the same time, she wants her food products for children to be almost in no way inferior in quality to breast milk. Critics say it's not enough to be "the lesser of the evils. “One of the challenges with regard to “level two” formula (after 6 months) is the need to understand whether foods for children aged 1 to 3 years should be considered specifically as “substitutes” for breast milk, and if not, what should they be called.” Tom Heilandt of the Codex Alimentarius Commission, an international food standards group, tells us this. nine0009

“One of the challenges with regard to “level two” formula (after 6 months) is the need to understand whether foods for children aged 1 to 3 years should be considered specifically as “substitutes” for breast milk, and if not, what should they be called.” Tom Heilandt of the Codex Alimentarius Commission, an international food standards group, tells us this. nine0009 Show more

“There is no point in restricting nutrition advertising for children under the age of one, especially when there are almost no restrictions on advertising Coca-Cola and other fast food anywhere,” says T. Filardo. nine0146

“There is no point in restricting nutrition advertising for children under the age of one, especially when there are almost no restrictions on advertising Coca-Cola and other fast food anywhere,” says T. Filardo. nine0146

Always guilty?