Baby food market analysis

Baby Food Market Size, Share and Growth

The global baby food market size was valued at $67.3 billion in 2019 and is projected to reach $96.3 billion by 2027, growing at a CAGR of 6.0% from 2021 to 2027. Traditionally, babies are fed with soft home cooked food, a practice that is still popular in underdeveloped and developing countries. However, growing urbanization and changing lifestyles have increased the demand for packaged baby foods in different societies and cultures. These foods are fed to babies between the ages of four to six months and two years. Growing awareness for nutrition, rise in organized retail marketing, urbanization paired with a significant increase in the count of working women population are key factors that boost the baby food market growth. Concerns related to food safety, falling birth rates, and the practice of feeding home cooked food to babies are the key restraints in this market.

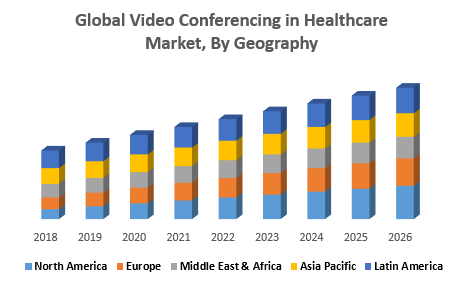

The baby food market is segmented based on product type, distribution channel and geography. Based on product type, the market is segregated into dried baby food, milk formula, prepared baby food, and other baby food. Presently, milk formula occupies the largest market share followed by the product segment of prepared baby food. However, over the forecast period, product segment of prepared baby food would gain prominent adoption in the global market. Sales of milk formula baby food is highly concentrated in the APAC region. Alternatively, demand for prepared baby food is largely limited to developed regions. However, market for prepared baby food, in developing regions would pick pace over the forecast period, subsequently leading to the dynamic growth of the market in the APAC region. Thus, this has opened a lot of opportunities for baby food market.

Supermarkets, hypermarkets, small grocery retailers, and health & beauty retailers are the key distribution channels in the market. Supermarkets are the primarily preferred distribution channel among consumers, followed by health and beauty retailers. However, considering the scenario in few Asian developing countries such as India, small grocery retailers and health & beauty retailers hold significant share considering sales in the region. Small grocery retailers account for a comparatively smaller share in the baby food market but would witness rapid growth over the forecast period. Other distribution channels include discounters, non-grocery retailers, and non-store retailing.

However, considering the scenario in few Asian developing countries such as India, small grocery retailers and health & beauty retailers hold significant share considering sales in the region. Small grocery retailers account for a comparatively smaller share in the baby food market but would witness rapid growth over the forecast period. Other distribution channels include discounters, non-grocery retailers, and non-store retailing.

Increasing urban population, changing lifestyles of individuals due to considerable rise in disposable incomes is the main factor that boost the overall growth of the global baby food market. In addition, increase population of women at workplace leaves less time for food preparation and breast-feeding the infants, in turn demands quality baby food for their baby. Packaged baby foods are popular in the urban areas, as they provide adequate amount of nutrition for infants.

Majority of parents prefer home-cooked baby food compared to packaged baby food for their infants. However, this trend has changed owing to the time constraints for food preparation due to increased participation of women at workplace and increasing concerns about the nutritional value of home-cooked food. Moreover, high price of the baby food products have restricted their adoption among middle-income groups. Furthermore, home-cooked food is preferred by consumers duel in the rural and isolated regions, due to lack of awareness about these products. However, promotional campaigns and affordable baby food products would lead to overall increase in the revenue generation of the market.

However, this trend has changed owing to the time constraints for food preparation due to increased participation of women at workplace and increasing concerns about the nutritional value of home-cooked food. Moreover, high price of the baby food products have restricted their adoption among middle-income groups. Furthermore, home-cooked food is preferred by consumers duel in the rural and isolated regions, due to lack of awareness about these products. However, promotional campaigns and affordable baby food products would lead to overall increase in the revenue generation of the market.

Strong global concerns about the pandemic, coronavirus have largely but negatively influenced the global baby food market. Moreover, due to the high demand and low supply trends, the prices and demand for baby food products rises in 2020 to overcome on economic instability. On the contrary, disruptions to the supply chain in shipping could lead to temporary shortages in the supply, putting upward pressure on prices in the short term.

According to the baby food market analysis, the market is segmented on the basis of product type, the market is divided into e dried baby food, milk formula, prepared baby food, and others. On the basis of distribution channel, it is fragmented into supermarkets, hypermarkets, small grocery retailers, health and beauty retailers, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Spain, Italy, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, United Arab Emirates, South Africa, Saudi Arabia and rest of LAMEA).

Baby Food Market

By Product Type

The Milk formula segment held the major share of 60.1% in 2019

Get more information on this report : Request Sample Pages

On the basis of product type, milk formulations segment dominated the global baby food market in 2019, accounting for around half of the overall market revenue. Increasing incidence of lactating issues in infants has influenced increased adoption of milk based baby food products. Breast-feeding problems in women are the major driving factor for the market.

Increasing incidence of lactating issues in infants has influenced increased adoption of milk based baby food products. Breast-feeding problems in women are the major driving factor for the market.

On the basis of distribution channel, the supermarket segment held the significant baby food market share in 2019. Supermarkets is gaining popularity owing to the availability of broad range of consumer goods under a single roof, ample parking space and convenient operation timings. These stores offer variety of brands in a particular product category, offering more options for the consumers. Moreover, some of the supermarkets have company representatives to assist the consumers in their selection of baby food products.

Baby Food Market

By Distribution Channel

Small Grocery Retailers segment witness a CAGR of 6.6% from 2021-2027

Get more information on this report : Request Sample Pages

On the basis of region, Asia-Pacific dominated the global baby food market during the baby food market forecast period. High birth rates and rising purchasing power of population in the Asia-Pacific region have significantly fostered the demand of the baby food and milk formula-based products in this region. Intensive R&D activities by various companies in the baby food segment would help the companies to offer affordable baby food products in this region. Baby food products include milk powder, cereals, snacks and different ready-to-drink fresh fruits and vegetables juices.

High birth rates and rising purchasing power of population in the Asia-Pacific region have significantly fostered the demand of the baby food and milk formula-based products in this region. Intensive R&D activities by various companies in the baby food segment would help the companies to offer affordable baby food products in this region. Baby food products include milk powder, cereals, snacks and different ready-to-drink fresh fruits and vegetables juices.

Players in the market have adopted business expansion and product launch as their key developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in the report include Nestlé, Danone, Perrigo Company Plc, Mead Johnson & Company LLC, Abbott Laboratories, Hero Group, Bellamy Organics, Hain Celestial Group, Campbell Soups and Friesland Campina.

Baby Food Market

By Region

2027

Asia-pacific

North America

Europe

Lamea

The Asia-Pacific region helds the higest market share of 40.

0% in 2019

0% in 2019Get more information on this report : Request Sample Pages

Key benefits for stakeholders

- The report provides quantitative analysis of the current baby food market trends, estimations, and dynamics of the market size from 2019 to 2027 to identify the prevailing baby food market opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size & segmentation assist to determine the market potential.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the baby food industry.

Baby Food Market Report Highlights

| Aspects | Details |

|---|---|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Abbott Laboratories, BELLAMY’S ORGANIC PTY LTD., CAMPBELL SOUP COMPANY., DANONE., HERO GROUP., MEAD JOHNSON & COMPANY, LLC., NESTLE S.A., PERRIGO COMPANY PLC, ROYAL FRIESLANDCAMPINA N.V., THE HAIN CELESTIAL GROUP, INC. |

Baby Food Market Size to Hit Around USD 120 Billion by 2030

The global baby food market size was estimated at USD 73.88 billion in 2021 and is expected to hit around USD 120 billion by 2030, growing at a CAGR of 5.54% during the forecast period 2022 to 2030.

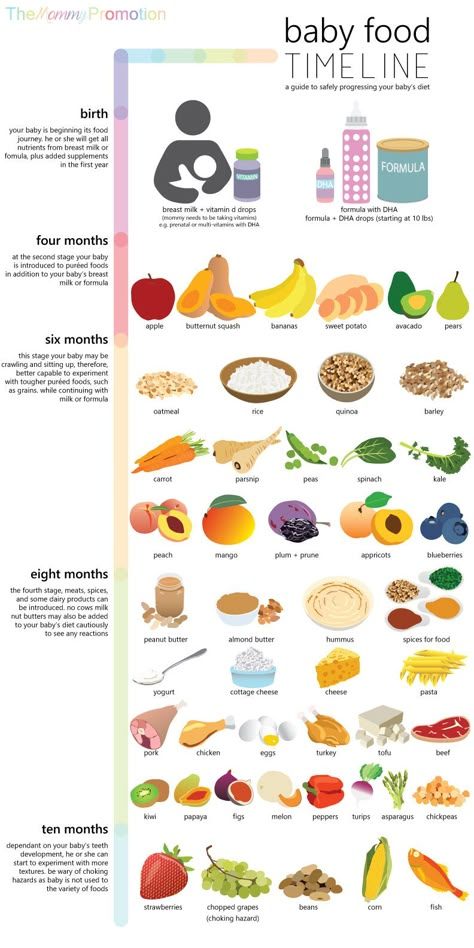

The increased awareness on innovative food products, organized retail marketing activities and increased number of working mothers, decreasing infant mortality rate and increasing parental concerns are all responsible for the growth of this market. During the pandemic, the parents were more conscious about the health of their babies and even though there were lockdowns across the nations the growth in this market has been seen even during the pandemic. In order to provide the infants with organic and healthier supplements and food products, the parents across the world are investing only in these food products. The baby food is soft, easily digestible meal which is created by keeping in mind the human babies aged between 4 to 6 months or up till two years of age.

During the pandemic, the parents were more conscious about the health of their babies and even though there were lockdowns across the nations the growth in this market has been seen even during the pandemic. In order to provide the infants with organic and healthier supplements and food products, the parents across the world are investing only in these food products. The baby food is soft, easily digestible meal which is created by keeping in mind the human babies aged between 4 to 6 months or up till two years of age.

Growth Factors

The demand for the organic baby food is increasing as the number of women working has increased in the recent years. There is a great demand for these convenient foods which is leading to a growth in the market. Due to a lack of time for home administration, the modern households are shifting to the use of these packed baby foods which are easy to prepare and packed with nutrients. This industry is expected to see a growth as it helps in saving time and also helps in maintaining a work life balance for the women while they take care of their domestic work. The nutritional requirements of the children are the priority of any woman. When it comes to working women, they choose the manufactured baby meals, which are resulting in the expansion of this industry. As the food manufacturers are increasing their expenditure on greater quality and inexpensive organic food materials there shall be a growth in the market.

The nutritional requirements of the children are the priority of any woman. When it comes to working women, they choose the manufactured baby meals, which are resulting in the expansion of this industry. As the food manufacturers are increasing their expenditure on greater quality and inexpensive organic food materials there shall be a growth in the market.

Due to the increasing population of infants and the increased penetration of organic baby food the market is expected to grow during the forecast period. The baby food is usually packed in various forms such as powder, liquid or paste, depending upon the requirement of the babies. There is adoption of the baby food across the globe as it helps in developing the brain, the nervous system, the muscles and helps in creating an awareness regarding the benefits of the nutrients it offers.

Report Scope of the Baby Food Market

| Report Coverage | Details |

| Market Size by 2030 | USD 120 Billion |

| Growth Rate from 2022 to 2030 |

CAGR of 5. |

| Largest Market | Asia Pacific |

| Online Distribution Channel Segment Growth Rate | 13.2% from 2022 to 2030 |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Category, Types, Distribution Channel, Ingredients, Formulation, Health Benefit, Geography |

| Companies Mentioned | Nestlé (Gerber Products Company), Danone S.A., Reckitt Benckiser (Mead Johnson & Company, LLC), Abbott, Feihe International Inc., Fries land Campina, Bellamy's Organic, Kraft Heinz, HiPP GmbH & Co. Vertrieb KG, Perrigo, Arla Food |

Category Insights

On the basis of category, the baby food market can be segmented into organic and conventional foods. Although the organic baby food is extremely good quality and have more nutrition value, but they are expensive, so this is a setback in the growth for this market. The conventional foods have shown a good growth in the previous years and it is expected to grow during the forecast period.

The conventional foods have shown a good growth in the previous years and it is expected to grow during the forecast period.

Type Insights

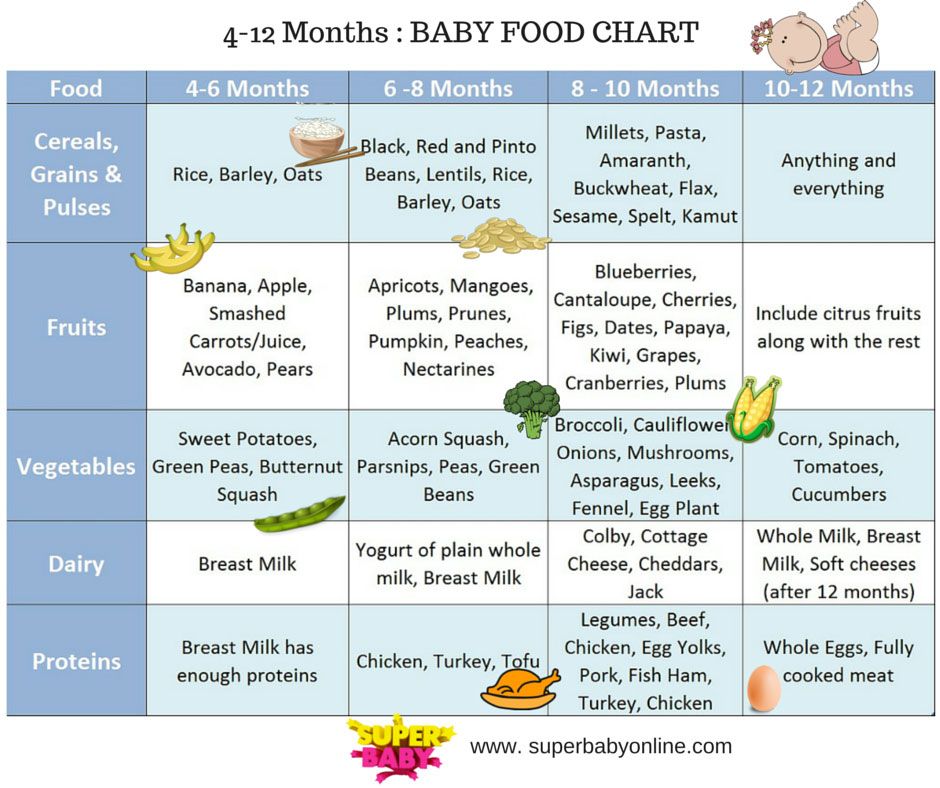

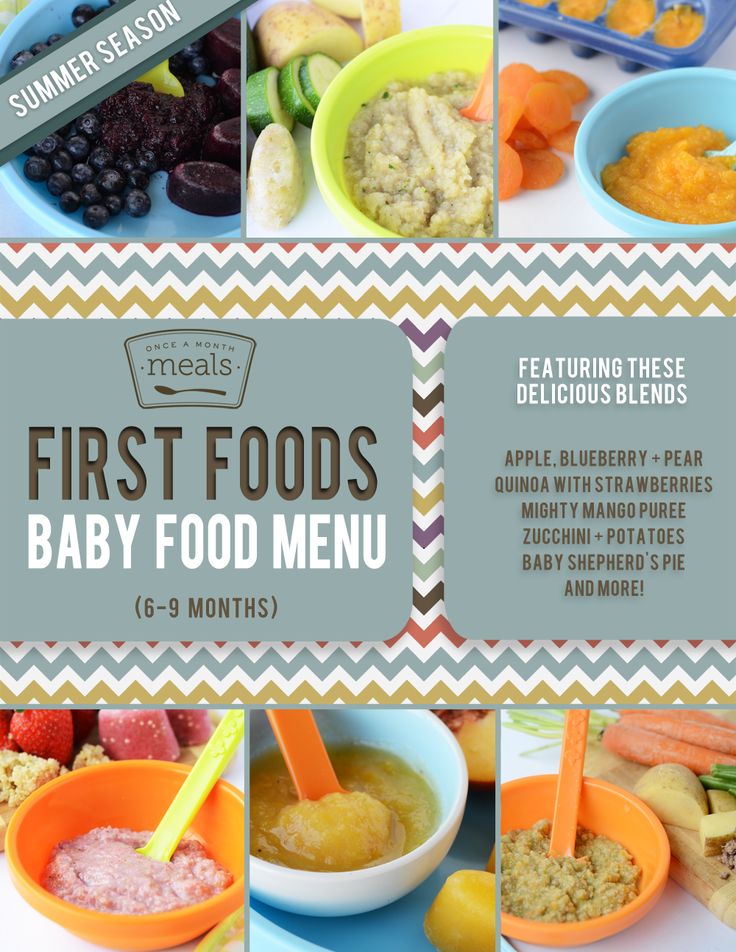

On the basis of the type of the baby food, the market can be segmented into dried baby food, ready to feed baby food, milk formula, and other types. The ready to eat baby food product accounts for the largest share in terms of revenue. It includes porridge, purees, squash. All these food items are ready to eat. As the number of working women is increasing in the economics across the world, the segment is expected to grow.

Apart from this, the dried food segment, which includes the cereals, fruits and vegetables, should also see a growth during the forecast period. The dried baby food segment is expected to grow at a CAGR of 13% as they have a good shelf life and they are easy to prepare.

Distribution Channel Insights

On the basis of the distribution channel, the hypermarket or the supermarket segment is expected to have the largest share, in the overall market it happens to have 35% of the total market size. As there is a great awareness and popularity of these food products amongst the people of the Asia Pacific region the supermarkets are expected to grow during the forecast. This segment provides aggressive marketing and lucrative pricing schemes.

As there is a great awareness and popularity of these food products amongst the people of the Asia Pacific region the supermarkets are expected to grow during the forecast. This segment provides aggressive marketing and lucrative pricing schemes.

Apart from the supermarkets, the online distribution channel is also expected to grow during the forecast. The online distribution channel is expected to have CAGR of 13.2% during the forecast period.

Regional Insights

The Asia Pacific market had the largest revenue in the previous years and it is expected to exhibit promising gains during the forecast period. As there is an increase in the working women population and an awareness of various baby food products that provide the nutrition and ensure the health of the babies the market is expected to grow. Due to diverse distribution options and strong marketing channels, the market shall grow during the forecast.

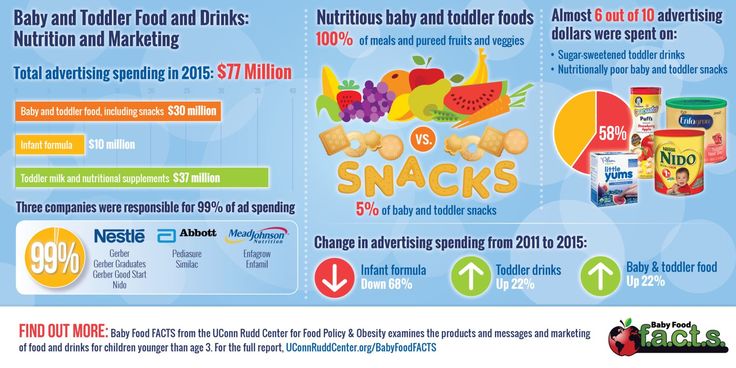

As a large number of raw material providers for the baby food are present in the European region. Stringent regulations and cutthroat competition among the manufacturers had led to a diversification in the product portfolio and an increase in the nutritional value of the food. The major players are actively engaged in mergers and acquisitions in order to provide a competitive edge. The global players also ensure partnership with the medium,small retailers or enterprise in order to provide the preferred baby food. Lot of revenue is spent on marketing and creating awareness regarding the products that these companies offer. So, the global food market is expected to grow during the forecast.

Stringent regulations and cutthroat competition among the manufacturers had led to a diversification in the product portfolio and an increase in the nutritional value of the food. The major players are actively engaged in mergers and acquisitions in order to provide a competitive edge. The global players also ensure partnership with the medium,small retailers or enterprise in order to provide the preferred baby food. Lot of revenue is spent on marketing and creating awareness regarding the products that these companies offer. So, the global food market is expected to grow during the forecast.

Key Market Players

- Nestlé (Gerber Products Company)

- Danone S.A.

- Reckitt Benckiser (Mead Johnson & Company, LLC)

- Abbott

- Feihe International Inc.

- Fries land Campina

- Bellamy's Organic

- Kraft Heinz

- HiPP GmbH & Co. Vertrieb KG

- Perrigo

- Arla Food

Key Market Developments

- In the year 2021, Danone launched the first ever formula milk in the United Kingdom which will be sold in a pre-measured format in order to provide an ease in preparation and provide greater convenience to the parents.

- A plant-based baby food range which will provide a very high-quality vegan diet to babies was launched in April 2021 by the Kraft Heinz Company. It includes three types of products that are made up of Potato baked with green beans and sweet garden peas, risotto with chickpeas and pumpkin and saucy pasta stars with beans and carrot.

- In November 2020, nestle launched frozen Baby food with a simple ingredient and line of foods made of organic ingredients and home grains packed in the bowls. These products will come in combination with vegetables in five different types.

Segments covered in the report.

(Note*: We offer report based on sub segments as well. Kindly, let us know if you are interested)

By Category

- Organic

- Conventional

By Types

- Milk Formula

- Dried

- Ready-to-Feed

- Other

By Distribution Channel

- Drugstores/ Pharmacies

- Supermarkets/Hypermarkets

- Convenience Store

- Online Channels

- Other Distribution Channels

By Ingredients

- Fats and Oils

- Lactose

- Protein

- Flour

- Flavour Enhancer

- Vitamins & Minerals

- Others

By Formulation

- Powder

- Liquid

By Health Benefit

- Brain & Eye Development

- Muscular Growth

- Bones & Teeth Development

- Blood Enhancement

- Nervous System

- Vascular System

- Body Energy

- Other

By Geography

- North America

- U.

S.

S. - Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Baby food market overview | International Marketing Group

Baby food market overview

Baby food belongs to the category of goods that buyers, with all their desire, cannot refuse. Perhaps that is why even during the crisis there was no massive reduction in sales on the market, as happened in other industries. At the same time, Ukrainian producers benefit little from this, since almost two-thirds of all baby food in our country is brought from abroad. High competition from foreign companies and timely unresolved legislative conflicts, in fact, blocked the entrance to the market for new players. However, there are examples when companies manage to occupy niches that have been left without the attention of eminent foreign brands.

High competition from foreign companies and timely unresolved legislative conflicts, in fact, blocked the entrance to the market for new players. However, there are examples when companies manage to occupy niches that have been left without the attention of eminent foreign brands.

The breadwinners of the younger generation

Food for children was produced on an industrial scale in Ukraine back in the 50s of the last century. At first, the range was limited to skimmed and semi-fat milk. Now on the shelves of stores there are all kinds of instant milk formulas, liquid and pasty products, fruit and vegetable purees and juices, canned fish and meat. About a dozen major manufacturers and small firms operate in Ukraine, focusing mainly on low-income citizens. The lion's share of the market (more than 70%) is occupied by importers, represented by almost all products, except for perishable ones, for example, such as curds and kefirs.

It is important that there are practically no domestic manufacturers specializing exclusively in baby food in Ukraine. After all, most companies combine the production of food for children, for example, with the production of fermented milk products or juices and nectars. In addition, some enterprises produce certain types of products - only mixtures and cereals or juices and purees. As a result, there is still no strong domestic brand that could be opposed to imported brands.

After all, most companies combine the production of food for children, for example, with the production of fermented milk products or juices and nectars. In addition, some enterprises produce certain types of products - only mixtures and cereals or juices and purees. As a result, there is still no strong domestic brand that could be opposed to imported brands.

In many ways, this situation has developed due to the fact that the technological equipment of the factories does not allow the production of mixes, curds, and fruit purees at the same time. Although this was not always the case. For example, the Odessa Baby Food Cannery (OKZDP), known for its fruit and vegetable juices and purees since 1960, once produced milk-based baby food. “Unfortunately, it is extremely difficult to develop the dairy business in Ukraine, since the raw material base leaves much to be desired, and high-quality raw materials are the basis for the production of baby food,” lamented Vitaliy Vinitsky, chairman of the supervisory board of OKZDP.

It is not surprising that companies that previously dealt with milk processing decide to develop the dairy niche. An illustrative example is the Milk Alliance holding, which plans to start production of fermented milk products, yoghurts and curds for children as early as October this year. By the way, the release of food for children over three years old can also be a promising undertaking. For example, Favor LLC has been supplying sour-milk food and fruit desserts under its own brand for pupils of preschool institutions in the capital for several years now. At the same time, as the director of the enterprise Raisa Mikhailova stated, their products are not represented in retail chains, since the shelf life of sour cream, ryazhenka, milk and other goods produced by Favor is only a few days. “We work today for tomorrow: every day by lunchtime we take orders from kindergartens, and in the morning they receive dairy products. In just a day, we process about 25 tons of milk, but we have room to develop, so in the future we will be able to serve schools in Kyiv,” Raisa Mikhailova is convinced.

Milk brothers

Potential consumers of baby food are divided into two categories - infants (from 0 to 1 year old) and young children (from 1 year to 3 years old). At the same time, from 400 to 500 thousand new Ukrainians are born annually. But due to uneven demand in megacities and provinces, companies should be very careful in choosing their product range. In addition, the saturation of a particular direction should also be taken into account.

In particular, as Sergei Kosyachenko, director of the baby food plant under construction at the Yagotinsky Butter Plant in Zgurovka, explained, their enterprise will specialize in liquid and pasty products. “Now it is a scarce market with good growth dynamics (from 18 to 33%). Actually, this attracted our attention to this product. Taking into account the current dynamics, we expect to occupy from 15 to 20% of the market, depending on the categories of baby food,” Mr. Kosyachenko shares his plans. According to him, so far there is little competition in this direction - two Russian trademarks are represented. “At the first stage of the project implementation, our products will be targeted at babies from eight months to three years old, while there is the possibility of expanding the range by producing food for children of preschool and school age. In particular, this is possible thanks to the School Milk social program, Sergey Kosyachenko notes.

“At the first stage of the project implementation, our products will be targeted at babies from eight months to three years old, while there is the possibility of expanding the range by producing food for children of preschool and school age. In particular, this is possible thanks to the School Milk social program, Sergey Kosyachenko notes.

The best for children

Buying baby food is often a necessity dictated by life's problems. After all, it often happens that a young mother does not have milk due to health problems, and she has to give her child a substitute purchased at a supermarket or a specialized store. This, by the way, is one of the differences in the Ukrainian market, since, for example, in Western countries, about 70% of baby food is sold through manufacturers' branded stores. In addition, the level of sales in different cities is very different. “If we talk about megacities, where there is traditionally a high demand for cereals and canned fruits, then suppliers of imported products have an advantage here. In the regions, the incomes of the population are significantly lower, and there citizens try to save as much as possible on baby food, except perhaps with the exception of breast milk substitutes, ”says Maria Kolesnik, head of the analytical department of the AAA consulting agency. In addition, Ms. Kolesnik believes that representatives of both domestic and imported brands often turn to, to put it mildly, non-standard ways of advertising their products: “The best way to distribute baby food is to work with medical staff. Many companies have long turned to doctors to unofficially "advertise" their product. After all, young mothers, first of all, will buy what the doctor in the hospital will advise them, and only as a last resort will they begin to study the composition of the product.

In the regions, the incomes of the population are significantly lower, and there citizens try to save as much as possible on baby food, except perhaps with the exception of breast milk substitutes, ”says Maria Kolesnik, head of the analytical department of the AAA consulting agency. In addition, Ms. Kolesnik believes that representatives of both domestic and imported brands often turn to, to put it mildly, non-standard ways of advertising their products: “The best way to distribute baby food is to work with medical staff. Many companies have long turned to doctors to unofficially "advertise" their product. After all, young mothers, first of all, will buy what the doctor in the hospital will advise them, and only as a last resort will they begin to study the composition of the product.

Milk and fruit assortment

All Ukrainian manufacturers of baby food have similar problems. And one of them is raw materials. According to the Law on Baby Food, it is allowed to use milk produced in special raw material zones for the production of milk-based products. According to the Ministry of Agrarian Policy, 83 milk production enterprises in 14 regions of the country have received the status of such zones. It is believed that milk purchased from these producers is an environmentally friendly product, and therefore it is not surprising that it costs significantly more. In addition, as a rule, in winter, the purchase prices for milk increase. That is why it is important to find a reliable supplier by agreeing in advance on the price and volume of purchases. Partially, the financial burden is relieved by the state, since since 2001 the payment of subsidies for environmentally friendly milk has begun. But these funds are received not by manufacturers of baby food, but by farms. According to the press service of the Ministry of Agrarian Policy, in 2011 the size of the budget subsidy was increased from UAH 500 to 750 per ton. In general, 19.6 mln hryvnia

According to the Ministry of Agrarian Policy, 83 milk production enterprises in 14 regions of the country have received the status of such zones. It is believed that milk purchased from these producers is an environmentally friendly product, and therefore it is not surprising that it costs significantly more. In addition, as a rule, in winter, the purchase prices for milk increase. That is why it is important to find a reliable supplier by agreeing in advance on the price and volume of purchases. Partially, the financial burden is relieved by the state, since since 2001 the payment of subsidies for environmentally friendly milk has begun. But these funds are received not by manufacturers of baby food, but by farms. According to the press service of the Ministry of Agrarian Policy, in 2011 the size of the budget subsidy was increased from UAH 500 to 750 per ton. In general, 19.6 mln hryvnia

In the fruit and vegetable sector of the market, the situation is not much easier, since the quality of raw materials, in fact, must be impeccable. “In the production of baby food, we use 24 quality standards at all stages, from the processing of raw materials to the release of finished products,” explains Vitaliy Vinitsky. “A certified laboratory of the plant carries out a full multi-stage quality control of products, a number of parameters are checked: organoleptic and physico-chemical indicators.” According to the manufacturer, the region where fruits and vegetables are grown, as well as whether fertilizers and plant protection products are used by farms, is of great importance. “We have been cooperating with farms from ecologically clean regions of Ukraine for a long time. Suppliers know our requirements for raw materials, although many complain that they are too high. Nevertheless, for many years we have been fruitfully cooperating with most of these farms and we ourselves process the raw materials for our products. We have our own production facilities for processing fresh fruits and vegetables, and few manufacturers of baby food can boast of this,” says Mr.

“In the production of baby food, we use 24 quality standards at all stages, from the processing of raw materials to the release of finished products,” explains Vitaliy Vinitsky. “A certified laboratory of the plant carries out a full multi-stage quality control of products, a number of parameters are checked: organoleptic and physico-chemical indicators.” According to the manufacturer, the region where fruits and vegetables are grown, as well as whether fertilizers and plant protection products are used by farms, is of great importance. “We have been cooperating with farms from ecologically clean regions of Ukraine for a long time. Suppliers know our requirements for raw materials, although many complain that they are too high. Nevertheless, for many years we have been fruitfully cooperating with most of these farms and we ourselves process the raw materials for our products. We have our own production facilities for processing fresh fruits and vegetables, and few manufacturers of baby food can boast of this,” says Mr. Vinitsky.

Vinitsky.

Spoon to dinner road

The production and sale of baby food is controlled by officials everywhere. It would seem that there is nothing surprising, because these are products of social significance, the quality and availability of which determine the health of the younger generation. At the same time, many manufacturers are convinced that government agencies, with their excessive attention and control, put them in unequal conditions with importers. In particular, entrepreneurs pay attention to the problem of regulating the level of profitability and trade markups, which local administrations have the right to set. “At the same time, for imported products that are supplied to the territory of Ukraine through resellers, the basis for establishing a trade markup is not the selling price of a foreign manufacturer, but the declared customs value. And it is formed without control by state bodies. Thus, Ukrainian manufacturers find themselves in an unequal position compared to foreign suppliers of baby food,” complains Mr. Vinitsky.

Vinitsky.

The authorities, on the contrary, are sure that they are helping the producers. In particular, the Ministry of Agrarian Policy and Food reported that the current legislation exempts from taxation the profits of enterprises received from the sale of special baby food. In addition, sales of some baby food products to retail outlets are exempt from VAT. But, as Mr. Vinitsky noted, this rule applies to products sold only through limited types of outlets, including dairy kitchens and distribution points: “At the same time, parents buy such products, as a rule, in the nearest store or supermarket, where they the cost is higher. Such a restriction, in my opinion, is discriminatory and completely unjustified.”

Not a child's start

Given the complexity of legislation and high competition from foreign companies, market operators do not yet expect new players in the industry. Although it is possible that there will be those who wish to follow the example of the Dairy Alliance, starting to develop a new direction to the main business. But this pleasure, to put it mildly, is not cheap. Thus, the Milk Alliance holding plans to invest about UAH 160 million in a new baby food plant. “The main part of the investments is aimed at the purchase and adjustment of technological and packaging equipment of the Swedish company Tetra Pak,” Sergey Kosyachenko explains. - The rest is the cost of building a new production building, creating an industrial infrastructure and a laboratory and research base. Taking into account the amount of investments, the specifics of the manufactured product and its social orientation, the payback period of the project will be 5–6 years.”

But this pleasure, to put it mildly, is not cheap. Thus, the Milk Alliance holding plans to invest about UAH 160 million in a new baby food plant. “The main part of the investments is aimed at the purchase and adjustment of technological and packaging equipment of the Swedish company Tetra Pak,” Sergey Kosyachenko explains. - The rest is the cost of building a new production building, creating an industrial infrastructure and a laboratory and research base. Taking into account the amount of investments, the specifics of the manufactured product and its social orientation, the payback period of the project will be 5–6 years.”

As Vitaliy Vinitsky noted, the baby food market in Ukraine is growing every year and, apparently, this trend will continue. However, if the state does not support its producers, nothing will prevent foreign companies from strengthening their positions in the market. Our enterprises, in the best case, will have to abandon the production of baby food and concentrate on "adult" - both sour-milk and fruit and vegetable - areas. “The abundance of imported juices and purees for children “slows down” the development of local producers. We, as representatives of Ukraine, still hope for assistance from the state in the development of not only the production, but also the raw material base, - says Mr. Vinitsky. “After all, children are the most precious thing in the life of every state, this is our future and we must take care of it. For us, as a manufacturer with a history, our reputation is extremely important. I am a father myself, and my child "grows up" on the juices and purees of our plant. It seems to me that the main indicator is when the manufacturer uses his products, regardless of whether they are cars or juices.

“The abundance of imported juices and purees for children “slows down” the development of local producers. We, as representatives of Ukraine, still hope for assistance from the state in the development of not only the production, but also the raw material base, - says Mr. Vinitsky. “After all, children are the most precious thing in the life of every state, this is our future and we must take care of it. For us, as a manufacturer with a history, our reputation is extremely important. I am a father myself, and my child "grows up" on the juices and purees of our plant. It seems to me that the main indicator is when the manufacturer uses his products, regardless of whether they are cars or juices.

Whether the authorities will heed the call of entrepreneurs and whether they will solve the sore problems of producers is an open question. In the meantime, the government, as a lifeline, has offered the market the State Target Social Program for the Development of Baby Food Production for 2012–2016, which provides for an increase in domestic production volumes and an expansion of the range. However, there are suspicions that officials do not yet have a concrete plan for implementing what they have planned.

However, there are suspicions that officials do not yet have a concrete plan for implementing what they have planned.

[expert's opinion]

Business costs

Maria Kolesnik, head of the analytical department of the AAA consulting agency:

“It is unlikely that the export of baby food can become an alternative to domestic sales for our producers. After all, the production volumes of most enterprises do not allow for large deliveries abroad. And it is always easier to conquer the domestic market than to enter foreign ones. In Ukraine, the manufacturer can count on a certain loyalty of consumers. And when sending products abroad, the costs of logistics and customs procedures are added. Moreover, it is not a fact that this product will be in demand there. And here it is also necessary to take into account the moment that in the same markets of the CIS and neighboring countries, the Ukrainian manufacturer will have to compete not only with local factories, but also with the same transnational corporations that they have to resist here in Ukraine. So if you can't compete successfully at home, it's unlikely you'll be able to compete anywhere else."

So if you can't compete successfully at home, it's unlikely you'll be able to compete anywhere else."

[from neighbors]

Western contrasts

Breast milk substitute products are the most demanded baby food in the world (2/3 of the total market structure). Moreover, more than 60% of sales are in developed countries, where 11% of all children in the world under the age of 3 live. But in different states, the statistics on the consumption of baby food is very different. For example, in North America, 75% of the market is filled with milk substitutes, in Asia - 80%, but in Eastern Europe - only 41%. In general, Europe is the second region in the world in terms of consumption of baby food after North America. Two years ago, in monetary terms, the European market amounted to EUR5.5 billion, EUR4.5 billion of which fell on Western European states. In particular, the leader in the consumption of milk substitutes was France (about 1/3 of the market), and canned products - Italy.

One of the features of the global market is a small number of manufacturers. In particular, Bristol-Myers, Abbott Laboratories and Novartis are the largest manufacturers in North America, accounting for 70% of local markets. And more than 50% of the European market is shared by Numico, Heinz and the Swiss Nestle. By the way, the latter also owns more than 35% of sales in Asia, Latin America and Africa. The influence of local producers on the balance of power in the industry is small. Although enterprises of the post-Soviet countries have recently become more active, offering consumers a kind of know-how. In particular, a project was launched in Russia to create baby food based on mare's milk. It is believed that the composition of this milk is very close to that of women and it does not cause allergies in babies. In addition, unlike products based on cow's milk, new baby food can be prescribed not only for feeding, but also for medicinal purposes in case of liver diseases and diabetes.

Author: Rostislav Shapravsky

Source: Status

Market analysis of manufacturers of pureed baby food products

Authors : Kovalenko Irina Alexandrovna, Prudnikova Anna Sergeevna

Section : Economics and management

Posted by in young scientist #19 (361) May 2021

Publication date : 05/07/2021 2021-05-07

Article viewed: 143 times

Download electronic version

Download Part 2 (pdf)

References:

Kovalenko, I. A. Market analysis of manufacturers of puree-like canned food for baby food / I. A. Kovalenko, A. S. Prudnikova. - Text: direct // Young scientist. - 2021. - No. 19 (361). - S. 119-121. — URL: https://moluch.ru/archive/361/80847/ (date of access: 04.12.2022).

A. Market analysis of manufacturers of puree-like canned food for baby food / I. A. Kovalenko, A. S. Prudnikova. - Text: direct // Young scientist. - 2021. - No. 19 (361). - S. 119-121. — URL: https://moluch.ru/archive/361/80847/ (date of access: 04.12.2022).

The article describes the features of the choice of baby food by consumers, which is based on canned fruits and vegetables, the dynamics of manufacturers in the market of the Russian Federation. According to the research, the factors influencing the development of the market as a whole are noticed.

Keywords :d baby food, puree, product, demographic situation, country, assortment, product quality.

During the dynamic development of the market system, the baby food segment is actively gaining momentum and occupying its niche. Without being tied to the difficult economic situation in Russia, there is a satisfactory growth dynamics in the share of the food industry engaged in the production of food for children. Canned fruit and vegetable purees, as well as juices, have always been in demand among different groups of the population. Giving preference to a product with a minimum amount of artificially synthesized components that have a positive effect on the development of the child. The sale takes place through the channels of both retail and wholesale trade, occupying one of the key places among essential goods [1].

Canned fruit and vegetable purees, as well as juices, have always been in demand among different groups of the population. Giving preference to a product with a minimum amount of artificially synthesized components that have a positive effect on the development of the child. The sale takes place through the channels of both retail and wholesale trade, occupying one of the key places among essential goods [1].

The importance of market monitoring lies in the continuous expansion and replenishment of the product range with new positions. The introduction of innovations to increase demand is driven by the rapid development of technology, as well as the variability of consumer requirements and preferences.

The main factors influencing the expansion of the baby food market, in particular viscous fruit and vegetable, are:

— unfavorable ecological situation in the country;

— growth of material security of the population;

- the desire to save time, in connection with the employment of the population;

— socio-demographic;

- advice from doctors and other specialists.

An important factor in Russia today is an unforeseen change in the demographic situation. It is connected, first of all, with a change in the lifestyle of young people who prefer to build a career rather than start a family.

It is important to trace the demographic situation in the country from 2010 to 2020. Thus, according to Rosstat, 2010–2011 was marked by a negative population growth. The main reason was the crisis conditions, which did not allow providing for their children in full. In the future, from 2013 to 2015, natural growth increases. The main influence was exerted by the demographic policy pursued by the Government of the Russian Federation [5].

In the future, in 2016–2020, population growth again falls to a critical point. This is due to a change in the moral and moral attitudes of the population in the direction of improving education. Meanwhile, the influence of religious and traditional foundations, preserved after the collapse of the USSR, is decreasing [5].

Starting from March 2020, the large-scale spread of coronavirus infection, there has been an increased demand for essential products, among which baby food has been included in the lists of citizens. The threat of food shortages pushed people to stock up on everything they need.

Conducted research and surveys of Russian residents made it possible to establish a list of more frequently purchased brands. The diagram shows the main factors influencing the choice of baby food by the consumer (Figure 1).

Rice. 1. The main factors influencing the choice of baby food

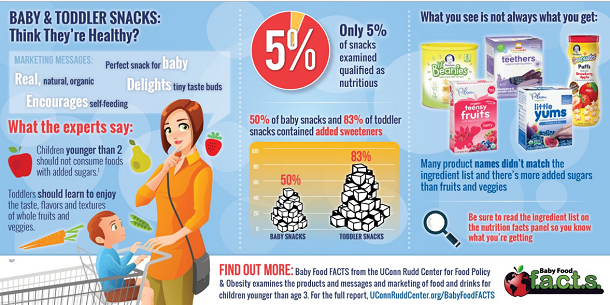

When choosing baby food, 79% of buyers are guided by the composition (in particular, the absence of preservatives and artificial additives) and price, 82% - by hypoallergenicity, 69% of consumers proceed from the taste preferences of the child. The biggest indicator is the quality of the product (93%). The main requirements include: natural composition, absence of sugar, as well as a rich vitamin complex [2].

It should be noted that it is baby food in the form of puree that occupies a segment of 3.5% of purchased essential goods.

Table 1 shows the rating of popular baby food manufacturers, which is based on selection criteria [5].

Table 1

| Brand | Manufacturer | Rating | Product Feature |

| hipp | Germany | 9.8 | Raw materials for production are grown on organic farms and plantations. Strict quality control starts with the soil and seeds. Baby formulas, complementary foods: purees - fruit and meat, fish and vegetable and meat and vegetable menus, soups, cereals and drinks, including those for digestion (carrot-rice broth) - the entire range of baby food meets the requirements of the development of babies. Hipp food products are formulated with special technology, contain natural ingredients and are guaranteed for children of any age. The company produces vitamin-enriched milk formulas (dry) for dietary nutrition that do not cause allergies [4]. |

| Gerber | USA | 9.3 | Manufacturer, on the market for almost 100 years. Deservedly has good reviews from moms around the world. The company's products are represented on the Russian market by more than 80 items. The range includes single-component and multi-component purees in fruit and vegetable jars, meat products, juices and desserts. The high quality of products is ensured by the observance of technology and adherence to standards [3]. |

| FrutoNanny | Russia | 9 | It is a more affordable analogue among its competitors, having a wide range in its arsenal. |

| Nutricia | Holland | 8.6 | A popular brand for the preparation of baby food, designed for babies from the first birthday to 3 years old. Nutricia specializes in baby food, making dry milk formulas. The company offers three product lines of baby food: "Baby"; "Baby"; Nutrilon. Nutrilon differs in that it contains special elements necessary for premature babies, as well as for children with indigestion, children with low weight and diet therapy, etc. "Baby" and "Baby" are made without sugar, do not contain preservatives and dyes, they contain important elements and vitamins: iron, zinc, prebiotics, etc. |

| Heinz | USA | 8.4 | The manufacturer offers a variety of baby purees, cereals, juices, for the most demanding customers, and all with the help of a multifaceted selection of flavors. But in connection with the pricing policy, it did not find huge popularity among the inhabitants of Russia. |

Based on the rating and consumer surveys, the most popular manufacturers can identify the following positive qualities:

- Hipp - excellent quality, the best taste;

- Gerber - Impeccable composition and quality of the product;

— FrutoNyanya — the best Russian manufacturer, the best value for money;

- Nutricia - modern production technologies, the best quality of the product;

- Heinz - a wide range, good value for money.

Based on the data obtained, it can be concluded that the baby food market, in particular fruit and vegetable-based puree-like canned food, is rapidly developing. New competitive products that have no analogues are being developed. Regardless of the declining birth rate, baby food will be a necessary and in-demand aspect of the lives of many buyers who value their time.

Literature:

- Zakharashvili S.G. Analysis of consumer preferences when choosing baby food // Young scientist. - 2021. - No. 1. - S. 235–238.

- Ivanchenko O. V. The specifics of marketing activities in the baby food market // Scientific and methodological electronic journal "Concept". - 2015. - T.30. — P.486–490.

- The best manufacturers of baby food [Electronic resource] / Enotznaet. — Access mode: https://enotznaet.ru/collection/luchshie-proizvoditeli-detskogo-pitaniya/#1–9— (date of access: 04/30/2021).

- 12 best manufacturers of baby food [Electronic resource] / MarkaQuality - Access mode: https://markakachestva.

ru/rating-of/1142-luchshie-proizvoditeli-detskogo-pitaniya.html - (date of access: 05/03/2021).

ru/rating-of/1142-luchshie-proizvoditeli-detskogo-pitaniya.html - (date of access: 05/03/2021). - Official data of the Federal State Statistics Service [Electronic resource] / Rosstat. — Access mode: https://rosstat.gov.ru/ — (date of access: 05.05.2021).

Basic terms (automatically generated) : baby food, demographic situation, product quality, russia, choice of products, resident of russia, huge popularity, food product, usa, wide range.

Keywords

range, children food, demographic situation, country, product, puree, product qualitybaby food, puree, product, demographic situation, country, assortment, product quality

Similar articles

Marketing Research of Cereal Cereals for

Baby Food . ..

.. The article describes the features of the choice of children's food by consumers, including cereal cereals, the dynamics of the activities of manufacturers in the market Russian Federation. According to the research, the factors influencing the choice of products are noticed, the main ones are described ...

Innovative idea and marketing rationale for creating...

The range offered by products can please with its richness and combination of flavors. For those who want a hearty and tasty snack, fresh and healthy food is waiting for you. A special children's menu is offered , characterized by an abundance of fruits, chocolate, ice cream...

Research on the consumption of

children's nutrition fruit and vegetable. ..

.. Eat quality products Children was of great importance and will be of great importance and is a priority for

Power supply - this is a collection of specialized goods , produced under strict control of documentation for. ..

Analysis of consumer preferences when

choosing cans...Key words: baby food nutrition , puree, manufacturers, quality standard , requirements. The start of complementary feeding is the most important stage in growing up

As sociological surveys have shown, for most mothers, the main criteria for choosing baby food are...

Marketing research of the macroenvironment of factors-regulators...

also product development opportunities in the industry.

2. Demographic situation in the Kaliningrad region, according to

Uncertainty about the future and the economy of Russia in general negatively affects the decisions of residents of the Kaliningrad region to start a family.

Catering Market Development Trends in Russia

Today the catering industry in Russia is represented by a huge number of enterprises with different levels of service, quality products , a variety of equipment used. Public catering is now one...

The current state and development trends of food...

Food industry - a set of enterprises engaged in production products nutrition aimed at meeting the needs of the population . Agro-industrial complex, which includes branches of the food industry...

Agro-industrial complex, which includes branches of the food industry...

Analysis of market trends

children's goods | Journal article...In addition, they offer a wide range a range of products for children at a low price for reason

Table 2 shows the largest retail chains in Russia and the CIS in terms of revenue

Rating of the largest retail chains in Russia and the CIS in terms of revenue, footprint...

catering market development trends

One can observe the accelerated production and distribution of products using information technology that allows

— April 9, 2015. Comparative characteristics of public enterprises supply different formats in Russia and abroad. ..

..

Similar articles

Marketing Research of Cereal Cereals for

Baby Food ... The article describes the features of the choice of children's food by consumers, including cereal cereals, the dynamics of the activities of manufacturers in the market of the Russian Federation . According to studies, factors affecting selection products , basic descriptions...

Innovative idea and marketing rationale for creating...

The range offered by products can please with its richness and combination of flavors. For those who want a hearty and tasty snack, fresh and healthy food is waiting for you. A special children's menu is offered , characterized by an abundance of fruit, chocolate, ice cream. ..

..

Consumption Study

baby food food fruit and vegetable...Eat quality products children was of great importance and will be of great importance and is a priority for

Power supply - this is a collection of specialized goods , produced under strict control of documentation for. ..

Analysis of consumer preferences at

choice jar...Key words: baby food nutrition , puree, manufacturers, quality standard , requirements. The start of complementary feeding is the most important stage in growing up

As sociological surveys have shown, for most mothers, the main criteria for choosing baby food are. ..

..

Marketing research of the macroenvironment of factors-regulators...

also product development opportunities in the industry.

2. Demographic situation in the Kaliningrad region, according to

Uncertainty about the future and the economy of Russia in general negatively affects the decisions of residents of the Kaliningrad region to start a family.

Catering Market Development Trends in Russia

Today the catering industry in Russia is represented by a huge number of enterprises with different levels of service, quality products , a variety of equipment used. Public catering is now one...

The current state and development trends of food.

..

.. Food industry - a set of enterprises engaged in production products nutrition aimed at meeting the needs of the population . Agro-industrial complex, which includes branches of the food industry...

Analysis of market trends

children's goods | Journal article...In addition, they offer a wide range a range of products for children at a low price for reason

Table 2 shows the largest retail chains in Russia and the CIS in terms of revenue

Rating of the largest retail chains in Russia and the CIS in terms of revenue, footprint...

catering market development trends

One can observe the accelerated production and distribution of products using information technology that allows

— April 9, 2015.

S., Canada, Mexico)

S., Canada, Mexico)  54%

54%

It is very popular among the inhabitants of Russia, thanks to the ratio of price and quality. In addition to the production of fruit and vegetable purees, juices, it produces cereals, water, and dairy products under its own brand [4].

It is very popular among the inhabitants of Russia, thanks to the ratio of price and quality. In addition to the production of fruit and vegetable purees, juices, it produces cereals, water, and dairy products under its own brand [4].  [4]

[4]